This blog was last updated on August 30, 2021

Finding all-in-one back office systems to help manage the day-to-day operations of a financial institution or insurance company can seem like an impossible task. Having all your organizational products, processes, channels, customer information and management tools in one place can save you time, increase efficiency and reduce your risk of errors. And that includes tax withholding and information reporting details.

Unfortunately, most banks and insurers fall short of having an all-in-one solution. Whether due to a variety of active systems producing tax data, rapidly changing federal and state tax requirements, or new product offerings with additional reporting needs, most organizations struggle to implement a compliant 1099 process using their back office systems alone.

Gaps in support, minimal tax compliance expertise, untimely technology updates, scarce IT resources and lack of comprehensive capabilities often drive banks and insurers to build their own “stop-gap” solutions and/or manual processes. All of which create more effort to maintain and more opportunity for error and risk.

Here are five ways Sovos tax solutions can complement your organizational processes for 1099 reporting compliance that can save time, remove IT burden and minimize risk:

1. More adaptable tax form support for back office systems

Included within many back office systems is a basic tax reporting functionality that will produce 1099 forms associated with the business products. As your organization expands into new product offerings or acquires new business entities your tax obligations may change, and the business operating solutions may not easily change with it. When a new 1099 or other tax form is needed the answer is often to deploy one-off desktop 1099 solutions to create these forms, or to purchase the paper forms and manually issue and file the forms. Over time, this patchwork of systems and processes create extra work and expense to maintain and may create pockets of data throughout the organization. This presents a number of compliance risks, including increased exposure to IRS backup withholding notices (B-Notices) and penalty notices for errors found in 1099 data. Having a stand-alone solution designed specifically for 1099 processing will complement the operating systems and provide easy access for multiple users across the business to access and change tax forms as needed, and using a cloud-based solution is an added benefit as all of your forms will always be up-to-date.

2. Keep up with constantly changing tax compliance rules

Fueled by the tax gap, federal and state governments have adopted significant changes to withholding and information reporting requirements since the mid 2000s. Forms 1099 and W-2 reporting have long been the primary enforcement mechanism for ensuring compliance with income tax reporting and governments continue to find ways to get more of this information.

Some of the most common trends include:

- New forms required to be reported, like the new Form 1099-NEC for tax year 2020.

- Changing form formats, like the renumbering of boxes on the Form 1099-MISC for the 2020 reporting season.

- State-specific rules for direct reporting. States are no longer relying on the IRS to share tax data through programs like the combined federal state filing (CF/SF) program, instead they are requiring businesses to submit information directly, following unique formats and deadlines. (See Figure 1 below).

- Changing submission and filing formats. Many states are eliminating paper and CD methods for submitting data and moving to various online electronic systems.

- Form due dates keep accelerating as governments push to receive data sooner to match against taxpayers income tax returns. Since 2015, the IRS and more than 32 states have moved up filing due dates from March to January.

Figure 1. CFS vs. DSR

!function(e,i,n,s){var t="InfogramEmbeds",d=e.getElementsByTagName("script")[0];if(window[t]&&window[t].initialized)window[t].process&&window[t].process();else if(!e.getElementById(n)){var o=e.createElement("script");o.async=1,o.id=n,o.src="https://e.infogram.com/js/dist/embed-loader-min.js",d.parentNode.insertBefore(o,d)}}(document,0,"infogram-async");

Financial and insurance back office system providers often do not provide customers with effective solutions to these issues because tax withholding and information reporting is not their core focus of expertise. Some provide an annual IRS “update” that generally includes the electronic filing specifications needed for filing the IRS version of Forms 1099 that are supported on the core solution but often leave out legislative changes that come late in the season. A great example is the 30+ states that released guidance for direct reporting of 1099-NEC data between October 2020 and January 2021. Most back office solutions do not provide full support for direct state tax reporting, causing organizations to adopt manual processes or separate systems to comply. This is where the expertise and flexibility of a tax-specific solution provider that is built to adapt to federal and state compliance changes is critical to help fill any gaps in your operating system capabilities.

3. Simplify the process of error correction

As hard as we try, there is no such thing as a perfect tax season. In every business, errors can occur in issuing tax forms for which corrections or late original versions of forms will need to be issued and filed. And the risk of error has only increased as due dates have accelerated. Whether you discover that you reported incorrect amounts, have an incorrect taxpayer identification number (TIN) for a customer, or you have forms that should or should not have been issued, dealing with corrections can be a time consuming activity that many back office solutions are not equipped to handle. Most back office systems generally produce the tax reporting information for all transactions that occurred through the end of the calendar year. This snapshot of the data at a specific point in time would be fine if it was 100% accurate. But when changes are required to be made or new forms created for the same calendar year, the core usually doesn’t support it.

Once again, to make up for this gap, companies often deploy manual processes including purchasing desktop software solutions or paper forms to solve this problem. When tax information is spread throughout different solutions, it is difficult to determine what was issued to the recipient and filed to what jurisdiction and when. Between customer service and audit issues, a central solution that houses all versions of the organizational data—originals, late originals, corrections, and amendments—that were issued to recipients and filed with the jurisdictions is crucial to minimizing risk.

