This blog was last updated on October 18, 2019

Does the e-business solution that supports your business-to-business transactions ensure that your e-invoices remain tax compliant, everywhere, always?

An e-business solution that must comply with multiple countries’ tax requirements has to address the problem of ongoing change. Otherwise, how can a business efficiently deal with the tsunami of new real-time and other regulatory control requirements that governments are introducing? I sometimes jokingly compare tax requirements with computer viruses – not to say governments are maleficent actors, obviously, but to get businesses to understand that a similar response is needed to endemic change.

Change affects e-invoicing more than other areas

The universal rule of change in tax legislation hurts e-invoicing processes more than others. Here’s why:

- The principal taxes at stake in e-invoicing are indirect, or transaction, taxes – Value Added Tax (VAT) undoubtedly foremost among them. As we all know, such taxes are a relatively flexible instrument in the toolkit of fiscal policies that governments have at their disposal to achieve specific policy goals. (Bad summer? Lower the VAT on typical summer consumptions to help the tourism sector pull through, for example.)

- The fact that these are ‘transaction’ taxes makes them very vulnerable to the evolution of business processes. VAT essentially turns businesses into tax collectors, but for this to work, governments must constantly ensure that the core mechanisms within VAT are adapted to the world of business. In that sense, the IT revolution has hugely increased and accelerated changes to VAT requirements – initially to ensure an orderly transition without increasing the already staggering ‘VAT gap’, and nowadays by imposing specific technology-based controls to increase collection.

How to address change systematically

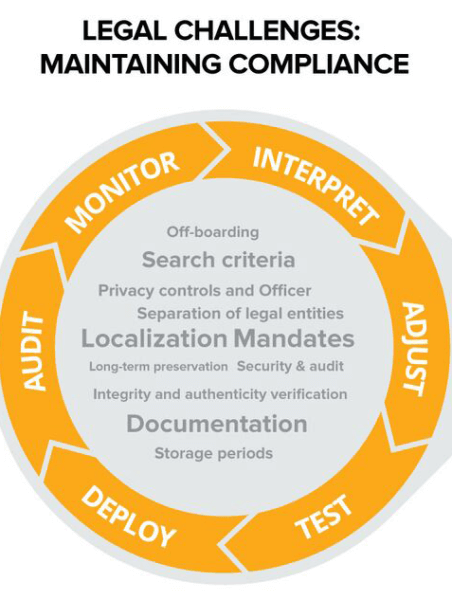

Businesses and their service providers need to acknowledge that tax compliance change is a systemic issue, and therefore maintenance needs to be addressed systematically. There are 6 phases to compliance maintenance:

- Monitor requirements

This is the basis. Without a regular update on how in-scope legal requirements change, you will be out of compliance in no time. - Interpret.

This is the hardest part. Often laws are vague and you’ll find that advisers are quick to explain possible interpretations, most refrain from taking responsibility for deciding which way to go in your real-life process. - Adjust your systems and processes.

Whether you run your own technology or have outsourced processes to a service provider, once you have decided on the most appropriate interpretation of a new legal requirement, you must have the change management resources and processes to make the necessary changes in time. - Test.

Does it work – also for negative cases? Is it well-documented? Don’t forget, having a compliant process is necessary but not sufficient: you alsoneed to be able to prove you did, sometimes for longer than a decade. - Deploy to your production systems.

(I’m leaving the fine details of staged deployment out here for convenience). - Audit.

If you’re not running the systems and processes yourself, you should be looking into the appropriate audit or assurance framework(s) you want to require from third party vendors.

And back to 1. And so forth.

As you can see, compliance of a solution out-of-the-gate is not only uninteresting but in many cases a dangerous distraction. It is, in fact, much better to have a process with in-built compliance maintenance that functions some 75% of the time than to set up a solution that is 100% compliant upon delivery and has no built-in compliance maintenance at all. One approach is to ask your service provider if they can help you with a systematic solution for e-invoicing compliance. That way, your international supply chain can remain tax compliant, everywhere, always – without your investing in huge resources.

This article was originally published by SupplyOn: https://www.supplyon.com/en/blog/six-best-practice-steps-for-maintaining-tax-compliance/