Blog

Update: 22 January 2024 by Tânia Rei Pre-Filled VAT Returns: Updates in 2024 In recent years, tax authorities worldwide have embraced digital transformation to streamline compliance processes, particularly through the increasing implementation of pre-filled VAT returns. Below we explore the countries that currently provide pre-filled VAT returns or are actively working on projects to implement […]

With a new month comes yet another report due in the Insurance Premium Tax (IPT) sphere. Insurance companies covering risks in Greece must report their insurance policies triggered in 2021 in the form of the Greek annual report. This is due by 31 March 2022. Let us cast our minds back, in late 2019 this […]

Many businesses will now be involved in “cross border” transactions meaning that a business in one territory will sell and, often, deliver goods to a customer located within another territory. The existence of two or more tax territories in the transaction, and the possibility that there may be a customer in the EU and a […]

IPT in Ireland reflects the dynamic shifts in the global tax landscape. With an increasing number of tax jurisdictions adopting electronic filings, Ireland has joined this progressive movement. The Irish tax authority has announced changes to how Stamp Duty, Life Levy, Government Levy and the Compensation Fund are declared and paid from the Quarter 1 […]

Unlike many other country initiatives that we have seen in the e-invoicing space recently, Australia does not seem to have any immediate plans to introduce continuous transaction controls (CTC) or government-portal involvement in their B2B invoicing. Judging from the recent public consultation, current efforts are focused on ways to accelerate business adoption of electronic invoicing. […]

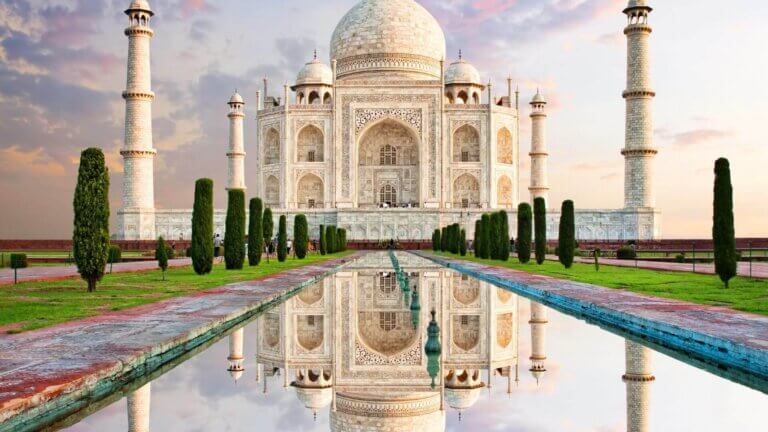

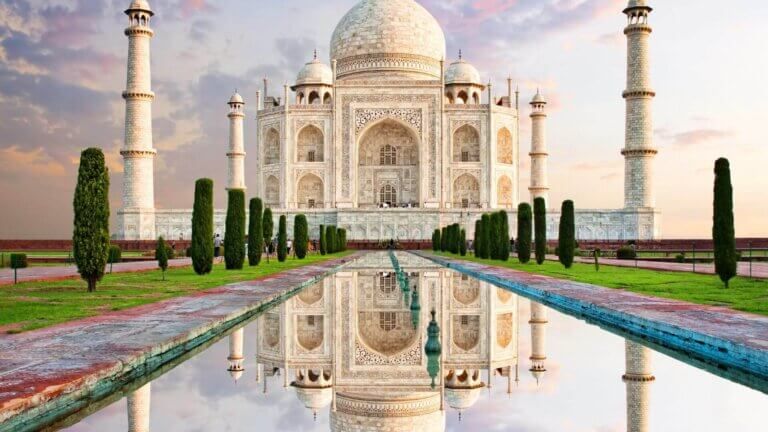

On 24 February 2022, the Indian Central Board of Indirect Taxes and Customs (CBIC) issued a notification (Notification No. 01/2022 – Central Tax) that lowered the threshold for mandatory e-invoicing. In India, e-invoicing is mandatory for taxpayers when exceeding a specific threshold (businesses operating in certain sectors are exempted). The current threshold for mandatory e-invoicing […]

Update: 7 December 2023 by Carolina Silva Spain Establishes Billing Software Requirements The long-awaited Royal Decree, establishing invoicing and billing software requirements to secure Spanish antifraud regulations, has been officially published by the Spanish Ministry of Finance. The taxpayers and SIF developers, defined further below in this article, must be aware of several new official […]

