MAKING TAX DIGITAL

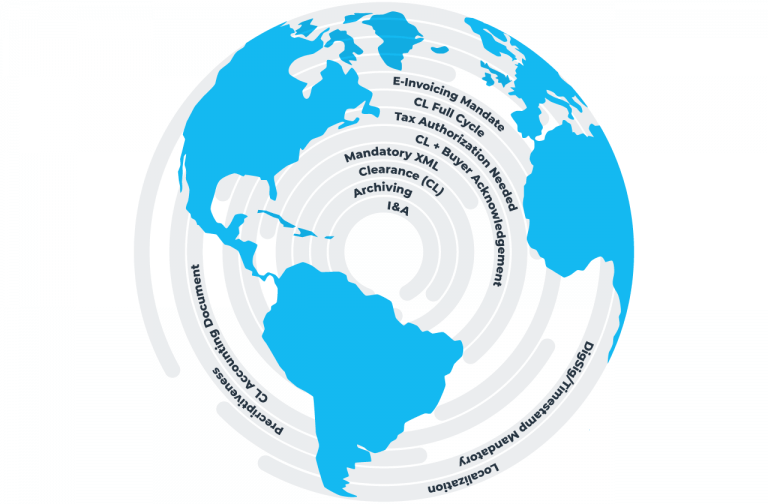

Tax authorities are going digital

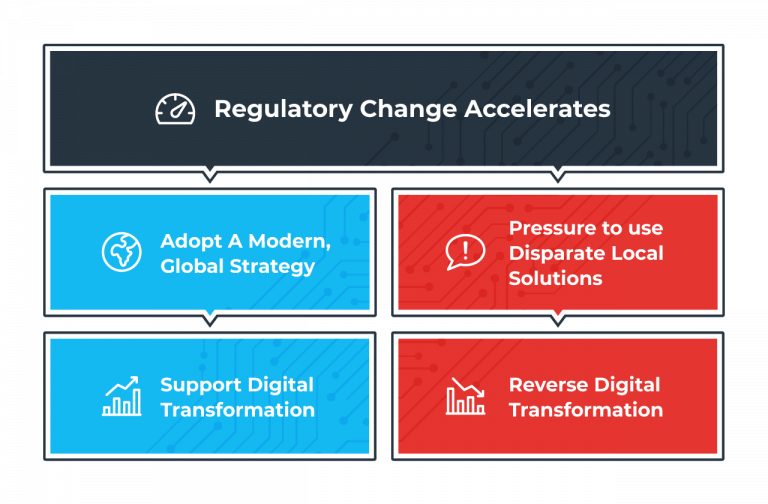

The wave of governments making tax digital is gaining momentum and shows little sign of slowing. Authorities globally continue to look for ways to tighten loopholes, reduce tax gaps and gain greater visibility into insurers’ tax liabilities.

Taxes on insurance are fragmented. And achieving compliance can be a headache requiring specialist knowledge especially as no two jurisdictions are the same and currencies, rates, deadlines and location of risk rules may vary by country.