Blog

Unlike many other country initiatives that we have seen in the e-invoicing space recently, Australia does not seem to have any immediate plans to introduce continuous transaction controls (CTC) or government-portal involvement in their B2B invoicing. Judging from the recent public consultation, current efforts are focused on ways to accelerate business adoption of electronic invoicing. […]

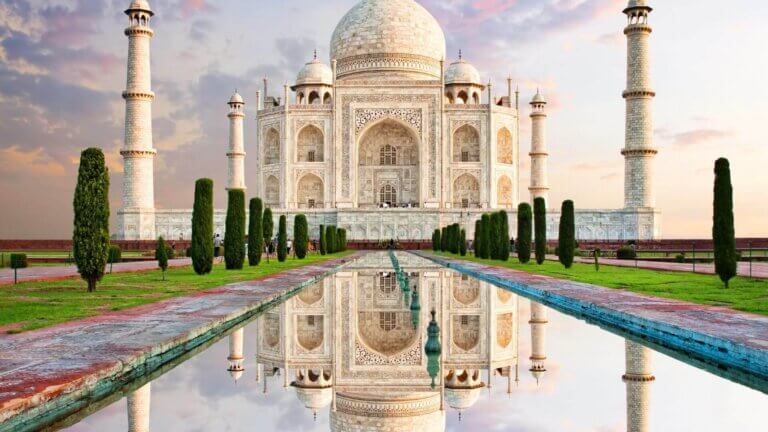

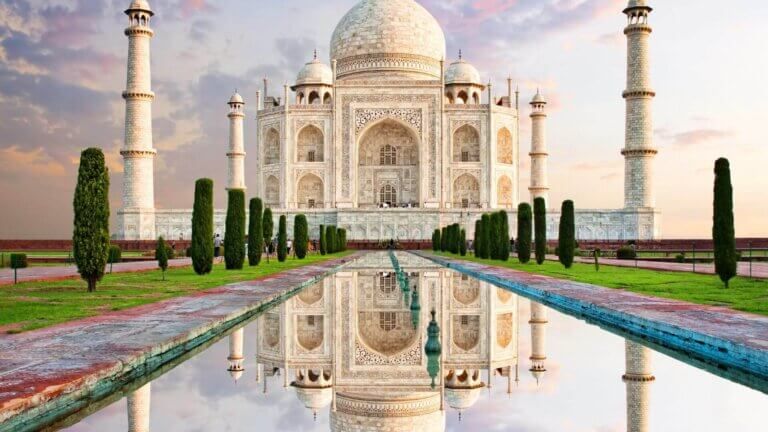

On 24 February 2022, the Indian Central Board of Indirect Taxes and Customs (CBIC) issued a notification (Notification No. 01/2022 – Central Tax) that lowered the threshold for mandatory e-invoicing. In India, e-invoicing is mandatory for taxpayers when exceeding a specific threshold (businesses operating in certain sectors are exempted). The current threshold for mandatory e-invoicing […]

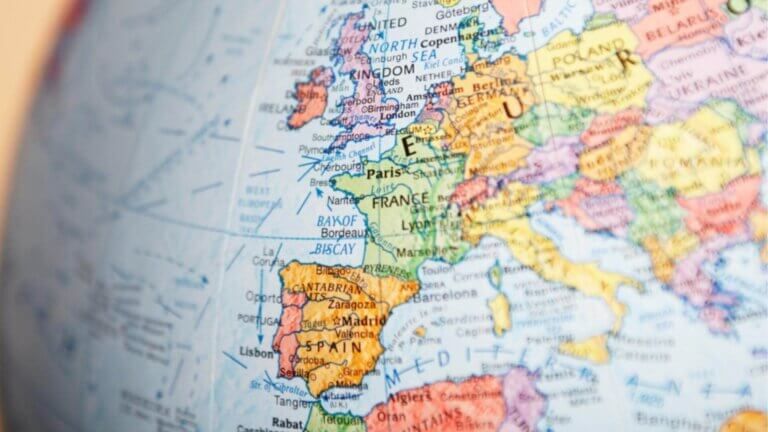

Update: 7 December 2023 by Carolina Silva Spain Establishes Billing Software Requirements The long-awaited Royal Decree, establishing invoicing and billing software requirements to secure Spanish antifraud regulations, has been officially published by the Spanish Ministry of Finance. The taxpayers and SIF developers, defined further below in this article, must be aware of several new official […]

