Craft beer drinkers want more choices. Brewers want more opportunities. And yet, legal barriers still stand in the way of direct-to-consumer (DtC) beer shipping. The 2025 Direct-to-Consumer Beer Shipping Report, produced by Sovos ShipCompliant in partnership with the Brewers Association, reveals how consumer demand, regulatory restrictions and potential revenue opportunities continue to shape the DtC beer shipping market.

Key takeaways from the 2025 Direct-to-Consumer Beer Shipping Report

Consumer interest in DtC beer shipping is not a passing trend, it’s a long-term demand that remains steady year over year. According to the report, 83% of regular craft beer drinkers and 64% of Americans 21+ believe current beer shipping laws should be expanded. When looking at what products consumers want to order online and have shipped directly to their door, beer ranks on par with other essentials in terms of popularity (60%; ranked fourth among other DtC products):

- Clothing (68%)

- Self-care products (63%)

- Food (62%)

- Beer (60%)

- Cleaning products (60%)

Clearly, craft beer drinkers expect beer shipping to be available like any other consumer good. With preferences remaining steady from 2023 (61%) and 2024 (61%), it’s evident that demand for legal DtC beer shipping isn’t going anywhere.

The economic potential of DtC beer shipping

The report confirms that DtC beer shipping is just as much about industry revenue as it is consumer convenience, as 76% of regular craft beer drinkers would buy more if it were legally available in their state. Among those that want beer shipped directly, 69% would spend $50+ per month and 44% would spend $100+ per month on DtC purchases. On average, beer buyers would spend $106 more each month—boosting potential annual sales by $1,268 per customer.

The success of wine clubs has also demonstrated the power of subscription-based DtC model—and beer consumers are ready for the same opportunities. In fact, 69% of regular craft beer drinkers who want DtC beer shipping say they would subscribe to a brewery’s beer club. For breweries, this represents an opportunity for recurring revenue, stronger customer retention and a direct way to introduce seasonal and limited-run products to a loyal audience.

What’s holding DtC beer shipping back?

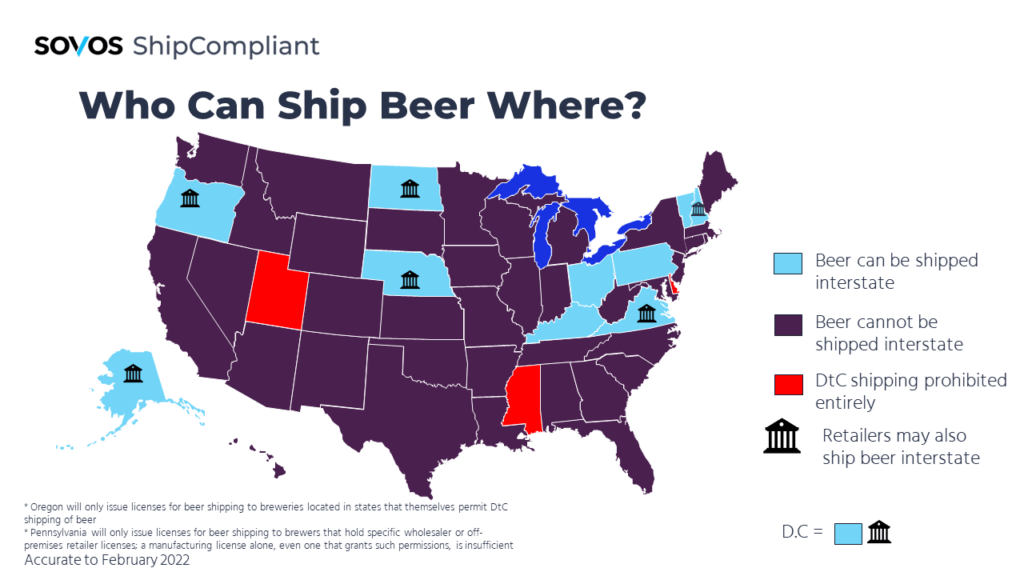

Despite this overwhelming demand, legal barriers remain the primary obstacle. Unlike wine, which can legally be shipped directly to consumers in 47 states + D.C., beer shipments are only legal in 11 states + D.C. This stark contrast highlights the need for legislative reform to align beer shipping laws with consumer demand. While several states introduced bills that would have expanded access in 2024, none were ultimately passed.

A common misconception is that DtC beer sales could negatively impact traditional retail and bar sales. However, this year’s data suggests the opposite. Nearly all (95%) craft beer drinkers would actively seek out brands shipped direct when shopping on-premises. Over half (53%) would be very likely to do so, ultimately reinforcing that DtC complements rather than replaces in-person beer sales.

As the 2025 Direct-to-Consumer Beer Shipping Report makes clear, the opportunity is there. Without legislative reform, the industry will continue to leave millions in potential sales untapped. Although regulatory change is possible, breweries and beer enthusiasts must actively work to make it happen.

How can breweries help push for DtC expansion?

- Partner with state guilds and/or political action committees to support legislative efforts.

- Encourage consumers to advocate for DtC shipping in their home states.

- Educate lawmakers on the benefits of DtC beer shipping, including its positive impact on brewery revenue and retail sales.

Want the full picture? Download the full 2025 Direct-to-Consumer Beer Shipping Report to explore the trends, insights and policy updates shaping the future of craft beer.