This blog was last updated on March 26, 2019

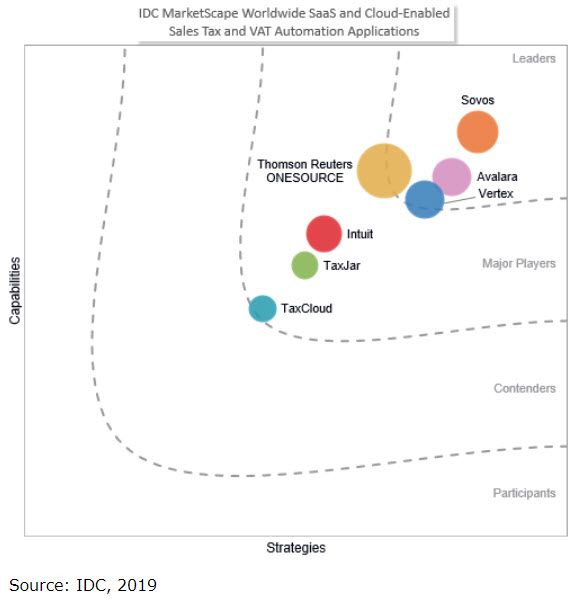

Sovos being named a “Leader” in the IDC MarketScape: Worldwide Sales Tax and VAT Automation Applications 2019 Vendor Assessment is a validation of its current and future product and business strategy. For those who are less familiar with IDC and its vendor evaluation process, or who are more familiar with the Gartner Magic Quadrant or Forrester Wave, this should shed some light.

IDC is “the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries.”

What is an IDC MarketScape report?

An IDC MarketScape is a vendor assessment tool, providing in-depth quantitative technology market assessments of Information & Communication (ICT) vendors for a wide range of technology markets.

It helps IT buyers:

- Evaluate specific products and services across many different technology markets;

- Identify vendors that best meet specific selection criteria;

- Confirm investment decisions with a 360-degree assessment of current and prospective vendors.

IDC MarketScape criteria selection, weightings, and vendor scores represent well-researched IDC judgment about the market and specific vendors. IDC analysts tailor the range of standard characteristics by which vendors are measured through structured discussions, surveys, and interviews with market leaders, participants and end users.

Market weightings are based on user interviews, buyer surveys and the input of a review board of IDC experts in each market. IDC analysts base individual vendor scores, and ultimately vendor positions on the IDC MarketScape, on detailed surveys and demo interviews with the vendors, publicly available information and end-user experiences in an effort to provide an accurate and consistent assessment of each vendor’s characteristics, behavior and capability.

What information does the IDC MarketScape report on Sales Tax and VAT automation include?

- IDC MarketScape reports open with a graphical chart depicting each vendor’s position within a given market broken into four segments, Leaders, Major Players, Contenders and Participants, based on current capabilities and future strategies.

Capabilities

The Capabilities section includes a deep dive into a company’s current cloud capabilities, architecture, implementation, APIs, scalability, security, etc. Vendor viability, such as number of customers, globalization (geographies covered, industries), partners, and integration are also taken into consideration. Likewise, user experience (U/X), a solution’s user interface, customer support, customer satisfaction, ease of use, TCO, and account management factor into this scoring.

Strategies

Equally important to IT buyers are a company’s plans for growth and unique competitive positioning, plans to serve new markets, and investments in solutions that serve their customers’ needs. A firm product and innovation roadmap, delivery models, functionality and cloud and architecture strategy are also closely scrutinized to ensure buyers will continue to be served well into the future.

Read the Sovos CEO blog post that asks the following question: The digital transformation of tax presents finance and IT leaders around the globe with a pivotal challenge: How do we prepare the business for the digital transformation of tax?

Not only do businesses have a need to reduce current burdens on their IT, finance and tax teams, they also a need to be prepared for the inevitable government regulatory tax changes to come over the next 5-10 years. Knowing which vendors scored highest on strategy, Y-axis, is paramount.

- The chart is followed by an IDC opinion section and overview of the market, the sales tax and VAT automation applications market in this case. IDC will answer questions such as: Which challenges are driving the need and investment? Which advanced technologies are being used to innovate in the space?

- It will provide a short section on inclusion criteria and detailed advice and sample questions for an RFI for technology buyers.

- Vendor summary profiles will then be included, discussing size, locations, industry focus, ideal customer size, average implementation times, infrastructure technology, pricing model, largest customer, partner ecosystem, and a few relevant facts.

- Strengths, challenges and IDC’s opinion on when to consider each vendor based on its differentiating qualities complete the vendor profiles portion.

How is a vendor measured in an IDC MarketScape?

Scoring in the IDC MarketScape for sales tax and VAT automation applications was based on 12 categories, six capabilities and six strategy categories. Get the IDC MarketScape brief to learn more.

What is the value of an IDC MarketScape?

- For buyers of sales tax and VAT applications, selecting a tax automation solution can be a complex process involving multiple departments and stakeholders across geographically distributed offices. Knowing which vendors are strong in all evaluated areas from a capabilities and strategy perspective can save IT, tax and finance leaders a lot of time in determining where to focus their attention, essentially creating a short list of vendors to evaluate.

- For vendors, an IDC MarketScape report is validation for competitive position in its relevant market from a well-respected, global IT advisory analyst firm.

Why did IDC begin covering the sales tax and VAT automation software market?

While tax gap issues began to heat up on the global stage, big changes in India, Brazil and within certain states in the United States highlighted the issue of tax compliance.

About the same time, IDC received a large number of inquiries on the topic of sales and use tax, tax automation, indirect tax, South Dakota v Wayfair, and global tax compliance. These inquiries came from multiple client groups within IDC. For example, IDC fielded calls from the investor community (hedge funds and venture capital), press (online and traditional), enterprise applications vendors in adjacent markets (ERP, Procurement, Travel/Expense) and most notably customers (end users of software). They all were asking about the various aspects of tax compliance that were relevant to them.

This collection of forces prompted IDC to energize its tax research and served as the impetus for this IDC MarketScape, of which a reprint brief for Sovos is available for download.

The digitization of VAT and sales tax is raising the stakes for tax compliance solutions. For businesses to thrive today, you need a complete solution that integrates determination, e-invoicing compliance and tax reporting; supports continuous interaction with governments around the world to maintain up-to-the-minute compliance; and connects your entire financial software ecosystem.

The digital enforcement of tax will be a problem for any company that isn’t prepared. But that doesn’t have to be you. See the power of the first complete, continuous and connected tax platform for yourself.

Take Action

Download the IDC MarketScape brief to learn how Sovos brings value to those looking to Solve Tax for Good.