Blog

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes and the latest developments on tax regimes across the world, […]

In the European Union, the VAT rules around supplies of goods, as well as ’traditional’ two-party supplies of services, are well-defined and established. Peer-to-peer services facilitated by a platform, however, do not always fit neatly into the categories set out under the EU VAT Directive (Council Directive 2006/112/EC). There are ambiguities around both the nature […]

Governments throughout the world are introducing continuous transaction control (CTC) systems to improve and strengthen VAT collection while combating tax evasion. Romania, with the largest VAT gap in the EU (34.9% in 2019), is one of the countries moving the fastest when it comes to introducing CTCs. In December 2021 the country announced mandatory usage […]

The European Commission’s “VAT in the Digital Age” initiative reflects on how tax authorities can use technology to fight tax fraud and, at the same time, modernise processes to the benefit of businesses. A public consultation was launched earlier this year, in which the Commission welcomes feedback on policy options for VAT rules and processes […]

Making Tax Digital for VAT – Expansion Beginning in April 2022, the requirements for Making Tax Digital (MTD) for VAT will be expanded to all VAT registered businesses. MTD for VAT has been mandatory for all companies with annual turnover above the VAT registration threshold of £85,000 since April 2019. As a result, this year’s […]

In November 2021, a Draft Royal Decree was published by the Chancery of the Prime Minister of Belgium, aiming to expand the scope of the existing e-invoicing mandate for certain business to government (B2G) transactions by implementing mandatory e-invoicing for all transactions with public administrations in Belgium. This obligation was already in place for suppliers […]

Registering for Insurance Premium Tax (IPT) with tax authorities across Europe can be challenging and complex, particularly when multiple territories are involved. There are many elements businesses must consider when registering for IPT. What are the required supporting documents? Who can sign? Do documents need to be legalised? Is there a two-step process? These are […]

On 10 March, the European Parliament (EP) adopted a Resolution to the Commission’s Action Plan on fair and simple taxation supporting the recovery strategy, which set forth 25 initiatives predominantly related to European Union Value Added Tax (EU VAT). The document includes several general considerations and recommendations to the Commission for the VAT Directive revision […]

Poland has been moving towards introducing the CTC framework and the system, the Krajowy System e-Faktur (KSeF), since early 2021. As of 1 January 2022, the platform has been available for taxpayers who opt to issue structured invoices through KSeF and to benefit from the introduced incentives. As the taxpayers have been using KSeF for […]

Update: 22 January 2024 by Tânia Rei Pre-Filled VAT Returns: Updates in 2024 In recent years, tax authorities worldwide have embraced digital transformation to streamline compliance processes, particularly through the increasing implementation of pre-filled VAT returns. Below we explore the countries that currently provide pre-filled VAT returns or are actively working on projects to implement […]

With a new month comes yet another report due in the Insurance Premium Tax (IPT) sphere. Insurance companies covering risks in Greece must report their insurance policies triggered in 2021 in the form of the Greek annual report. This is due by 31 March 2022. Let us cast our minds back, in late 2019 this […]

Many businesses will now be involved in “cross border” transactions meaning that a business in one territory will sell and, often, deliver goods to a customer located within another territory. The existence of two or more tax territories in the transaction, and the possibility that there may be a customer in the EU and a […]

IPT in Ireland reflects the dynamic shifts in the global tax landscape. With an increasing number of tax jurisdictions adopting electronic filings, Ireland has joined this progressive movement. The Irish tax authority has announced changes to how Stamp Duty, Life Levy, Government Levy and the Compensation Fund are declared and paid from the Quarter 1 […]

Unlike many other country initiatives that we have seen in the e-invoicing space recently, Australia does not seem to have any immediate plans to introduce continuous transaction controls (CTC) or government-portal involvement in their B2B invoicing. Judging from the recent public consultation, current efforts are focused on ways to accelerate business adoption of electronic invoicing. […]

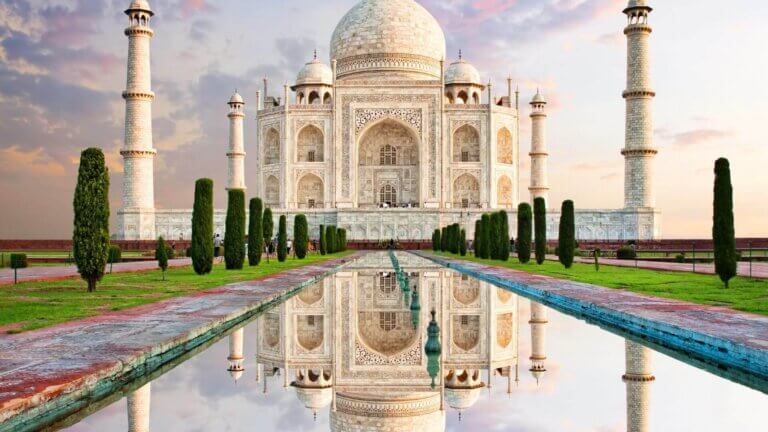

On 24 February 2022, the Indian Central Board of Indirect Taxes and Customs (CBIC) issued a notification (Notification No. 01/2022 – Central Tax) that lowered the threshold for mandatory e-invoicing. In India, e-invoicing is mandatory for taxpayers when exceeding a specific threshold (businesses operating in certain sectors are exempted). The current threshold for mandatory e-invoicing […]

Update: 7 December 2023 by Carolina Silva Spain Establishes Billing Software Requirements The long-awaited Royal Decree, establishing invoicing and billing software requirements to secure Spanish antifraud regulations, has been officially published by the Spanish Ministry of Finance. The taxpayers and SIF developers, defined further below in this article, must be aware of several new official […]

Annual reporting requirements vary from country to country, making it complex for cross-border insurers to collect the data required to ensure compliance. Italy has many unique reporting standards and is known for its bureaucracy across the international business community. Italy’s annual reporting is different due to the level of detail required. The additional reporting in […]

In 2020, the European Commission (EC) adopted a four-year plan to develop a fairer and simpler taxation framework. The Action Plan aspires to tighten up the tax system, ensure that digital platforms are made to follow transparency rules and utilise data better, reducing tax fraud and evasion. In 2021, the Commission implemented e-commerce changes – […]