Blog

In a blog post earlier this year, we wrote about how several Eastern European countries have started implementing continuous transaction controls (CTC) to combat tax fraud and reduce the VAT gap. However, it’s been an eventful year with many new developments in the region, so let’s take a closer look at some of the changes on the […]

The EU e-commerce VAT package was introduced in July 2021. The new schemes, One Stop Shop (OSS) and Import One Stop Shop (IOSS) bring significant changes to VAT treatment and reporting mechanisms for sales to private individuals in the EU. In the last of our series of FAQ blogs, we answer some of the more […]

In our previous blog, we completed the compliance cycle with tax authority audits. However, that’s not the end of the challenges businesses face in remaining compliant in the countries where they have VAT obligations. VAT rules and regulations change as do a business’s supply chains – these need to be carefully reviewed and appropriate action […]

The EU e-Commerce VAT Package is nearly six months old and businesses should have submitted their first Union One Stop Shop (OSS) return by the end of October 2021. Union OSS provides a welcome simplification to the requirement to be registered for VAT in multiple Member States when making intra-EU B2C supplies of goods and […]

In our previous blog, we looked at the challenges that businesses face in submitting VAT and other declarations on an ongoing basis. However, the compliance cycle doesn’t end there as tax authorities will carry out audits for a variety of reasons to validate declarations. Why do tax authorities carry out audits? When VAT returns consisted […]

As we inch closer to the implementation date of 1 January 2022 for Norway’s new digitized VAT return, let’s take a second look at the details. Norway announced its intentions to introduce a new digital VAT return in late 2020, with an intended launch date of 1 January 2022. With this update comes the removal […]

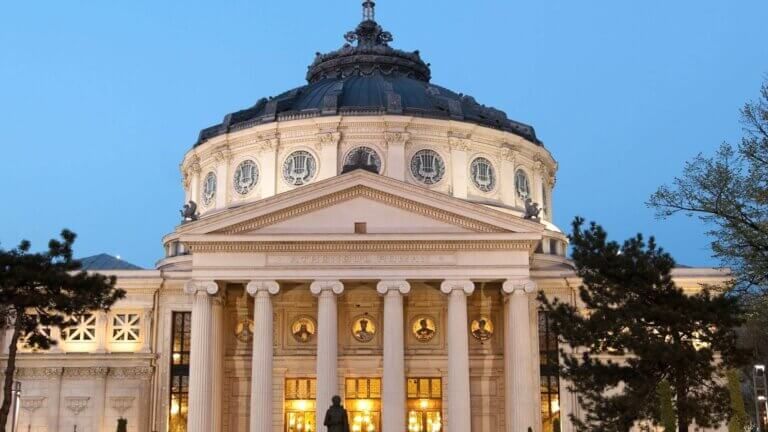

Update: 3 January 2024 by Inês Carvalho Romania Issues Last-Minute Amendments to B2B E-invoicing Regulations After the implementation of Romania’s new B2B e-invoicing regulations, effective January 2024, the country introduced Government Emergency Order No. 115/2023 with last-minute amendments. We can summarise the key amendments from the new legislation in three categories: 1. Exemptions from the […]

Electronic invoicing is rapidly becoming a standard business process. Governments are pushing for the adoption of B2G invoicing to optimize the public procurement process and also to provide a boost to the adoption of e-invoicing between businesses. Apart from countries that have introduced general e-invoicing mandates to improve fiscal controls – most of which have […]

Update: 25 June 2024 by Dilara İnal Ministry Publishes Draft Guideline on B2B E-Invoicing The German Ministry of Finance (MoF) released a draft guideline on 13 June 2024, detailing the upcoming B2B e-invoicing mandate which will roll out on 1 January 2025. Although the current law only obliges taxpayers to issue and receive e-invoices for […]

The Zakat, Tax and Customs Authority (ZATCA) announced the finalised rules for the Saudi Arabia e-invoicing system earlier this year, announcing plans for two main phases for the new e-invoicing system. The first phase of the Saudi Arabia e-invoicing system is set to go live from 4 December 2021. With the mandate just around the […]

On 1 July 2021 the EU E-Commerce VAT Package was introduced. The package replaced existing distance-selling rules and extended the Mini One Stop Shop (MOSS) into a wider-ranging One Stop Shop (OSS). The implementation of the EU E-Commerce VAT Package was designed to simplify the VAT reporting requirements for sellers and improve the tax take […]

Back in 2019, Portugal passed a mini e-invoicing reform consolidating the country’s framework around SAF-T reporting and certified billing software. Since then, a lot has happened: non-resident companies were brought into the scope of e-invoicing requirements, deadlines have been postponed due to Covid, and new regulations were published. This blog summarises the latest and upcoming […]

In our last look at Romania SAF-T, we detailed the technical specifications released from Romania’s tax authority. Since then, additional guidance has been released including an official name for the SAF-T submission: D406. Implementation timeline for mandatory submission of Romania SAF-T Large taxpayers (as designated by the Romanian tax authorities) – 1 January 2022 Medium […]

Welcome to our Q&A two-part blog series on the French e-invoicing and e-reporting mandate, which comes into effect 2023-2025. That sounds far away but businesses must start preparing now if they are to comply. The Sovos compliance team has returned to answer some of your most pressing questions asked during our webinar. We have outlined […]

In our recent webinar, Sovos covered the new French e-invoicing and e-reporting mandate, and what this means for businesses and their tax obligations. We are witnessing a global move towards Continuous Transaction Controls (CTCs), where tax authorities are demanding transactional data in real-time or near real-time, affecting e-invoicing and e-reporting obligations. As such, from 2023, […]

What is Intrastat? Intrastat is a reporting regime relating to the intra-community trade of goods within the EU. Under Regulation (EC) No. 638/2004, VAT taxpayers who are making intra-community sales and purchases of goods are required to complete Intrastat declarations when the reporting threshold is breached. Intrastat declarations must be completed in both the country […]

Progress has been made in the roll-out of the Polish CTC (continuous transaction control) system, Krajowy System of e-Faktur. Earlier this year, the Ministry of Finance published a draft act, which is still awaiting adoption by parliament to become law. Draft e-invoice specifications have been released and there has been a public consultation on the […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team are often the first to know about new regulatory changes, ensuring you stay compliant. We spoke to Wendy Gilby, […]