4. Extend tax reporting capabilities to reduce errors

Yes a perfect tax season is almost impossible, but you can get as close as possible with a proactive approach. The year-end reporting process is the “final test” of what was hopefully a year-long process of effectively managing your tax information reporting data. To be proactive in eliminating errors, implement a comprehensive process for customer setup at account opening. Capturing accurate information at the onset of the relationship is foundational to providing accurate tax information to your customers and accurate reporting to the IRS and the states. While most back office systems have a process for setting up a customer, most do not have the ability to do a real-time check with the IRS to verify accuracy. This capability can easily be integrated with most back office systems via a simple API connection to provide real-time validation. Instantly reducing the chance of name and TIN mismatches, which result in B-Notices and potential penalties later on. Other capabilities such as electronic statements are desirable by many customers but are typically not offered as part of the back office system. A simple API connection can allow your customers to instantly access their tax statements while giving you the ability to make instant corrections—saving time and money, reducing paper and creating a better customer experience.

5. Consolidate data from multiple back office systems

From finding new efficiencies to redefining customer experience, financial institutions have been merging at a rapid pace since the mid 1980s. As a result, the number of operating U.S. banks has declined from almost 14,500 in the 1980s to under 6,000 today. Similarly, life insurance companies have declined by more than 35% since 1990, from 2,159 insurers to 773 as of 2018. When M&A occurs between organizations, technology is also acquired and over time, banks and insurance companies end up with a web of operating systems inherited from various institutions.

As a result, for most financial institutions and insurers, 1099 reporting requires the aggregation of transactions and data from all over the organization in order to submit data to the IRS, states and end recipients. That tax information also has to be validated according to the IRS and state tax jurisdiction requirements and then transformed into specific formats. Then, each of those outputs has to be delivered to recipients, to each of the states and to the IRS.

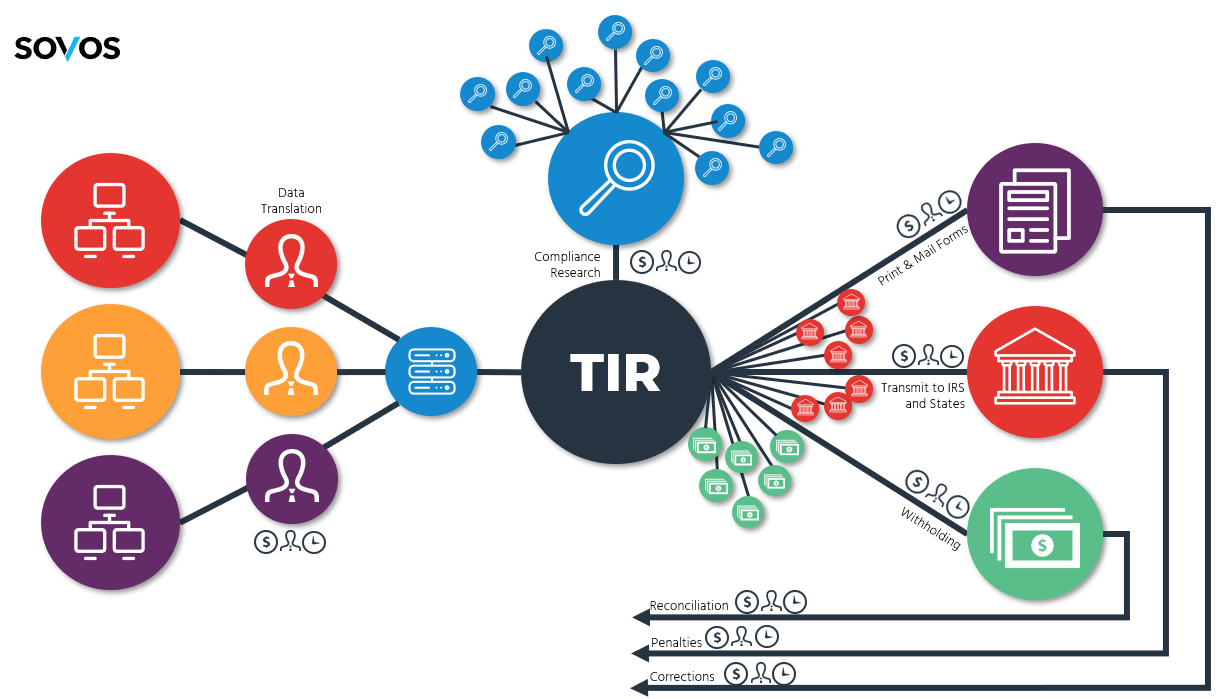

As organizations grow in complexity, the risk of errors in processing this data grows exponentially. A typical tax information reporting scenario that is a reality for most financial institutions and insurers is depicted in Figure 2.

Figure 2. Typical Tax Information Reporting Process

The myriad of systems producing data that needs to flow into some sort of tax information reporting process requires a lot of IT and operational resources to maintain. Compliance resources are tied up with the research and updates to those product systems and operational processes. And, after the information makes its way into the tax information reporting system, operations teams must utilize the technology to generate printed or electronic recipient statements and create transmittals to go to the IRS and states.

Many organizations will approach these challenges by managing numerous processes through various operating systems or by building internal systems to help consolidate all of this data in one place for tax reporting purposes. The latter is redundant and prone to error, and the former ties up valuable IT resources with maintaining systems to extract, consolidate and format data.

A tax reporting solution that can complement your back office systems by easily taking in data in whatever format needed and consolidating and transforming that data to make it “tax ready” can save significant organizational time and effort.

Take Action

See how TIN matching can help your organization manage fraud and compliance by watching a demo of our Real-time TIN Matching and Bulk TIN matching solutions.