This blog was last updated on September 2, 2021

Increased visibility into, and control over, taxpayer financial and trade data is the key benefit highlighted by governments that have introduced continuous transaction controls (CTC) regimes.

Its importance cannot be overstated. Transactional data cleared by or exchanged through a tax administration authorised platform becomes the new source of truth for tax authorities to assess the accuracy of accounting ledgers and tax returns.

CTCs also provide tax authorities with relevant data about the condition of the country’s formal economy and enable targeted policies. It’s the latter that has become increasingly relevant to countries across the world as they look to repair struggling economies in the wake of the pandemic.

Understanding the economy by analysing tax big data

Brazil is one of the top 10 economies worldwide, with diversified businesses and sectors. However, it is also one of the most complex countries in the world for tax compliance.

Over the years, Brazil has introduced a plethora of different fiscal e-document types. The common denominator is real-time submission of trade relevant documents (notably e-invoices) in structured form to one of the several state-operated clearance platforms. These compliance regimes do more than just register data for tax control purposes; the electronic invoices contain data of the specific goods and services negotiated by a taxpayer, providing a valuable source of data about the country’s economy.

In Brazil, virtually the entire economy is registered through some sort of CTC requirement. Different supplies are registered by different invoice types (e.g. NF-e, NFS-e, CT-e, NF3-e) and cleared by different local tax administration clearance platforms. Interpreting all this financial data is not easy, but many Brazilian state and municipal authorities have released information and provided analysis on the impact of COVIDf-19 on the economy – all based on electronic invoice data. The Brazilian Federal Revenue Agency (RFB) has released bi-weekly bulletins that include data split by region and sector, as well as comparing current data against the same period in previous years.

The effect of COVID-19 on Brazil’s economy

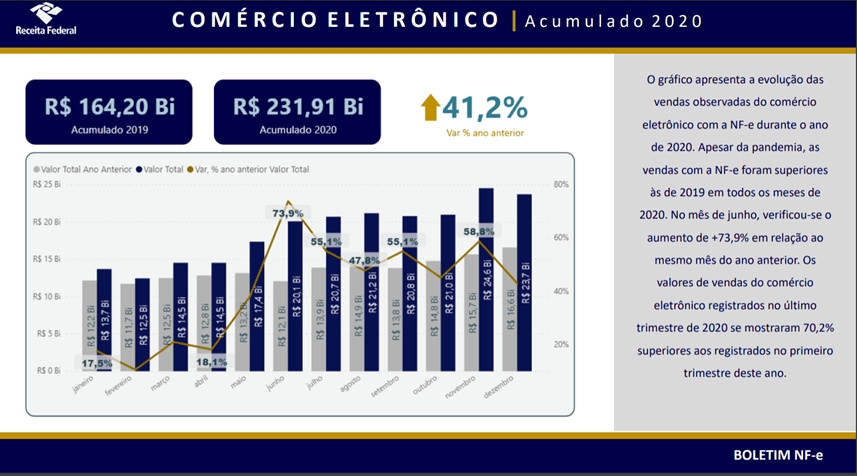

The data revealed that in April 2020 when the first restrictive measures were imposed in some states and municipalities, the industrial sector had a 24% decrease in sales compared with April 2019. At the same time, sales of electricity and gas increased 25%. The most notable effect was to e-commerce, where sales registered were higher in every month of 2020 compared to the same month in the previous year.

Source: Receita Federal do Brasil. Boletim NF-e. 6th Edition. Published on 1 January 2021. Available at https://www.gov.br/receitafederal/pt-br/acesso-a-informacao/dados-abertos/boletim-da-receita-federal_impactos-da-covid-19/boletim-6a-edicao-1-janeiro-2021-v4e.pdf. Accessed on 7 April 2021.

