Meet the Expert is our series of blogs where we share more about the team behind our innovative software and insurance premium tax (IPT) compliance services.

As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes, to support you in your tax compliance.

We spoke with Mai Nguyen, senior compliance services representative who explained why it’s so important for insurers to get IPT filing right and shared her top three tips for submitting IPT liabilities.

I’m a senior compliance services representative – specialising in IPT at Sovos. I joined the company over four years ago and I deal with a diverse portfolio of 30+ clients, helping them with the entire cycle of IPT submission.

My team reviews data provided by our clients, creates a summary of tax due and confirms IPT and parafiscal liabilities due for a specific period. My day-to-day tasks include approving the IPT liabilities to be declared correctly and compliantly and authorising payments to be made on behalf of our clients.

My role is to oversee the day-to-day operational management whilst ensuring all compliance requirements are met consistently. I also work closely with clients to answering their queries to ensure their IPT submissions meet the strict regulations set by global tax offices.

The IPT filing process varies from one territory to another and it’s crucial for insurers to follow it accurately and compliantly. There are many elements that need to be considered in this process:

IPT filings can be made online in Portugal, Spain, Ireland, Finland and Germany. This filing method is becoming a common trend and is likely to be introduced in other jurisdictions.

In Portugal a data file must be uploaded to a web portal which requires detailed information for each policy such as NIF number (policyholder Tax ID), postcode, country code and territoriality.

In Spain the IPT portal determines the declaration period for each transaction, tax payment or any interest payment due. The portal links the payments due directly to the bank account, meaning the payment is made by direct debit.

IPT filings can be made by post or in person. With any method, it’s important to make sure that deadlines are met to avoid unnecessary penalties.

The consequence of noncompliance is not only the penalty or interest regimes imposed by tax offices but also the indirect costs to insurers which are more significant. These can include the cost for correcting the mistake, as well as additional associate or representative costs. Noncompliance could also have an adverse impact on the insurer’s reputation.

To avoid the unnecessary consequence of noncompliance when submitting IPT liabilities, here are my three top tips:

It can be very challenging for insurers to ensure that IPT is declared accurately and compliantly while adhering to the latest rules and regulations. Here at Sovos, our dedicated IPT Compliance Services team is equipped with in-depth expertise and the most up-to-date changes to help insurers meet all IPT requirements to make submissions efficient and compliant.

All IPT compliance information can be found through Sovos’ blogs, webinars, tax alerts, LinkedIn, Twitter and newsletters.

Have questions about IPT compliance? Speak to our tax experts or download our e-book, Indirect Tax Rules for Insurance Across the World.

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services.

As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes, to support you in your tax compliance.

We spoke with Hector Fernandez, principal compliance tax services representative, who explained the complexities surrounding Spanish insurance premium tax (IPT) and how Sovos helps insurers operating in Spain.

I’m a principal compliance tax services representative at Sovos. As part of my role I work with the different teams helping them with the tax requirements of different tax authorities.

I also work with clients with IPT requirements in Spain, helping them with the many elements of tax compliance.

As mentioned in previous blogs about Spanish IPT, Spain has one of the most complex monthly and annual IPT reporting procedures. It’s challenging due to many factors such as multiple IPT tax authorities (national and provinces), additional entities to deal with including the Fire Brigade Tax (FBT) and the surcharges that must be paid to the Consorcio de Compensación de Seguro (CCS) or other bodies like Spanish Motor Insurers Bureau (OFESAUTO).

In Spain, five tax authorities charge IPT: the National Tax Authority (AEAT) and four provinces (Alava, Guipuzcoa, Navarra and Vizcaya). They are responsible for the policies in those territories. The Modelo 480 contains the same information for different tax authorities, but the formats and requirements can vary.

The annual submission coincides with the December monthly period, which means that it occurs at the same time as submitting the last monthly submission of the year and the annual report.

The Modelo 480 is a yearly overview form submitted by insurance entities that summarise monthly returns and payments. Insurers must include exempt premiums written during the year on this form because this information is not included in the monthly returns.

The data provided in this summary form will be broken down by class of business and monthly payment. While this form is purely informative, it’s vital since it helps tax authorities to find any mistakes, inconsistencies or fraud that could have been committed in the monthly submissions.

There is a compulsory annual return for those entities that subscribe to Fire and Multi-risk policies in Spain (Class 8 & 9). The report is submitted through a specific portal provided by CCS. Insurers must submit the return before the last day of April.

In this report, the different Fire or Multi-risk policies must be declared and broken down by the postcode where the risk is located and include the taxable premium of each policy.

CCS will share this information with the local bodies with competencies to calculate and charge the Fire Brigade in Spain, including councils and provincial councils or the body that helps the insurance companies to deal with this surcharge such as GESTORA (Gestora de Conciertos para la Contribución a los Servicios de Extinción de Incendios).

Those insurance companies that provide car insurance must deal with the Green card surcharge paid to OFESAUTO, the body in charge of this surcharge. Companies must provide the number of car insurance policies issued during the year, and the body will issue the invoice.

Spanish IPT complexity is based on the timing and the high amount of data that insurers must take into account to provide accurate data to the tax authority. It’s important to have software that can compile and process vast amounts of data in an accurate way.

Sovos’ team of IPT experts can help ease the burden of Spanish IPT compliance, through our managed services or consultancy offering as well as our IPT determination software.

Still have questions about Spanish IPT? Sovos can help. Contact our team of experts today or watch our webinar on The Complexity of Insurance Premium Tax in Spain.

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes, to support you in your tax compliance.

We spoke with Manisha Patel, senior compliance services representative – Insurance Premium Tax (IPT), about their role, how they support Sovos clients and their top compliance tips for captives.

I’m a senior compliance services representative – IPT at Sovos. I joined the company over five years ago.

My role at Sovos is multi-faceted. My primary responsibility is to oversee IPT compliance for an extensive portfolio of clients, specifically within the captives practice.

I help ensure that all clients’ tax requirements are met, including checking and signing off tax returns and ensuring that correct payments are made to relevant tax authorities within specified statutory deadlines. Additionally, I help advise clients on more complex or urgent queries that have been escalated within the team.

A P&I Club is a non-profit cooperative association of marine insurance providers that provides P&I insurance to all its member companies. A P&I Club covers a broad range of liabilities, including loss of life, personal injury, cargo loss or damage, pollution via hazardous substances, wreck removal, collision and property damage.

These clubs offer ship owners the highest limits and broadest ranges of coverage. Through their participation in a P&I Club, the member clubs share claims above an individual’s retention via a pooling structure. Pooling together allows members to provide the insurance

cover needed by ship owners and their ships to trade while meeting compulsory insurance and financial security requirements.

Increasing numbers of global tax authorities are switching to digital submissions and, in some cases, require more detailed information to complete these submissions.

My tip for captives would be to invest time learning about these ever-changing requirements for your relevant territories and organise yourself in a way that you can easily and readily have the information you need to hand. This will reduce your business’s risk of errors and non-compliance when settling IPT.

Sovos’ Captives Team caters to the specific needs of captive insurers. Our team can review any program a client may have before the program’s renewal, where we can assist with premium tax calculations, validate applicable country tax rates and prepare payment summaries. Due to limited in-house expertise, we recognise that sometimes additional guidance is needed.

