A VAT and SAF-T solution for compliance peace of mind

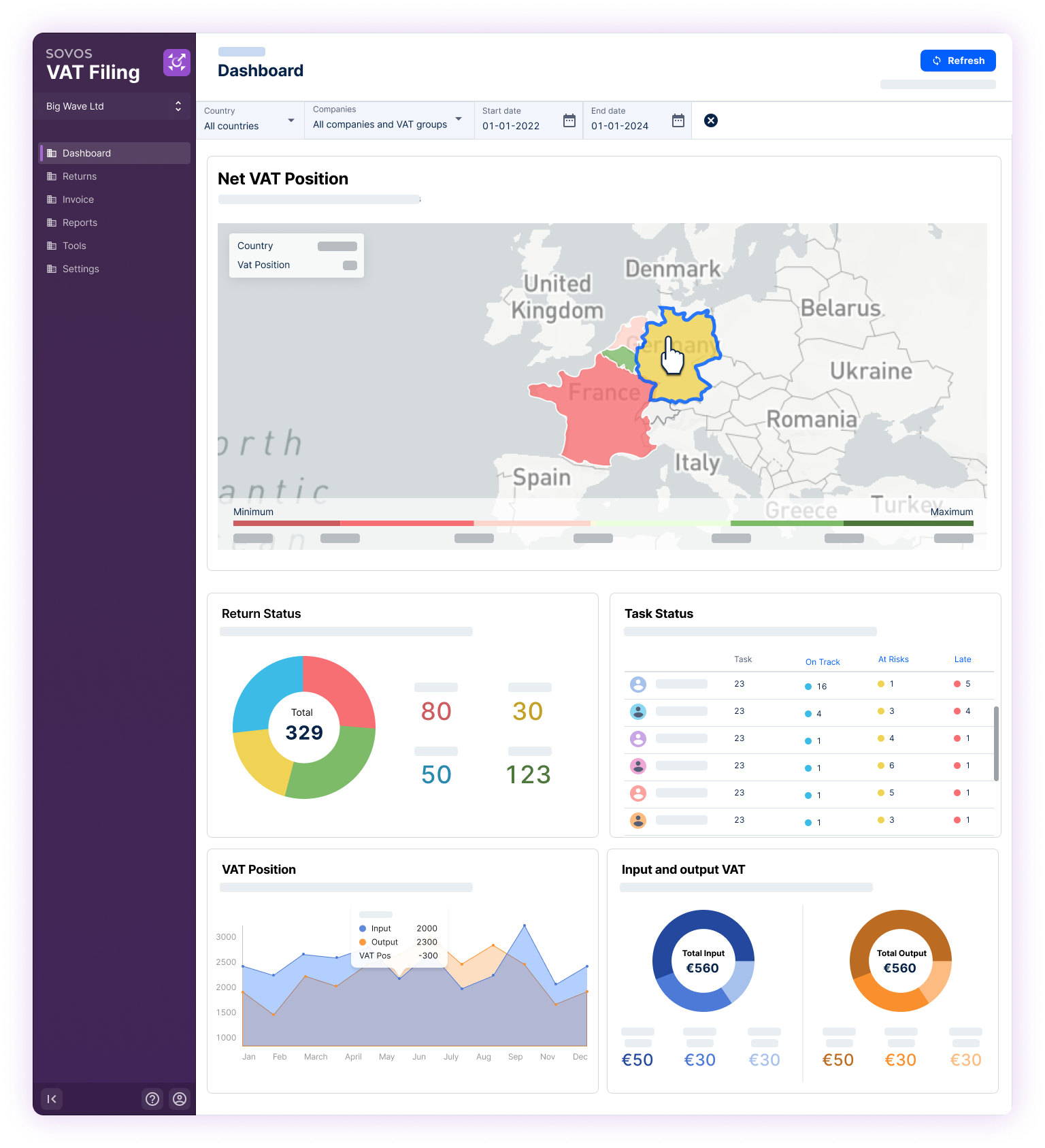

Sovos’ Advanced Periodic Reporting (APR) is a cloud solution that mitigates the risks and costs of compliance, future-proofing and streamlining the handling of customers’ periodic reporting obligations using data to deliver insights that power performance enhancement. The solution automates, centralises and standardises the preparation, reconciliation, amendment and validation of summary reports for tax authorities across VAT jurisdictions around the world.