For an overview about other VAT-related requirements in Spain read this comprehensive page about VAT compliance in Spain.

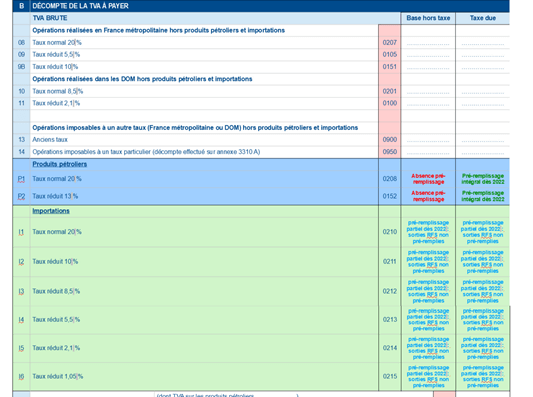

Figure 1: Draft extract of 2022 FR VAT Return

Many businesses will now be involved in “cross border” transactions meaning that a business in one territory will sell and, often, deliver goods to a customer located within another territory. The existence of two or more tax territories in the transaction, and the possibility that there may be a customer in the EU and a supplier in a third country such as the UK, will inevitably lead to VAT challenges with varying degrees of complexity.

Different challenges will be faced by suppliers involved in B2B transactions compared to B2C transactions – although there will also be some common issues. This article will focus on B2B transactions.

Let’s consider a UK supplier with a contract to supply goods manufactured in the UK to customers within the EU.

The first point to recognise is that to deliver the goods to the EU customer the goods must pass through an EU customs border. And here is the first point for supply chain management.

Who will import the goods into the EU and what are the considerations?

The customer’s starting point is likely to be that they will want the supplier to import the goods and a salesperson, eager to please their customer, is likely to agree. Is this a problem for the supplier? OH YES!

A salesperson returns triumphant with an order with Incoterms of DDP (Deliver Duty Paid) – but is this a cause for celebration?

Deliver Duty Paid means that the supplier must deliver the goods to the territory of the customer from which, for VAT purposes, a local sale will be made. This will require the UK supplier to import the goods into the EU and this creates the first issue.

Under the Union Customs Code (UCC) the person presenting the goods to the customs authority (the declarant) must be established within the EU. An EU established business importing goods can be both the importer and the declarant. A business established outside the EU can be the importer but not the declarant. In this case the non-EU importer must appoint an EU established business to act as its “indirect customs agent”. This agent is jointly and severally liable for the import duties that are due and there are not too many businesses which provide such a service because of the risk. So the seller could find itself unable to satisfy a contractual obligation because it cannot find someone to act as its indirect customs agent in time to make the required delivery – or at all.

If a supplier successfully manages to overcome this hurdle then there is the issue of dealing with local VAT on the sale – must the supplier register for VAT and apply it to the sales invoice – or does the reverse charge apply? And will the customer pay the non-refundable duty costs incurred by the supplier at the border?

The takeaway here is that a contract concluded under DDP terms may be much easier for the sales team to achieve but it can create serious issues down the line. UK suppliers should seek to agree any Incoterm other than DDP wherever possible.

To reduce the possibility of delays some UK suppliers have set up warehouse facilities within the EU from which deliveries can be made. One issue which can affect both VAT and direct taxes is whether the warehouse creates a permanent or fixed establishment. For the purposes of this article we assume no – although creating a permanent establishment could avoid the need to appoint an indirect customs agent.

Once the UK supplier has successfully brought the goods into an EU warehouse it will make deliveries to customers. One big consideration here is how the import VAT is dealt with. Several Member States offer the possibility to postpone import VAT to the VAT return via a reverse charge. In such circumstances import VAT deduction is guaranteed so long as the formalities are followed and the business is able to fully recover VAT. Where goods are imported into a Member State where import VAT must be first paid and then deducted consideration as to how this will happen is important. Where there is a VAT registration in place, the VAT can normally be recovered via the VAT return. However, where the Member State of import has a reverse charge mechanism for domestic sales, a non-EU supplier will need to make 13th Directive claims to recover import VAT. One Member State where this will arise is Spain which has reciprocity rules in place so not all businesses are able to make 13th Directive claims.

Therefore if a supplier is considering utilizing an EU warehouse or making sales on a DDP basis, they should first map out all of the likely flows and then determine the VAT treatment to understand if any negative VAT issues will arise. The planning opportunities and potential pitfalls that arise from such a warehouse will be considered in a later article.

Get in touch with our tax experts to discuss your supply chain VAT requirements or download our e-book Protecting Global Supply Chains.

Unlike many other country initiatives that we have seen in the e-invoicing space recently, Australia does not seem to have any immediate plans to introduce continuous transaction controls (CTC) or government-portal involvement in their B2B invoicing.

Judging from the recent public consultation, current efforts are focused on ways to accelerate business adoption of electronic invoicing. This consultation builds on the government’s previous outreach undertaken in November 2020 on “Options for the mandatory adoption of e-invoicing by businesses”, which led to a serious government effort to enhance the value of e-invoicing for businesses and increase business awareness and adoption.

In addition to a decision to make it mandatory for all commonwealth government agencies to receive PEPPOL e-invoices from 1 July 2022, the Australian government seeks to also boost e-invoicing in the B2B space, but without the traditional mandate for businesses to invoice electronically. Instead, the proposal is to implement the Business e-Invoicing Right (BER).

Under the government’s proposal, businesses would have the right to request that their trading parties send an e-invoice over the PEPPOL network instead of paper invoices.

To make and receive these requests, businesses need to set up their systems to receive PEPPOL e-invoices. Once a business has this capability, it would be able to exercise its ‘right’ and request other companies to send them PEPPOL e-invoices.

According to the current proposal, BER would be delivered in three phases, with the first phase to include large businesses, and the later stages to include small and medium-sized businesses. The possible rollout of BER would be as follows:

The objective of the Australian BER initiative to boost the adoption of B2B e-invoicing is complemented by a proposal for several other initiatives supporting businesses in this direction. One measure would be the enabling of PEPPOL-compatible EDI networks. As EDI networks represent a barrier to broader adoption of PEPPOL e-invoicing, particularly for small businesses that interact with large businesses that use multiple EDI systems, the proposal to enable PEPPOL-compatible EDI networks could ultimately reduce costs for businesses currently interacting with multiple EDI networks. Furthermore, the government is contemplating expanding e-invoicing into Procure-to-Pay. Businesses may realise more value from adopting e-invoicing if the focus grows to embrace an efficient and standardised P2P process that includes e-invoicing.

