Blog

Update: 25 January 2024 by James Brown Judgment in the Netherlands and Lloyd’s Position on Space Insurance There have been a couple of key developments in the space insurance landscape in recent months from an IPT perspective. The Netherlands’ judgment on space insurance In October 2023, a District Court in the Netherlands passed judgment […]

Update: 2 March 2023 by Kelly Muniz Postponement of EFD-REINF Deadline for Events Referring to Withholding IRPF, CSLL, PIS and COFINS The publishing of Normative Instruction RFB n. 2.133, of 27 February 2023 postpones the deadline of the obligation to submit EFD-REINF (Digital Fiscal Record of Withholdings and Other Fiscal Information) events related to withholding: […]

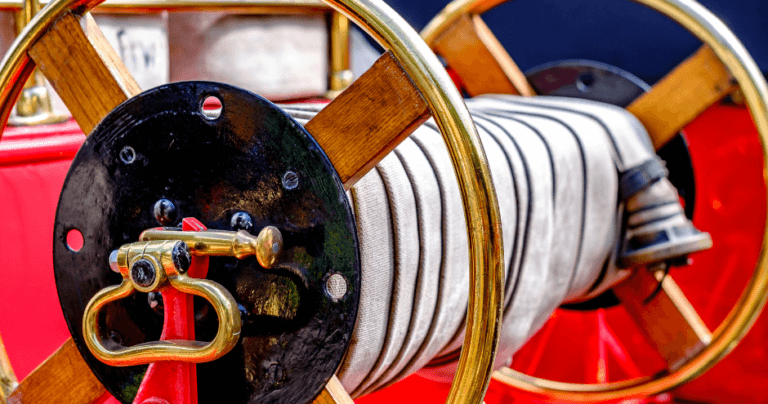

There are several countries within the European Union (EU) and European Economic Area (EEA) that have introduced a Fire Brigade Tax (FBT). Fire Brigade Tax is payable on certain premium amounts and usually in addition to Insurance Premium Tax (IPT). Fire Brigade Tax, or the Fire Brigade Charge (FBC) or Fire Protection Fee (FPF) as […]

Update: 27 July 2023 by Edit Buliczka Changes to IPT registration requirements in Austria The registration requirements for settling taxes in a country are similar – if not the same, usually involving the central tax administration or tax authority. This, however, is not always the case and there are exceptions. For example, due to a […]

Portugal’s state budget entered into force on 27 June 2022 after protracted negotiations. The budget contained an interesting provision: the obligation to present invoice details to the tax authorities was extended to all VAT-registered taxpayers including non-resident taxpayers

Continuing our IPT prepayment series, we take a look at Italy’s requirements. In previous articles we have looked at Belgium, Austria, and Hungary. All insurers authorised to write business under the Italian regime have a legal obligation to make an advance annual payment for the following year. Refer to this blog for a general overview […]

Brazil is known for its highly complex continuous transaction controls (CTC) e-invoicing system. As well as keeping up with daily legislative changes in its 26 states and the Federal District, the country has over 5,000 municipalities with different standards for e-invoicing. The tax levied on consumption of services (ISSQN – Imposto Sobre Serviços de Qualquer […]

Update: 17 April 2025 by Edit Buliczka New IPT Prepayment Rules in Hungary Starting in 2025, new prepayment rules will apply to the Extra Profit Tax on Insurance Premium Tax (EPTIPT). The current structure of two prepayments—due in May and November—will be replaced by a single prepayment, which must be made by 10 December 2025. […]

Update: 8 March 2023 by Kelly Muniz Spain launches public consultation for B2B mandatory e-invoicing The Ministry of Economic Affairs and Digital Transformation (Ministerio de Asuntos Económicos y Transformación Digital) has launched a public consultation on the upcoming B2B e-invoicing mandate. The mandate will enable citizens to participate in elaborating norms before its development. This […]

In the next edition of our series of blogs in Insurance Premium Tax (IPT) prepayments, we look at a less familiar regime to many, the Austrian IPT Prepayment. IPT prepayments in Austria Those who are well versed in the IPT sphere will be perplexed at this blog, as they most likely will never have paid […]

Many countries have recently started their continuous transaction controls (CTC) journey by introducing mandatory e-invoicing or e-reporting systems. We see more of this trend in the European Union as the recent reports on the VAT in the Digital Age Initiative discuss that the best policy choice would be to introduce an EU-wide CTC e-invoicing system covering […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and insurance premium tax (IPT) compliance services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about regulatory changes and developments in global tax regimes, to […]

On 30 August 2022, the Ministry of Finance published draft legislation amending the Regulation on the use of the National e-Invoice System (KSeF). The purpose of the draft amendment is to adapt KSeF’s terms of use to the specific conditions that apply to the local government units and the VAT groups that will operate as […]

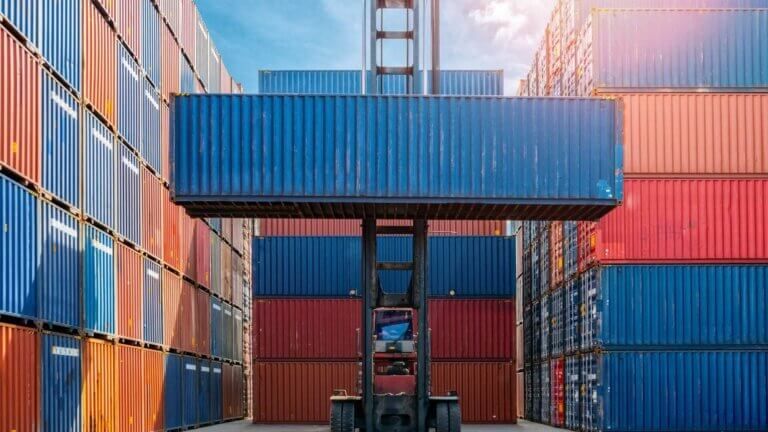

For the UK and other non-EU businesses it’s vital to determine the importer of the goods into the EU as this will impact the VAT treatment. For goods under €150 there are simplified options such as the Import One Stop Shop (IOSS) or special arrangements through the postal operator. However, when supplying goods over €150, […]

It’s time to return to Insurance Premium Tax (IPT) prepayments – a continuation of our blog series on this important IPT topic. You can find the first entry in our blog series here. Throughout Europe’s different countries and jurisdictions, IPT is declared and settled in different ways. Monthly, quarterly, biannually – this varies across Member […]

The Colombian tax authority (DIAN) continues to invest in the expansion of its CTC (continuous transaction controls) system. The latest update proposes an expansion of the scope of documents covered by the e-invoicing mandate. In this article we’ll address the newly published Draft Resolution 000000 of 19-08-2022. This advances important changes for taxpayers covered by […]

It seems such a short time since HMRC sent a reminder letter in March 2022 recalling the upcoming changes to the UK’s customs systems and explaining what to do to prepare for these changes. With the deadline rapidly approaching, here’s a brief recap. The Customs Handling of Import and Export Freight (CHIEF) system, which is […]

The Dutch government issued an updated Policy Statement for Insurance Premium Tax (IPT) on 12 May 2022. The first of its kind since February 2017, the update is intended to replace the 2017 version in full. While the majority of the content remained consistent, there were notable details pertaining to Netherlands storage insurance and ‘own […]