Our IPT Managed Services Team offers a vast amount of knowledge, providing the expertise to our Captive clients through webinars, tax alerts and newsletters to boost their confidence with tax filing and reporting. Additionally, our Consultancy Team can assist with any further queries.

Have questions about IPT compliance? Speak to our experts or download our e-book, Indirect Tax Rules for Insurance Across the World.

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services.

As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes and the latest developments on tax regimes across the world, to support you in your tax compliance.

We spoke to Hooda Greig, compliance services manager about ways insurers can make the Insurance Premium Tax (IPT) process more efficient.

I lead an IPT team that delivers compliance services in Europe. I oversee the day-to-day management and delivery of IPT compliance for an extensive portfolio of global clients. We are the first point of contact between Sovos and our clients. My focus is ensuring all tax requirements for the clients are met, that is filing and paying their liabilities to the various territories they are registered in. I also work closely with other departments within our company, particularly our consulting team to assist with more technical aspects of IPT compliance.

Modernising the tax process will help insurers operate efficiently. There are still many insurers reliant on manual reporting methods for IPT. Strategic management of the end-to-end process is key to improving efficiencies, with a focus on managing risks by investing in digitization. Tax technology tools will make compliance for insurers simple, as will collaborating with tax teams with specialised IPT knowledge at a local level.

My top tip to manage risk is the use of tax technology. Tax authorities are introducing more demanding reporting requirements and digitization of filing and reporting processes can result in efficiency, accuracy, and cost reductions.

Efficiency, accuracy, and the costs of getting it wrong are concerns for insurers. The consequences of IPT non-compliance are not limited to statutory or legal penalties, the indirect costs to insurers are often more significant, the cost of correcting a mistake and non-compliance could also have an impact on the company’s reputation. Tax authorities are becoming more stringent in their reporting requirements. It’s important for insurers to work closely with a managed services team to help meet all their tax obligations and in preparation for future IPT requirements to ensure compliance now and in the future.

To minimise risks, we’re seeing an increasing number of insurers looking to technology solutions to change the way they operate. Sovos’ mission is to solve tax for good and we specialise in tax technology and data analysis with specialised knowledge at a local level, ensuring insurers’ compliance requirements are met. Keeping abreast of all regulatory changes can be difficult, Sovos issues regular tax alerts, newsletters and hosts webinars to keep clients up to date with the latest IPT updates.

Have questions about IPT compliance? Speak to our experts or download our e-book, Indirect Tax Rules for Insurance Across the World.

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services.

As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes and the latest developments on tax regimes across the world, to support you in your tax compliance.

We spoke to Rahul Lawlor, Senior Compliance Services Representative – IPT, about his top compliance tips for large and small insurers.

I’m a senior compliance services representative – IPT at Sovos. I joined the company just over five years ago and in that time have dealt with insurers of all sizes, from multinationals to startups, domiciled in a plethora of different countries in the EU and beyond.

I oversee the compliance activities of a portfolio of insurers. As part of my team there are associates and representatives handling more of the day-to-day data, who I oversee to ensure everything’s on track. Queries from our customers are escalated to me and I also approve returns for customers as well as assisting with reports and annual requirements.

In terms of rules and regulations there is largely no difference in IPT requirements for large and small insurers, one exception could be in Hungary where the IPT rate applied is based on the volume of business.

I would say the main difference between large and small insurers is how they approach IPT compliance. Small insurers don’t tend to have dedicated tax teams – we tend to speak to finance departments who handle invoices and have also been tasked with IPT. When filing IPT in other countries outside their domicile, smaller insurers might not have the language or tax expertise required to file returns or register IPT. Whereas large insurers have specialised teams spanning the globe who deal with a variety of complex tax issues.

Small insurers tend to need more assistance, we help them through the IPT compliance process from start to finish, whereas larger insurers broadly understand IPT and often come to us with queries about more complicated IPT requirements.

Small insurers are often still using legacy systems that were designed before the IPT revolution when the requirements weren’t as extensive as they are now. This means that the information and data necessary for IPT submissions isn’t always being collected at source and on occasion we notice there are elements missing. This then requires going back to policyholders to retrieve the additional information, which can cause submission delays.

Not having the information required for IPT submissions can lead to some countries not accepting the risks and not accepting reports. The cost of non-compliance outweighs the cost of staying with a cheaper system. Setting up a new system might feel like a significant undertaking but in the long-term it provides benefits and minimises the risk of reputational damage associated with not filing risks on behalf of policyholders.

My top tip for small insurers is to educate themselves on IPT, especially if they are writing risks in countries where the tax points aren’t uniform and could pose issues for their systems. The tax point is the date which triggers the tax but it can vary – often it’s cash received, but in can be issuance, written date, maturity date (the list goes on).

Always allow plenty of time ahead of filing and reporting deadlines, especially when entering new markets. We’ve helped many insurers with registration and IPT requirements to avoid any surprises.

Don’t rest on your laurels. Large insurers are more experienced with IPT but when there are wholesale changes, details can sometimes be missed or not fully understood. Make sure you are expanding your horizons and always learning. When changes are required, for example when Portugal went from return to transactional filing or when Spain announced a rate change, it’s important to understand the effect this will have on systems and consequently submission.

Don’t be afraid to ask for help beyond your team. At Sovos we deal with a wide range of insurers and have a wealth of experience, so we’ve most likely helped with a similar query and our team of experts are up to date with the latest IPT requirements.

Don’t be scared to reach out and get a second opinion if you’re unsure, we can help guide you.

Preparation and education are key! There are various stakeholders in the data supply chain, and it is important that everyone is uniform in their understanding of the requirements needed for ongoing compliance.

For small insurers who are still using legacy systems, Sovos’ IPT Determination software can integrate with legacy systems to ensure relevant details are captured. We’ve helped many small insurers with IPT registrations, assisting with the process from preparation stage, submitting documents on a client’s behalf, and advising once registration is complete. You can lean on our expertise to save you time and enable you to focus on your business.

Implementation of Sovos’ IPT Determination software is not limited to solely smaller insurers. For large insurers we also offer an end to end to end solution. Furthermore, our IPT consultancy is on hand to advise on complex tax issues, to give you confidence in high-level decision making.

We have extensive relationships with tax authorities and we have local representatives and associates in countries across the globe who can assist us and our clients with the most complex of IPT queries and requirements.

Have questions about IPT compliance? Speak to our experts or download our e-book, Indirect Tax Rules for Insurance Across the World.

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services.

As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes and the latest developments on tax regimes across the world, to support you in your tax compliance.

We spoke to Russell Brown, senior IPT consulting manager, about Sovos’ IPT consultancy, supporting tax teams and his thoughts about the future of IPT.

I head up the Insurance Premium Tax (IPT) consultancy practice within Sovos. We’re responsible for providing advice, mostly to compliance clients on tax issues of different types of insurance that they write in EU and non-EU countries. We provide clarity on applicable tax rates and their compliance requirements in various countries, as well as location of risk queries.

One of my main responsibilities is to review and approve the reports written by consultants in the team. I also assist our sales team with clients interested in registering for IPT in different countries. This involves discussing the insurance the client provides and the countries involved and helping to onboard new customers. I also participate in writing regular IPT blogs and articles on a variety of subjects, and in webinars and other client events where we discuss a wide range of IPT issues around the world.