Finally, integrating e-invoicing with payments is another proposed means to boost e-invoicing. This would allow businesses to efficiently receive invoices from suppliers directly into their accounting software and then pay those invoices through their payment systems.

How efficient the proposed measures will be in accelerating adoption of e-invoicing, and whether the Australian government will feel it was the right decision not to introduce a proper e-invoicing mandate, as is becoming more and more common globally, remains to be seen.

Need help staying up to date with the latest VAT and compliance updates in Australia that may impact your business? Get in touch with Sovos’ team of experts today.

On 24 February 2022, the Indian Central Board of Indirect Taxes and Customs (CBIC) issued a notification (Notification No. 01/2022 – Central Tax) that lowered the threshold for mandatory e-invoicing.

In India, e-invoicing is mandatory for taxpayers when exceeding a specific threshold (businesses operating in certain sectors are exempted). The current threshold for mandatory e-invoicing is 50 Cr. Rupees (approximately 6.6 million USD). From 1 April 2022, taxpayers with an annual threshold of 20 Cr. Rupees (approximately 2.65 million USD) or above must comply with the e-invoicing rules.

E-invoicing has been mandatory in India since October 2020. The IRP must approve and validate e-invoices before being sent to the buyer. Therefore, the Indian e-invoicing system is categorised as a clearance e-invoicing system, a type of continuous transaction controls (CTC).

From the beginning, the Indian tax authority clearly expressed their intention to gradually expand the scope of e-invoicing. In line with its message, the threshold limit has been lowered twice; in January 2021 (from 500 CR. To 100 Cr.) and April 2021 (from 100 CR. To 50 Cr.). Once again, the threshold limit is reduced to require more taxpayers to transmit their transactional data to the tax authority’s platform.

One important thing to be noted in this context is that voluntary adoption of e-invoicing is still not possible. Taxpayers cannot opt in to use the e-invoicing system and transmit their invoices to the IRP voluntarily. Given the recent developments, this might change in the future.

Suppliers in the mandatory scope of e-invoicing must generate e-waybills relating to B2B, B2G and export transactions through the e-invoicing platform because their access to the e-waybill platform is blocked for generating e-waybills relating to these transactions. E-waybills relating to transactions outside of the scope of e-invoicing can still be generated through the e-waybill platform.

Therefore, it would be advisable for taxpayers who are getting ready to implement e-invoicing to consider this aspect.

Get in touch with our team of tax experts to learn how Sovos’ tax compliance software can help meet your e-invoicing requirements in India.

Update: 7 December 2023 by Carolina Silva

The long-awaited Royal Decree, establishing invoicing and billing software requirements to secure Spanish antifraud regulations, has been officially published by the Spanish Ministry of Finance.

The taxpayers and SIF developers, defined further below in this article, must be aware of several new official deadlines set forth by the Spanish tax authority in the Royal Decree:

Therefore, companies that fall within scope must ensure their computer systems are adapted to this regulation as of 1 July 2025.

Looking for more information on tax compliance in Spain? This page can help.

Update: 10 February 2023 by Carolina Silva

The Spanish government is pursuing various routes for digitizing tax controls, including introducing software requirements on the billing system.

In February 2022, Spain published a Draft Royal Decree establishing invoicing and billing software requirements to secure Spanish antifraud regulations.

The Draft Decree ensures billing software meet the legal requirements of integrity, conservation, accessibility, legibility, traceability and inalterability of billing records. It sets standards for systems known as SIF (Sistemas Informaticos de Facturación).

To comply with SIF standards, taxpayers may use a Verifactu system – a verifiable invoice issuance system which is further detailed later in this article.

Since publishing the Draft Decree and concluding its public consultation, the Spanish tax authority has released draft technical specifications for the Verifactu system and a list of modifications to be introduced to the Draft Decree. One is the estimated date of entry into force of the billing software requirements.

Among the many SIF requirements established in the Draft Decree is the capability to generate a billing record in XML format for each sale of goods or provision of services. This needs to be sent to the tax authority simultaneously or immediately before the issuance of the invoice.

The Draft Decree establishes two alternative systems taxpayers can adopt to comply with the technical standards of the SIF: the ordinary SIF and the Verifactu system.

A Verifactu system is a verifiable invoice issuance system, and its adoption is voluntary under the Draft Decree. Taxpayers who use computer billing systems to comply with invoicing obligations may choose to continuously send all the billing records generated by their systems to the tax authority.

A Verifactu billing system complies with all the technical obligations imposed by the Draft Decree., Taxpayers use the system to effectively send all billing records electronically in a continuous, automatic, consecutive, instantaneous, and reliable manner.

A taxpayer opts for a “verifiable invoice issuance system” by systematically initiating the transmission of billing records to the tax authority. If the systems are Verifactu, invoices must include a phrase stating so.

There are several benefits for taxpayers who decide to opt for a Verifactu system:

Taxpayers and SIF developers must be aware of several deadlines set forth by the Spanish tax authority. These are still part of the draft development of the SIF and official deadlines are outstanding:

Although still in draft form, it’s expected there will be official publication of the Draft Royal Decree – along with a Ministerial Order detailing the technical and functional specifications of the billing systems. Official publication of the Verifactu technical specifications is to come.

The Draft Decree explicitly states that its implementation is compatible with an electronic invoicing mandate which is also underway in Spain. Therefore, taxpayers must ready themselves to comply.

For further information on the incoming changes to tax in Spain, speak with a member of our expert team.

Update: 24 February 2022 by Victor Duarte

The Spanish Ministry of Finance has published a draft resolution that will – once adopted – establish the requirements for software and systems that support the billing processes of businesses and professionals. This law will have a significant impact on the current invoice issuance processes. It will require implementing new invoice content requirements, including a QR code, and the generation of billing records by January 2024.

The regulation is also intended to adapt the Spanish business sector, especially SMEs, micro-enterprises, and the self-employed, to the demands of digitization. For this, it is considered necessary to standardise and modernise the computer programs that support the accounting, billing, and management of businesses and entrepreneurs.

The regulation establishes the requirements that any system must meet to guarantee the integrity, conservation, accessibility, legibility, traceability and inalterability of the billing records without interpolations, omissions or alterations.

