New rules - better approach

Stay on top of regulatory changes as they happen

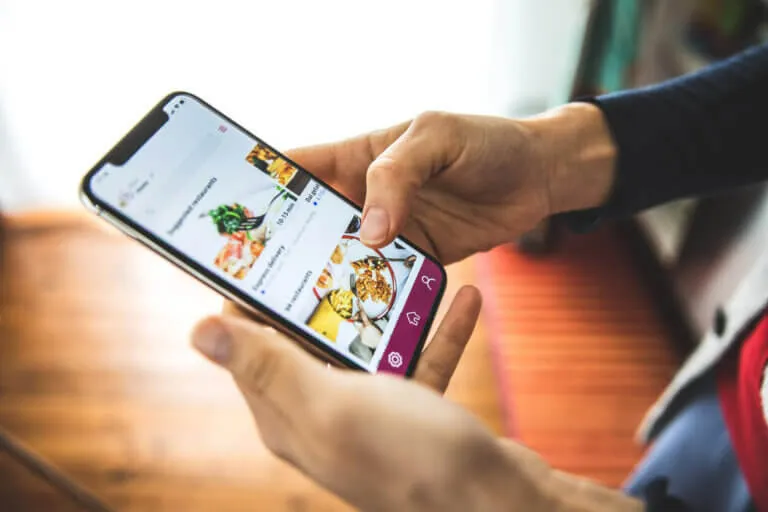

Rideshares, delivery services and even ethical hacking are all examples of emerging job sectors under the new economy and all of them have tax implications. This has caused governments to implement new tax regulations to account for them. The result is constant change as regulatory authorities work to refine and tune processes and obligations to ensure accurate reporting to maximize revenue and eliminate fraud. It is not unusual for reporting forms to change multiple times within a given year and for income thresholds to be adjusted without notice. Conditions are changing quickly as governments embrace digitization to stay a step ahead.