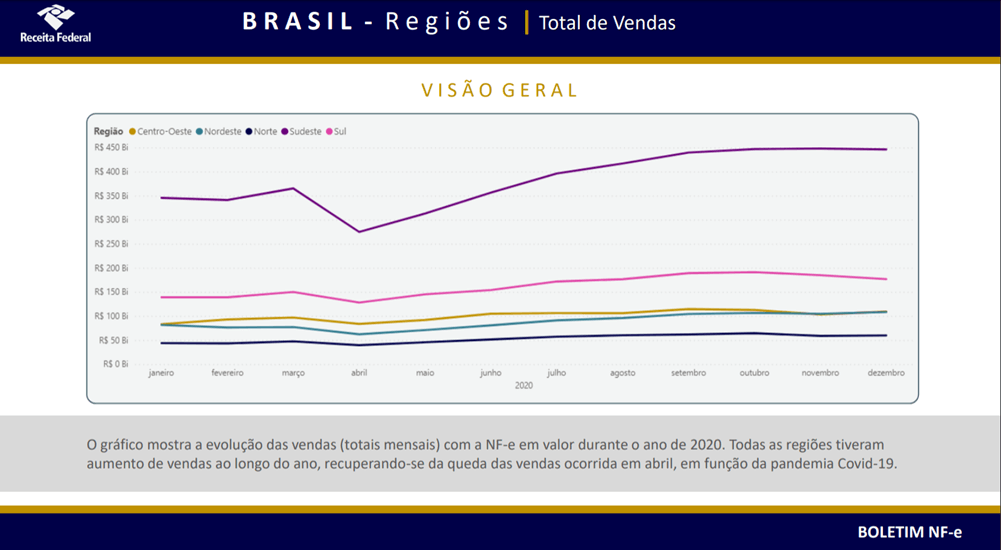

The region most affected by COVID-19 measures was the South East – home to 44% of the country’s population and Sao Paulo and Rio de Janeiro. The region registered a BRL 100 billion (USD 178 billion) drop in sales in April 2020 compared with the previous month but surprisingly the yearly volume of registered sales surpassed pre-pandemic levels.

Although the country has been hit hard by the COVID-19 pandemic, the data gathered by the tax authority highlights the industries that have been successful during this time. The sectors included in RFB’s reports registered a 3.4% increase in sales in 2020 compared with 2019, driven by pharmacy and construction industries. In contrast, the sales of fuel, cars and motorcycles decreased by 6.4% and 5.6% respectively.

Source: Receita Federal do Brasil. Boletim NF-e. 6th Edition. Published on 1 January 2021. Available at https://www.gov.br/receitafederal/pt-br/acesso-a-informacao/dados-abertos/boletim-da-receita-federal_impactos-da-covid-19/boletim-6a-edicao-1-janeiro-2021-v4e.pdf. Accessed on 07 April 2021.

Source: Receita Federal do Brasil. Boletim NF-e. 6th Edition. Published on 1 January 2021. Available at https://www.gov.br/receitafederal/pt-br/acesso-a-informacao/dados-abertos/boletim-da-receita-federal_impactos-da-covid-19/boletim-6a-edicao-1-janeiro-2021-v4e.pdf. Accessed on 07 April 2021.

Brazil’s influence on Europe’s tax regimes

While closing the VAT gap is what drives most economies to adopt CTC systems, Brazil is a striking example of how access to granular transactional data can be a significant benefit to tax administrations. The data extracted from e-invoices, e-reporting, e-accounting and other documents can be used as an economic policy driver as well as a tool to improve tax revenue. The transactional data made available to public authorities enables governments to intervene in specific economic sectors with surgical precision.

While Latin-American countries have consolidated their CTC platforms over the years, in Europe a multitude of different frameworks are gaining traction. Italy has introduced its own invoice clearance system and is soon expected to be followed by Poland. France, Germany and Slovakia are also paving the way to introduce their own local iterations of transactional controls.

While these reforms will introduce technological tools to reduce VAT deficits, more importantly they will provide tax authorities with valuable economic data – a benefit that will become critical as countries recover from the economic effects of the pandemic.

Take Action

To find out more about what we believe the future holds, download VAT Trends: Toward Continuous Transaction Controls. Follow us on LinkedIn and Twitter to keep up-to-date with regulatory news and updates.