The new rules established in the regulation will apply to:

Companies that do not fall within the above categories do not need to comply, but those who do must ensure their computer systems are adapted to this regulation as of 1 January 2024.

Invoices generated by the computer systems or electronic systems and programs that support the billing processes of businesses and professionals must include an alphanumeric identification code and a QR code, generated per the technical and functional specifications established by the Ministry of Finance.

The computer systems that support billing processes must have the capability to:

To achieve these ends, all computer systems must certify that they ensure the commitment to comply with all the requirements established in this regulation through a “responsible statement”. The Ministry of Finance will establish the minimum content of this statement later in a new resolution.

The billing records must comply with several content requirements laid down by the regulation.

The taxpayers using computer systems to comply with their invoicing obligations may voluntarily send all its billing records generated by the computer systems to the AEAT automatically by electronic means. The response of a formal acceptance message from the AEAT will automatically mean that these records have been incorporated into the taxpayer’s sales and income ledgers.

The AEAT may appear in person where the computer system is located or used and may require full and immediate access to the data record, obtaining, where appropriate, the username, password and any other security key that is necessary for full access.

The AEAT may request a copy of the billing records, which companies may provide in electronic format through physical support or by electronic means.

The regulation doesn’t include any specific rule for the B2B e-invoice mandate draft decree currently being discussed in Congress and waiting for approval. However, if the mandate is approved, all the B2B e-invoices issued under this draft decree will have to comply with all the new rules established in this regulation.

While this new regulation does not seem to take Spain further down the continuous transaction control (CTC) route, the proposal has clear similarities with Portugal’s invoice requirements.

The draft resolution establishing these is currently open for public consultation until 11 March 2022. Once this resolution is approved, the Ministry of Finance will publish the technical and functional specifications needed to comply with the new requirements and the structure, content, detail, format, design and characteristics of the information that companies must include in the billing records.

The Ministry of Finance will also publish the specifications of the signature policy and the requirements that the fingerprint or ‘hash’ must meet. Once these details are published, it will be clearer whether Spain is going down the Portuguese route or carving out its own path.

Need help staying up to date with the latest VAT and compliance updates in Spain that may impact your business? Get in touch with Sovos’ team of experts today.

In 2020, the European Commission (EC) adopted a four-year plan to develop a fairer and simpler taxation framework. The Action Plan aspires to tighten up the tax system, ensure that digital platforms are made to follow transparency rules and utilise data better, reducing tax fraud and evasion.

In 2021, the Commission implemented e-commerce changes – another step in the modernisation process. Beginning in July of 2021, the Mini One Stop Shop (MOSS) system was expanded to the One Stop Shop (OSS) and Import One Stop Shop (IOSS).

The implementation of OSS expanded the use of the union and non-union schemes. This allows European and non-European business-to-consumer sellers of digital services and goods to simplify their reporting practices. Meanwhile, IOSS allows businesses to register and import goods into the EU with a value not exceeding €150.

In 2022, there are plans to release legislation under the “VAT in the digital age” Action Plan. Much like its predecessors in 2020 and 2021, the core purpose of this plan is to tackle the issue of fraud and improve the way businesses engage with the VAT system. The Commission has announced three points it seeks to address in its legislation:

Specifically, one point of interest is the single EU VAT registration point, which aims to facilitate compliance among Member States. With this, the European Commission is requesting feedback on how businesses think the I/OSS implementation has gone and on other potential legislative options for the future, including:

The European Commission began a period of public consultation on 21 January regarding adapting VAT rules in a digital economic landscape. They are seeking feedback on how the EC should adapt VAT tax processes and how they can incorporate technology to solve principal issues in tax, such as fraud and the complexity of its systems. The Commission is accepting feedback in this public consultation period until 15 April 2022 – submissions can be made here.

Sovos will continue to monitor the development of this legislation throughout the year as more information about its structure and impact is released, as these changes are sure to be impactful upon the European VAT landscape.

Need more information? Sovos’ VAT Managed Services provide a full IOSS and OSS service for your business. Contact our team to learn more or read more about VAT in the Digital Age in this guide.

South Korea has an up-and-running e-invoicing system that combines mandatory e-invoicing with a continuous transaction controls (CTC) reporting obligation. This mature and well-established system, launched over a decade ago, is seeing its first significant changes in years.

Presidential Decree No. 31445 (Decree) has recently amended certain provisions of the Enforcement Decree of the Value-Added Tax Act. Among other changes, the scope of e-invoicing has been expanded and a new timeline and threshold limits introduced. This means that more taxpayers in South Korea must comply with e-invoicing rules in accordance with the timelines.

In South Korea, e-invoicing has been mandatory for all corporate businesses since 2011. From 2012, individual businesses (entrepreneurs) have also been required to comply with e-invoicing obligations if they meet the threshold limits which have been updated a couple of times over the years. Currently, an individual business whose aggregate supply value (including transactions that are tax exempt) for the immediately preceding tax year is KRW 300,000,000 or more, is required to comply with the country’s e-invoicing rules.

After the recent amendments, the current threshold is now lowered to KRW 200,000,000 and the new threshold limit will be applicable from 1 July 2022. The tax authority has already communicated further adjustments, announcing that from 1 July 2023, the threshold will be reduced further to the limit of KRW 100,000,000. The Korean tax authority aims to enhance the transparency of tax sources by requiring more businesses to comply with the e-invoicing rules.

The expansion of the scope of e-invoicing obligations does not come as a surprise. Like in many other CTC jurisdictions, transactional data collected from a larger number of taxpayers provides greater insight to the tax authority about VAT, market trends and more.

Due to its success and maturity, e-invoicing in South Korea continues to inspire other countries in the Asia Pacific region. The Philippines tax authority is in the process of launching an e-invoicing pilot for the country’s 100 largest taxpayers from 1 July 2022. When designing their e-invoicing system, the Philippines tax authority had several meetings with its South Korean counterparts to benefit from Korean expertise and experience. Therefore, the Philippines is introducing a relatively similar CTC system to the Korean one.

Need to ensure compliance with the latest e-invoicing requirements in South Korea? Get in touch with our tax experts. Follow us on LinkedIn and Twitter to keep up-to-date with regulatory news and updates.

Whilst the UK leaving the European Union (EU) on 31 December 2020 seems like a long time ago, UK businesses still have to deal with changes to the processes in place when importing goods from suppliers in the EU.

