The basics of the Streamlined Sales Tax Project (SSTP)

Sovos has been an active industry participant in the Streamlined Sales Tax Project (SSTP) since its inception in the year 2000. Sovos is a certified service provider™ (CSP) under the Streamlined Sales and Use Tax Agreement and both Sovos Enterprise and Small Market sales and use tax solutions are Certified Automated Systems (CAS). Information about the project, Sovos involvement, and the immediate benefits customers realize from using a Streamlined Sales Tax™ (SST) certified solution are discussed below.

What is the Streamlined Sales Tax Governing Board?

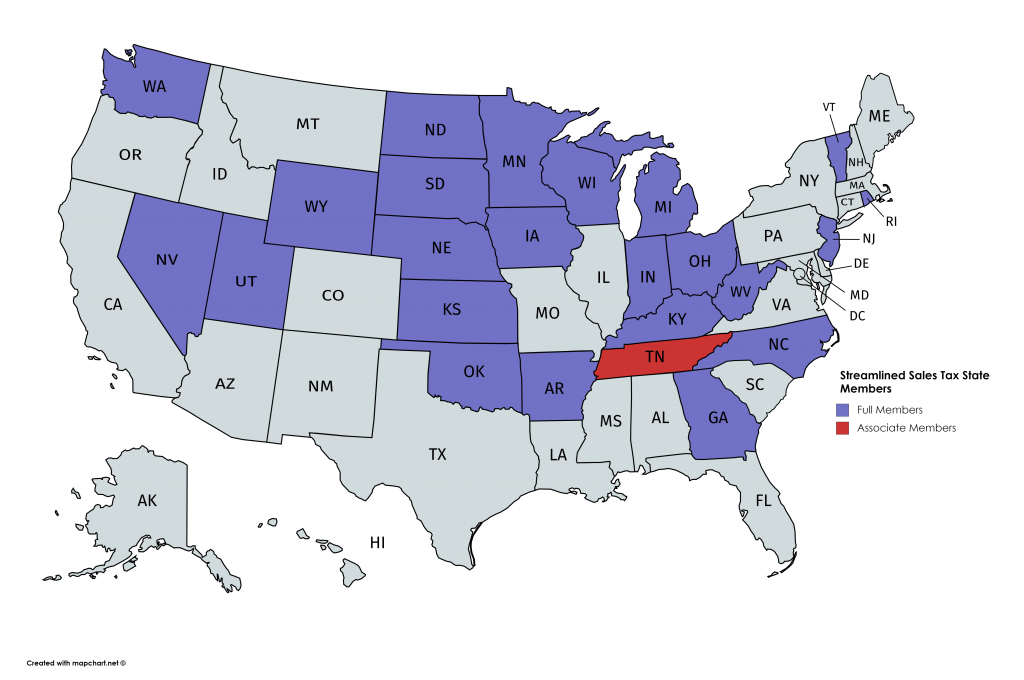

The Streamlined Sales Tax Governing Board is an organization of 24 state governments – representing 31 percent of the U.S. population – who have voluntarily chosen to work together in an effort to modernize and simplify sales and use tax administration. The result of their efforts is the Streamlined Sales and Use Tax Agreement, which serves as a set of foundational principles for simplified sales tax to which every member state must adhere. While state membership is completely voluntary, the organization is self-policing. That is, if a member state enacts laws or rules that run contrary to Streamlined principles, they can be removed from the organization by a vote from their fellow members.

Early on, the Streamlined member states recognized the crucial role technology would play in modern tax administration and as part of their foundational principles, created a process whereby tax software providers could have both their technology and content certified as accurate by the members.

The highly effective work of the Streamlined organization in simplifying tax was recognized by the United States Supreme Court in the recent South Dakota v. Wayfair, Inc. ruling. Justice Kennedy acknowledged South Dakota’s membership in the Agreement as evidence that the state has undertaken steps to ensure compliance with their laws does not represent an “undue burden.”

Why is Sovos involved in the Streamlined Sales Tax Project (SSTP)?

The member states of Streamlined have always recognized that they should not create rules in a vacuum, and from the beginning sought collaboration from both sellers and solution providers. Sovos immediately recognized the mutual benefit of being involved in Streamlined and has been a collaborative participant in the organization from its inception.

As part of this relationship, Sovos is actively present in meetings of the Streamlined Sales Tax Governing Board (where changes to the agreement and other major decisions are debated and voted upon), the State and Local Advisory Council (SLAC), and the Business Advisory Council (BAC) – which both advise the Governing Board on any variety of issues. Participation in these sessions with the Governing Board member states provides Sovos with a direct line of sight into many sales tax changes before they become law.

What does it mean to be a certified service provider (CSP)?

A certified service provider (CSP) is an agent certified under the Streamlined Sales and Use Tax Agreement to perform all the seller’s sales and use tax functions, other than the seller’s obligation to remit tax on its own purchases. A CSP is designed to allow a business to outsource most of its sales tax administration responsibilities to organizations with the expertise, tools and resources to streamline the process and limit potential audit risk.

For example, CSPs must offer the following services:

- Integrate the CSP’s software with the seller’s systems.

- Calculate tax on all relevant sales transactions by applying the correct rate and product taxability rule.

- Maintain a proper record of each transaction.

