This blog was last updated on June 18, 2024

Mergers and acquisitions (M&A) have always been inherent in the financial institution landscape but have recently increased at an unprecedented pace. A recent Fortune.com article indicated a whopping $2.4 trillion in M&A deals in 2021, up 158% from last year. In February 2022, the FDIC prioritized policy updates to the 25-year-old Bank Merger Act in response to the increased activity in the industry.

Organizations must be prepared to tackle the associated regulatory compliance obligations to realize the strategic return on an M&A deal. Proper transitioning of state unclaimed property and annual tax information reporting processes are two areas within a financial institution that are often overlooked in the M&A process. Penalties associated with erroneous or missed reporting of tax and unclaimed property reporting requirements are steep. Organizations often find themselves receiving surprise penalty notices from the IRS and state tax jurisdictions, or multi-state audits of their unclaimed property processes shortly after the M&A completion.

Following are best practices to prepare for the unintended consequences of M&A activity associated with tax and unclaimed property reporting.

Unclaimed property

Imagine the excitement of a new acquisition and the focus on integration into your business, only later to find out you have a multi-million-dollar unclaimed property exposure. If the new acquisition was not in compliance with unclaimed property law, that excitement can quickly turn into a mad scramble to gather resources, hire outside experts and work with regulators to bring the business into compliance. The purchase transaction alone could draw the attention of state regulators or third-party contingency fee auditors.

In the case of M&A activity, it is important to understand the unclaimed property compliance history of the target company to help determine your risk. Companies can avoid the surprises lurking in the shadows of unclaimed property compliance with a little up front due diligence. Below is a sampling of items to consider during the M&A due diligence process in the target company investigation:

- Request and review copies of the target company’s unclaimed property policies and procedures.

- Review the company’s process for unclaimed property due diligence.

- Review the company’s process for, and frequency of, state reporting.

- Request sample copies of due diligence letters and state reports to support adherence to policies and procedures.

- Inquire about any historical unclaimed property audits or voluntary disclosure agreements with states.

- Review the company’s record retention policies to ascertain whether they could defend the expansive scope of an unclaimed property audit.

- Evaluate previous M&A activity by the target company to determine whether there has been an inheritance of previous liabilities.

- Review relationships with third parties (e.g., payroll) and understand where the unclaimed property legal responsibilities lie.

Unclaimed property should be included in your review efforts and become a standard practice as part of the M&A checklist.

Tax information reporting

Financial institutions typically utilize one or more core banking platforms to facilitate their products and services, as well as payroll and ERP systems to manage corporate functions. Through M&A, these systems and processes are often consolidated as legal entities fold into one another and customer accounts are migrated over to new platforms. Given the significant tax information reporting obligations associated with payroll, accounts payable, and financial services transactions, the following are key to consider during the M&A process:

- Determine which organizational Employer Identification Numbers (EINs) will be used for tax information reporting to all payees from all lines of business in the organization. Also find which EINs will be used for reporting to the government agencies and for what purposes.

- Prepare a plan to update Legal Entity information with the IRS, states and localities soon after the M&A closes. Final returns will need to be filed to close out the entities that will no longer report tax information. These transactions often include final tax payments too. Online portals will need to be updated with legal name and/or EIN changes. Depending on the jurisdiction, there are a host of details that will need to be addressed to avoid erroneous penalty notices being assessed by the agencies.

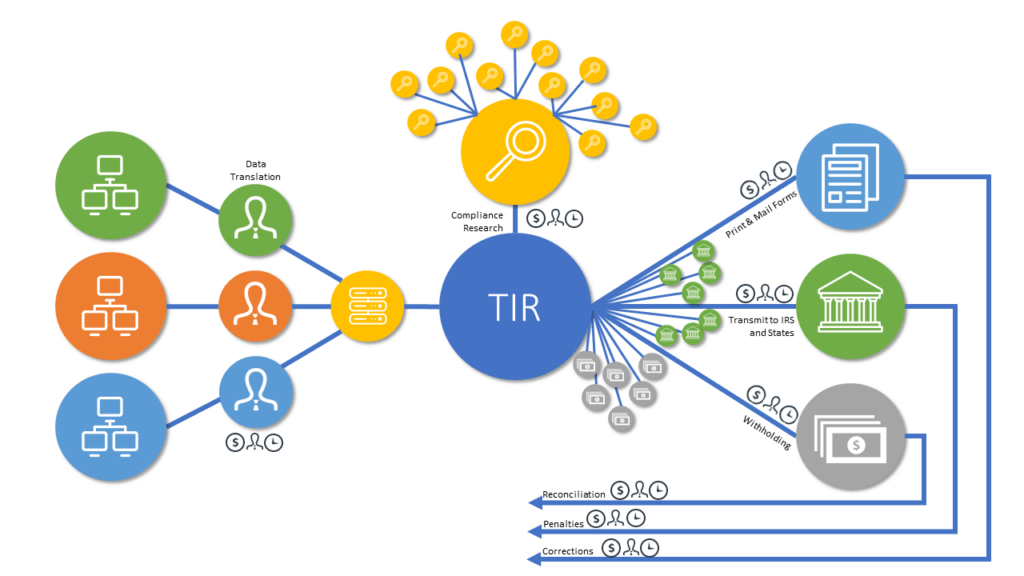

- Consolidate tax data from back office systems. Whether it’s collecting and validating tax documentation like Form W-9 or managing withholding tax payments and reporting it on Form 1099 and Form 945, all of the transaction data for the newly acquired entity(ies) must be pulled together with the existing entity(ies) for consolidated tax information reporting to the payees, the IRS and the states. A typical tax information reporting scenario that is a reality for most financial institutions and insurers is depicted below.

The myriad of back office systems producing data that needs to flow into some sort of tax information reporting process requires a lot of IT and operational resources to maintain. Compliance resources are tied up with the research and updates to those product systems and operational processes. From there, operations teams must utilize the technology to generate printed or electronic recipient statements and create transmittals to go to the IRS and states.

Conclusion

Inevitably, these compliance practices will save your organization money, improve client relationships and delight your most valuable asset – your employees.

Many businesses will approach these challenges by managing numerous processes through various operating systems, or by building internal systems to help consolidate data in one place for tax or unclaimed property reporting purposes. The latter is redundant and prone to error, and the former ties up valuable IT resources with maintaining systems to extract, consolidate and format data.

A tax reporting solution that complements your back office systems, easily taking in data in whatever format needed, and consolidates and transforms that data to make it “tax ready” can save significant organizational time and effort. Additionally, an unclaimed property solution that is backed by a team of experts, consistently updated with state legislative changes, and is intelligent enough to handle the most complex due diligence and reporting requirements is a compliance safeguard for financial institutions.

Take Action

Check out our annual report on the state of unclaimed property to learn more about alleviating the stress of the compliance process.