Blog

We recently partnered with StudioID on a global survey of 150 finance leaders to reveal significant insights into how companies are navigating the increasingly complex world of indirect tax compliance. The research, which included CFOs, EVPs/SVPs/VPs of Finance, and Finance Directors from companies with revenues ranging from $500 million to over $5 billion, provides a […]

In the first blog in our series, we introduced SAP Clean Core concept and how much is being made about its impact on business, specifically the ability to customize an ERP to meet operational needs. In part two, we addressed how businesses can use the SAP Clean Core principles to create a system that better […]

In the first blog in our series, we introduced SAP Clean Core concept and how much is being made about its impact on business, specifically the ability to customize an ERP to meet operational needs. For part two, I’d like to address how businesses can use the SAP Clean Core principles to create a system […]

Canada’s Border Services Agency (CBSA) has introduced CARM, a new process to modernise and digitalize import of goods in Canada. The agency’s vision is to deliver a globally leading customs experience that facilitates legitimate trade, improves compliance and revenue collection and contributes to securing Canadian Borders. What is CARM? CARM, which stands for CBSA Assessment […]

Argentina has recently expanded its perception VAT (Value Added Tax) collection regime to ensure efficient tax administration. It has included selling food and other products for human consumption, beverages, personal hygiene, and cleaning items under its scope. The Argentinian Federal Administration of Public Revenue (AFIP) established this through Resolution No. 5329/2023 in early February 2023. […]

Update: 8 March 2023 South Korea has recently approved a tax reform which introduces several measures for 2023, among which is the possibility of issuance of self-billing tax invoices. This tax reform amends the current VAT law to allow the purchaser to issue invoices for the supply of goods and services. However, this will only […]

Northern European Jurisdictions: CTC Update The European Commission’s VAT in the Digital Age (ViDA) proposal continues to unfold with the latest details published on 8 December 2022. As a result, many EU countries are stepping up their efforts towards digitising tax controls – including mandatory e-invoicing. While we see different approaches to initiate this transition […]

Update: 3 May 2024 by Dilara İnal Israel Postpones CTC Rollout The Israeli Tax Authority (ITA) has postponed the rollout of the continuous transactions controls (CTC) mandate. The deduction of input tax is allowed with this second postponement, even in the absence of an allocation number, until 4 May 2024. The previous cut-off date was […]

Last updated: 19 July 2023 Insurance Premium Tax in Croatia Under the Freedom of Services (FoS), Croatia currently levies an Insurance Premium Tax (IPT), Compulsory Health Insurance Contributions (CHIC) and Fire Brigade Charge (FBC) on the premium amounts of insurance policies written by EU and EEA insurance companies. In Croatia, IPT only applies to selected […]

Update: 12 January 2024 by Edit Buliczka Upcoming Submission Deadline for Polish Claims Report The Polish Financial Ombudsman Office (Rzecznik Finansowy), like other regulatory bodies such as the Italian IVASS, requires insurance companies to submit various reports about their activities. One of these is the Claims Report. According to the Act on the Consideration of […]

Update: 25 June 2024 by Dilara İnal Ministry Publishes Draft Guideline on B2B E-Invoicing The German Ministry of Finance (MoF) released a draft guideline on 13 June 2024, detailing the upcoming B2B e-invoicing mandate which will roll out on 1 January 2025. Although the current law only obliges taxpayers to issue and receive e-invoices for […]

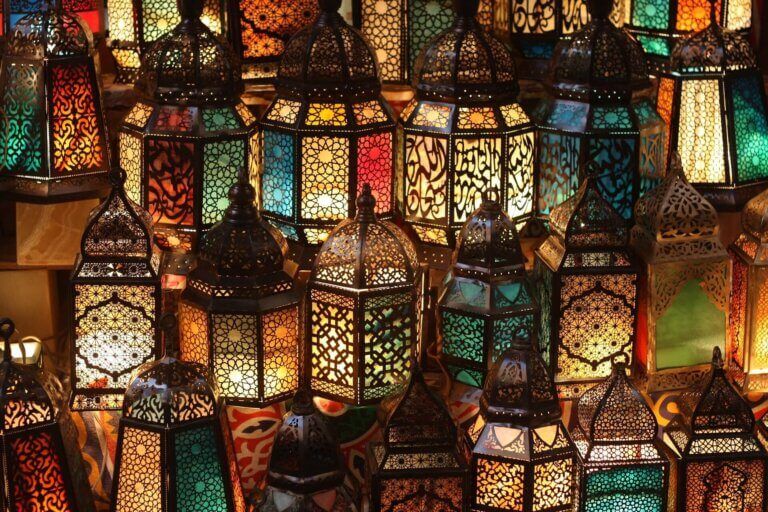

Update: 20 November 2023 by Dilara İnal E-invoicing systems in the Middle East and North Africa are undergoing significant transformations, aiming to modernise the financial landscape and improve fiscal transparency. Recent updates have seen numerous countries implementing electronic invoicing solutions designed to streamline tax collection and reduce VAT fraud. E-invoicing Trends in the Middle East […]