This blog was last updated on June 26, 2021

Sales and Use Tax Webinar for Manufacturers – Recap from May 16

Thank you again for joining us on May 16 for our latest Tax Tuesday Webinar, Sales and Use Tax Process Benchmarks and Best Practices for Manufacturers. During this webinar, Mark Christenson and I shared results of a recent Aberdeen Benchmark Study that contained responses from Tax, IT and Finance managers and leaders from over 100 manufacturers of various sizes about:

- Their most pressing challenges and risks

- Strategies and drivers for change

- How Leaders achieve superior results

This educational event was recorded and you can now view it on-demand.

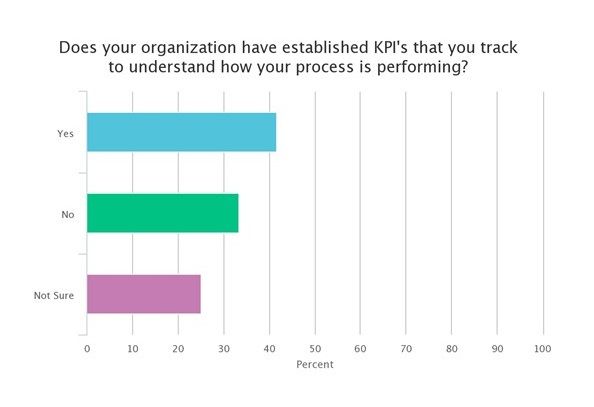

Below are some responses to our live webinar polls asked during the event.

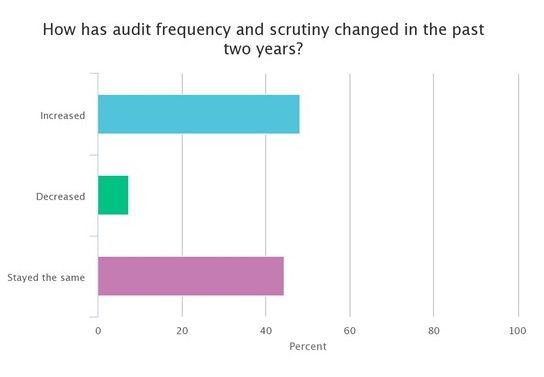

Webinar Attendee Poll Question 1 Results:

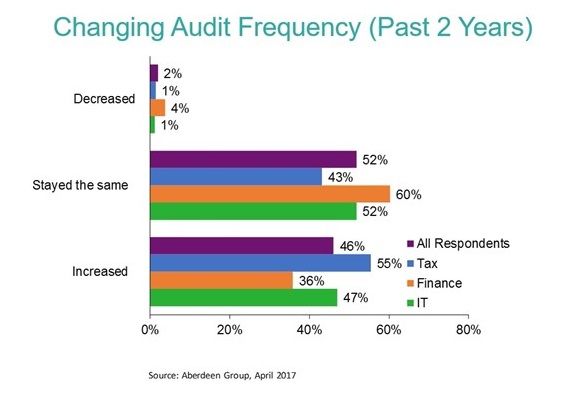

Comparison to Aberdeen Report:

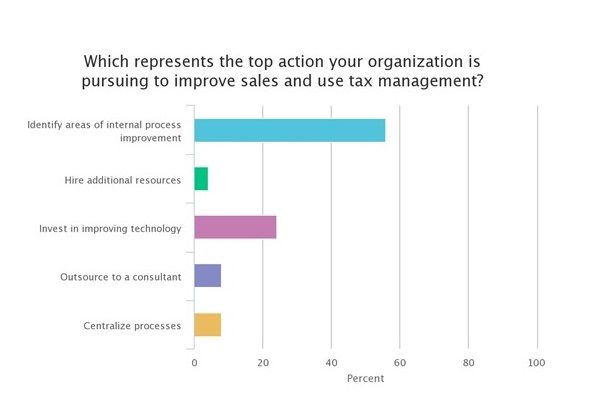

Webinar Attendee Poll Question 2 Results:

Comparison to Aberdeen Report:

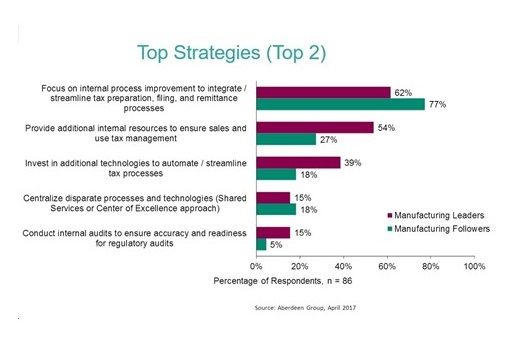

When asked to indicate their top two strategies, the Leaders (the Top 35% of respondents based on performance) begin to outline their recipe for success in the following ways:

Webinar Attendee Poll Question 3 Results:

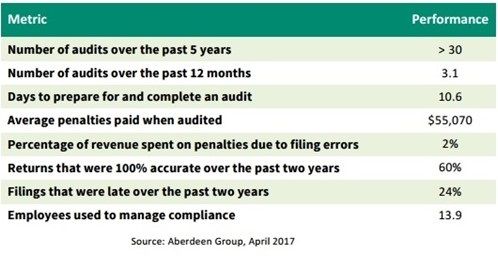

Aberdeen Report

The following table from the Aberdeen study shows how survey takers identify their performance across a wide variety of metrics. Today, on average, manufacturers are spending a significant amount of time on audits, producing a large amount of returns that are inaccurate or late, and paying substantial fines.

If you missed this live event, the onDemand recording and slides are available to review at your leisure. You will learn:

- How your performance stacks up against your manufacturing peers

- The biggest risks and tax compliance challenges for manufacturers of all sizes

- How functional leaders feel about the compliance process vs. those managing the process

- What is driving process improvement and what capabilities and approaches leaders are taking

- How you can successfully drive change in your organization

For other useful webinar and video resources, visit our Resource Center.

Take Action

Watch the on-demand webinar as we detail how to take a fresh look at your business’ performance compared to other manufacturing industry peers. You’ll also learn about the capabilities and approaches leaders in compliance are implementing today.