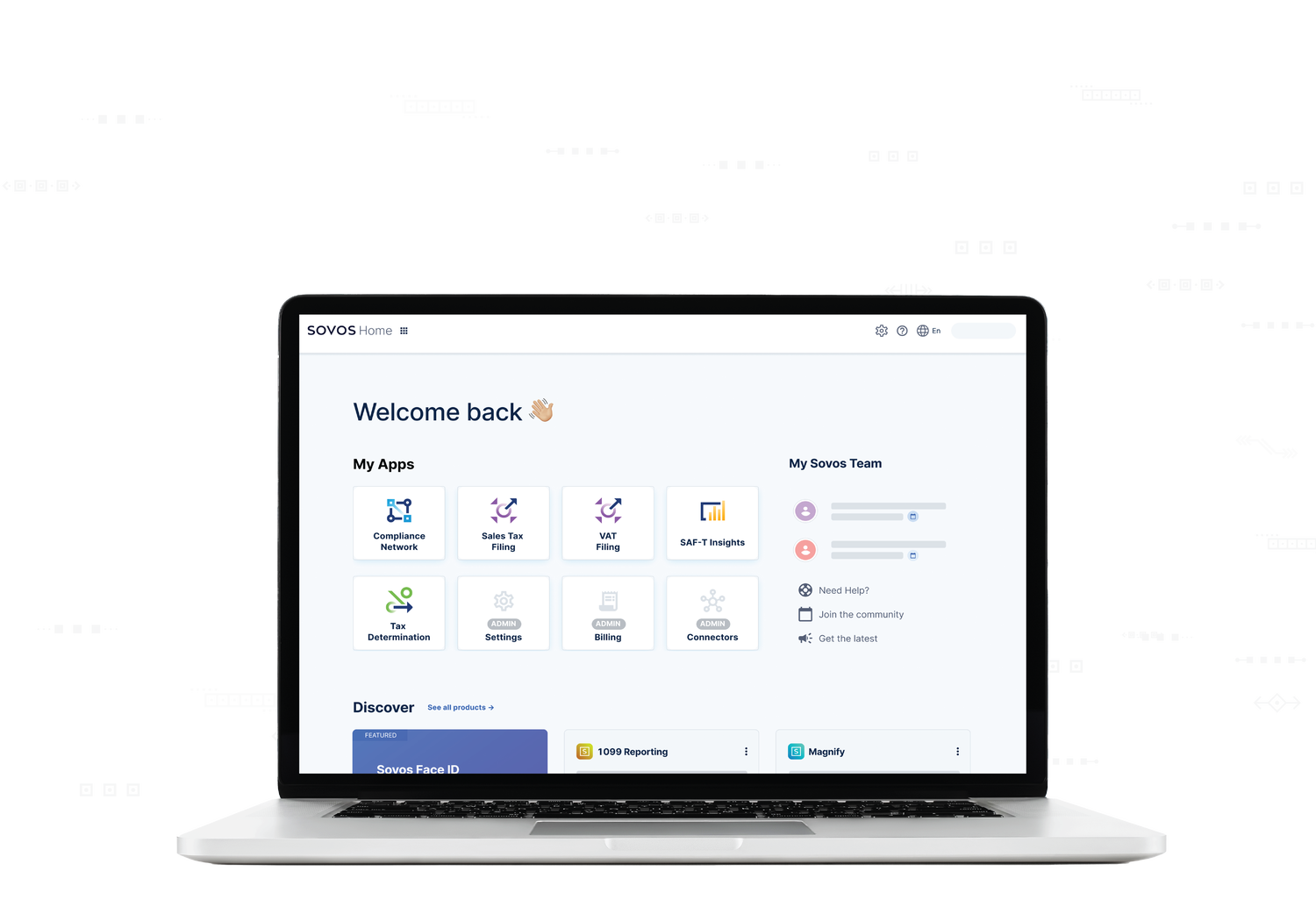

Sovos Compliance Cloud

The industry’s first and only complete platform for tax compliance and regulatory reporting

Trusted by the World’s Best Companies Including Half the Fortune 500

The industry’s first and only complete platform for tax compliance and regulatory reporting

Disparate point solutions silo your data, business processes and teams. The Sovos Compliance Cloud provides one place for your finance and IT teams to identify, determine, and report on all of your tax obligations globally.

Built to scale for global businesses

Support business growth globally by ensuring the correct indirect taxes, VAT and Sales and Use Tax (SUT), are being applied or paid.

