The direct-to-consumer (DtC) wine shipping channel has seen a continuation of movement tracked in the January release of the Sovos ShipCompliant/Wine Business Analytics Direct-to-Consumer Wine Shipping Report, with the top destination states experiencing a dip in volume and value.

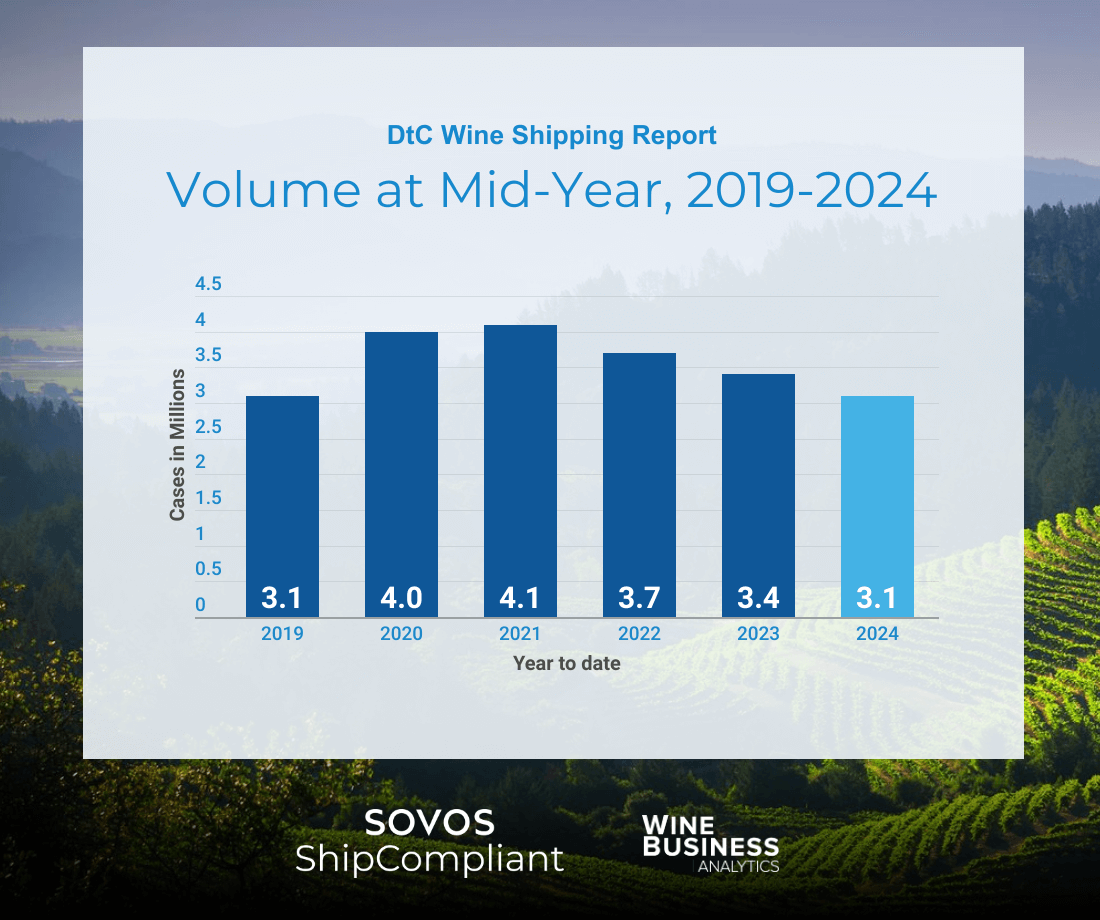

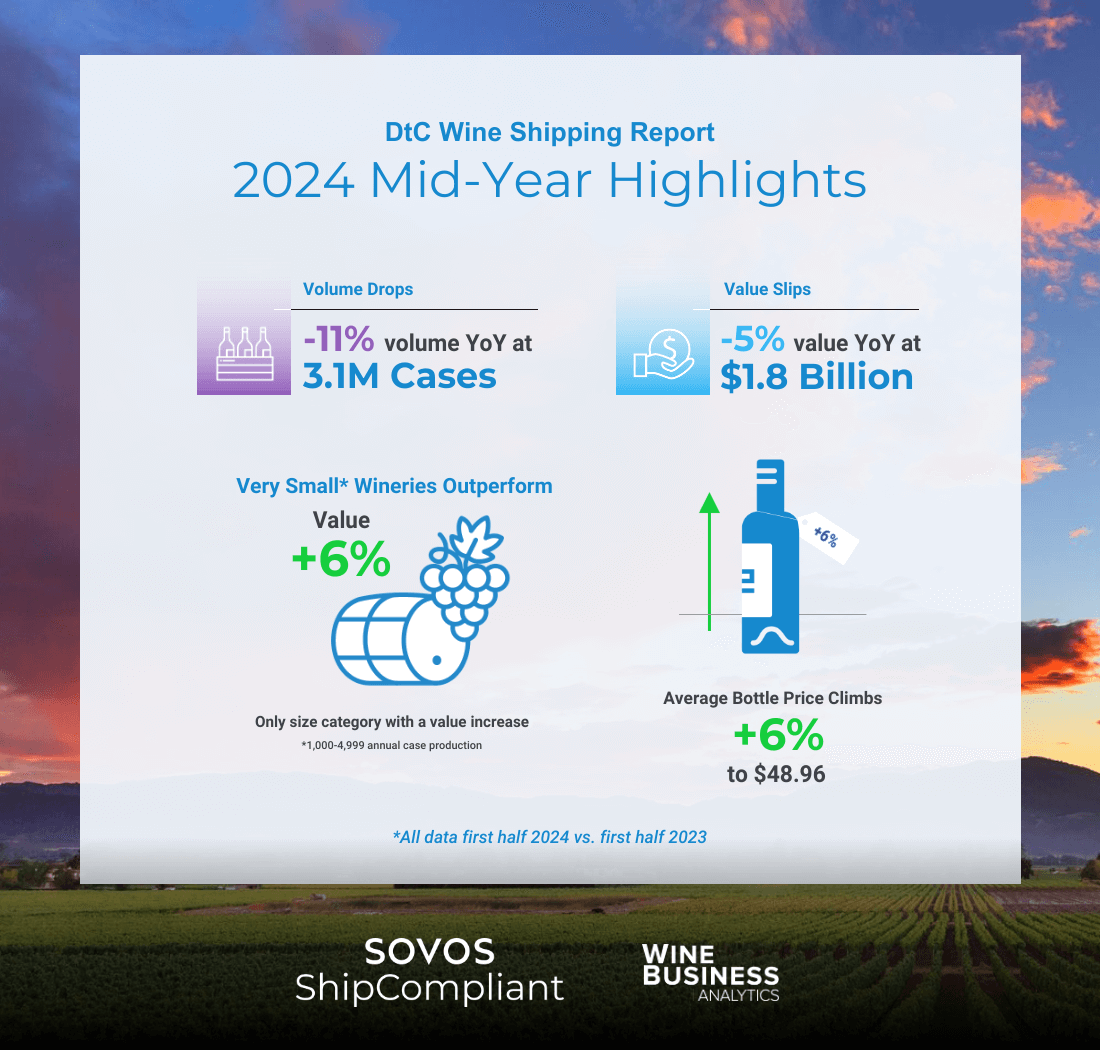

The latest data for the U.S. wine DtC shipping market reveals shipment data trending downward. Nationwide, shipment volume has declined by 11% for the January-June 2024 period, amounting to 3.1 million in cases sold, while the overall value of these shipments has decreased by 5%, totaling $1.8 billion. Amidst these declines, the average bottle price has increased by 6%, reaching $48.96. All regions across the country experienced losses in both shipment volume and value, reflecting the broader challenges faced by the industry.

Note: The proprietary data featured in this mid-year report is compiled from an algorithm measuring total DtC shipments based on millions of anonymized direct shipping transactions filtered through the ShipCompliant system and paired with WineBusiness Analytics’ comprehensive data on U.S. wineries, resulting in the most accurate depiction of the DtC wine shipping channel.

Here is a deeper look at the changes in the DtC shipping channel from January through June of this year.

