Blog

The introduction of the new Portuguese Stamp Duty system has arguably been one of the most extensive changes within IPT reporting in 2021 even though the latest reporting system wasn’t accompanied by any changes to the tax rate structure. The new reporting requirements were initially scheduled to start with January 2020 returns. However this was […]

As our webinar explored in depth, location of risk rules are complex and constantly evolving. The Sovos compliance team covered many topics on the session, such as sources for identification of the location of risk and location of risk vs location of the policyholder. Despite this deep dive, there were plenty of questions that we […]

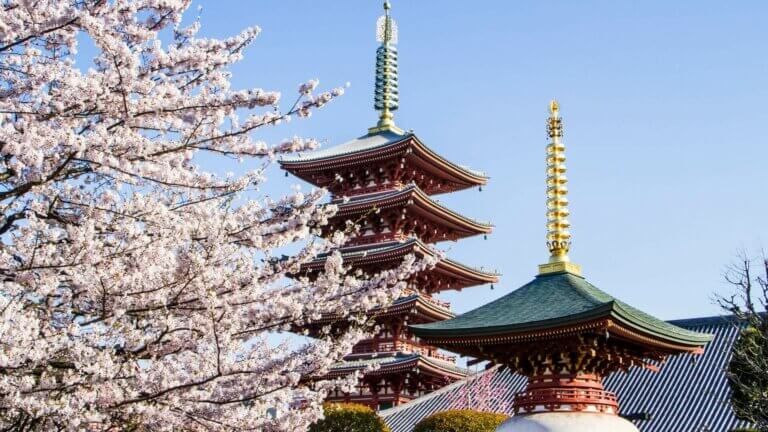

Update: 23 March 2023 by Dilara İnal Japan’s Qualified Invoice System Roll-out Approaches Japan is moving closer to the roll-out of its Qualified Invoice System (QIS), which will happen in October 2023. Under QIS rules, taxpayers will only be eligible for input tax credit after being issued a qualified invoice. However, exceptions exist where taxpayers […]

Turkey’s e-transformation journey, which started in 2010, became more systematic in 2012. This process first launched with the introduction of e-ledgers on 1 Jan 2012 and has since reached a much wider scope for e-documents. The Turkish Revenue Administration (TRA), the leader of the e-transformation process, has played an important role in encouraging companies to […]

In this blog, we provide an insight into continuous transaction controls (CTCs) and the terminology often associated with them. With growing VAT gaps the world over, more tax authorities are introducing increasingly stringent controls. Their aim is to increase efficiency, prevent fraud and increase revenue. One of the ways governments can gain greater insight into […]

Since 1993, supplies performed between Italy and San Marino have been accompanied by a set of customs obligations. These include the submission of paperwork to both countries’ tax authorities. After the introduction of the Italian e-invoicing mandate in 2019, Italy and San Marino started negotiations to expand the use of e-invoices in cross-border transactions between […]

Starting in 2023, French VAT rules will require businesses to issue invoices electronically for domestic transactions with taxable persons and to obtain ‘clearance’ on most invoices before their issue. Other transactions, such as cross-border and B2C, will be reported to the tax authority in the “normal” way. This will be a major undertaking for affected […]

Treatment of fire charges is tricky in almost all jurisdictions. Fire coverage can vary from as high as 100% to 20%. No-one would dispute that the most complex fire charge treatment is in Spain. In Portugal, whilst the rules are less complex, they have a unique reporting system for how the policies covering fire must […]

Norway announced its intentions to introduce a new digital VAT return in late 2020, with an intended launch date of 1 January 2022. Since then, businesses have wondered what this change would mean for them and how IT teams would need to prepare systems to meet this new requirement. Norway has since provided ample guidance […]

Sovos recently sponsored a benchmark report with SAP Insider to better understand how SAP customers are adapting their strategies and technology investments to evolve their finance and accounting organizations. This blog hits on some of the key points covered in the report and offers some direct responses made by survey respondents, as well as conclusions […]

Six months after Brexit there’s still plenty of confusion. Our VAT Managed Services and Consultancy teams continue to get lots of questions. So here are answers to some of the more common VAT compliance concerns post-Brexit. How does postponed VAT accounting work? Since Brexit, the UK has changed the way import VAT is accounted for. […]

In Poland, the Ministry of Finance proposed several changes to the country’s mandatory JPK_V7M/V7K reports. These will take effect on 1 July 2021. The amendments offer administrative relief to taxpayers in some areas but create potential new hurdles elsewhere. Poland JPK_V7M and V7K Reports The JPK_V7M/V7K reports – Poland’s attempt to merge the summary reporting […]

As detailed within our annual report VAT Trends: Toward Continuous Transaction Controls, there’s an increasing shift toward destination taxability which applies to certain cross-border trades. In the old world of paper-based trade and commerce, the enforcement of tax borders, between or within countries, was mostly a matter of physical customs controls. To ease trade and […]

Update: 25 October 2023 by Maria del Carmen Mexico releases Carta Porte Version 3.0 On 25 September 2023, the Tax Authority in Mexico (SAT) published Version 3.0 of the Carta Porte Supplement on its portal with some adjustments. The use of Version 2.0 of the Carta Porte became mandatory as of 1 January 2022 in […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes, ensuring you stay compliant. We spoke to Christina Wilcox, […]

The General Authority of Zakat and Tax’s (GAZT) previously published draft rules on ‘Controls, Requirements, Technical Specifications and Procedural Rules for Implementing the Provisions of the E-Invoicing Regulation’ aimed to define technical and procedural requirements and controls for the upcoming e-invoicing mandate. GAZT recently finalized and published the draft e-invoicing rules in Saudi Arabia. Meanwhile, […]

It’s been more than a few years since Romania first toyed with the idea of introducing a SAF-T obligation to combat its ever-growing VAT gap. Year after year, businesses wondered what the status of this new tax mandate was, with the ANAF continuously promising to give details soon. Well, the time is now. What is […]

The Turkish Revenue Administration (TRA) has published updated guidelines on the cancellation and objection of e-fatura and e-arsiv invoice. Two different guidelines are updated: guidelines on the notification of cancellation and objection of e-fatura and guidelines on the notification of cancellation and objection of e-arsiv. The updated guidelines inform taxable persons about the new procedures […]