Blog

In Turkey, the Revenue Administration (TRA) published the long-awaited e-Delivery Note Application Manual. The manual clarifies how the electronic delivery process will work in addition to answering frequently asked questions. It addresses the application as well as its scope and structure, outlines important scenarios and provides clarity for companies who are unclear about the adoption […]

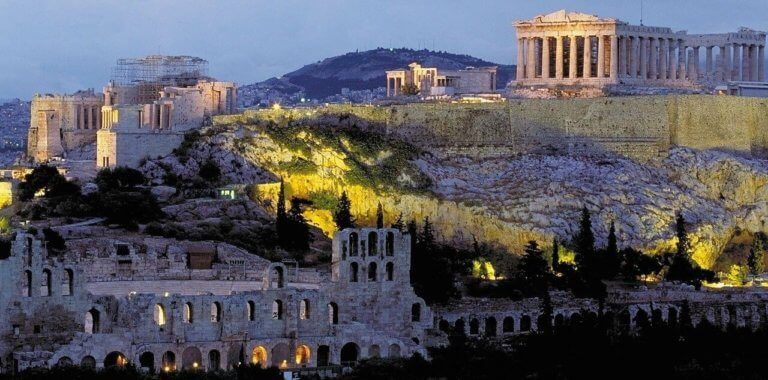

The upcoming tax reform in Greece is expected to manifest itself in three continuous transaction control (CTC) initiatives. The myDATA e-books initiative, which entails the real-time reporting of transaction and accounting data to the myDATA platform which will in turn populate a set of online ledgers maintained on the government portal; Invoice clearance, which is […]

Certification of e-invoice service providers is an important first step and milestone ahead of the implementation of e-invoicing in Greece. The Greek Government has now defined the regulatory framework for e-invoice service providers, their obligations, and a set of requirements needed to certify their invoicing software. Find out what you need to know about the […]

Two months after closing the public consultation on the myDATA scheme, the Greek tax authority, IAPR, has yet to share the feedback received from the industry on the proposed scheme or make any official announcement in this regard. However, local discussions indicate that, the IAPR may reintroduce its initial agenda proposed back in August 2018, […]

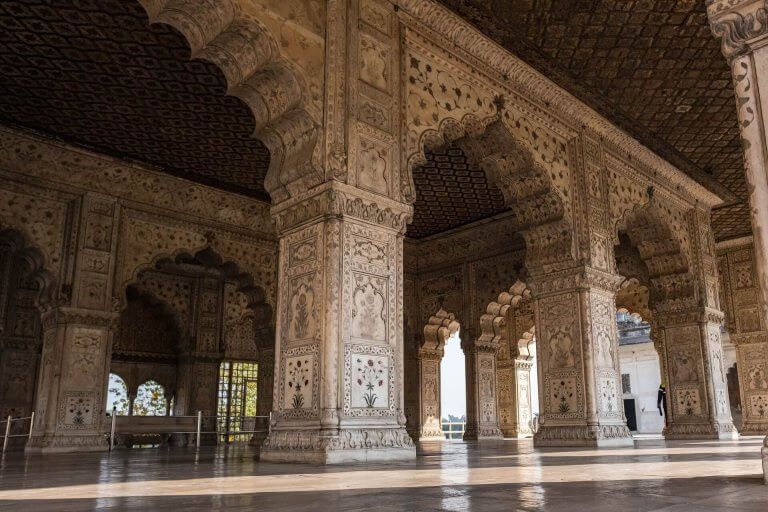

Following India’s recent public consultation looking at the proposed introduction of an e-invoicing regime, the GST council has now released a white paper on the architecture of the new framework and also provided answers to a number of outstanding questions. From 1 January 2020, taxpayers in India can start to use the new e-invoicing framework, […]

Greece made an important step to digitise its tax system and introduce an innovative platform for taxpayers to fulfil their tax obligations. The new platform will offer businesses a collaborative environment where the data they provide to the Greek Independent Authority of Public Revenues (IAPR) will not only affect their own books but will also […]