Average bottle price

Overall, the average price of a bottle shipped DtC now stands at $48.96, a solid 6% increase. The area grouped as Rest of California* saw a 10% rise in average bottle price, the highest percentage increase in the country, followed by a tie of an 8% increase seen by both Oregon and Sonoma.

* Rest of CA = Wineries in Mendocino, Lake, Livermore and Temecula counties and the Sierra Nevada region, plus all other areas outside the Central Coast, Napa County and Sonoma County

Destination state

It comes as no surprise that once again, as has been the case since the inception of our Direct-to-Consumer Wine Shipping Mid-Year Report, California is the top destination state, maintaining its 29% share from last year.

In terms of volume, there were no positive volume growths among the top 10 destination states. However, small-volume states Alabama (20%) and Arkansas (1%) saw an increase in volume through the mid-year. Similarly, there were no top 10 ship-to states that recorded a positive value increase, but Alabama (17%) Arkansas (4%), Hawaii (5%), North Dakota (10%), New Mexico (5%), Kentucky (2%) and Tennessee (1%) all achieved an increase in value.

Winery location

Wineries in all regions noted a decline in both volume and value, with Central Coast experiencing the most drastic changes in volume (-14%) and value (-9%). The Rest of the US* had the smallest decline in volume (-5%), while the Rest of California had the smallest decline in value at –1%.

*Wineries in every other state aside from California, Washington and Oregon.

Winery size

The largest wineries — those who produce 500,000+ cases per year — saw a 14% increase in average bottle price, climbing to $22.12. This marks the highest bottle price growth in the channel, though the largest wineries also experienced a 16% drop in volume growth. The second best-performing segment in average bottle price was small wineries who produce less than 1,000 cases. Their average bottle price is now $68.69, a 13% jump from January. We reported similar results for these two segments in the 2023 Direct-to-Consumer Wine Shipping Mid-Year Report.

Only very small wineries (with production of 1,000-4,999 cases per year) demonstrated an increase in value, with a 6% rise. On the other hand, medium-sized wineries (50,000-499,000 cases) faced the steepest declines, with a -17% drop in shipments and a -15% decrease in value.

Varietal

Of the top four wine types (Cabernet Sauvignon, Pinot Noir, Chardonnay, Red Blend) that account for 54% of the total share of the volume of wine shipped DtC, each saw negative value growth (-3% to -6%), and all but Red Blend had an increase in average bottle price.

In terms of volume growth, White Blend (3%), Cabernet Franc (13%), Fume/Sauvignon Blanc (2%) and Sangiovese (11%) saw increases. Pinot Grigio had the largest volume decline at –24%.

Cabernet Franc led with a 26% increase in value. Other varietals that saw value increases include White Blend (11%), Fume/Sauvignon Blanc (5%), Other Red (3%) and Sangiovese (13%), with Merlot experiencing the largest decline in value at –15%.

What’s next for DtC wine shipping?

“What we’ve seen in the winery DtC shipments market this year is similar to the wider U.S. wine market. While this recent trend is new for the DtC sector, which has traditionally outperformed the total market, it is indicative of a mature and integrated DtC sector rather than challenges unique to the business of DtC shipments or a widespread change in consumer sentiment regarding direct shipments,” observed Andrew Adams, an editor with WineBusines Analytics. “It’s also encouraging to see an increase in shipments to states such as Alabama and Kentucky as that growth is a reminder that the U.S. wine business is truly a national one that continues to offer opportunities for proactive wineries.”

With an unpredictable economy, a turbulent U.S. political landscape and shifting consumer preferences in beverage alcohol, predicting the future of the DtC wine shipping channel is challenging. No matter how the market evolves, we will continue to offer our observations and insights. Our comprehensive 2025 report will be released next January. In the meantime, you can explore detailed 2024 findings by downloading your free copy of the 2024 Direct-to-Consumer Wine Shipping Report.

This data was compiled in partnership with WineBusiness Analytics, a leading source for wine industry data.

Take Action

Find the most comprehensive look at the DtC wine shipping channel in the 2024 Direct-to-Consumer Wine Shipping Report.