Indirect Tax Software Solution

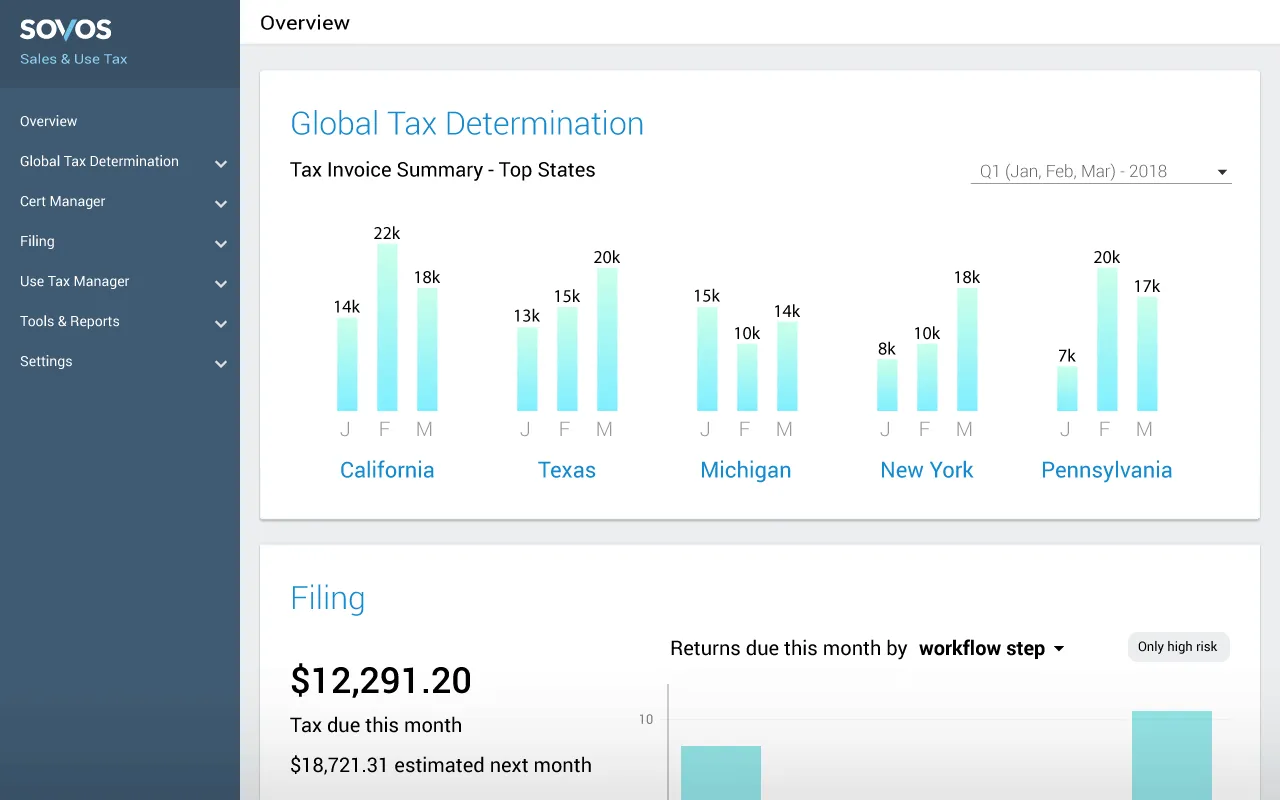

Global Tax Determination

You need accurate rates for value-added tax (VAT), goods and services tax (GST), and sales and use tax. You need to be right every time — in real time — no matter how often rates change or how many product and jurisdictional combinations you’re managing.

By combining VAT, GST, excise, and sales and use tax determination support in a single solution, Sovos safeguards businesses from error-triggered audits, while keeping your systems up to speed with constantly changing determination rules.