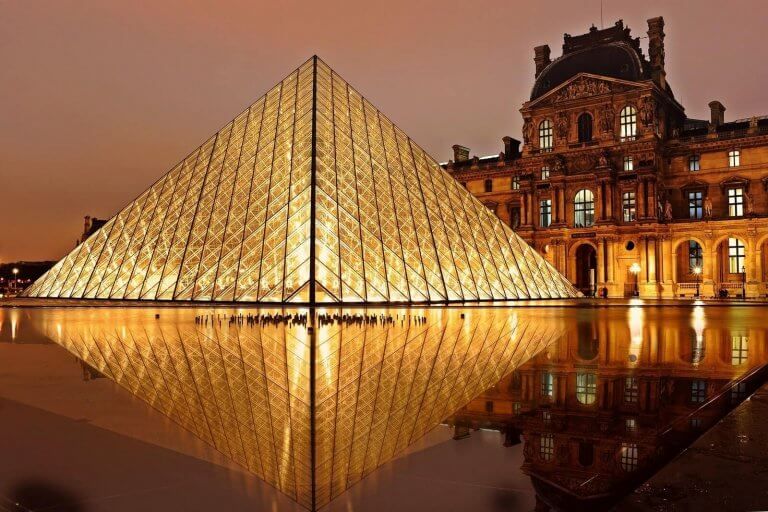

Back in June this year, many heads were turned when the French Minister of Public Accounts and Action, Gérald Darmanin, went on record stating that the French Government has the intention of making e-invoicing mandatory also for B2B transactions. Now it seems that the Government – spearheaded on this topic by Minister Darmanin as well as by the Minister of Finance Bruno Le Maire – has moved from word to […]

On 7 July, Greece began voting to elect a new government. The disposed governing left party has been dealt with a hefty blow having been in power since 2015. It was hoped they would introduce less severe politics which many claim they have not only failed to do but, in fact, they actually introduced stricter […]

As more and more countries across the world depend on VAT, GST or other indirect taxes as the single most significant source of public revenue, governments are increasingly asking themselves what technical means they can use to ensure that they maximise the collection of the taxes due under the new tax regimes. India is the […]

Italy has been at the forefront of B2G e-invoicing in Europe ever since the central e-invoicing platform SDI (Sistema di Interscambio) was rolled out and made mandatory for all suppliers to the public sector in 2014. While a number of its European neighbours are slowly catching up, Italy is continuing to improve the integration of […]

The French Minister of Public Accounts and Action, which has authority over all tax matters, has taken advantage of the process that is required to transpose the EU E-Commerce Directive to launch a number of initiatives to curb VAT fraud, including a renewed attempt to create a system of mandatory e-invoicing. Going from B2G to […]

To help reduce delays in the payment of invoices, the French authorities by Ordinance No. 2019-359 of 24 April 2019 have clarified their invoicing rules to include two new mandatory content requirements. These are in addition to those already in place. The two new requirements stipulated in the France invoice mandate are: 1) To provide […]

Beyond the implications outlined in our last blog, Decree-Law 28/2019 (the Decree-Law) impacts areas beyond invoicing, introducing modifications to both archiving and the reporting of tax data. Mandatory electronic archiving A novelty of the Decree-Law is the explicit introduction of an obligation to archive electronic invoices in electronic format which in turn further promotes the […]

On 15 February 2019, Portugal published Decree-Law 28/2019 regarding the processing, archiving and dematerialisation of invoices and other tax related documents including: The mandatory use of certified invoicing software General requirements for paper and electronic invoices Dematerialisation of tax documentation Archiving of tax documentation (including ledgers, etc) Adjacent tax rules and obligations The decree aims […]

There is no doubt that the roll out of the Italian clearance e-invoicing mandate has kept the e-invoicing market and local taxpayers on their toes. Compliance with the mandate’s legal and technical requirements is not an easy task to fulfil. Consequently, taxpayers of different sectors of the economy, as well as different stakeholders of the […]

More than six months ago the Greek authorities announced their intention to introduce mandatory e-invoicing and e-bookkeeping rules, and enough information is now available to assess what the proposed rules will mean for Greece. Although formal legislation has yet to be published, it’s expected the new e-invoicing measures by the Independent Public Revenue Authority, the […]

Companies struggling to meet Italy’s electronic invoicing deadline of January 1 will get some relief from financial penalties if they can’t immediately issue invoices at the moment of supply, but it seems the Italian Tax Authority will not delay rolling out the system. The government had stated that invoices that did not comply with the […]

Companies dealing with complex sales and use tax determination, VAT regulations and other tax challenges across the globe know that SAP alone is not equipped to support the varying requirements from country to country. As SAP sunsets support and updates for ECC and R3, companies must move to HANA to keep their systems up to […]