Throughout 2021, goods imported into Great Britain from the EU were subject to several easements from a customs perspective. This was to reduce the burden of completing full customs declarations and dealing with all of the consequences of importing goods that were previously not subject to import documentation and controls.

UK businesses were unprepared, partly due to impacts from the COVID-19 pandemic, so these simplifications were extended a few times during 2021. As of 1 January 2022, goods moving between the EU and Great Britain will be subject to full customs declarations and controls. Subsequently, there is no longer the ability to defer customs declarations as was previously the case.

Additionally, any customs duty due on goods will be due at the time of entry rather than when the customs declaration is submitted, as was the case in 2021. Businesses can achieve delayed payment of the customs duty by applying for a duty deferment account with HMRC. In some instances, it can be achieved without the need for a financial guarantee to be lodged, so it is worth considering.

Due to the negotiations between the UK government and the EU on the Northern Ireland Protocol, imports of non-controlled goods from Ireland and Northern Ireland will not be subject to these changes. The previous easements will still apply. This means that customs declarations can be delayed for up to 175 days. The UK government will make further announcements once the discussions on the Protocol have been completed. We will update further when that happens.

Regarding import VAT, Postponed Import VAT Accounting (PIVA) remains available and, whilst not compulsory, it is recommended, as it provides a valuable cashflow benefit. It applies to imports from all countries and not just the EU. Unlike in some EU countries, it is not automatically applied and has to be claimed when the import declaration is submitted. Therefore, the importer must advise whoever submits the declaration to complete it accordingly. If it is not claimed, import VAT is payable at the time of entry and will have to be recovered on the VAT return – HMRC continues to issue the C79 certificate when VAT is paid at the border, and it is required evidence to recover VAT.

Businesses will also need to remember to download the monthly PIVA statement from HMRC’s website – this is required to determine the amount of import VAT payable on the VAT return. This needs to be done within six months as it is not available after that time.

Another change is regarding Intrastat reporting for imports into Great Britain from the EU. Arrivals declarations were required during 2021 to provide the UK government with trade statistics, given that importers could delay submitting full customs declarations. Intrastat arrivals are now only required for goods moving from the EU to Northern Ireland – this is because Northern Ireland is still considered part of the EU for goods.

The EU-UK Trade and Cooperation Agreement provisions have to be considered when importing goods from the EU especially regarding the origin of the goods and whether the import is tariff-free. This has been in place since 1 January 2021, but there are practical changes that are considered further in our article which discusses the origin of goods and claiming relief on trade between the EU and UK. These changes mean that imports from the EU are treated in the same way as imports from any other country, except for goods from Ireland and Northern Ireland, which are still subject to special arrangements.

Keen to know how changes between the EU and UK will impact your VAT compliance obligations? Contact us to find out more.

The EU-UK Trade and Cooperation Agreement (TCA) provides for tariff-free trade between the United Kingdom (UK) and the European Union (EU) but does not work in the same way as when the UK was part of the EU.

Before Brexit, if the goods were in free circulation within the EU, they could be moved cross-border without incurring any additional customs duty. Therefore, the origin of the goods was not relevant for this intra-EU movement. If the goods originated from outside the EU, customs duty would have been paid as required when they first entered into free circulation but was not payable again.

This difference creates issues for UK businesses where they import finished goods into the UK first before being sold to the EU. As the goods are not being processed in the UK, they cannot be of UK origin and will be subject to double duty unless specific duty mitigations measures are taken.

The same tariff-free trade between the EU and the UK can be achieved under the TCA, but it depends on meeting the detailed rules within the agreement. The key is in the origin of the goods and whether they qualify under the terms of the TCA. This ensures that only eligible goods are tariff-free and removes the risk of goods entering from outside the Free Trade Area without paying customs duty.

The requirement for goods to be of relevant origin to benefit from zero tariffs on imports under the TCA has been in place since 1 January 2021.

If goods meet the appropriate rules of origin, preference can be claimed on the customs declaration when they are imported. Thus, the claim is made by the importer of the goods. However, it is not as simple as completing the appropriate box on the declaration; there is a requirement for the proper evidence to be held.

To claim tariff preference, the importer needs to have one of the following proofs of origin:

If they are relying on a statement of origin, the exporter will have to prove that the goods are of appropriate origin to qualify.

In 2021, there was a light touch approach towards holding evidence when the customs declaration was made. The TCA allowed for a declaration to be made and the evidence to be obtained later to reduce the burden on business. There is still a requirement to provide the appropriate evidence on request, so businesses must ensure that it will be available if necessary.

There may be checks that the goods are of appropriate origin to be free of duty under the TCA. With effect from 1 January 2022, there is a need to have the appropriate evidence that the goods meet the origin requirements when the declaration is lodged. Therefore, businesses will need to ensure that the appropriate documents are immediately available should they be requested.

Businesses should note that it is not obligatory to claim preference at the time of entry of the goods as claims can be made up to three years later, as long as there is valid proof of origin. It is beneficial to claim preference at the earliest possible time to benefit cash flow and provide certainty of the cost of the goods.

Therefore, businesses will need to ensure that they determine origin of goods correctly and have the appropriate evidence to support the goods being tariff-free.

It’s important to remember that the rules for trade between Northern Ireland and the EU are different because of the Northern Ireland Protocol.

Get in touch with Sovos to discuss your company’s obligations for cross-border trade.

During the last decade, the Vietnamese government has been developing a feasible solution to reduce VAT fraud in the country by adopting an e-invoice requirement for companies carrying out economic activities in Vietnam. Finally, on 1 July 2022, a mandatory e-invoicing requirement is scheduled to enter into force nationwide.

Despite the postponement of the original starting date for the mandatory nationwide e-invoicing obligation, which was first intended to enter into force in July 2020, the Vietnamese government quickly established a new deadline.

Later that year, in October 2020, the new timeline was communicated through Decree 123, delaying the e-invoicing mandate until 1 July 2022. This new deadline is also in line with the implementation dates for the rules concerning the e-invoicing system envisaged in the Law on Tax Administration.

Vietnam’s General Taxation Department (GTD) announced its plan to work first with the local tax administrations of six provinces and cities: Ho Chi Minh City Hanoi, Binh Dinh, Quang Ninh, Hai Phong and Phu Tho to start implementing technical solutions for the new e-invoice requirements and the construction of an information technology system that allows the connection, data transmission, reception, and storage of data. According to the GTD’s action plan, by March 2022, these six cities and provinces should be ready for the e-invoice system’s activation.