We also assist the compliance managed services team with any questions from their clients that they need help with. This can include legislative references or just confirmation of tax rates.

The short answer is we help insurers with their IPT compliance queries but that can vary from project to project.

A typical project for the consultancy team would be for a client to approach us and say, “We’re thinking of writing this type of insurance policy in 10 countries. Could you please tell us all the taxes and tax rates that apply, who bears the cost of those taxes and how they’re calculated. Could you also provide us with guidance on the compliance requirements in each country?”. This could be for EU and non-EU countries.

Another common project is to look at insurance policies and confirm the type of insurance to ensure its taxed correctly or looking at location of risk for an insurance type. This will involve analysing a sample policy from the client to confirm what the insurable risk is so that the correct rules are applied on taxing it in the relevant countries.

Sovos’ IPT customers tend to deal in non-life insurance; we’re often asked to look at property policies or liability risks. Spain, France, Portugal and Belgium are the countries we’re asked most about due to their complicated IPT and parafiscal charges regimes and different rates.

We are also asked questions about non-admitted insurance. For example, if a company is writing insurance but isn’t licensed in that country, they might have questions about how the taxes are calculated, who is liable for the taxes, who should settle taxes etc. These questions tend to be from non-EEA insurers writing policies in EEA countries.

Brokers are another type of client we deal with, or as part of discussions with insurers when there are queries around who is responsible for settling taxes on premiums. We’re able to offer advice to both the insurer and the broker in these cases.

Tax teams want certainty that they’re charging the correct taxes, and that they’re compliant in settling those taxes with the relevant countries’ authorities. That’s where we come in, providing guidance as well as reporting. We’ve received feedback from clients saying the reports have been especially useful to show senior stakeholders that tax compliance is being maintained. The reports are also an important document to have on file that demonstrates that there was an issue identified and they received external advice. Having this activity on record for senior managers and both internal and external auditors is important. If a tax team is asked any questions by tax authorities, they can provide evidence.

We tend to work with tax teams in the planning stages, when an organisation wants to identify any potential tax issues ahead of time to ensure systems are updated and compliant from day one.

I have a few thoughts.

The first is about Germany’s IPT laws. When the country changed its IPT law at the end of 2020, the authority extended the scope of who could potentially be taxed for German IPT. There was some thought that other countries in Europe might try to do the same, the Dutch being a good example where current legislation does potentially allow this under certain circumstances. But because the application of Germany’s law wasn’t the most successful, there’s a feeling that other countries are unlikely to follow this path for the moment.

There is also the question whether or not IPT will be abolished in the UK and replaced with VAT. The government is in the process of starting a VAT consultation on financial services, and it’s likely that this proposal will be included in the discussions between HMT, HMRC and the insurance market including both insurers and brokers. This consultation will likely run for a couple of years, so we won’t know the results for some time, and it is possible that any decisions on this point may be delayed by the timing of the next general election.

There is also always the discussion of the digitization of IPT. There hasn’t been much movement on this recently. Ireland is in the process of digitization and France was due to follow suit but has postponed until next year. We are already helping our customers to possess the ability to file IPT online when this does become a requirement.

Need help with IPT compliance? Speak to our experts or download our e-book, Indirect Tax Rules for Insurance Across the World

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services.As a global organisation with indirect tax experts across all regions, our dedicated team is often the first to know about new regulatory changes and the latest developments on tax regimes worldwide to support you in your tax compliance.

We spoke to Khaled Cherif, senior client representative here at Sovos to discover more about Insurance Premium Tax (IPT) and, in particular, the complexities of France and the French overseas territories.

I joined Sovos as part of the IPT team in June 2017. My role is senior client representative and I mostly work with our French and Italian clients, which is around 54 organisations.

I am the first point of contact so my role along with the rest of the team is to provide clients with all the assistance that they require, including helping them with filing their liabilities and ensuring they are compliant with the relevant regulations.

IPT in France is quite complex as there are many parafiscal charges that can apply to insurance premiums. There are also multiple IPT rates depending on the type of risk being covered. This can range from 7% IPT rate to as high as 30%. As well as the different IPT rates there are also 10 parafiscal charges that could be due on insurance premiums and again all with varying rates.

There are also French overseas territories to be considered. There are two groups of French overseas territories, the Départements and Régions d’Outre-Mer (DROMs), and Collectivités d’Outre-Mer (COMs).

It’s important to understand the differences in IPT requirements with the French overseas territories.

DROMs (French Guyana, Guadeloupe, Martinique, Mayotte, and Reunion) are treated the same as mainland France for premium tax purposes. Premiums covering risks located in these territories should be declared in the same way, except for Guyana and Mayotte where the IPT rates applicable are reduced by half.

For COMs the local tax authority for the territory can levy taxes on insurance premiums. Most have set up their own IPT regimes, often requiring insurers to appoint a fiscal representative. In some COMs territories the tax ID issued for Mainland France can be used.

As many French and international organisations have subsidiaries in overseas French territories it’s important to understand how the different IPT rates and filings affect compliance. Not being based in the territory where IPT needs to be filed can make things complicated, so working with local partners or representatives can ease the burden.

Sovos has a team with global IPT expertise, meaning we can help organisations understand their IPT requirements wherever they operate, including in France and the French Overseas Territories.

Sovos has in-depth knowledge of local requirements, laws and regulations as well as local partners and representatives to assist with IPT requirements.

Need help with IPT compliance? Speak to our experts to see how Sovos can help you solve tax for good.

We recently launched the 13th Edition of our annual Trends report, the industry’s most comprehensive study of global VAT mandates and compliance controls. Trends provides a comprehensive look at the world’s regulatory landscape highlighting how governments across the world are enacting complex new policies and controls to close tax gaps and collect the revenue owed. These policies and protocols impact all companies in the countries where they trade no matter where they are headquartered.

This year’s report looks at how large-scale investments in digitization technology in recent years have enabled tax authorities in much of the world to enforce real-time data analysis and always-on enforcement. Driven by new technology and capabilities, governments are now into every aspect of business operations and are ever-present in company data.

Businesses are increasingly having to send what amounts to all their live sales and supply chain data as well as all the content from their accounting systems to tax administrations. This access to finance ledgers creates unprecedented opportunities for tax administrations to triangulate a company’s transaction source data with their accounting treatment and the actual movement of goods and money flows.

After years of Latin America leading with innovation in these legislative areas, Europe is starting to accelerate the digitization of tax reporting. Our Trends report highlights the key developments and regulations that will continue to make an impact in 2022, including:

According to Christiaan van der Valk, lead author of Trends, governments already have all the evidence and capabilities they need to drive aggressive programs toward real-time oversight and enforcement. These programs exist in most of South and Central America and are rapidly spreading across countries in Europe such as France, Germany and Belgium as well as Asia and parts of Africa. Governments are moving quickly to enforce these standards and failure to comply can lead to business disruptions and even stoppages.

This new level of imposed transparency is forcing businesses to adapt how they track and implement e-invoicing and data mandate changes all over the world. To remain compliant, companies need a continuous and systematic approach to requirement monitoring.