Annual reporting requirements vary from country to country, making it complex for cross-border insurers to collect the data required to ensure compliance. Italy has many unique reporting standards and is known for its bureaucracy across the international business community. Italy’s annual reporting is different due to the level of detail required. The additional reporting in […]

In 2020, the European Commission (EC) adopted a four-year plan to develop a fairer and simpler taxation framework. The Action Plan aspires to tighten up the tax system, ensure that digital platforms are made to follow transparency rules and utilise data better, reducing tax fraud and evasion. In 2021, the Commission implemented e-commerce changes – […]

Insurance is a dynamic sector in constant flux to accommodate with insured’s needs. An increase in holidays abroad following WWII saw the need for Assistance insurance for any unforeseen events that occurred away from the insured’s home country. Council Directive 84/641/EEC regulated Assistance insurance for the first time, and a new class of insurance was […]

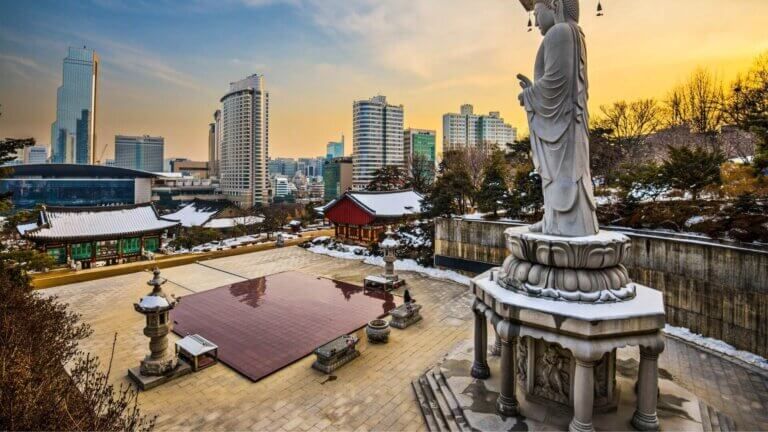

South Korea has an up-and-running e-invoicing system that combines mandatory e-invoicing with a continuous transaction controls (CTC) reporting obligation. This mature and well-established system, launched over a decade ago, is seeing its first significant changes in years. Presidential Decree No. 31445 (Decree) has recently amended certain provisions of the Enforcement Decree of the Value-Added Tax […]

Whilst the UK leaving the European Union (EU) on 31 December 2020 seems like a long time ago, UK businesses still have to deal with changes to the processes in place when importing goods from suppliers in the EU. Customs Declarations Throughout 2021, goods imported into Great Britain from the EU were subject to several […]

The EU-UK Trade and Cooperation Agreement (TCA) provides for tariff-free trade between the United Kingdom (UK) and the European Union (EU) but does not work in the same way as when the UK was part of the EU. Before Brexit, if the goods were in free circulation within the EU, they could be moved cross-border […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services.As a global organisation with indirect tax experts across all regions, our dedicated team is often the first to know about new regulatory changes and the latest developments on tax regimes worldwide to support […]

During the last decade, the Vietnamese government has been developing a feasible solution to reduce VAT fraud in the country by adopting an e-invoice requirement for companies carrying out economic activities in Vietnam. Finally, on 1 July 2022, a mandatory e-invoicing requirement is scheduled to enter into force nationwide. 2020 e-invoicing mandate postponement Despite the […]

We recently launched the 13th Edition of our annual Trends report, the industry’s most comprehensive study of global VAT mandates and compliance controls. Trends provides a comprehensive look at the world’s regulatory landscape highlighting how governments across the world are enacting complex new policies and controls to close tax gaps and collect the revenue owed. […]

Identifying the Location of Risk in the case of health insurance can be a tricky subject, but it’s also crucial to get it right. A failure to do so could lead to under-declared tax liabilities in a particular territory and the potential for penalties to be applied once these deficits are identified and belatedly settled. […]

On 30 January 2022, the Zakat, Tax and Customs Authority (ZATCA) published an announcement on its official web page concerning penalties for violations of VAT rules, and it is currently only available in Arabic. As part of the announcement, the previous fines have been amended, ushering in a more cooperative and educational approach for penalizing […]