Welcome to our Q&A two-part blog series on the French e-invoicing and e-reporting mandate, which comes into effect 2023-2025. That sounds far away but businesses must start preparing now if they are to comply.

The Sovos compliance team has returned to answer some of your most pressing questions asked during our webinar.

We have outlined the new mandate, e-invoicing specifically, and questions around this topic in our first blog post.

This blog will look at the other side of the mandate – e-reporting obligations. These will apply to B2C and cross-border B2B transactions in France, which must be periodically reported.

Payments E-reporting

First let’s look at common questions around payments e-reporting.

What are the invoice and payment statuses to be reported?

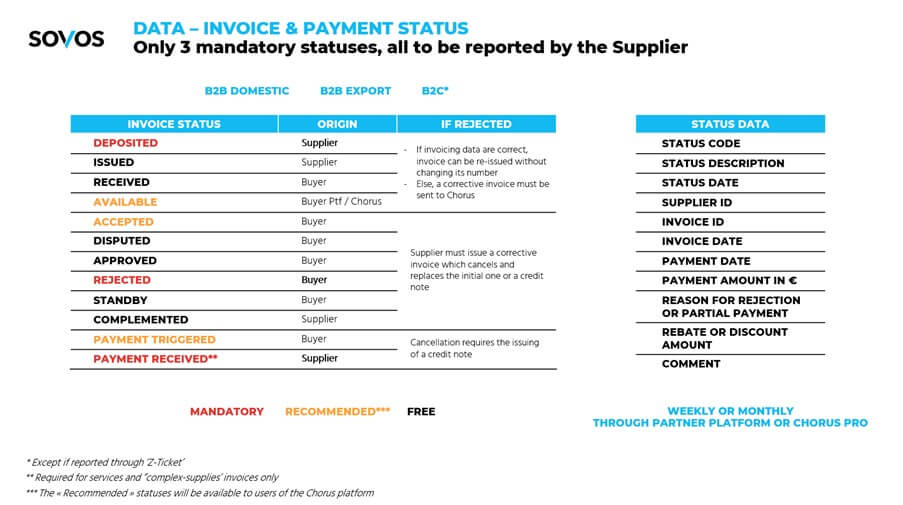

Here is a slide from our webinar showing invoice statuses, whether these are mandatory, recommended, or free, origins, action to take if rejected, status data, and when it needs to be reported:

Who is responsible for payment e-reporting? The buyer, the seller, or both?

It was initially rumoured to be both on the buyer and the seller side, but the latest information from DGFIP clearly states that it will be the responsibility of the seller to report the invoice status, and, if applicable, its payment status.

Some further clarification is needed though since the seller is dependent on the buyer’s response on some status (e.g. ‘invoice rejected’).

‘Partner’ platform certification requirements

Your e-invoicing and e-reporting project cannot be done in isolation. This is a significant project with many dependencies that involve external third parties.

There will be one or, in most likelihood, several third parties in the middle of the transaction chain. This will include Chorus Pro, chosen by the French government as the official and obligatory platform for businesses to issue e-invoices to public administrations.

This section covers common questions on partner platform certification requirements.

Is there a list of official validated partner platforms?

The 13 July 2021 DGFIP workshop dedicated to this matter highlighted that there would be a registration process for third-party platforms, as well as taxpayers who would want to run their own platform.

The registration process will consist of two phases:

Phase 1. A prior selection by the tax authorities based on the general profile of the candidate (e.g. are they up to date in their own tax payment duties?) and the services they propose;

Phase 2. Within 12 months after registration, an independent audit would have to performed that demonstrates that the platform meets the DGFIP requirements, such as:

-

- Updating of the e-invoicing central directory

- Issuing, transmitting / receiving e-invoices (including guaranteeing integrity and authenticity, as well as an advanced authentication process)

- Processing and transmitting to Chorus Pro e-invoicing, e-reporting and payment status data

<liPerforming the control and mapping activities (extraction of invoicing data for both e-invoicing and e-reporting, certain invoice validation checks – mandatory fields, check sums, Customer ID verification – mapping to and from a minimum set of mandatory formats, compliance with GDPR, etc)

A few other key points to note are:

- The registration and audit would need to be periodically renewed.

- The consequences for non-compliant platform are not defined, an escalation process leading to the withdrawal of the registration would apply.

- The platform operator might be French or foreign (although there is still a question mark as to whether non-EU operators will be permitted).

Implementation timeline

What is the current expectation on when exact required fields with be supplied by the government (invoice specs with all required fields and values)?

Excel files are available as a draft document at a very detailed level which Sovos can provide on request. The final specs should be known by the end of September 2021.

Take Action

Still have questions about e-reporting? Access our webinar on-demand for more information and advice on how to comply.