Blog

There are a variety of different approaches to Insurance Premium Tax (IPT) treatment for marine insurance across Europe. Before looking at how individual countries treat marine insurance, it is worth noting the challenges in determining the country entitled to levy IPT and any associated charges. The location of risk relating to marine vessels falls within […]

The Colombian electronic invoicing system is reaching maturity level. Since its inception in 2018, Colombia has been steadily consolidating and expanding the mandate to make it more stable, reliable and comprehensive. As a result of the enactment of the recent Resolution 000013/2021, the Colombian tax administration (DIAN), officially expanded the electronic invoicing mandate to also […]

Update: 24 September 2025 Insurance Premium Tax (IPT) regulations in Spain are among the most intricate within the European Union. Compliance is particularly challenging due to the involvement of multiple tax authorities. These include the central tax administration – commonly referred to as “HACIENDA/AEAT” (Agencia Estatal de Administración Tributaria) – as well as four provincial […]

An amendment in the General Communiqué No. 509 has announced healthcare service providers and taxpayers providing medical supplies and medicines or active substances must use the e-invoice application from 1 July 2021. The mandated scope for transition to e-invoice and e-arşiv invoice applications in the healthcare industry Published in the Official Gazette the implementation will […]

Italy postpones e-document legislation until 2022. In September 2020, Italy introduced major changes to the country’s rules on the creation and preservation of electronic documents. These new requirements were expected to be enforced on 7 June 2021 however the Agency for Digital Italy (AGID) has now decided to postpone the introduction of the new rules […]

This blog is an excerpt from Sovos’ Annual VAT Trends report. Please click here to download your complimentary copy in full. VAT requirements and their relative importance for businesses have changed significantly in recent years. For data that is transactional in nature, the overall VAT trend is clearly toward various forms of continuous transaction controls […]

On 22 March 2021 the EU Council approved DAC7, which establishes EU-wide rules meant to improve administrative cooperation in taxation. In addition, the Directive addresses additional challenges posed by a growing digital platform economy. What is DAC7? In 2011, the EU adopted Directive 2011/16/EU on administrative cooperation in the field of taxation in the EU […]

Russia introduces a new e-invoicing system for traceability of certain goods on 1 July 2021. Federal Law No. 371-FZ will amend the Russian Tax Code to introduce the new procedure for the traceability system, which will bring the introduction of mandatory e-invoicing for taxpayers dealing with traceable goods. Since its introduction, B2B e-invoicing in Russia […]

It’s difficult to pinpoint exactly when new taxes or tax rate increases will happen. Covid-19 has impacted almost everything, including a massive deficit in the economy. Many banks have applied negative interest and governments have put funding in place to aid recovery. It’s highly likely that tax authorities will be looking at ways to bring […]

Update: 25 August 2023 by Carolina Silva Croatia to Introduce E-Invoicing and CTC Reporting System According to official sources from the Ministry of Finance, the Croatian tax authority will introduce a decentralised e-invoicing model alongside a continuous transaction control (CTC) real-time reporting system of invoice data to the tax authority. This move is part of […]

VAT accounts for 15-40% of all public revenue globally. We estimate that the global VAT gap – i.e. lost VAT revenue due to errors and fraud – could be as high as half a trillion Euros. The GDP of countries like Norway, Austria or Nigeria are at a similar level and this VAT gap is […]

Given the complexity of international VAT and the potential risk, pitfalls and associated costs, finance directors face a predicament. Unlike direct taxes, which tend to be retrospectively determined, VAT is effectively calculated in real-time. It’s linked to various aspects of the supply chain. If the related transaction has incorrect VAT calculations or erroneous codes, these […]

It’s good to see light at the end of the tunnel. Nonetheless, it’s too little, too late for many smaller – but also plenty of larger – companies. Thousands couldn’t weather the storm because they were particularly dependent on human contact. Others were affected disproportionally simply because COVID-19 hit them just as they traversed a […]

The EU introduces the E-Commerce VAT Package and OSS on 1 July 2021. The previous delay from 1 January 2021 was due to the COVID-19 pandemic. COVID-19 is far from resolved with many Member States still suffering significantly with wide-ranging restrictions in place in many countries. Regardless, the European Commission’s current plan is to press ahead […]

The basic principle of value added tax (VAT) is that the government gets a percentage of the value that is added at each step of an economic chain, which ends with the consumption of the goods or services by an individual. While VAT is paid by all parties in the chain, including the end customer, […]

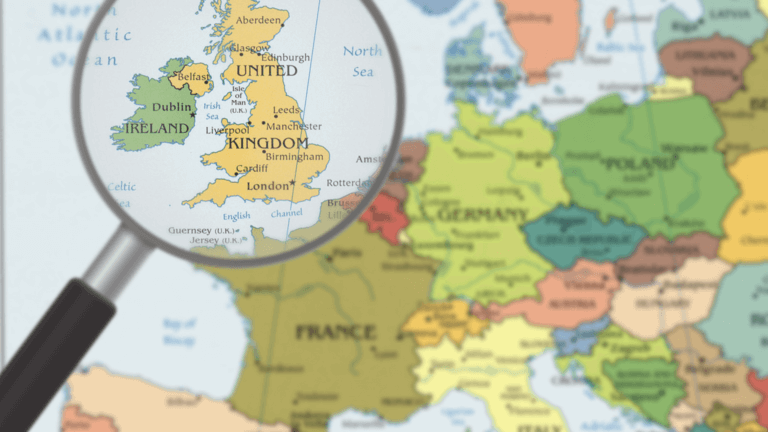

The UK entered into a new relationship with the EU on 1 January 2021. The Transition Period ended and the EU-UK Trade and Cooperation Agreement (TCA) came into force. The UK fully implemented this into law but applied on a provisional basis by the EU. The European Parliament needs to ratify it. This is due […]

There is a plethora of misinformation and misconceptions surrounding Brexit and tax. The aim of this blog is to dispel such myths and clear up any confusion. We will dig deeper into news stories to explain the facts and keep you informed. Brexit Myth 1 – Brexit’s unique taxation regime for EU imports The story: […]

The EU-UK Trade and Co-operation Agreement (TCA) was finally agreed on 24 December 2020. A week before the end of the transition period. Fully implemented into UK law, but the TCA remains provisional. It needs to be ratified in the European Parliament. Therefore it applies on a provisional basis until 28 February 2021. The TCA […]