Trends is the most comprehensive report of its kind. It provides an objective view of the VAT landscape with unbiased analysis from our team of tax and regulatory experts. The pace of change for tax and regulation continues to accelerate and this report will help you prepare.

Contact us or download Trends to keep up with the changing regulatory landscape for VAT.

We’re addressing Insurance Premium Tax (IPT) compliance in different countries. Written by our team of IPT and regulatory specialists, this guide is packed full of insight to navigate the ever-changing regulatory landscape. Let’s start with IPT in Slovakia. Effective on 1 January 2019, the default IPT tax rate is 8%.

As of 1 January 2026, the IPT tax rate will rise to 10% for insurance policies where the insurance period commences after 31 December 2025, where the payment is received after that date, and the tax point date (as opted by the insurer) is also on or after 1 January 2026.

You can read other blogs in this series by visiting our Denmark, Finland, and the UK entries or by downloading Sovos’ Guide on IPT Compliance.

There are three tax points for IPT in Slovakia:

Insurers are not required to separately notify or request permission to use one tax point over another but an insurer must notify on the quarterly tax return which tax point they’re using. It’s important to note the choice of tax point must be used for eight consecutive calendar quarters.

Interestingly, Slovakia’s approach to tax points provides flexibility for insurers when choosing to pay tax, giving the option to pay upfront or spread out IPT payments in instalments across multiple returns.

Slovakian IPT is due on a calendar quarterly basis (e.g. January to March return declared in April). This is the same for the payment due at the end of the month. It’s worth noting that all returns are filed electronically so there are no paper returns.

An issuance of a premium is treated according to the relevant class of business and is placed in the corresponding section on the return. A renewal would be treated in the same manner.

For treatment of mid-term adjustments, in the case whereby a premium or part thereof, is increased, reduced or cancelled, there is a separate box on the return used for submission (Box 19). This is unusual in comparison to other countries, predominantly because an increase in premium results in a different treatment.

A correction error can be categorised in two ways.

Mistakes can happen and typos can occur in the supply chain. Maybe there was a multi global risk covering multiple countries and apportionment was incorrectly allocated in the first instance.

In the case of a correction of an error, a supplementary declaration must be submitted for the appropriate period affected.

For example, if in the first quarter EUR 1,000 was declared for a particular risk based on apportionment produced. Later down the line in Q3, on further review it should have been EUR 1,200. In this case, the additional EUR 200 cannot be submitted on the Q3 declaration. An amended return would need to be considered for Q1 and submitted separately – this is true for both increases and decreases.

Overall, negatives are allowed and the Slovakian tax authority should refund the money back to the insurer. Therefore, the credit cannot be carried over to the next reporting period. There are no limits regarding how much the insurer can regularise but a degree of caution is advised.

Whilst there’s no official guidance, it would be wise to keep any documentation as evidence if a large amount needs to be reclaimed.

Historicals need to be submitted as a supplementary return (i.e. outside the current return). The Slovakian tax authority can impose penalties between EUR 30.00 and EUR 32,000.00.

A temporary Tax Amnesty measure was introduced. According to the tax amnesty rules, a taxpayer can settle its outstanding tax liabilities (via corrective returns) or submit historical returns (missed declarations) without incurring penalties or interest for late payment or failure to declare.

This temporary measure applies to tax returns with filing deadlines on or before 30 September 2025. For insurance premium tax (IPT) purposes, it means tax returns submitted for Q2 2025 (due by 31 July 2025) or earlier.

To benefit from the amnesty, the relevant returns must be submitted and the associated tax paid between 1 January 2026 and 30 June 2026.

Download our IPT Compliance Guide for help navigating the changing regulatory landscape across the globe.

Welcome to our Q&A two-part blog series on the French e-invoicing and e-reporting mandate, which comes into effect 2023-2025. That sounds far away but businesses must start preparing now if they are to comply.

The Sovos compliance team has returned to answer some of your most pressing questions asked during our webinar.

We have outlined the new mandate, e-invoicing specifically, and questions around this topic in our first blog post.

This blog will look at the other side of the mandate – e-reporting obligations. These will apply to B2C and cross-border B2B transactions in France, which must be periodically reported.

First let’s look at common questions around payments e-reporting.

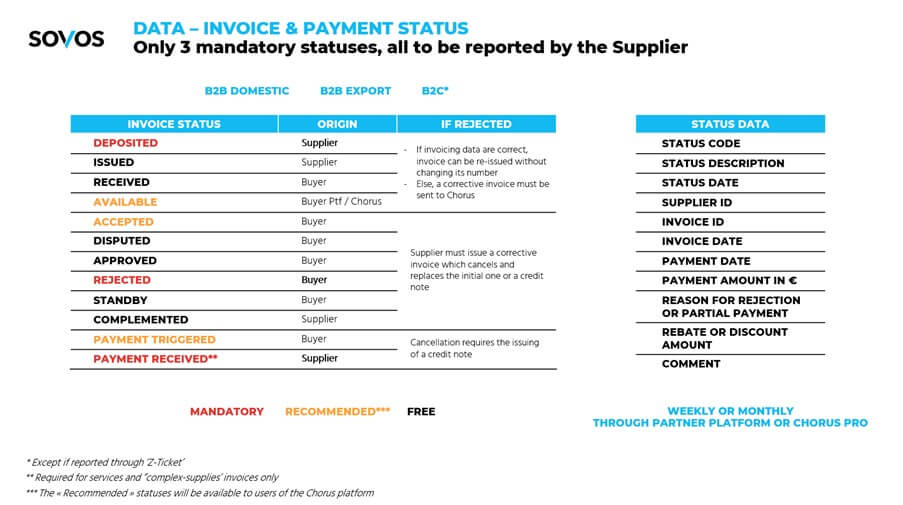

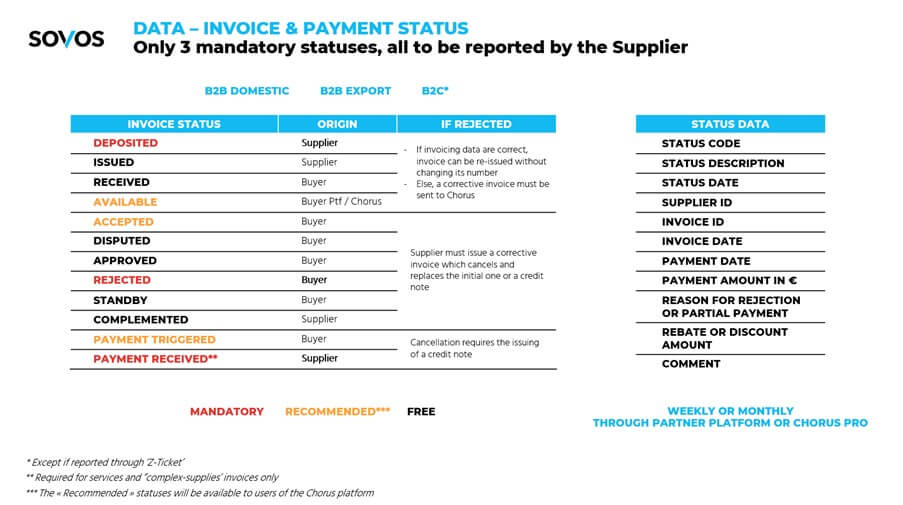

What are the invoice and payment statuses to be reported?