The GTD announced that, from April 2022, the new e-invoicing system will continue to be deployed in the remaining provinces and cities.

Finally, under this local implementation plan, by July 2022, all cities and provinces in Vietnam must deploy the e-invoicing system based on the rules established in Decree 123 and the Circular that provides guidance and clarification to certain aspects of the new e-invoicing system.

Taxable persons operating in Vietnam will be required to issue e-invoices for their transactions from 1 July 2022 and must be ready to comply with the new legal framework. Enterprises, economic organisations, other organisations, business households and individuals must register with the local tax administration to start using e-invoices according to the rules established in the mentioned Decree 123.

Vietnam is finally moving forward to adopt mandatory e-invoicing. However, there is plenty of work related to the necessary technical documentation and local implementation of the new e-invoicing system. We will continue to monitor the latest developments to determine whether the GTD can meet all the requirements in time for the mandatory e-invoicing roll-out.

Need help staying up to date with the latest VAT and compliance updates that may impact your business? Get in touch with our team of experts today.

We recently launched the 13th Edition of our annual Trends report, the industry’s most comprehensive study of global VAT mandates and compliance controls. Trends provides a comprehensive look at the world’s regulatory landscape highlighting how governments across the world are enacting complex new policies and controls to close tax gaps and collect the revenue owed. These policies and protocols impact all companies in the countries where they trade no matter where they are headquartered.

This year’s report looks at how large-scale investments in digitization technology in recent years have enabled tax authorities in much of the world to enforce real-time data analysis and always-on enforcement. Driven by new technology and capabilities, governments are now into every aspect of business operations and are ever-present in company data.

Businesses are increasingly having to send what amounts to all their live sales and supply chain data as well as all the content from their accounting systems to tax administrations. This access to finance ledgers creates unprecedented opportunities for tax administrations to triangulate a company’s transaction source data with their accounting treatment and the actual movement of goods and money flows.

After years of Latin America leading with innovation in these legislative areas, Europe is starting to accelerate the digitization of tax reporting. Our Trends report highlights the key developments and regulations that will continue to make an impact in 2022, including:

According to Christiaan van der Valk, lead author of Trends, governments already have all the evidence and capabilities they need to drive aggressive programs toward real-time oversight and enforcement. These programs exist in most of South and Central America and are rapidly spreading across countries in Europe such as France, Germany and Belgium as well as Asia and parts of Africa. Governments are moving quickly to enforce these standards and failure to comply can lead to business disruptions and even stoppages.

This new level of imposed transparency is forcing businesses to adapt how they track and implement e-invoicing and data mandate changes all over the world. To remain compliant, companies need a continuous and systematic approach to requirement monitoring.

Trends is the most comprehensive report of its kind. It provides an objective view of the VAT landscape with unbiased analysis from our team of tax and regulatory experts. The pace of change for tax and regulation continues to accelerate and this report will help you prepare.

Contact us or download Trends to keep up with the changing regulatory landscape for VAT.

Towards the end of 2021, the tax authority in Turkey published a draft communique that expands the scope of e-documents in Turkey. After minor revisions, the draft communique was enacted and published in the Official Gazette on 22 January 2022.

Let’s take a closer look at the changes in the scope of Turkish e-documents.

Taxpayers meeting these thresholds and criteria must start using the e-fatura application from the start of the year’s seventh month following the relevant accounting period.

In terms of accommodation service providers, if they provide services as of the publication date of this communique, they must start using the e-fatura application from 1 July 2022.

For any business activities that start after the publication date of the communique e-fatura must be used from the beginning of the fourth month following the month in which their business activities began.

Taxpayers not in scope of e-arşiv invoices have been obliged to issue e-arşiv invoices if the total amount of the invoices to be issued exceeds TRY 30.000 including taxes (in terms of invoices issued to non-registered taxpayers, the total amount including taxes exceeds TRY 5.000) from 1 January 2020.

With the amended communique, the Turkish Revenue Administration (TRA) lowered the total amount of the invoice threshold to TRY 5.000, and thus more taxpayers will be required to use the e-arsiv application. The new e-arsiv invoice threshold applies from 1 March 2022.

Another change introduced by the communique was the expansion of the scope of e-delivery notes. The gross sales turnover threshold for mandatory e-delivery notes has been revised to TRY 10 million, effective from the 2021 accounting period. In addition, taxpayers who manufacture, import or export iron and steel (GTIP 72) and iron or steel goods (GTIP 73) are required to use the e-delivery note application. E-fatura application registration is not applicable to those taxpayers.

Get in touch with our team of tax experts to find out how Sovos’ tax compliance software can help meet your e-fatura and e-document requirements in Turkey.

The Tax Bureaus of Shanghai, Guangdong Province and Inner Mongolia Autonomous Region have all issued announcements stating they intend to carry out a new pilot program for selected taxpayers based in some areas of the provinces. The pilot program will involve adopting a new e-invoice type, known as a fully digitized e-invoice.

Many regions in China are currently part of a pilot program that enables newly registered taxpayers operating in China to voluntarily issue VAT special electronic invoices to claim input VAT, mostly for B2B purposes.

The new fully digitized e-invoice is a simplified and upgraded version of current electronic invoices in China. The issuance and characteristics of the fully digitized invoice are different from other e-invoices previously used in the country.

Relying on the national unified electronic invoice service platform, tax authorities will provide selected taxpayers for this pilot program with services such as issuance, delivery, and inspection of fully digitized e-invoices 24 hours a day. Taxpayers will be able to verify the information of all electronic invoices through the electronic invoice service platform or the national VAT invoice inspection platform.

This new pilot program has been effective in Shanghai, Guangzhou, Foshan, Guangdong-Macao Intensive Cooperation Zone, and Hohhot since 1 December 2021. Despite the lack of an official timeline for implementation, it’s expected that the scope of this pilot program will be extended in 2022 to cover new taxpayers and regions in China, paving the way for nationwide adoption of the fully digitized e-invoice.

To find out more about what we believe the future holds for VAT, download the 13th edition of Trends. Follow us on LinkedIn and Twitter to keep up-to-date with regulatory news and updates.

