This blog was last updated on March 11, 2019

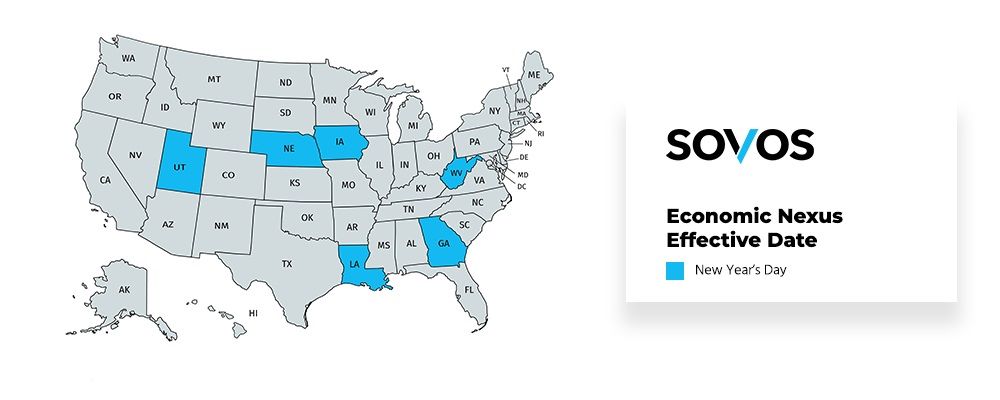

On January 1, 2019, as we ring in the New Year, the number of states that have implemented economic nexus rules will rise to 32. Georgia, Iowa, Louisiana, Nebraska, Utah and West Virginia will all join the ranks of states requiring ecommerce sellers to collect and remit tax. If your company does business in any of these states, the time is now to consider your sales tax software options.

States have acted with urgency since the June 21 Supreme Court decision in South Dakota v. Wayfair which eliminated the traditional “physical presence” requirement by upholding as constitutional a South Dakota rule that imposed a tax collection obligation on any seller that has more than $100,000 of in-state sales or made more than 200 separate transactions with South Dakota customers. While most states have followed the South Dakota rule in lock step, Georgia and Louisiana have put their own unique spin on economic nexus.

Georgia – Remote Sellers Sales Tax

On May 3, 2018, the State of Georgia passed HB 61 which imposes a collection and remittance responsibility on remote sellers. Beginning January 1, 2019 remote sellers with Georgia sales exceeding $250,000 or 200 or more separate sales transactions in the current or preceding calendar year must either remit Georgia sales tax on their taxable sales into Georgia or comply with certain notice and reporting requirements.

Unlike other states that strictly follow the thresholds addressed in the Wayfair decision ($100,000 or 200 or more transactions per year), Georgia has a $250,000 threshold and gives sellers who meet the threshold the option to collect and remit sales tax or comply with notice and reporting requirements. However, be forewarned, the requirements are substantial. Guidance on the Georgia notice and reporting requirements can be found in Georgia DOR Policy Bulletin SUT-2018-07, here.

Stay tuned – while Georgia has been focusing on publishing guidance on its economic nexus standard, our understanding is that Georgia will publish additional guidance on the new reporting requirement as we move into the new year.

Iowa – Remote Sellers Sales Tax

On May 30, 2018, the State of Iowa passed SB 2417 which imposes a collection and remittance responsibility on remote sellers with Iowa sales of $100,000 or more or 200 or more transactions in the preceding or current calendar year.

Iowa is fairly straightforward in implementing economic nexus in that the state has aligned its requirements with the South Dakota standard. Currently the Iowa Department of Revenue has issued limited guidance related to SB 2417 but, the Department is working to provide more detailed guidance and has created a web space to provide information on tax reform here.

Louisiana – Remote Sellers Sales Tax

In the 2018 special session, the Louisiana legislature passed HB 17 re-defining the term “dealer” to include remote sellers that have more than $100,000 in sales or make more than 200 separate sales into Louisiana. In Information Bulletin No. 18-001 the Louisiana Department of Revenue indicated that in order to allow sellers time to prepare, it would not enforce these new rules until on or after January 1, 2019.

Under the new regime, which looks a little like the Alabama Voluntary Use Tax Program, tax is collected at the special rate of 8.45 percent. By way of a simplification, standard local taxes are not collected, and all funds are remitted to the state directly via Form R-1031. No local filing is required.

Although January 1, 2019, is the official start date for remote sellers to collect and remit, it is important to note Draft Information Bulletin 18-002 seems to suggest that remote sellers should expect at least thirty days’ notice prior to the commencement of enforcement. However, this bulletin is only a draft, so the January start date looks official, at least for now. If any changes are made, Sovos will keep you informed.

12/24 UPDATE: This bulletin is now official and the start date for mandatory collection will no longer be January 2019, but 30 days after the state gives notice. Subscribe to our Regulatory Feed for updates as details come to light on this and other remote seller legislation.

Nebraska – Remote Sellers Sales Tax

On July 27, 2018, the Nebraska Department of Revenue announced its intention to enforce sales tax collection on remote sellers starting January 1, 2019. The Department plans to apply a threshold similar to that of South Dakota.

The Department has published a statement on Wayfair, which can be seen here, along with an FAQ page that addresses common questions and answers.

Utah – Remote Sellers Sales Tax

On July 21, 2018, Utah joined the ranks by enacting SB 2001, known as the Online Sales Tax Amendment Bill. Modeled after the South Dakota rule, remote sellers who have more than $100,000 of sales or more than 200 transactions in a year into Utah will be required to collect and remit sales tax to the state. The text of the bill can be seen here.

Aside from mandating remote seller sales tax collection and remittance, SB 2001 repeals the 18 percent seller discount Utah offered remote sellers who voluntarily collected and paid Utah sales tax. The repeal is also effective Jan. 1, 2019.

West Virginia – Remote Sellers Sales Tax

On October 3, 2018, the West Virginia State Tax Department issued an Administrative Notice that out-of-state vendors who deliver more than $100,000 of goods or services into West Virginia or engage in 200 or more separate transactions in the preceding calendar year will be required to collect and remit West Virginia state and municipal sales and use taxes on all sales West Virginia sales made on and after January 1, 2019.

To see the Administrative Notice click here.

A Look to the Future

In April 2019, California will join the ranks of states enforcing economic nexus. With Tennessee and Wyoming nexus laws pending decisions by the courts, only 10 states (not including Alaska, which only has local sales tax) remain to enact economic nexus rules. Economic nexus can be fairly simple or very complex. Having a comprehensive cloud-based tax solution with rooftop address accuracy could drastically reduce the burden and risk for a business.

Take Action

Be a sales tax hero by safeguarding your business with the world’s most complete sales & use tax filing solution. Request a Sovos Sales and Use Tax Filing demo today and solve sales tax filing for good. See our full line of sales and use tax solutions.