Here is a slide from our webinar showing invoice statuses, whether these are mandatory, recommended, or free, origins, action to take if rejected, status data, and when it needs to be reported:

Who is responsible for payment e-reporting? The buyer, the seller, or both?

It was initially rumoured to be both on the buyer and the seller side, but the latest information from DGFIP clearly states that it will be the responsibility of the seller to report the invoice status, and, if applicable, its payment status.

Some further clarification is needed though since the seller is dependent on the buyer’s response on some status (e.g. ‘invoice rejected’).

Your e-invoicing and e-reporting project cannot be done in isolation. This is a significant project with many dependencies that involve external third parties.

There will be one or, in most likelihood, several third parties in the middle of the transaction chain. This will include Chorus Pro, chosen by the French government as the official and obligatory platform for businesses to issue e-invoices to public administrations.

This section covers common questions on partner platform certification requirements.

Is there a list of official validated partner platforms?

The 13 July 2021 DGFIP workshop dedicated to this matter highlighted that there would be a registration process for third-party platforms, as well as taxpayers who would want to run their own platform.

The registration process will consist of two phases:

Phase 1. A prior selection by the tax authorities based on the general profile of the candidate (e.g. are they up to date in their own tax payment duties?) and the services they propose;

Phase 2. Within 12 months after registration, an independent audit would have to performed that demonstrates that the platform meets the DGFIP requirements, such as:

<liPerforming the control and mapping activities (extraction of invoicing data for both e-invoicing and e-reporting, certain invoice validation checks – mandatory fields, check sums, Customer ID verification – mapping to and from a minimum set of mandatory formats, compliance with GDPR, etc)

A few other key points to note are:

What is the current expectation on when exact required fields with be supplied by the government (invoice specs with all required fields and values)?

Excel files are available as a draft document at a very detailed level which Sovos can provide on request. The final specs should be known by the end of September 2021.

Still have questions about e-reporting? Access our webinar on-demand for more information and advice on how to comply.

In our recent webinar, Sovos covered the new French e-invoicing and e-reporting mandate, and what this means for businesses and their tax obligations.

We are witnessing a global move towards Continuous Transaction Controls (CTCs), where tax authorities are demanding transactional data in real-time or near real-time, affecting e-invoicing and e-reporting obligations.

As such, from 2023, France will implement a mandatory B2B e-invoicing clearance and e-reporting obligation in an effort to increase tax efficiency, cut costs, and fight fraud.

The pace towards this mandate has been accelerating lately with the adoption of the Finance law for 2021, followed by a number of workshops organised by the Ministry of Finance — namely the Direction Générale des Finances Publiques (DGFIP).

In the first of two blogs on the mandate, we answer some of your most pressing questions asked during our webinar.

In part one, we focus on setting the scene in terms of scope, and cover questions around e-invoicing specifically, invoicing file formats, processes and controls, and archiving.

The second blog covers questions around e-reporting obligations.

In this section, we answer questions on the scope of the regulation, such as which companies must comply with the mandate and how.

Are non-resident companies (foreign companies with only a French VAT-registration) obliged to fulfil this new regulation? Are foreign legal entities with a French VAT number in scope?

The Budget Laws for 2020 and 2021 introduced the CTC scheme from a legal perspective. Both include “persons subject to VAT” in the scope.

VAT registration is a strong indication that a company is subject to VAT, but classification as a VAT “taxable person” also depends on other factors.

Therefore, it is not as simple as just looking at whether a company has a local VAT registration, to decide whether it is subject to VAT and therefore targeted by the mentioned budget laws.

However, the scope cannot be unilaterally decided by France as the French CTC scheme is dependent on a derogation from the EU Council.

As a comparison, Italy initially included all taxable persons in the scope of its e-invoicing clearance mandate, including those with a mere VAT registration but no establishment. But in this case, the EU Council limited the scope (of its derogation) to persons established in Italy.

From an e-invoicing perspective, we can therefore expect that France will need to follow the Italian path (due to its reliance on a derogation from the EU Council), limiting the scope to established persons.

DGFIP has however suggested that companies that are non-established but VAT registered will be in scope of the reporting obligation.

Is import of goods in the scope of e-reporting? What about import of services?

Only imports (supplies from outside of the EU) of services are in the scope of the current proposal.

In this section, we discuss permitted e-invoice formats.

The fact that the new regime creates a specific process for domestic B2B e-invoicing does not change the need for businesses to demonstrate the integrity and authenticity of each invoice.

This can be done through one of the 3 legal methods defined by the existing regulations:

To ensure there’s no impact of the reform on integrity and authenticity demonstration methods, one can still apply any of them.

However, with the new regime, e-invoicing data sent to the DGFIP does need to be in a structured format.

Will digital signatures be required?

Digital signatures are not strictly required today and will not be strictly required in the new scheme. Integrity and authenticity will still need to be ensured though, irrespective of invoice format, as is the case today.

The options remain the same; use of digital signatures, use of EDI with security measures, or the BCAT option whereby the audit trail should prove the transaction and its authenticity and integrity.

Are PDF and XML invoice file formats still possible to receive from 2023-2025?

The legal invoice format can be anything, as long as the supplier and buyer agree on it and the integrity and authenticity are guaranteed. Also, a human readable version (normally a PDF) is required upon audit as part of the general EU requirements.

What e-invoicing formats are permitted?

This is not fully defined yet, but DGFIP has indicated the following syntax, based on the EN16931 standard:

Those formats would apply to:

In this section, we answer questions around the processes for sending and receiving e-invoices, what information they need to include, and the Chorus Pro platform.

Will the e-invoice need to be sent real-time?

Yes, it can be considered a “real-time clearance system”. As part of the e-invoicing obligation, the reporting of mandatory data to the tax authorities and the issuance of the original invoice to the buyer by the supplier’s partner platform should happen right after receiving the invoicing data from the supplier.

If the invoice doesn’t have all the mandatory information like the SIRET number of a customer, will the Chorus Pro platform clear it?

Will Chorus Pro also be validating the VAT rates used?

No, or at least not on the fly when submitting the invoicing data to Chorus Pro. Our understanding is that those verifications will be done by the tax authorities after the fact, using data analytics / AI algorithms.

Are there common data, connection and bridges with the current SAF-T?

The French version of SAF-T (FEC) must still be available on demand from the tax authorities.

In this section, we answer questions around compliant archiving of e-invoices.

Does the Chorus Pro/Tax Authority portal provide a compliant electronic archive for AP/AR invoices in France?

Yes. However, in our experience, even though a tax authority’s archiving solution would be available for taxable persons, few larger companies choose to solely rely on it for evidence purposes and instead continue to use their compliant internal or third-party archiving solutions.

This decision is ultimately based on the fact that the tax authority’s archiving solution poses a conflict of interest: it is maintained by the tax authority, which, from a legal perspective, is not an independent party but rather the counterparty in a fiscal claim.

In fact, from discussions with many experts and customers over that past year, we see that the market request for third-party archiving services is even stronger after the introduction of clearance, especially as customers see a need to store not only the invoice but also response messages from the CTC portal to further maintain evidence of compliance.

Still have questions about the e-invoicing mandate? Access our webinar on-demand for more information and advice on how to comply.

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services.

As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes, ensuring you stay compliant.