As a result of the 2020 Finance Law implementation, which transfers the management and collection of import VAT from customs to the Public Finances Directorate General (DGFIP), France has implemented mandatory reporting of import VAT in the VAT return instead of having the option to pay through customs as is typically the process. This change came into effect on 1 January 2022, with additional VAT reporting changes in France, including the Declaration of Exchange Goods (DEB) split where the Intrastat dispatch and EC sales list are now separate reports.

This new import procedure is mandatory for all taxpayers identified for VAT purposes in France. Registered taxpayers may no longer opt to pay import VAT to customs and must report all import VAT via the VAT return. This is a departure from the prior process, where taxpayers needed to receive prior authorisation to implement a reverse charge mechanism to pay import VAT through the VAT return. Now, this process is automatic and mandatory, and no authorisation is required.

Consequently, taxpayers with import transactions into France must now register for VAT purposes with the French tax authorities. Additionally, the French intra-community VAT number of the person liable for payment of import VAT must be listed on all customs declarations.

Changes to the French VAT return include (see Figure 1):

From 31 December 2021, “foreign traders” who imported goods and then made local sales under the domestic reverse charge are now required to register as a result of the import portion of the transaction and will still apply the reverse charge to their sales. This will now require a new VAT declaration to be submitted.

Additionally, until 31 December 2021, a foreign company that imported goods into France and made local sales under the reverse charge had to recover the import VAT paid under the Refund Directive (EU companies) or the 13th Directive (non-EU companies). For Refund Directive claims, there would have been a cash advantage for France because either companies did not submit claims (small value) or because claims were rejected for non-compliance. For claims under the 13th Directive and the two previous considerations, there was also the issue of “reciprocity” which prevented claims from some counties such as the US, for example. Under the new regime, all import VAT is reclaimed, leading to a potential budget shortfall.

To find out more about what we believe the future holds, download Trends and follow us on LinkedIn and Twitter to keep up-to-date with the latest regulatory news and updates.

With the most significant VAT gap in the EU (34.9% in 2019), Romania has been moving towards introducing a continuous transaction control (CTC) regime to improve and strengthen VAT collection while combating tax evasion.

The main features of this new e-invoicing system, e-Factura, have been described in an earlier blog post. Today, we’ll take a closer look at the roll-out for B2B transactions and the definition of high-fiscal risk products, as well as the new e-transport system that was introduced through the Government Emergency Ordinance (GEO) no. 130/2021, published in the Official Gazette on 18 December.

For more information about e-invoicing in Romania in general refer to this overview or VAT Compliance in Romania.

According to GEO no. 120/2021 (the legislative act introducing the legal framework of e-Factura), the supplier and the recipient must both be registered with the e-Factura system. The recently published GEO no. 130/2021 establishes an exception for high fiscal risk products and ensures that taxpayers will use the e-Factura system regardless of whether the recipients are registered.

In line with the GEO no. 130/2021, the National Agency for Fiscal Administration has issued an order to clarify which products are considered high fiscal risk products.

The five product categories are as follows:

High fiscal risk products are defined based on the nature of the products, marketing method, traceability of potential tax evasion and degree of taxation in those sectors. Detailed explanations, as well as product codes, can be found in the Annex of GEO no. 130/2021.

The enforcement timeline of this requirement means that businesses that supply these types of products must be ready to comply with the new Romanian e-Factura system as follows:

Another reform that shows the intention of the Romanian authorities to combat tax fraud and evasion is the introduction of an e-transport system.

Taxpayers will be required to declare the movement of goods from one location to another in advance. Once declared, the system will issue a unique number written on the transport documents. Authorities will then verify the declaration on the transport routes.

Moreover, it is stated in the justification letter that the e-transport system will interconnect with the Ministry of Finance’s current systems, Romanian e-invoice, and traffic control, much like similar initiatives in other countries, such as India, Turkey and Brazil.

The introduction of the e-transport system is still pending as the Ministry of Finance has not yet issued the order regarding the application procedure of the system. According to GEO 130/2021, the Ministry of Finance had 30 days to do so after GEO 130/2021 was published in the Official Gazette. However, the deadline expired on the 17 January, and no announcement has been made yet. Therefore, the details of the system are still unknown.

Need to ensure compliance with the latest Romanian regulatory requirements? Speak to our team. Follow us on LinkedIn and Twitter to keep up-to-date with the latest regulatory news and updates.

The Northern Ireland Protocol regarding goods moving from Great Britain to Northern Ireland continues to cause problems, leading to calls to suspend it via Article 16. But at the same time, some NI politicians are looking to capitalise on the possibility of inward investment by companies that can benefit from being in both the UK and the Single Market at the same time. This will be an interesting circle to square.

For goods moving from Great Britain to the EU, it has been necessary to review supply chains and VAT compliance, especially where the GB supplier is required to import the goods. Here we have the issue of theory clashing with reality, requiring plans to be revised.

Many UK suppliers selling goods into the EU decided that a good approach would be to obtain a VAT number in the Netherlands and then import the goods under an Article 23 licence to defer the import VAT to the VAT return – a straight-forward scheme to set up and manage. However, under the Union Customs Code, anyone who imports goods into the EU is required either to be established in the EU or to appoint an “indirect customs agent” who is established in the EU.

Upon accepting such an appointment, the EU entity becomes jointly liable with the importer for the VAT and duty that is due. Not surprisingly, it is difficult to find businesses that will offer such a service. In 2020, the body representing freight forwarders in Germany suggested that no such appointments should be accepted because of the financial risk. For many UK businesses, the only solution has been to establish a company in the EU, often the Netherlands, to import in their name.

Brexit also caused issues for GB businesses that supply equipment required to be installed in factories or other premises – such as parts of manufacturing production lines.

Within the Single Market there is a simplification for such supplies. The vendor can move the goods to another Member State to install them with the customer accounting for the acquisition tax due on the goods. This is because there is no need for the supplier to have a local VAT number in the Member State where the goods are installed.

Following Brexit, suppliers shipping goods from Great Britain to the EU for installation are no longer able to use this simplification. Instead, the GB supplier must now import the goods into the EU and then make a sale. If the goods are imported and installed in a Member State where the extended reverse charge applies to the sale, there will be a cash flow issue regarding the paid import VAT. Claims need to be made under the 13th Directive and, if the Member State concerned applies the concept of “reciprocity”, then the claim may be denied.

