This blog was last updated on December 26, 2023

The Senate has proposed legislation that would nullify penalties for the individual and employer mandates. However, it would not repeal IRS reporting obligations under IRC §§ 6055 and 6056 or nullify penalties under IRC §§ 6721 and 6722. Accordingly, any employer or insurer that does not issue and file the relevant 1094 and 1095 forms would still be penalized by the IRS for $260 per return — with a maximum of $3,193,000 per organization — unless the failure to file was due to intentional disregard, in which case it would increase $530 per return with no maximum penalty.

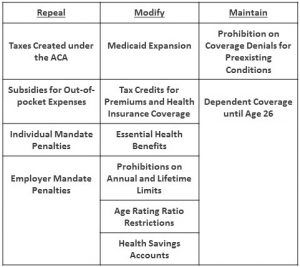

Senate leadership released a second draft of the Better Care Reconciliation Act of 2017 – its version of the House’s American Health Care Act (AHCA) intended to repeal and replace the Affordable Care Act.

The Senate bill maintains — with slight modifications — the premium tax credits that would be available to certain individuals who purchase their own insurance plans. Individuals are only eligible for these tax credits if they are not offered employer coverage.

The IRS will maintain employer information reporting as a means of administering these tax credits. The health insurance coverage credits would similarly depend on information provided by employers to their employees and to the IRS. In addition, this legislation does not appear to repeal the requirement for employers to report offers of minimum essential coverage.

While the bill may simplify reporting requirements to a degree under the executive action, there are no definitive plans from the IRS to take any such action. Examples of simplification may include removing certain fields on Form 1095 that are specifically designed to enforce the employer mandate. The IRS will also have the option, as contemplated under the House bill, to eventually incorporate healthcare coverage reporting into Form W-2.

However, for the time being, Applicable Large Employers will still have an obligation to report on and file Forms 1094-C, 1095-B, and/or 1095-C annually, even though the mandates will be zeroed out and individuals will no longer be required to carry insurance or face penalties.

Senate Modifications to the Affordable Care Act

The initial draft of this bill lacked the “continuous coverage requirement” that was intended to replace the individual mandate in the AHCA. This provision would have permitted insurers to impose a 30 percent premium surcharge for those who were uninsured for more than 63 days in a given year. This current draft, released on Monday June 26 added in a variation on the AHCA’s continuous coverage requirement.

However, instead of the premium surcharge, it would impose a six-month waiting period to obtain coverage on those who are uninsured for more than 63 days in a given year. This requirement could potentially lead to fewer people being uninsured, as well as complicated reporting issues for those employers that hire individuals who have been uninsured in excess of the statutory period.

The Congressional Budget Office released its report on the discussion draft of the bill, indicating it would result in an additional 22 million uninsured — compared to 23 million under the AHCA — on top of the 28 million who are currently uninsured or exempt from the individual mandate. It also estimates that the bill will reduce the federal deficit by $321 billion over the next decade.

In the wake of the CBO report, there are still four Republican Senators who are solid “no” votes: Sen. Rand Paul (R – KY), Sen. Ron Johnson (R – WI), Sen. Susan Collins (R – ME), and Sen. Dean Heller (R – NV). In addition, Senators Ted Cruz (R – TX) and Mike Lee (R – UT) have not committed to voting for or against the bill. The conservative voices in the caucus are advocating for further rollbacks to both the Medicaid expansion and essential health benefits, while Collins and Heller are working to ensure more people would be guaranteed coverage and to prevent cuts to Medicaid.

The Republican caucus can only afford for two members to vote against this bill. As such, leadership will likely endeavor to put forth a draft that will pass muster for at least 50 Senators by the second week in July. Although Senate leadership pushed to hold a vote before next week’s July 4th recess, Senate Majority Leader Mitch McConnell announced Tuesday afternoon that they would not hold a vote until after the holiday to continue redrafting the bill and to gain support from the current bill’s critics. The Senate Republicans likely will not move forward unless they know they have the requisite votes to succeed.

This is an evolving situation, and we encourage readers to stay tuned for further developments, as another draft may be released at a moment’s notice. The Senate may hold a vote with little warning after the holiday, as Senator McConnell has invoked a procedural rule that will allow the bill to bypass the committee process. If the measure is brought to a vote and passes, it will then go to a joint conference committee to reconcile the differences between the House and Senate bills. If the bill does not pass the Senate, it will likely undergo further revisions and redrafting.

Regardless of whether the vote happens, pass or fail, health care coverage reporting remains in effect and the law of the land.

Take Action

Learn more about Sovos ACA, and keep up to date with regulatory changes with our regulatory update feed.

Register for our annual conference to learn more about 10-series reporting changes and regulatory updates.

Further Reading

- Health Affairs Blog: Obamacare Isn’t Dead Yet Unpacking The Senate’s Take On ACA Repeal And Replace

- Society for Human Resource Management: Senate Health Care Bill Would End Employer Mandate Penalty, Keep Cadillac Tax

- Washington Post: What the Senate Bill Changes About Obamacare

- Wall Street Journal: Senate GOP Health Bill Would End ACA Penalties, Cut Taxes on High Incomes

- The Hill: Four GOP Senators Will Vote Against Taking up Healthcare Bill Without Changes

- CNN Money: 22 Million Fewer Americans Insured Under Senate GOP Bill

- CNBC: Revised Senate Health-care Bill Penalizes Consumers Who Have Gaps in Coverage

- The New York Times: How Senate Republicans Plan to Dismantle Obamacare