Blog

A current mega-trend in VAT is continuous transaction controls (CTCs), whereby tax administrations increasingly request business transaction data in real-time, often pre-authorising data before a business can progress to the next step in the sales or purchase workflow. When a tax authority introduces CTCs, companies tend to view this as an additional set of requirements […]

Turkey’s e-transformation journey, which started in 2010, became more systematic in 2012. This process first launched with the introduction of e-ledgers on 1 Jan 2012 and has since reached a much wider scope for e-documents. The Turkish Revenue Administration (TRA), the leader of the e-transformation process, has played an important role in encouraging companies to […]

Since 1993, supplies performed between Italy and San Marino have been accompanied by a set of customs obligations. These include the submission of paperwork to both countries’ tax authorities. After the introduction of the Italian e-invoicing mandate in 2019, Italy and San Marino started negotiations to expand the use of e-invoices in cross-border transactions between […]

The General Authority of Zakat and Tax’s (GAZT) previously published draft rules on ‘Controls, Requirements, Technical Specifications and Procedural Rules for Implementing the Provisions of the E-Invoicing Regulation’ aimed to define technical and procedural requirements and controls for the upcoming e-invoicing mandate. GAZT recently finalized and published the draft e-invoicing rules in Saudi Arabia. Meanwhile, […]

The Turkish Revenue Administration (TRA) has published updated guidelines on the cancellation and objection of e-fatura and e-arsiv invoice. Two different guidelines are updated: guidelines on the notification of cancellation and objection of e-fatura and guidelines on the notification of cancellation and objection of e-arsiv. The updated guidelines inform taxable persons about the new procedures […]

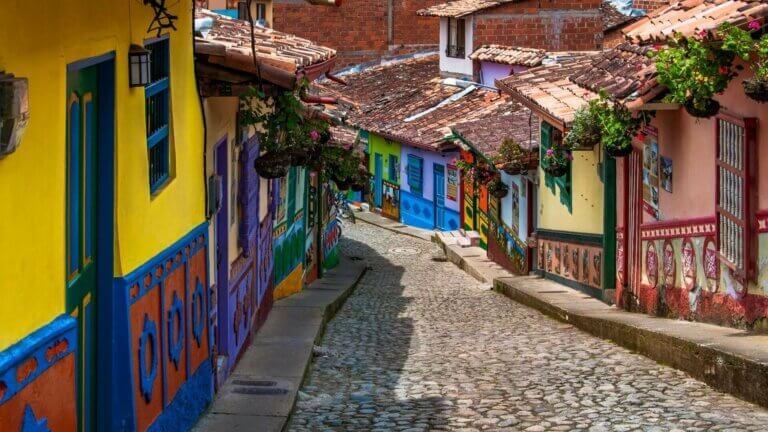

The Colombian electronic invoicing system is reaching maturity level. Since its inception in 2018, Colombia has been steadily consolidating and expanding the mandate to make it more stable, reliable and comprehensive. As a result of the enactment of the recent Resolution 000013/2021, the Colombian tax administration (DIAN), officially expanded the electronic invoicing mandate to also […]

An amendment in the General Communiqué No. 509 has announced healthcare service providers and taxpayers providing medical supplies and medicines or active substances must use the e-invoice application from 1 July 2021. The mandated scope for transition to e-invoice and e-arşiv invoice applications in the healthcare industry Published in the Official Gazette the implementation will […]

Italy postpones e-document legislation until 2022. In September 2020, Italy introduced major changes to the country’s rules on the creation and preservation of electronic documents. These new requirements were expected to be enforced on 7 June 2021 however the Agency for Digital Italy (AGID) has now decided to postpone the introduction of the new rules […]

Russia introduces a new e-invoicing system for traceability of certain goods on 1 July 2021. Federal Law No. 371-FZ will amend the Russian Tax Code to introduce the new procedure for the traceability system, which will bring the introduction of mandatory e-invoicing for taxpayers dealing with traceable goods. Since its introduction, B2B e-invoicing in Russia […]

It’s good to see light at the end of the tunnel. Nonetheless, it’s too little, too late for many smaller – but also plenty of larger – companies. Thousands couldn’t weather the storm because they were particularly dependent on human contact. Others were affected disproportionally simply because COVID-19 hit them just as they traversed a […]

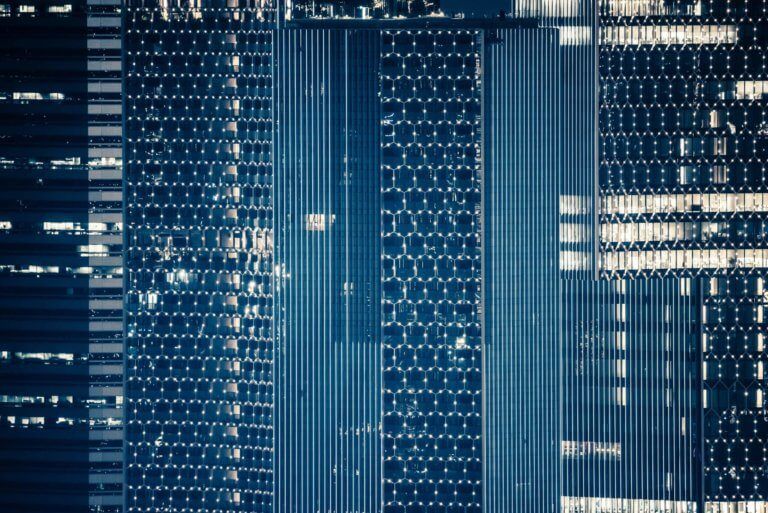

Find out why it makes sense to invest in tech and automation to streamline tax processes and alleviate the burdens finance teams face. The shift towards digitisation necessitates a radical adaption and shift in existing tech for industries across the board. As this occurs, tensions and anxieties rise around automation and job losses. With Oxford […]