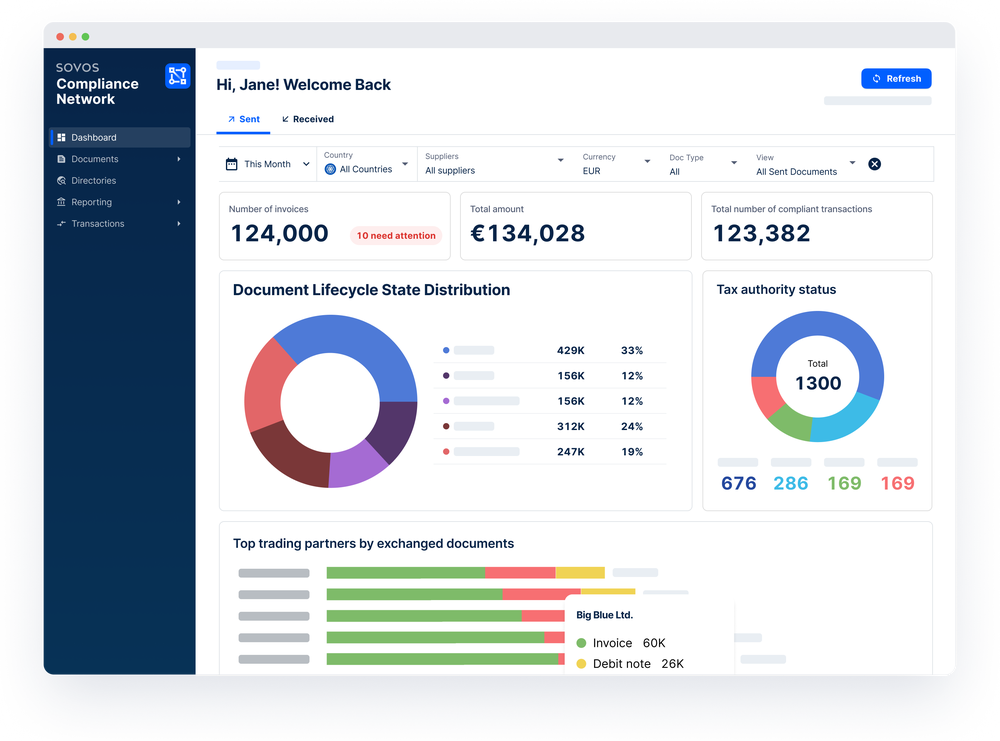

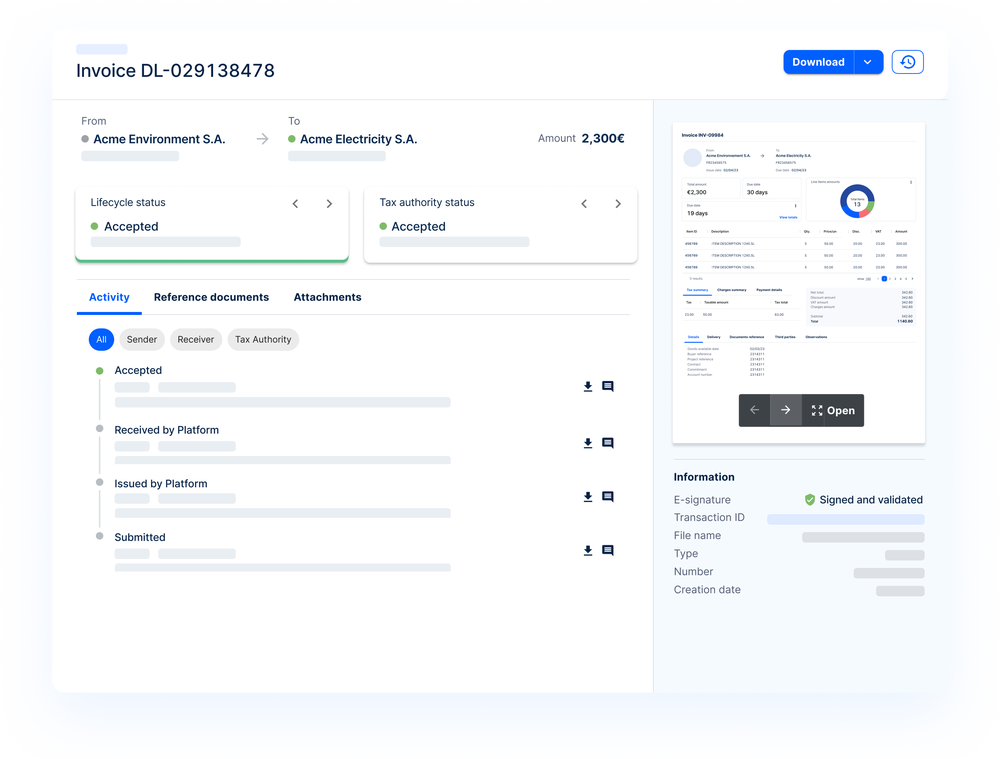

Get complete transaction lifecycle visibility on purchases or sales through a smart orchestration layer that follows business and local regulatory requirements.

Keep pace with a diverse range of reporting requirements – Sales and Use Tax (SUT), VAT, Intrastat, European Community (EC) Lists, SAF-T/ eAccounting and more.

Centralize tax information reporting (1095s, 1099s, 1042-S, and W-2s) and withholding into a single solution. Give your team a holistic view of customer and vendor information, while ensuring accurate reporting and tax compliance.

Stay ahead of state-level unclaimed property compliance obligations. Prevent costly state audits with unclaimed property reporting and escheatment solutions, services, and consulting.

Streamline and automate the preparation and submission of annual and quarterly statements to the National Association of Insurance Commissioners (NAIC) and states.

Move to a unified compliance platform.

Automatically connect to governments CTCs and understand your obligation immediately.

Create fidelity between government data and your AP, AR, ERP and other financial systems

As you unify direct tax, indirect tax, and enterprise financial data under one umbrella for analysis, anticipate change before it happens.

Keep up with regulatory changes by eliminating processes that are prone to errors and prompt audits and penalties.

to a rich ecosystem of partners, financial technologies, and government agencies.

each party in the transaction or obligation.

every transaction accurately, and in the moment.

File every obligation accurately.

Get ahead of future changes.

Save $1M or more moving from point to platform.

Avoid multi-million penalties from missing changes to tax compliance regulations.

By proactively communicating business risk and new opportunities.

“Compliance is now inside the transaction, elevating its importance and driving businesses to look beyond just meeting a minimum threshold. Now, the goal is a global view of compliance with a single source of data that allows them to generate actionable business intelligence”Kevin Permenter, Research Director

Get decades of experience from experts who implemented tax and compliance programs for your specific vertical.

With new techniques, best practices, and integration strategies, your compliance program stays ahead of market changes.

Utilize a combination of human and AI-driven analysis to find new opportunities for your compliance strategy.

To learn more about the Sovos Compliance Cloud and why a platform approach to compliance is so important, please view this additional content.