This blog was last updated on March 11, 2019

Sovos indirect tax experts, Matthew Walsh and Chuck Maniace, recently presented webinar attendees with valuable information on how to automate tax compliance on the AP side in our Webinar, “Leading Practices in Automating Tax Compliance Along the Procure-to-Pay Process.” They discussed the benefits and drawbacks of manual, semi-automated, and fully automated (real-time or batch) compliance solutions. Several common use cases were outlined. Chuck and Matt also provided a number of options, given varying levels of resources and technology, to improve AP compliance.

You may now view the OnDemand webinar recording and slides.

I’ve provided you with the minute each section below begins so you may fast forward to the area that is of most interest if you are short on time.

Jump to the Poll Results below

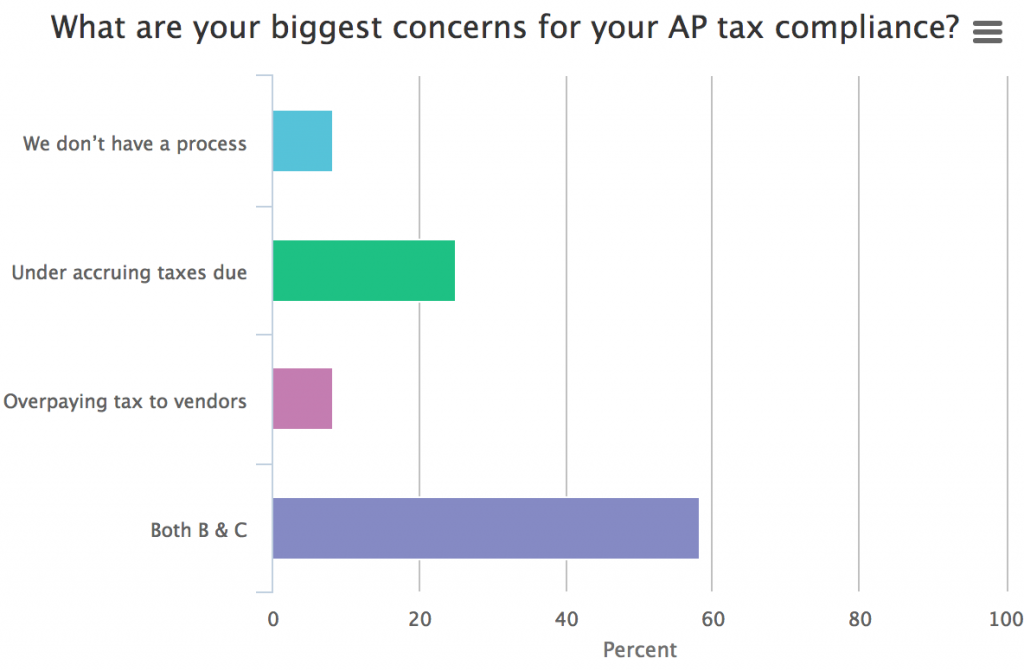

Chuck was quick to point out that companies face a serious audit risk and liability on the AP side and auditors conducting a sales tax audit will go right after possible AP liabilities, especially with companies that utilize P-Cards. Not only will they likely ask for a sampling of PCard and other purchase transactions but will also demand affirmative proof that tax was applied correctly. And, as you may know, mistakes here are a twofold direct cost to your business, either under accruing what tax you owe (and then being hit with interest and penalties) or overpaying your vendors. While tax recovery options are available, getting back that money can be expensive and time-consuming.

“If you’re going to contend to an auditor that you owed no use tax liability on this particular item because it was transported out of the jurisdiction and not within the reach of the auditing jurisdiction, you’re probably going to have to go a long way to demonstrate, with documentation, that indeed that’s the case.”

What Makes the Procure to Pay Process So Challenging for Manufacturers?

[7: 00-minute mark into recording]

Manufacturers face a patchwork of exemptions and exclusions each is potentially entitled to based on very nuanced rules across the country, not only based on what is being manufactured, how and where, but also what part of the manufacturing process the item is used (production, quality control, testing, pollution control), how much of it is being used, is it being used primarily or exclusively, and even if it is completely and totally absorbed during production. Definitions of these rules can vary state to state and can get tricky, quickly and your vendors can’t always be trusted to get the tax right.

Semi-automated Tax Calculation

[21: 00-minute mark into recording]

The challenges of using, and maintaining, a tax matrix look-up tool were discussed. What if a manufacturer purchased a piece of qualifying equipment that was marked as exempt but in actuality, it was taxable at a reduced rate based on a recent law change pertaining to the location where the equipment will be used? Your tax matrix look-up tool not only becomes super difficult to maintain but may be costing the business money if inaccurate.