“Reciprocity” allows a Member State to refuse VAT refunds to taxpayers from third countries which do not allow VAT refunds to taxpayers of the Member State. The Member State normally publishes a list of third countries that can submit claims where reciprocity is invoked.

Pre Brexit, there was no need for the UK to be on such a list, so this now represents a real risk. Some Member States, including Spain, added the UK to their list immediately following Brexit. If these subtle complexities are not considered before a transaction is agreed the cashflow consequences could be severe – so planning is essential.

Businesses also have to ensure that they are prepared for changes which came into effect on 1 January 2022.

Under the EU-UK Trade and Cooperation Agreement, goods exported from Great Britain to the EU with a UK origin are free of import duty. In some situations, exporters require information from their suppliers about the origin of the goods they are supplying.

Until 31 December 2021, an exporter of goods from Great Britain to the EU did not need to hold a supplier’s declaration when making a statement on origin to be used by the customer to claim the zero-duty rate on imports into the EU. It is enough that the exporter is confident that the origin rules are met and make every effort to get supplier declarations retrospectively.

Suppose a UK exporter finds that a supplier statement is not available retrospectively. In that case, they must inform the EU customer who will have to consider the impact on the imports they have made.

If an exporter cannot comply with an official request for verification of the origin of the goods being the UK, the EU customer will be liable to pay the full duty rate retrospectively.

From 1 January 2022, an exporter must hold a supplier’s declaration, when required, when making the statement on origin declaration to the customer or the full rate of Customs Duty is payable. This significant change to the rules will impact all businesses exporting to the EU, including e-commerce retailers selling goods above EUR150.

Get in touch about the benefits a managed service provider can offer to ease your business’ VAT compliance burden.

In a blog post earlier this year, we wrote about how several Eastern European countries have started implementing continuous transaction controls (CTC) to combat tax fraud and reduce the VAT gap. However, it’s been an eventful year with many new developments in the region, so let’s take a closer look at some of the changes on the horizon.

Latvia has recently revealed its new CTC regime plans. The Latvian government approved a report prepared by the Ministry of Finance to implement an electronic invoicing system in the country. The concept described in the report envisages the introduction of electronic invoicing as mandatory for B2B and B2G transactions from 2025 under the PEPPOL framework. The details about the system, including the legislation and technical documentation, are expected in due course.

Serbia is another country moving rapidly towards a CTC framework, and apparently, various stakeholders find this movement rather quick. The Ministry of Finance recently announced that upon the request for a transition period to adapt to the new system of e-invoices, they have decided to postpone the date for entry into force of CTC clearance for B2G transactions until the end of April 2022. It must be noted that there has been no delay concerning B2B transactions.

According to the revised calendar:

Slovenia is also looking to introduce CTCs. In June 2021, the Ministry of Finance submitted a draft law to the Slovenian parliament, aimed at introducing mandatory B2B e-invoicing in the country. According to the draft regulation, all business entities would be obliged to exchange e-invoices exclusively in their mutual transactions (B2B). In the case of B2C transactions, consumers could opt to receive their invoices in electronic or paper form. However, the Ministry of Finance withdrew the draft law due to disagreement with various stakeholders but intends to review it by simplifying the process and reducing the administrative burden on businesses.

Discussions around the introduction of CTCs in the country continue among various stakeholders, e.g., the local Chamber of Commerce. However, seeing as national elections are expected in Slovenia in April 2022, the CTC reform is not expected to gain much traction until summer 2022 at the earliest.

Earlier this year, we reported that the Slovakian Ministry of Finance had prepared draft legislation to introduce a CTC scheme. The aim was to lower Slovakia’s VAT gap to the EU average and obtain real-time information about underlying business transactions. Public consultation for the draft law was completed in March 2021. However, no roll-out timeline was published at the time.

Over the past months, the Slovakian government has launched the CTC system and published new documentation. The CTC system is called Electronic Invoice Information Systems (IS EFA, Informačný systém elektronickej fakturácie) and is a unified process of electronic circulation of invoices and sending structured data from invoices to the financial administration. The timeline for the gradual roll-out of entry into force looks as follows:

There have been serious developments regarding Poland’s CTC framework and system, the Krajowy System e-Faktur (KSeF). The CTC legislation was finally adopted and published in the Official Gazette on 18 November 2021. Starting from January 2022, KSeF goes live as a voluntary system, meaning there is no obligation to use this e-invoicing system in B2B transactions. It is expected that the system will be mandatory in 2023, but no date has been set yet for the mandate.

For more information see this overview about e-invoicing in Poland or VAT Compliance in Poland.

With the largest VAT gap in the EU (34.9% in 2019), Romania has also been moving towards introducing a CTC regime to streamline the collection of taxes to improve and strengthen VAT collection while combating tax evasion. In October 2021, Government Emergency Ordinance (GEO) no. 120/2021 introduced the legal framework for implementing e-Factura, regulating the structure of the Romanian e-invoice process and creating the framework for basic technical specifications of the CTC e-invoicing system. While the Romanian e-Factura went live as a voluntary system on 6 November 2021, no timeline has yet been published for a mandate. Suppliers in both B2B and B2G transactions may opt to use this new e-invoicing system and issue their e-invoices in the Romanian structured format through the new system.

For more information see this overview about e-invoicing in Romania or VAT Compliance in Romania.

Contact us or download VAT Trends: Toward Continuous Transaction Controls to keep up with the changing regulatory landscape.

The EU e-commerce VAT package was introduced in July 2021. The new schemes, One Stop Shop (OSS) and Import One Stop Shop (IOSS) bring significant changes to VAT treatment and reporting mechanisms for sales to private individuals in the EU.

In the last of our series of FAQ blogs, we answer some of the more common questions asked on the IOSS.

In previous pieces, we’ve looked at understanding marketplace liability, understanding OSS and understanding IOSS and imports

IOSS VAT is the VAT collected at the time when the supply takes place and subsequently remitted to the tax authority in the Member State of Identification (MSI).

Under the old rules, when goods imported from third countries were sold to private individuals, the normal steps would require the supplier to account for import VAT, then account for the VAT on the subsequent supply (the sale to the private individual) then deduct the import VAT.

Instead, with IOSS, the VAT on the import is exempt and only the VAT on the subsequent supply is to be collected and remitted to the tax authority.

IOSS is short for Import One Stop Shop. This is a special scheme that simplifies the registration obligations for taxpayers who carry out distance sales of goods imported from third countries to private individuals in the EU.