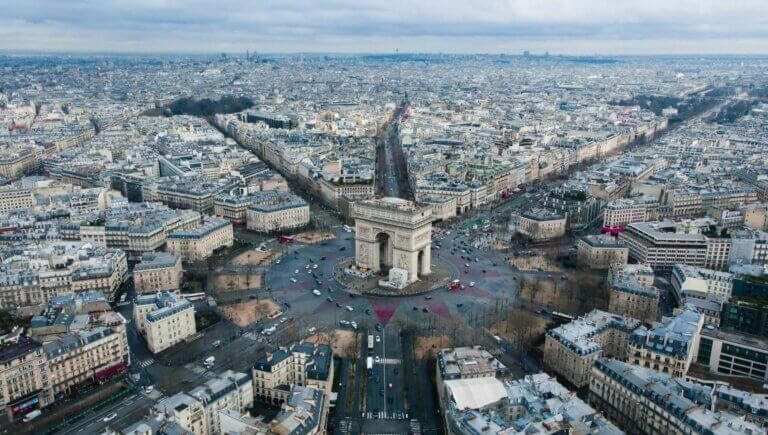

France is introducing continuous transaction controls (CTC). From 2023, France will implement a mandatory B2B e-invoicing clearance and e-reporting obligation. With these comprehensive requirements, alongside the B2G e-invoicing obligation that is already mandatory, the government aims to increase efficiency, cut costs, and fight fraud. Find out more. France shows a solid understanding of this complex […]

As anticipated, further information has been published by the Portuguese tax authorities about the regulation of invoices. Last weeks’ news about the postponement of requirements established during the country’s mini e-invoice reform, and the withdrawal of a company’s obligation to communicate a set of information to the tax authority, culminated in the long-waited regulation about […]

myDATA updates On 22 June, the joint Ministerial Decision that sets forth the myDATA framework was published. The decision specifies, among other things, the scope of application and applicable exemptions, the data to be transmitted, transmission methods and procedures, applicable deadlines and how transactions should be characterized. Starting from January 2021, the required data must […]

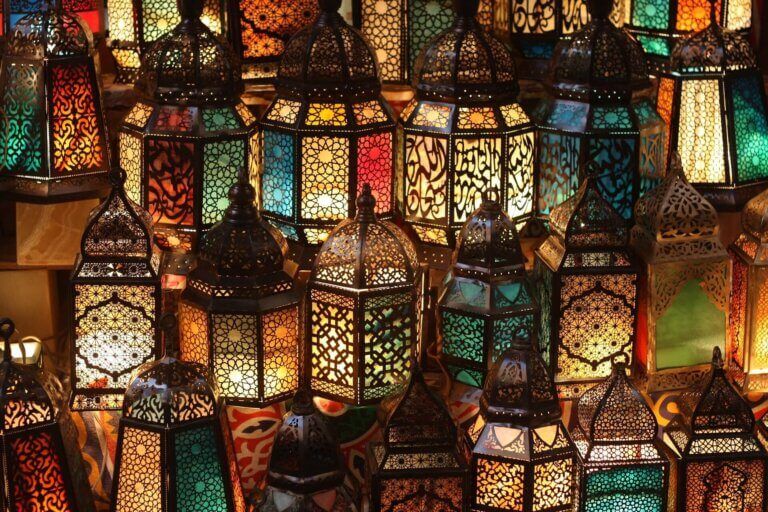

Update: 20 November 2023 by Dilara İnal E-invoicing systems in the Middle East and North Africa are undergoing significant transformations, aiming to modernise the financial landscape and improve fiscal transparency. Recent updates have seen numerous countries implementing electronic invoicing solutions designed to streamline tax collection and reduce VAT fraud. E-invoicing Trends in the Middle East […]

For companies operating in Turkey, 2019 was an eventful year for tax regulatory change and in particular, e-invoicing reform. Since it was first introduced in 2012, the e-invoicing mandate has grown, and companies are having to adapt in order to comply with requirements in 2020 and beyond. Turkey’s digital transformation and e-invoicing landscape continues to […]

With two weeks to go until the first mandatory phase of the Indian e-invoicing reform go live, the GST Council slammed the breaks. Or at least, bring it to a significant temporary standstill of 6 months. As a result, the India e-invoicing reform is now postponed until 1 October 2020 Following a long list of […]

Anyone predicting Italy’s clearance model e-invoicing system, FatturaPA, would undergo further reform would be right. Agenzia delle Entrate – AdE, the Italian tax authority, has issued new technical specifications and schemas for Italian B2B and B2G e-invoices. But – what do these changes really mean? And what impact do they have on business processes? Technical […]