Manual Invoice Review Process

[24:00-minute mark into recording]

Many manufacturers today rely on a manual invoice review process in order to verify the tax made on an invoice by their vendor. As invoices pile up, decisions need to be made as to which will get reviewed with a closer eye and which will not, usually based on dollar amounts. Invoice review is a labor-intensive process, often times requiring two-and-a-half to three days per month to review all of them, flag issues, go back to the PO and determine what action needs to be taken. Is this something you want your top tax talent spending their time doing?

Automated Tax Tolerance Processing

[26:00-minute mark into recording]

Here our experts discuss the advantages and concerns with real-time and batch PO estimated tax determination through an ERP or purchasing system based on a tolerance to help determine which invoices to review. Tolerance processing can utilize a determination engine to estimate what taxes “should” be charged and kicks out “for manual review” invoices where vendor determined tax does not align with expectations. Organizations retain the flexibility to choose how narrowly or widely to set their tolerance. Tolerance can generally be configured differently for different vendors, cost centers, jurisdictions, etc. Tolerance processing has many advantages over manual invoice review. However, initial setup is critical. Further, if you (or your engine) make errors in correctly identifying what is being purchased, the jurisdictions buying into, or the cost centers and various groups that are purchasing, incorrect tax results are not going to make the process any better than what you have today. Garbage in, garbage out as they say. And one must still set up a self-assessment process to assess the tax and accrue it properly.

Evaluated Receipts Settlements

[29:50-minute mark into recording]

The “gold standard” of the AP process, evaluated receipts settlements, is an automated process where the buyer takes complete responsibility for determining the tax due and payable to sellers as the PO is created and informing the seller what they will get for tax with the buyer’s purchase.

Some of the challenges associated with implementing ERS include the fact that the seller and buyer must agree. Also, the seller, who still remains legally responsible for their own tax compliance, must have faith that the buyer is calculating tax correctly. The buyer must also know and understand the nexus profile of their vendors and keep it up to date. Misunderstanding nexus may cause problems if a company sends their vendor a tax they can’t remit, or withholds a tax they should have collected. However, a properly executed ERS program can be extremely beneficial. First, it can have a positive impact on cash flow because the company is no longer overpaying taxes it shouldn’t be paying, and only accruing taxes it needs to pay. It also puts tax determination in the company’s hands and out of the vendor’s to determine if an item or piece of equipment should be taxable or not.

As margins decrease and the focus on granular compliance increases from auditors, more companies are taking a closer look at their AP processes.

Real-time Tax Determination

[34:45-minute mark of recording]

Lastly, our experts discussed the benefits of implementing a real-time and flexible tax determination solution that keeps rates and rules up to date and accurate as things change – an important backbone that some companies may overlook during the vendor selection process. If the rates and rules are not right, companies are merely putting a nice front end on what’s ultimately a manual process, akin to putting lipstick on a pig (as my software readers will attest).

One use case the speakers shared was a manufacturer that buys accounting software that they will use across their 15 locations around the globe. The right solution not only knows the proper tax treatment of software globally but is flexible enough to take this single bill and properly allocate the charge across all those multiple locations. Some products being purchased by one cost center may be considered “manufacturing,” while if purchased by another cost center and used internally may not be classified as such, requiring tax to be paid.

Tax breaks or special rates may also apply in situations where a manufacturing plant or an office is built in a particular location, requiring those specific one-off negotiated rates and rules to be managed correctly with that tax authority. Having to drill into the details of each transaction is what makes AP so complicated. Is something taxable, tax exempt, require a reduced rate, is there a threshold or limitation, etc.

With real-time tax determination, direct integration between the company’s ERP system, or purchasing system and the tax determination engine for both purchase order and the AP modules, enables real-time automation. The tax included on POs, meaning as the PO is created, is evaluated in real time by a parallel determination through the tax engine. If the amount is wrong, the invoice can be suspended (pending a discussion with the vendor) or paid with the tax amount the buyer determines to be correct. Perhaps they overcharged the company because it missed an exemption it was entitled to, or a rate changed and they were out of compliance.

Some companies choose a batch determination option rather than processing in real-time. Batch determination can be completed, at defined intervals (nightly, weekly, monthly) based on the organization’s preference. The main benefit of batch review is that it keeps the payment process moving – meaning the organization gets the supplies they need when they need them and remains primed to take advantage of any available prompt payment discounts. One downside, some checks may be cut and paid with incorrect tax, and recovering overpaid tax after the fact can sometimes be a labor intensive effort.

Listener Poll

Q&A

Three important questions that came in during the webinar can be listened to beginning at 50:05 of the recording. Get insights into what your peers are struggling with and recommendations on how to solve them.

Take Action

View the Recording and download slides for: “Leading Practices in Automating Tax Compliance Along the Procure-to-Pay Process,” to learn different ways you can achieve higher levels of control within your AP and tax compliance processes.