Similar to the OSS, the IOSS scheme allows taxpayers to register in a single EU Member State where they account for VAT that was actually due in other Member States.

Here’s an example. A business registered for IOSS in the Netherlands, can account for its sales to German, French, Italian, Polish etc. customers in its Dutch IOSS return thus avoiding the requirement to register in multiple jurisdictions.

Other advantages of using the schemes are:

The scheme, however, is restricted to consignments of up to €150. Additionally, signing up for the scheme requires careful analysis of the taxpayer’s profile, the way the supply chain is structured and other factors. All of these would affect the business’ eligibility for the scheme, and the requirements to appoint a special type of representative for the purposes of the scheme that is required in certain cases.

If such representative is required, they will be jointly and severally liable with the taxpayer’s IOSS obligations. It’s also important to note that such representative must be established in the EU.

An IOSS number is the specific identification for the IOSS scheme that is designated by the MSI (the country where the taxpayer is eligible or decides to register for the scheme) to the taxpayers that have decided to make use of this mechanism.

Although IOSS identification is a type of VAT identification it’s not an actual resident VAT registration in the MSI.

Instead, it’s an IOSS number specifically for the purposes of the scheme. In this sense only the eligible type of supplies can be accounted for using the IOSS number and the IOSS registration. In case the taxpayer will carry out other type of supplies which require a regular VAT registration the latter should be obtained for the purposes of being compliant.

The cost of IOSS compliance can vary depending on multiple factors. This would be ultimately affected by:

An IOSS number is required for any taxpayer that wants to make use of the IOSS special scheme. This mechanism isn’t mandatory hence there’s no obligation to apply for an IOSS number.

However, it is advisable that any taxpayer that carries out supplies eligible to be reported using IOSS should consider this option as it has some considerable advantages. Of course, the consideration should also include the numerous requirements and conditions that must be met if a person opts to use the IOSS scheme.

Both are special schemes used to simplify the registration obligations for taxpayers involved in B2C supplies. They provide an option to account for VAT, that is due in multiple EU VAT jurisdictions, using a single registration and only one IOSS or OSS return.

The difference between both schemes is the different types of supplies that can be accounted for. More precisely:

Considering the above, the main difference is that with IOSS the goods are located in a third country (outside the EU customs territory) at the time of the sale, whereas with OSS the goods are located within the EU’s territory.

No, IOSS is currently an optional scheme for taxpayers. If not used, the taxpayer’s supplies are subject to the normal rules and depending on the way the supply is structured normal VAT registration/s may be required instead.

IOSS tax ID is the special IOSS VAT number assigned to a taxpayer that has chosen to opt in for the IOSS scheme. It‘s not a regular VAT number that is assigned in the course of a normal VAT registration but is instead used to identify a taxpayer specifically for the purposes of the scheme.

Also, in more practical terms, the IOSS number must be indicated in a specific way on each shipment/supply in order to identify it as eligible under the IOSS as this would allow for:

Need more information on the changes, and how to comply with the EU e-commerce VAT package? Access our webinar on-demand, and download our e-book on the New Rules for 2021.

The EU e-Commerce VAT Package is nearly six months old and businesses should have submitted their first Union One Stop Shop (OSS) return by the end of October 2021. Union OSS provides a welcome simplification to the requirement to be registered for VAT in multiple Member States when making intra-EU B2C supplies of goods and services.

Whilst a simplification, there are several conditions that need to be met on an ongoing basis to continues its use. The European Commission produced a number of guides on the application of Union OSS prior to its introduction which provided guidance on its operation. However, there are still several questions about how Union OSS interacts with other compliance obligations in place for e-commerce sellers around the EU.

Intrastat is the EU’s mechanism to provide details of intra-EU trade in the absence of customs borders. It’s made up of two components: dispatches declarations submitted in the Member State where the transport starts and arrivals declarations in the Member State of delivery.

E-commerce businesses selling intra-EU goods have long had to comply with Intrastat obligations when they exceeded the reporting thresholds. For lots of businesses an obligation arose in the Member State from where the goods are dispatched given that goods were delivered to multiple other EU countries, so thresholds were often exceeded.

In addition, larger e-commerce sellers also had obligations to submit arrivals declarations in the country of delivery of the goods even though they were not the purchaser of the goods. The very largest may also have had obligations to submit dispatches declarations in the Member State of their customer because of returned goods.

There is no mention of Intrastat in any of the European Commission’s guides about OSS so no guidance is provided on how it will apply when a business adopts Union OSS. Furthermore, many Member States do not currently seem to have a finalised position on the interaction with Union OSS.

The position in the Member State of dispatch of the goods seems clear but there are potentially complexities when goods are dispatched from more than one Member State especially if there is no VAT registration in that country. Whilst this is unlikely, there are circumstances where no VAT registration is required or even allowed.

The real complexity is with regards to Intrastat arrivals declarations. The principle of Union OSS is that no VAT registration is required in the Member State of the customer for intra-EU supplies. There may be other reasons for a VAT registration there but for many e-commerce sellers, they will not have to be registered in the Member State of delivery.

This raises the question of whether arrivals declarations are required in those territories. Some Intrastat authorities have provided guidance and those that have are taking different routes. Some are clear it is not required for arrivals when using Union OSS whilst others still require declarations to be made even though there is no local VAT registration in place.

We continue to monitor the situation and will update further as more information is available.

E-commerce sellers of goods can have other compliance and tax obligations in the countries to which they deliver goods. These include meeting local country rules with regards to environmental taxes. For example in Romania there is a requirement for e-commerce sellers to submit Environmental Fund returns even if the business has opted to use Union OSS. This creates complexity as the Romanian VAT number is normally used to file the returns. A separate registration seems to be possible to ensure compliance with the environmental regulations.

There is also potentially an issue in Hungary with the retail tax that is payable by businesses with a turnover in excess of HUF 500 million. There is still a liability to pay the tax even if there is no VAT registration because of Union OSS. Affected businesses will need to ensure that they remain compliant.

Teething problems can be expected with any new regime but there is an argument that some of these should have been predicted and clear guidance provided, especially for Intrastat. It is clear that some authorities have not considered the matter at all prior to Union OSS’s introduction. We will continue to monitor the situation and provide further updates when more information is available.

Get in touch to discuss your Union OSS queries with our tax experts and follow us on LinkedIn and Twitter to keep up-to-date with regulatory news and updates.