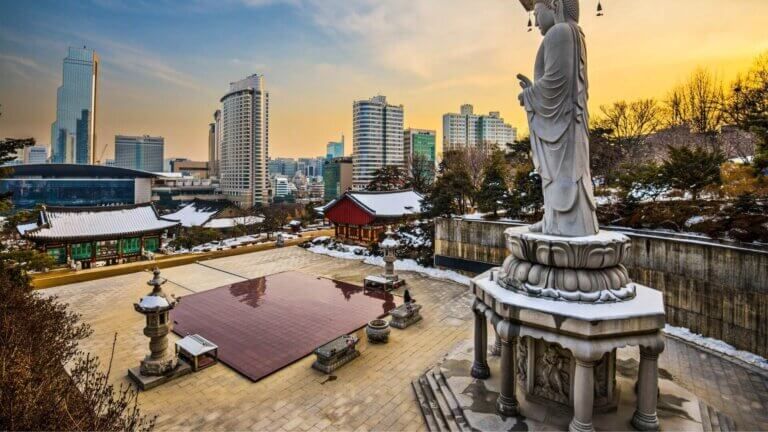

South Korea has an up-and-running e-invoicing system that combines mandatory e-invoicing with a continuous transaction controls (CTC) reporting obligation. This mature and well-established system, launched over a decade ago, is seeing its first significant changes in years. Presidential Decree No. 31445 (Decree) has recently amended certain provisions of the Enforcement Decree of the Value-Added Tax […]

During the last decade, the Vietnamese government has been developing a feasible solution to reduce VAT fraud in the country by adopting an e-invoice requirement for companies carrying out economic activities in Vietnam. Finally, on 1 July 2022, a mandatory e-invoicing requirement is scheduled to enter into force nationwide. 2020 e-invoicing mandate postponement Despite the […]

On 30 January 2022, the Zakat, Tax and Customs Authority (ZATCA) published an announcement on its official web page concerning penalties for violations of VAT rules, and it is currently only available in Arabic. As part of the announcement, the previous fines have been amended, ushering in a more cooperative and educational approach for penalizing […]

Towards the end of 2021, the tax authority in Turkey published a draft communique that expands the scope of e-documents in Turkey. After minor revisions, the draft communique was enacted and published in the Official Gazette on 22 January 2022. Let’s take a closer look at the changes in the scope of Turkish e-documents. Scope […]

The Tax Bureaus of Shanghai, Guangdong Province and Inner Mongolia Autonomous Region have all issued announcements stating they intend to carry out a new pilot program for selected taxpayers based in some areas of the provinces. The pilot program will involve adopting a new e-invoice type, known as a fully digitized e-invoice. Introduction of a […]

With the most significant VAT gap in the EU (34.9% in 2019), Romania has been moving towards introducing a continuous transaction control (CTC) regime to improve and strengthen VAT collection while combating tax evasion. The main features of this new e-invoicing system, e-Factura, have been described in an earlier blog post. Today, we’ll take a […]

In a blog post earlier this year, we wrote about how several Eastern European countries have started implementing continuous transaction controls (CTC) to combat tax fraud and reduce the VAT gap. However, it’s been an eventful year with many new developments in the region, so let’s take a closer look at some of the changes on the […]

Several EU Member States have been introducing continuous transaction controls (CTCs), aiming to close their VAT gaps, increase revenue and have more control over the data of their economy. However, the CTC regimes adopted by those countries are far from uniform. So far, Italy is the only country that obtained a derogation from the VAT […]

Electronic invoicing is rapidly becoming a standard business process. Governments are pushing for the adoption of B2G invoicing to optimize the public procurement process and also to provide a boost to the adoption of e-invoicing between businesses. Apart from countries that have introduced general e-invoicing mandates to improve fiscal controls – most of which have […]

Update: 25 June 2024 by Dilara İnal Ministry Publishes Draft Guideline on B2B E-Invoicing The German Ministry of Finance (MoF) released a draft guideline on 13 June 2024, detailing the upcoming B2B e-invoicing mandate which will roll out on 1 January 2025. Although the current law only obliges taxpayers to issue and receive e-invoices for […]

The Zakat, Tax and Customs Authority (ZATCA) announced the finalised rules for the Saudi Arabia e-invoicing system earlier this year, announcing plans for two main phases for the new e-invoicing system. The first phase of the Saudi Arabia e-invoicing system is set to go live from 4 December 2021. With the mandate just around the […]

Back in 2019, Portugal passed a mini e-invoicing reform consolidating the country’s framework around SAF-T reporting and certified billing software. Since then, a lot has happened: non-resident companies were brought into the scope of e-invoicing requirements, deadlines have been postponed due to Covid, and new regulations were published. This blog summarises the latest and upcoming […]

Progress has been made in the roll-out of the Polish CTC (continuous transaction control) system, Krajowy System of e-Faktur. Earlier this year, the Ministry of Finance published a draft act, which is still awaiting adoption by parliament to become law. Draft e-invoice specifications have been released and there has been a public consultation on the […]

Moving goods from one place to another is a quintessential part of business. Manufacturers, wholesalers, transporters, retailers and consumers all need to carefully orchestrate the shipping and handling of raw materials, parts, equipment, finished goods and other products to keep business flowing. This supply chain harmony is what makes production and trade possible in society. […]

More than 170 countries throughout the world have implemented a VAT system, and some of the most recent adopters are the Gulf countries. In a bid to diversify economic resources, the Gulf countries have spent the past decade investigating other ways to finance its public services. As a result, in 2016 the GCC (Gulf Cooperation […]