We spoke to Wendy Gilby, technical product manager at Sovos, to find out more about her role developing Sovos’ Insurance Premium Tax (IPT) software to help customers meet the demands of a constantly changing regulatory environment.

Prior to joining Sovos I worked at an investment bank in London, working my way up from trainee programmer to programmer, analyst, business analyst, systems analyst, project manager, global production support manager and eventually vice president.

Due to personal circumstances, I started working part time and was even briefly a rowing coach before heading back to university to complete a Computing and IT degree.

I was looking for another role in IT and originally worked for FiscalReps (now part of Sovos) on a short-term contract in 2016 or 2017. This is the product that we now know as Sovos IPT which needed testing to ensure it was fit for purpose.

After completing the project, I came back on a six month contract, which became a full-time permanent position and I’m still here today!

My role is to work out how to implement any modifications to the Sovos IPT system. We agree with the wider Sovos IPT team what new functionality or changes they want and work closely with the development team to convert the ideas into the solutions that our customers use.

I’ve recently been looking at the Sovos VAT solution to try and see the synergies between VAT and IPT in terms of user set up, user roles, uploading data, and initial validation on the files that we get from clients to improve the overall user experience for our IPT solutions.

We’re always trying to make the whole process of filing taxes more efficient, and a lot smoother for customers, whichever country they file their taxes in.

We’ve spent a lot of time refining the IPT Portal to make the process of filing and reporting IPT easier but also more compliant. We’re trying to eliminate as many of the manual steps involved in filing taxes as possible to reduce errors.

Sovos is a blend of technology and human expertise so we work closely with the compliance team who ensure reporting is accurate and compliant across all the tax authorities our customers file IPT in.

Our aim is to automate and integrate as much of the filing process as possible from data submission to receiving funds and submitting to the tax authorities to ensure we don’t miss any tax return dates and avoid late fees.

This probably ties into the work we’re doing on the IPT Portal. We’re trying to make everything more transparent so customers can see everything in one place including the status of their tax returns.

We’ve also introduced APIs as well, so customers can send us a file straight from their system, it’s a lot less hassle for them. We’re always focused on making it easier for customers to send us their data and providing as many options as possible to do this.

I think the biggest impact has been the IPT Portal. When I started, much of the reporting processes were still paper based which meant a lot of sifting through paper tax return documents for the compliance team ahead of filing.

So having the IPT portal with all the documents that used to be printed out in one place, where clients can view everything online, has been the biggest change and one that our customers and our compliance team value, especially over the past year when companies have had to adapt to working remotely and not having as easy access to resources in the office.

I think it’s the move towards a more connected reporting processes, joining all these disparate elements of tax returns to make the IPT reporting and filing process even easier and far less error-prone. As certain elements still require some manual input there’s still opportunities for mistakes so eliminating this concern altogether and making it a simple process from initial upload to submission to the tax authorities is really exciting.

Automated returns are becoming more prevalent and we’re in the process of working on these for Germany, France and Hungary so when I say future it’s actually already happening which is very exciting.

Get in touch about the benefits a managed service provider can offer to ease your IPT compliance burden.

The introduction of the new Portuguese Stamp Duty system has arguably been one of the most extensive changes within IPT reporting in 2021 even though the latest reporting system wasn’t accompanied by any changes to the tax rate structure.

The new reporting requirements were initially scheduled to start with January 2020 returns. However this was postponed until April 2020 and once again until January 2021 due to the COVID-19 pandemic.

In addition to the information currently requested, mandatory information required for successful submission of the returns now includes:

Our reporting systems have evolved to help customers meet these new requirements.

For example, our technical department have built a formula that confirms a valid ID to ease data validation and reporting. Consequently, a sense check was built within our systems to determine whether an ID is valid.

With the recent change in the treatment of negative Stamp Duty lines, we’ve also changed our calculations to account for two contrasting methods of treating negatives within our systems.

Previously, both the Portuguese Stamp Duty and parafiscal authorities held identical requirements for the submission of negative lines. However, the introduction of the more complex Stamp Duty reporting system called for amendments to the initial declaration of the policy.

Understandably, this new requirement is a more judicious approach towards tax reporting and will likely be introduced within more tax systems in the future.

As with any new reporting system, changes within your monthly procedures are necessary. Our IPT compliance processes and software are updated as and when regulatory changes occur providing peace of mind for our customers.

And with each new reporting system, we learn more and more about how tax authorities around the world are trying to enter the digital age with more streamlined practices, knowledge and insight to increase efficiency and close the tax gap.

Contact our experts for help with your Portugal Stamp Duty reporting requirements.

As our webinar explored in depth, location of risk rules are complex and constantly evolving.

The Sovos compliance team covered many topics on the session, such as sources for identification of the location of risk and location of risk vs location of the policyholder.

Despite this deep dive, there were plenty of questions that we didn’t have time to answer. As was the case with our IPT Changes in Europe 2021: Your Questions Answered blog, we’ve provided answers to these questions in this blog.

Is there a case for a General Liability policy where the activity is held in Spain and the policyholder is in France?

Where the coverage doesn’t relate to property, vehicles or travel risks then it will be dealt with by the “catch-all” provision in article (13)(13)(d). As a result, assuming that the policyholder is a legal person in this scenario, it will be the policyholder’s establishment that determines the contract. Based on the limited information provided with this question, it seems that the policyholder’s only establishment here is in France, in which case the location of risk would be in France.

If you have a risk located in EU with a local EU policy, can the premium be paid by the entity of the company in UK?

The entity within a policyholder’s group that pays the premium to the insurer doesn’t have a bearing on the location of risk for IPT purposes.

Do the location of risk rules in the UK still follow those used in the EU following Brexit, and could a UK-based policyholder declare the tax instead of the insurer?

The location of risk rules haven’t changed in the UK following Brexit and, as such, the rules remain the same as is seen in Solvency II with each of the different four categories of risk.

For declarations made by UK-based policyholders, although there are provisions in the UK legislation allowing for the tax authority to pursue policyholders in certain circumstances, these are intended as a last resort when they’ve been unable to recover IPT from an insurer and there are no relevant agreements between the UK and the insurer’s country of establishment that enable the issue to be resolved.

The general rule remains therefore that the insurer should declare the tax, assuming they’re still authorised in the territory.

Could there be double taxation caused by the new approach in Germany towards group contracts?

Based on the natural interpretation of the new German legislation and, specifically, the Ordinance for its implementation, we see there is the potential for double taxation.

In particular, if there is the potential for double taxation within the EU then this would make it considerably more controversial. We could see this in the case of a policyholder based in a Member State other than Germany and an insured person based in Germany.

Double taxation across EU Member States would be inconsistent with EU law. As mentioned, we’ll closely monitor developments to see how group contracts are treated in practice and whether the position in the new legislation is challenged at EU level in the future.

I understand the German authorities may be issuing further guidance on whether non-EEA subsidiaries of a German policyholder do create an establishment for IPT purposes if a policy written by an EEA insurer covers them alongside the German policyholder, as the amended law from December last year only mentions that non-EEA branches would be caught in the net and subject to double taxation. Up to now, the guidance seems to have been that the answer is yes, but that the Ministry of Finance may be rethinking this. Have you heard anything on this point?