- Prepare and file the required tax returns.

- Remit the tax to each of the Streamlined member states.

- Resolve any notices or audits by any Streamlined member states.

- Protect the privacy of the tax information it obtains.

CSPs provide these services through a Certified Automated System. Our certified system is called Sovos Global Tax Determination.

Each streamlined full member, contingent member and associate member state has certified the accuracy of the tax rules maintained in Sovos certified solutions. This means they have pored through the Sovos product taxability matrix and confirmed the accuracy of virtually every single sales tax decision contained therein. Further, each state sends Sovos periodic tests to ensure Sovos is capturing every single rate and boundary change enacted in their jurisdiction.

What is the Model 1 seller program?

A “model 1 seller” is a business entity registered under the Agreement that has selected a CSP as its agent to perform all the seller’s sales and use tax functions, other than the seller’s obligation to remit tax on its own purchases.

Registration as a model 1 seller highlights an important fact. If a customer selects Sovos as a CSP under the SST program under model 1, that seller must use Sovos for both calculation and reporting/remittance.

When Sovos agrees to take on a model 1 customer, Sovos agrees to perform the following services:

- Set up and integrate the certified automated system with the seller’s system – including a product mapping exercise performed by the CSP or through a method provided by the CSP.

- Calculate the amount of tax due on a transaction, which includes identifying the relevant taxing jurisdiction, the proper taxation of the product being sold, and the applicable state and local rate.

- Generate and file the appropriate sales tax returns and make the necessary remittance.

- Respond to all notices and audits stemming from the services outlined above.

When acting as a CSP, Sovos must provide implementation, tax determination, and filing/remittance managed services for those member states where the seller is a volunteer (see definition below). Sovos compensation is not paid by the seller but through the member states. The amount of compensation received by Sovos is dictated by the terms of the contract between the Certified Service Providers and the Streamlined Sales Tax Governing Board.

For any member state where the seller is not a volunteer (e.g., they collect and remit for the state as a standard taxpayer) and for any state that is not a member of Streamlined, Sovos would be compensated directly by the customer for our determination and filing services.

What is a CSP compensated seller?

A CSP compensated seller is defined in the contractual agreement between the CSPs and the Streamlined Sales Tax Governing Board. Understanding what the term means is critically important to understanding whether an entity qualifies for certain benefits associated with using a CSP.

A CSP compensated seller is defined as a seller that registers through Streamlined Sales Tax through the Streamlined Sales Tax Registration System (SSTRS) and has no fixed place of business in the state and less than $50,000 of property or payroll in the state. In other words, if you have physical nexus in a given state or have significant people or property in a given state, you are not eligible to be considered a CSP compensated seller.

Assess your status with our CSP compensated seller assessment.

What does it mean to be a Model 1 CSP compensated seller?

All Sovos customers receive the direct and substantial benefit of using software that has been comprehensively reviewed by the member states. However, for those sellers that are eligible, there are three distinct benefits that apply to Model 1 volunteers:

- Compensation – The Streamlined member states pay CSPs directly for calculation and filing services provided to Model 1 volunteers in their states.

- Audits – Sovos is required to supply member states with transactional data supporting the monthly filings of CSP compensated sellers. Further, during an audit of a Model 1 CSP compensated seller, Sovos serves as the first point-of-contact – not the seller. While Sovos may need to obtain additional details from the seller on certain transactions, audit questions may be resolved with the auditor and Sovos directly, relieving the CSP compensated seller from many time consuming and expensive audit tasks.

- Liability relief – Member states cannot assess either a seller or the CSP audit liability for any error in the calculation of tax that flows from any rate, rule or boundary information provided by the member state and properly used by the seller. However, it is important to understand that liability relief is not absolute. If, for example, a seller misidentifies an item being sold, for its CSP to map to its determination engine, and it leads to an incorrect tax result, liability will exist.

What Sovos solutions are available for Model 1 sellers?

When a company partners with Sovos for its SST Model 1 needs, it will utilize the Sovos SaaS-based Global Tax Determination engine, the Sovos filing managed services offering and our certificate management managed services solution.

What services may be separately purchased by Model 1 sellers?

While not required of program participants, sellers may also choose to enhance audit defense further by utilizing the Sovos CertManager solution to aggregate and store exemption certificates, and Sovos Use Tax Manager for vendor invoice validation needs.

In addition, Sovos Intelligent Compliance Cloud solutions can be purchased to cover additional determination and filing needs outside of SST Certified states to consolidate tax strategies and technology with a single provider.

Why should Model 1 sellers select Sovos for SST?

While all Certified Service Providers must comply with the requirements set by the Streamlined Sales Tax Project, Sovos sets itself apart by being the only comprehensive solution for modern tax. In addition to providing the highest accuracy possible in sales tax determination in SST and non-SST states, Sovos also provides solutions for exemption certificate management and vendor invoice validation of sales and use tax on purchases. Sovos works with governments around the world in rolling out new tax solutions and helping global companies in these countries to comply with new regulations quickly, accurately and efficiently. The combination of these offerings is a comprehensive global solution for the modern business, enabling unhindered growth, agile response to change and security from regulatory risks to enable frictionless commerce.

Take Action

Contact us to discuss how Sovos may put the streamlined sales tax project to work for you.