Blog

Technology can help businesses and governments measure and mitigate the impact of Covid-19. With further waves and recessions biting, technology offers an unparalleled opportunity for governments and business alike to gain a clearer picture of the current panorama. Digital tax returns and real-time or near-real time reporting offer up-to-date financial insight and many tax authorities […]

We recently launched the 12th Edition of our Annual Trends Report. We put a spotlight on current and near-term legal requirements across regions and VAT compliance domains. The report, “VAT Trends: Toward Continuous Transaction Controls” is authored by a team of international tax compliance experts and provides a comprehensive look at the regulatory landscape as […]

The European Union’s VAT E-Commerce Package has been delayed until 1 July 2021. Consequently, in the New Year businesses will have to contend with both Brexit related VAT changes and the impact of the One Stop Shop – amounting to two new set of rules for VAT reporting in 2021. Treatment of B2C goods and […]

To help businesses understand the impact of Brexit, we’ve cover the essential considerations for supply chain planning in this blog. Goods and services in 2021 The treatment of goods moving between Great Britain and the EU will change significantly from 1 January 2021. Exports and imports will apply to GB-EU trade, replacing the concept of […]

Recently, we outlined the need for speed in understanding fiscal representation obligations. Post-Brexit, there are many ramifications for businesses operating cross-border. Among them the requirement to appoint a fiscal representative to register for VAT purposes . As outlined in our previous piece, there is a limit on tax authorities’ capacity to authorise new fiscal representation […]

Northern Ireland Protocol: ‘Windsor Framework’ Developments Update: 28 March 2023 by Russell Hughes UK Government reaches agreement with EU on new Brexit Deal The UK government has agreed with the EU on major changes to the Northern Ireland protocol, referred to as the ‘Windsor Framework’. The protocol is the part of the Brexit deal which […]

Find out why it makes sense to invest in tech and automation to streamline tax processes and alleviate the burdens finance teams face. The shift towards digitisation necessitates a radical adaption and shift in existing tech for industries across the board. As this occurs, tensions and anxieties rise around automation and job losses. With Oxford […]

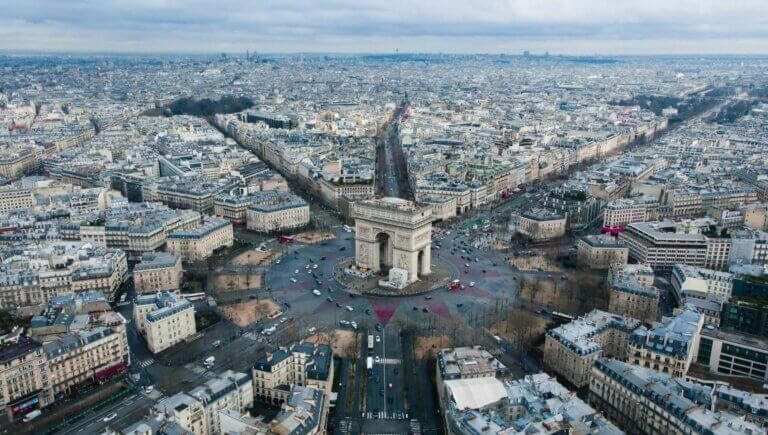

France is introducing continuous transaction controls (CTC). From 2023, France will implement a mandatory B2B e-invoicing clearance and e-reporting obligation. With these comprehensive requirements, alongside the B2G e-invoicing obligation that is already mandatory, the government aims to increase efficiency, cut costs, and fight fraud. Find out more. France shows a solid understanding of this complex […]

Our Brexit and VAT series aims to offer the vital information and planning tips businesses operating cross border need. This week, we’re addressing fiscal representation in the EU. As the UK is now a third country from a VAT perspective, there are various urgent steps businesses must take. Post-Brexit Fiscal Representation in the EU Fiscal […]

As discussed in three key reasons to appoint a VAT managed service provider, the VAT compliance demands from tax authorities around the world continue to increase. They are only going to become more onerous to boost economic efficiency, combat fraud and reduce VAT gaps. The demands for more granular tax reporting are increasing for this […]

Businesses that trade cross border must turn their attention to the treatment of goods post-Brexit. Recently, we discussed postponed import VAT accounting in the UK. This week, we’re turning our attention to postponed import VAT accounting in the EU. Deferred and postponed accounting for VAT post-Brexit In theory, when goods enter the EU, import VAT […]

On 30 September 2020, the European Commission published its “Explanatory Notes on VAT E-Commerce Rules,” to provide practical and informal guidance on the upcoming July 2021 e-commerce regulations. This “EU VAT e-commerce package” was initially adopted (under Directive 2017/2455 and Directive 2019/1995) and set to be implemented on 1 January 2021 but has since been […]

If you listen carefully, you can hear the tick tock of the Brexit clock growing ever louder. As 31 December looms into view, there’s lots to consider from a VAT point of view. One area business must get up to speed with is the movement of goods between the EU and the UK post-Brexit. Whether […]

In our Brexit and VAT series, we delve into some of the most important issues of the day to bring you clarity and advice. Last week we looked at goods, services, and VAT. This week, we address UK border controls post-Brexit and importing goods. Movement of goods post-Brexit Currently, the concept of dispatches and acquisitions […]

The sands of transition period time are draining away. As we edge ever closer to the final Brexit deadline, there are a raft of VAT related considerations for businesses to attend to. Though uncertainty reigns about the shape of the trading relationship, most of the Brexit scenarios up for debate would render the UK a […]

With a VAT gap across EU countries estimated at €140 billion in 2018, tax authorities are continuing to take steps to boost revenues, increase efficiency and reduce fraud. As a result, VAT compliance obligations are becoming more demanding. Failure to comply can not only result in significant fines but also reputational damage. Many multinational companies […]

Since 31 January 2020, the UK is officially no longer part of the EU but is considered a third country to the union although EU legislation will still apply to the country until the end of 2020. Although Northern Ireland is part of the UK, the region will remain under EU VAT legislation when it […]

As anticipated, further information has been published by the Portuguese tax authorities about the regulation of invoices. Last weeks’ news about the postponement of requirements established during the country’s mini e-invoice reform, and the withdrawal of a company’s obligation to communicate a set of information to the tax authority, culminated in the long-waited regulation about […]