We’re continuing to monitor developments in this area. Most recently, the issue is considered in the guidance issued by the Ministry of Finance on 4 March 2021, as mentioned in our webinar. As is always the case, we’ll ensure that our customers are informed of any updates as they happen.

If vehicles in Malta only include motor vehicles, how do you determine the location of risk for ships and aeroplanes?

This would be another example of when article 13(13)(d) can be used. As a result, it would be either the policyholder’s establishment to which the contract relates (assuming it’s being insured by a legal person) or the habitual residence of the policyholder (if it’s being insured by an individual). This could be the same country as where it’s registered but it may not be.

Still have questions about IPT? Watch our recent webinar, IPT regulation changes in Europe.

In this blog, we provide an insight into continuous transaction controls (CTCs) and the terminology often associated with them.

With growing VAT gaps the world over, more tax authorities are introducing increasingly stringent controls. Their aim is to increase efficiency, prevent fraud and increase revenue.

One of the ways governments can gain greater insight into a company’s transactions is by introducing CTCs. These mandates require companies to send their invoice data to the tax authority in real-time or near-real-time. One popular CTC method requires an invoice to be cleared before it can be issued or paid. In this way, the tax authority has not only visibility but actually asserts a degree of operational control over business transactions.

The basic principle of VAT (value-added tax) is that the government gets a percentage of the value added at each step of an economic chain. The chain ends with the consumption of the goods or services by an individual. VAT is paid by all parties in the chain including the end customer. However only businesses can deduct their input tax.

Many governments use invoices as primary evidence in determining “indirect” taxes owed to them by companies. VAT is by far the most significant indirect tax for nearly all the world’s trading nations. Many countries with VAT see the tax contribute more than 30% of all public revenue.

The VAT gap is the overall difference between expected VAT revenues and the amount actually collected.

In Europe, the VAT gap amounts to approximately €140 billion every year according to the latest report from the European Commission. This amount represents a loss of 11% of the expected VAT revenue in the block. Globally we estimate VAT due but not collected by governments because of errors and fraud could be as high as half a trillion EUR. This is similar to the GDP of countries like Norway, Austria or Nigeria. The VAT gap represents some 15-30% of VAT due worldwide.

Continuous transaction controls is an approach to tax enforcement. It’s based on the electronic submission of transactional data from a taxpayer’s systems to a platform designated by the tax administration, that takes place just before/during or just after the actual exchange of such data between the parties to the underlying transaction.

A popular CTC is often referred to as the ‘clearance model’ because the invoice data is effectively cleared by the tax administration and in near or real-time. In addition, CTCs can be a strong tool for obtaining unprecedented amounts of economic data that can be used to inform fiscal and monetary policy.

The first steps toward this radically different means of enforcement began in Latin American within years of the early 2000s. Other emerging economies such as Turkey followed suit a decade later. Many countries in LatAm now have stable CTC systems. These require a huge amount of data for VAT enforcement from invoices. Other key data – such as payment status or transport documents – may also be harvested and pre-approved directly at the time of the transaction.

Electronic or e-invoicing is the sending, receipt and storage of invoices in electronic format without the use of paper invoices for tax compliance or evidence purposes. Scanning incoming invoices or exchanging e-invoice messages in parallel to paper-based invoices is not electronic invoicing from a legal perspective. E-invoicing is often required as part of a CTC mandate, but this doesn’t have to be the case; in India, for example, the invoice must be cleared by the tax administration, but it’s not mandatory to subsequently exchange the invoice in a digital format.

The objective of CTCs and e-invoicing mandates is often to use business data that is controlled at the source, during the actual transactions, to prefill or replace VAT returns. This means that businesses must maintain a holistic understanding of the evolution of CTCs and their use by tax administrations for their technology and organisational planning.

As more governments realise the revenue and economic statistics benefits that introducing these tighter controls bring, we’re seeing more mandates on the horizon. We expect the rise of indirect tax regimes based on CTCs to accelerate sharply in the coming five to 10 years. Our expectation is that most countries that currently have VAT, GST or similar indirect taxes will have adopted such controls fully, or partially, by 2030.

Looking ahead, as of today we know that in Europe within the next few years that France, Bulgaria and also Poland will all introduce CTCs. Saudi Arabia has also recently published rules for e-invoicing and many others will follow suit.

Upcoming mandates present an opportunity for a company’s digital transformation rather than a challenge. If viewed with the right mindset. But, as with all change, preparation is key. Global companies should allow enough time and resources to strategically plan for upcoming CTC and other VAT digitization requirements. A global VAT compliance solution will suit their needs both today and into the future as the wave of mandates gains momentum across the globe.

With coverage across more than 60 countries, contact us to discuss your VAT e-invoicing VAT requirements.

Sovos recently sponsored a benchmark report with SAP Insider to better understand how SAP customers are adapting their strategies and technology investments to evolve their finance and accounting organizations. This blog hits on some of the key points covered in the report and offers some direct responses made by survey respondents, as well as conclusions made by the report author. To get the full report, please download your complimentary copy of SAP S/4HANA Finance and Central Finance: State of the Market.

In this year’s benchmark report, research found that most companies are focused on reducing complexity and cost as a primary driver of their overall finance and accounting, including tax, strategies. With this reduction, they are working to solve their biggest pain point which continues to be a lack of visibility into financial transactions and reporting.

The survey revealed several key strategies and investments that SAPinsiders are prioritizing to evolve their finance and accounting processes and organizations. The number one driver of finance and accounting strategy in 2021 is to reduce cost and complexity. This was named by 57% of our audience as the top driver of their finance and accounting strategy. This jumped 24% from last year. To support their top drivers, a majority (56%) of the finance and accounting teams in the study plan to increase their use of automation in 2021.

Clean and harmonized data and a centralized single point of truth are the most important requirements that SAPinsiders are prioritizing. 83% of survey respondents report that clean data is important or very important, while 80% highlight the significance of the Universal Journal in centralizing critical information.

How do technology and tax intersect?

Continued complexity within core financial and accounting systems is limiting organizations’ ability to adapt rapidly to changing business conditions and provide real-time visibility into operations. That is why the number one driver of finance and accounting strategy based on this year’s survey is the pressure to cut both cost and complexity.

Survey responses and interviews with customers about their largest sources of pain consistently mention system and process complexity as one of their most significant challenges. Respondents are focused on addressing this obstacle in a variety of ways such as through investments in analytics, automation, centralization, and system consolidation.

This directly impacts how companies approach tax as rapidly changing global tax laws and mandates often have organizations playing catch up to ensure they are charging and remitting the proper amounts of tax to each country in which they operate. Failure to do this can lead to costly audits, potential fines and penalties and damage to brand reputation.

Why move to SAP S/4HANA Finance?

Simplicity, speed, and easy access to data were among the top benefits cited by survey respondents who have completed or nearly completed their move to SAP S/4HANA Finance. Several mentioned the ease with which they can go from high-level reports and drill down to the document or line-item level, making it easier to understand the numbers and perform in-depth analysis quickly. This directly aligns with the pain points that were identified in the benchmark report survey.

Why now?

What is clear from this survey and subsequent report is that complexity across all layers of finance is having a direct impact on a companies’ ability to function at the highest operational level possible and is threating to impact the bottom line.

