Blog

The Zakat, Tax and Customs Authority (ZATCA) announced the finalised rules for the Saudi Arabia e-invoicing system earlier this year, announcing plans for two main phases for the new e-invoicing system. The first phase of the Saudi Arabia e-invoicing system is set to go live from 4 December 2021. With the mandate just around the […]

On 1 July 2021 the EU E-Commerce VAT Package was introduced. The package replaced existing distance-selling rules and extended the Mini One Stop Shop (MOSS) into a wider-ranging One Stop Shop (OSS). The implementation of the EU E-Commerce VAT Package was designed to simplify the VAT reporting requirements for sellers and improve the tax take […]

The widespread adoption of electronic invoicing regimes has given tax authorities access to enormous quantities of taxpayer data. In many jurisdictions, this data enables tax authorities to summarise a taxpayer’s transactional information for a given filing period. It also enables them to present the taxpayer with a draft VAT Return, filled in ahead of time […]

In Insurance Premium Tax (IPT) compliance, the Aviation Hull and Aviation Liability policy is defined under Annex 1, Classes of Non-Life Insurance, as described in DIRECTIVE 138/2009/EC (SOLVENCY II DIRECTIVE). But there are variations and identifying which class the policy is covering can be a challenge. This article will cover what insurers need to know […]

Back in 2019, Portugal passed a mini e-invoicing reform consolidating the country’s framework around SAF-T reporting and certified billing software. Since then, a lot has happened: non-resident companies were brought into the scope of e-invoicing requirements, deadlines have been postponed due to Covid, and new regulations were published. This blog summarises the latest and upcoming […]

In our last look at Romania SAF-T, we detailed the technical specifications released from Romania’s tax authority. Since then, additional guidance has been released including an official name for the SAF-T submission: D406. Implementation timeline for mandatory submission of Romania SAF-T Large taxpayers (as designated by the Romanian tax authorities) – 1 January 2022 Medium […]

Welcome to our Q&A two-part blog series on the French e-invoicing and e-reporting mandate, which comes into effect 2023-2025. That sounds far away but businesses must start preparing now if they are to comply. The Sovos compliance team has returned to answer some of your most pressing questions asked during our webinar. We have outlined […]

A tax authority audit can come in various forms, whether it be directly to the insurer itself or indirectly through a policyholder or broker. It can be targeted, for example, where an insurer has been specifically identified to be investigated due to a discrepancy on a tax return, or it can be indiscriminate in its […]

Insurance Premium Tax (IPT) in Germany is complex. From IPT rates to law changes, this quick guide will help you navigate the challenges of German IPT. For an overview about IPT in general, read our Insurance Premium Tax guide. What is the filing frequency for IPT declarations in Germany? Based on IPT declarations made for […]

In our recent webinar, Sovos covered the new French e-invoicing and e-reporting mandate, and what this means for businesses and their tax obligations. We are witnessing a global move towards Continuous Transaction Controls (CTCs), where tax authorities are demanding transactional data in real-time or near real-time, affecting e-invoicing and e-reporting obligations. As such, from 2023, […]

In the “Statement on a Two-Pillar Solution to Address the Tax Challenges Arising From the Digitalization of the Economy” issued on 1 July 2021, members of the G20 Inclusive Framework on Base Erosion and Profit Shifting (“BEPS”) have agreed upon a framework to move forward with a global tax reform deal. This will address the […]

For anyone relatively new or unfamiliar with insurance premium tax (IPT), an understanding of each of the core components is key to ensuring compliance. They also sit in a logical sequence of five distinct areas. Location of risk Class of business Applicable taxes and tax rates Declaration and payment Additional reporting 1.Location of risk rules […]

What is Intrastat? Intrastat is a reporting regime relating to the intra-community trade of goods within the EU. Under Regulation (EC) No. 638/2004, VAT taxpayers who are making intra-community sales and purchases of goods are required to complete Intrastat declarations when the reporting threshold is breached. Intrastat declarations must be completed in both the country […]

Progress has been made in the roll-out of the Polish CTC (continuous transaction control) system, Krajowy System of e-Faktur. Earlier this year, the Ministry of Finance published a draft act, which is still awaiting adoption by parliament to become law. Draft e-invoice specifications have been released and there has been a public consultation on the […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes, ensuring you stay compliant. We spoke to Wendy Gilby, […]

Moving goods from one place to another is a quintessential part of business. Manufacturers, wholesalers, transporters, retailers and consumers all need to carefully orchestrate the shipping and handling of raw materials, parts, equipment, finished goods and other products to keep business flowing. This supply chain harmony is what makes production and trade possible in society. […]

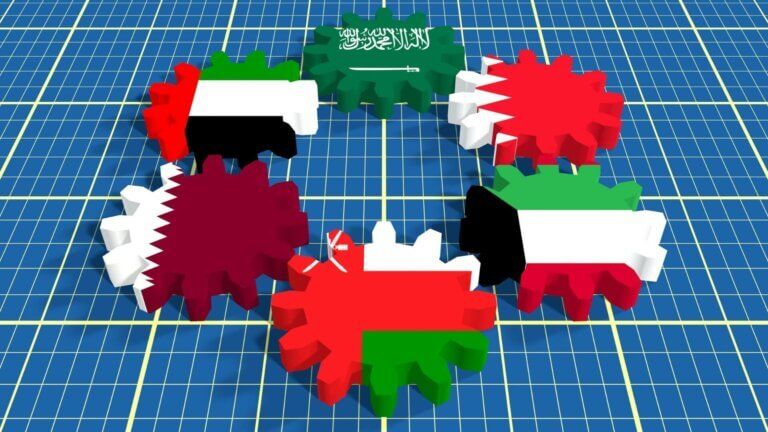

More than 170 countries throughout the world have implemented a VAT system, and some of the most recent adopters are the Gulf countries. In a bid to diversify economic resources, the Gulf countries have spent the past decade investigating other ways to finance its public services. As a result, in 2016 the GCC (Gulf Cooperation […]

A current mega-trend in VAT is continuous transaction controls (CTCs), whereby tax administrations increasingly request business transaction data in real-time, often pre-authorising data before a business can progress to the next step in the sales or purchase workflow. When a tax authority introduces CTCs, companies tend to view this as an additional set of requirements […]