This blog was last updated on March 11, 2019

Business Repercussions in the Wake of the Supreme Court Decision on South Dakota v. Wayfair

In the weeks since the South Dakota v. Wayfair Supreme Court decision, many tax professionals and experts have written about how organizations need to start planning and preparing for expanded sales tax determination, collection, and reporting responsibilities. Some have even written about addressing expanded filing requirements, but sales tax exemption certificate management has received little to no attention until now.

Before jumping into certificate management, let’s examine what a company needs for accurate sales tax compliance. To truly get things right and avoid audit exposure, organizations need to:

- Make a correct tax calculation at the time of sale – at a minimum, this requires knowing the correct taxing location, the appropriate rate for that location, and any special product taxability rules.

- Report the transaction on the right line of the tax return and complete your filing on-time – to do this you must understand which form you are required to file, the applicable filing frequency, and any obligation you may have to make prepayments.

- Maintain proper documentation that substantiates sales to exempt entities or sales for an exempt use – proper compliance here means that you need to understand your required level of due diligence in accepting a customer exemption certificate, whether particular types of exemption documentation are valid for a given state, and certificate expiration rules.

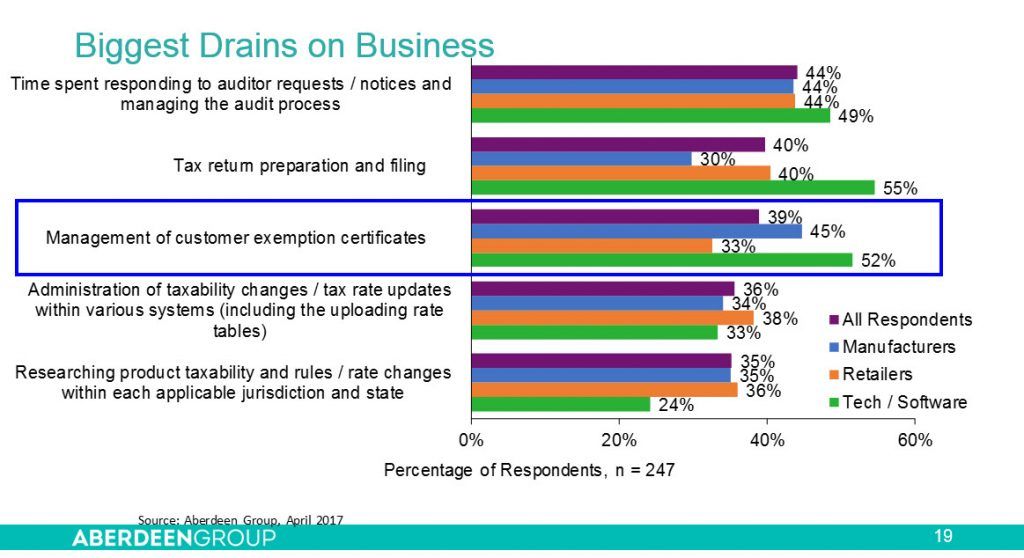

Even before Wayfair, certificate management was no easy feat. According to Aberdeen Research, collecting exemption certificates, validating them, and keeping them up-to-date is one of the top time consuming and costly challenges for businesses:

Do You Have All Necessary Sales Tax Exemption Certificates?

Since the SD v. Wayfair decision, no fewer than 13 states have moved to enact economic nexus rules that have clear and specific start dates, beginning as far back as July 1 and extending through January 1, 2019. As state legislatures reconvene after the summer recess, this number is sure to rise.

While no two rules are exactly alike, most states have the following two common standards:

- The total dollar value of sales to in-state customers and

- The total number sales into a given state.

However, not every state is particularly clear on how to determine either figure. For example, should sales to exempt entities or sales for an exempt purpose (e.g. resale transactions) count towards these totals?

Regardless, expanded nexus means expanded exemption certificate management requirements because once you cross either standard, the burdens you face as an economic nexus taxpayer will largely be the same as if you have traditional physical nexus. This translates into if you are audited by a state, the Department of Revenue will subject you to the same scrutiny as any other taxpayer, and you must properly document an exempt sale.

Failing to affirmatively approve the propriety of an exemption will result in an assessment. In fact, scrutiny could be even tighter in a post-Wayfair world as states begin to embrace technology and automation as part of their audit process or if they opt to employ contract auditors who may offer little to no leniency.

This means for any new state where you are now collecting, remitting, and reporting sales tax you will need to:

- Understand what exemption types are valid under each state’s law

- Understand what exemption forms are appropriate

- Obtain valid exemption certificates from your existing exempt customers

- Create a process that ensures certificates are obtained going forward with new exempt customers at the time of sale

- React to certificate expirations and define procedures where expired certificates are either properly replaced with fresh certificates or tax begins to be charged on the customer’s invoice

- Define a process that allows you to safely store and readily access certificates if audited

Improving Your Exemption Certificate Process

The time is now to consider your exemption certificate management process. Do you have a plan that will keep your company compliant in the face of a vastly expanded virtual nexus footprint? Do you have a solution that enables frictionless commerce? Or will your company be exposed to expanded audit risk and liability?

All is not lost – companies can reduce risk by ensuring all the items on the above checklist are addressed. This can be accomplished by adopting an integrated solution capable of:

- Calculating and determining tax appropriately across the country.

- Reporting your taxed and exempt transactions on the right return and getting your return to the taxing authority on-time.

- Ensuring your exemption certificates are valid, up-to-date and readily accessible.

Take Action

Learn how Sovos CertManager, backed by the Intelligent Compliance Cloud, reduces burdens and safeguards businesses from risk and penalty exposure by automating both tax exemption certificate management and real-time verification. Get a preview, below.