Accounting for tax early in your migration strategies and technology upgrades is a key component to ensuring that you are prepared to handle the challenges of modern tax on an international scale. For companies that operate on a multi-national basis, having a centralized approach to tax with enhanced visibility and reporting capabilities is imperative to achieving and remaining compliant no matter how many changes to tax law are introduced every year.

Please download the full report for a more detailed explanation of these critical areas of focus.

Ready to learn more about the impact SAP S/4HANA Finance can have on your tax organization? Download your complementary copy of the SAP S/4HANA Finance and Central Finance: State of the Market report for all the latest information.

Six months after Brexit there’s still plenty of confusion. Our VAT Managed Services and Consultancy teams continue to get lots of questions. So here are answers to some of the more common VAT compliance concerns post-Brexit.

Since Brexit, the UK has changed the way import VAT is accounted for. Before January 2021, you had to pay or defer import VAT at the time the goods entered the UK. Because of the volumes of trade between the UK and the EU, the government have understandably changed this. So, now rather than having to pay import VAT you can choose to postpone it to the VAT return. In practice, this effectively means it’s paid and recovered on the same VAT return. This is a significant cash flow benefit. It’s common among many EU Member States and it was allowed in the UK many years ago. The UK reintroduced it from the start of this year.

There’s no need to be approved to use postponed VAT accounting but an election to use it must be made when completing each customs declaration. It doesn’t happen automatically and the reality is that businesses can choose whether they want to use it or not. The import VAT is then accounted for in box 1 of the UK VAT return and then recovered in box 4. If you’re a fully taxable business and the VAT is recoverable, this will mean that there is no need to make any payment of the import VAT. There are no costs involved in using postponed VAT accounting. The business will have to download a monthly statement from the Customs Declaration Service. The statement shows the postponed amount of VAT.

There are also import VAT accounting mechanisms in place in the EU but they vary from country to country. If you’re a UK business and you’re going to be the importer of the goods into the EU, there is the ability to use postponed accounting in some other countries but the rules on how it applies can vary. In some countries it’s like the UK, so no permission required.

In others you’ll need to make an application and meet the conditions in place. If there is no postponed VAT accounting, there may be the opportunity to defer import VAT which can still provide a cash flow benefit. It’s really important that companies understand how it works in the Member State of import, and if it’s available to them as it can have a big impact on cash flow. It’s good news that the UK have reintroduced postponed VAT accounting as it’s certainly a benefit and applies to all imports, not just those that come from the EU.

I’m shipping my own goods to a third party logistics provider in the Netherlands. I will ship the goods to customers around the EU. How do I value the goods for customs purposes as they remain in my ownership? They’re not of UK origin so customs duty may apply.

This question comes up a lot as customs valuation, like the principle of origin has not arisen for many years for UK companies who have only traded with the EU.

The rules on customs valuation are complex. In this scenario, there is no sale of the goods. So it’s not possible to use the transaction value which is the default valuation method. As customs duty is not recoverable, it’s essential that the correct valuation method is used. This minimises the amount of duty paid and also to remove the possibility of the customs and VAT authorities challenging a valuation. We would recommend seeking specialist advice.

When goods go from Great Britain to the EU, we’re currently in the transition period between Brexit and the introduction of the EU e-commerce VAT package which comes into play on 1 July 2021. Until then, whether you need to be registered or not in an EU country depends on the arrangements in place with your customer. If you sell on a Delivery Duty Paid (DDP) basis, you’re undertaking to import those goods into the EU. So if you do that, you’ll incur import VAT on entry into each country and then make a local sale. If you do that in every Member State country, you’ll have to register for VAT in every Member State.

It should be noted that these are the rules for GB to EU sales and not those from Northern Ireland. This is because the Northern Ireland protocol treats NI to EU sales under the EU rules. The distance selling rules that were in force before the end of 2020 still apply.

Going forward, the EU has recognised that this isn’t really a manageable system. There has been significant abuse of low value consignment relief. LCVR relieves imports of up to €22 from VAT. So they’re introducing a new concept – the Import One Stop Shop (IOSS). IOSS will be available from 1 July 2021 as part of the EU E-Commerce VAT package. From this point, the principle is that for goods with an intrinsic value of below €15. you can use the IOSS. IOSS accounts for VAT in all the countries to which you deliver. You only need a VAT registration in one country where you then pay all your VAT. You submit one return in that country on a monthly basis. This should simplify VAT compliance and ease the admin burden.

There will also be a One Stop Shop (OSS) for intra-EU transactions. So the simplifications ahead will reduce the burden to businesses. What’s important is making sure you review your options. Make an informed decision as to which is the right scheme for your business. Ensure you can comply with VAT obligations to avoid VAT compliance problems in the future.

Get in touch to discuss your post-Brexit VAT requirements and download our e-book EU E-Commerce VAT Package: New Rules for 2021.

As detailed within our annual report VAT Trends: Toward Continuous Transaction Controls, there’s an increasing shift toward destination taxability which applies to certain cross-border trades.

In the old world of paper-based trade and commerce, the enforcement of tax borders, between or within countries, was mostly a matter of physical customs controls. To ease trade and optimise resources, many countries have historically applied ‘de minimis’ rules. These set specific limits (e.g. EUR 10-22 applied in the European Union) below which imported goods had an exemption from VAT.

Cross-border services, which couldn’t, or not easily, be checked at the border would often escape VAT collection altogether or be taxed in the country of the service provider. There has been a huge increase in cross-border trade in low-value goods and digital services over the last decade. As a result, tax administrations are taking significant measures to tax these supplies in the country of consumption/destination.

Since the 2015 publication of the OECD/G20’s Base Erosion and Profit Shifting (BEPS) Project Action 1 Report on Addressing the Tax Challenges of the Digital Economy, most OECD and G20 countries have adopted rules for the VAT treatment of B2C digital/electronic supplies by foreign suppliers. The International VAT/GST Guidelines issued in conjunction with the Project Action 1 Report recommend the following approaches for collecting VAT/GST on B2C sales of electronic services by foreign suppliers:

Many industrialised and emerging countries have since passed laws on this OECD guidance; most apply to B2C transactions only, although some of these jurisdictions have imposed obligations that apply or could apply to both B2B and B2C transactions.

For low value goods, the OECD has made similar recommendations providing for both a vendor and an intermediary-based collection model. The destination-based taxability trend affects many different areas of consumption tax, including the following examples.

The EU has been gradually introducing new rules for VAT on services. This is to ensure more accurately accrues to the country of consumption. From 1 January 2015, and as part of this change, where the supply of digital services is taxed changes. It will be taxed in the private end customer’s EU location, has their permanent address or usually resides. These changes sit beside the introduction of the One Stop Shop (OSS) system which aims to facilitate reporting for taxable persons and their representatives or intermediaries. Under the EU e-commerce VAT package scheduled to take effect from 1 July 2021, all services and all goods including e-commerce based imports are subject to intricate regulations that include changes to the way customs in all Member States operate.

With this shift toward destination taxability for certain cross-border transactions it’s key that companies fully understand the impact. That is not only on their business processes but also comply with changing rules and regulations.

Get in touch to discuss your VAT obligations for cross-border trade. To find out more about the future of VAT, download our report VAT Trends: Toward Continuous Transaction Controls.