The Case for Spirits Direct-to-Consumer (DtC) Shipping

The wine industry has been shipping direct-to-consumer (DtC) for more than 15 years, and this once-novel market expansion has proven win-win-win for producers (business growth), states (increased tax revenue) and consumers (increased choice) alike. And yet, spirits DtC remains a much narrower market. Why?

Spirits producers aren’t the only ones asking that question. A Distilled Spirits Council of the United States (DISCUS) survey shows overwhelming consumer demand for DtC shipping of distilled spirits. Eight out of 10 consumers surveyed said distillers should be allowed to directly ship their products to legal-age consumers in any state. Additionally, some 76% said they would consider purchasing spirits online shipped directly from distillers to them from outside or within their state.

Lessons from 15 years of DtC wine shipping

DtC wine shipping is a $4.2 billion market as of 2021. Because DtC shipping and three-tier distribution complement one another, the three-tier system has continued to thrive in its central role in alcohol distribution even as the DtC channel has grown. In fact, while DtC wine shipping has been in place for 15+ years, it makes up 10%-11% of total off-premise wine sales in the U.S. (as estimated by Jon Moramarco, managing partner at bw166).

The success the DtC wine channel has found has gone hand in hand with shippers’ commitment to following state regulations and tax requirements. DtC wine shippers participate in a safe, well-regulated market, complying with varying state regulations that include:

- Getting properly licensed by the destination state;

- Abiding by regulatory rulings of the destination state;

- Conducting age checks and preventing sales to minors; and

- Correctly determining, paying and reporting on taxes owed to the states.

Additionally, shippers abide by destination states’ jurisdiction in terms of other producer-enablement rules that include customer volume limits, the registration of brand labels and brand ownership requirements.

Distinct product offerings

The products that reach consumers through the DtC wine shipping channel are not the same ones they are shopping for at their local retail outlets. Rather, wineries typically offer special allocations or other higher-end, limited offerings via the DtC channel — compared to more inexpensive wines that are widely available at retail or for which a consumer would be hard-pressed to justify the shipping cost. In fact, the average price per bottle of wine shipped DtC hovers around $40, three to four times the average price paid at grocery stores and liquor shops.

Thus, there is generally no direct competition between the products available through these different channels — though a producer that grows its fan base via DtC shipping can expect to see increased demand for their products sold through the three-tier system.

From a DtC shipping standpoint, a bottle of wine and a bottle of spirits look a lot alike — and as in wine, spirits producers offer a number of speciality or limited production releases — so there is every reason to expect that as more states open to DtC spirits shipping, the spirits industry will follow wine’s lead in offering distinct products via different channels.

An equitable marketplace?

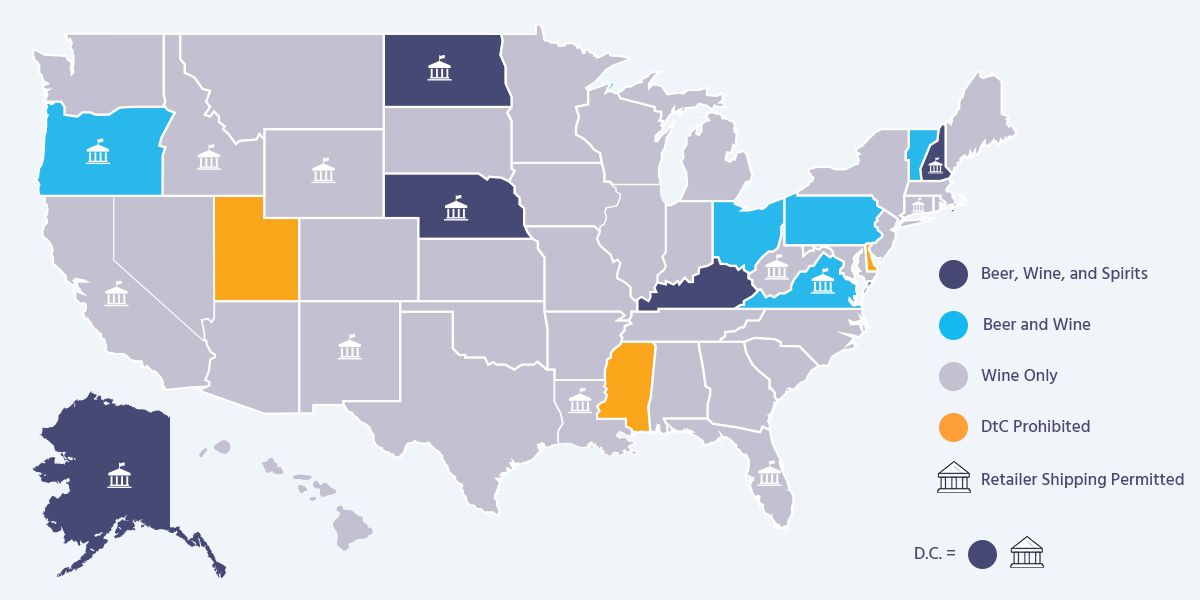

Across the vast majority of the U.S. — 46 states and the District of Columbia — DtC wine shipping is permitted. The map of where spirits producers are legally entitled to ship DtC is much, much narrower.

* Oregon will only issue licenses for beer shipping to breweries located in states that themselves permit DtC shipping of beer

* Pennsylvania will only issue licenses for beer shipping to brewers that hold specific wholesaler or off-premises retailer licenses; a manufacturing license alone, even one that grants such permissions, is insufficient

Accurate to October 2021

As the map demonstrates, the only seven locales open for DtC spirits shipping are Alaska, D.C., Kentucky, Nebraska, Nevada, New Hampshire, North Dakota and (in very limited fashion) Rhode Island, compared to wine’s 47.

As spirits producers have demonstrated through their compliant participation in the three-tier system, they are readily equipped to mimic the compliant behaviors of their winery counterparts in the DtC shipping channel.

What's fair for wine is also fair for spirits

How states have benefited from DtC shipping

Naturally, states are eager to maximize the tax revenues they collect, as taxes fund their service to the public, including infrastructure, education and social services.

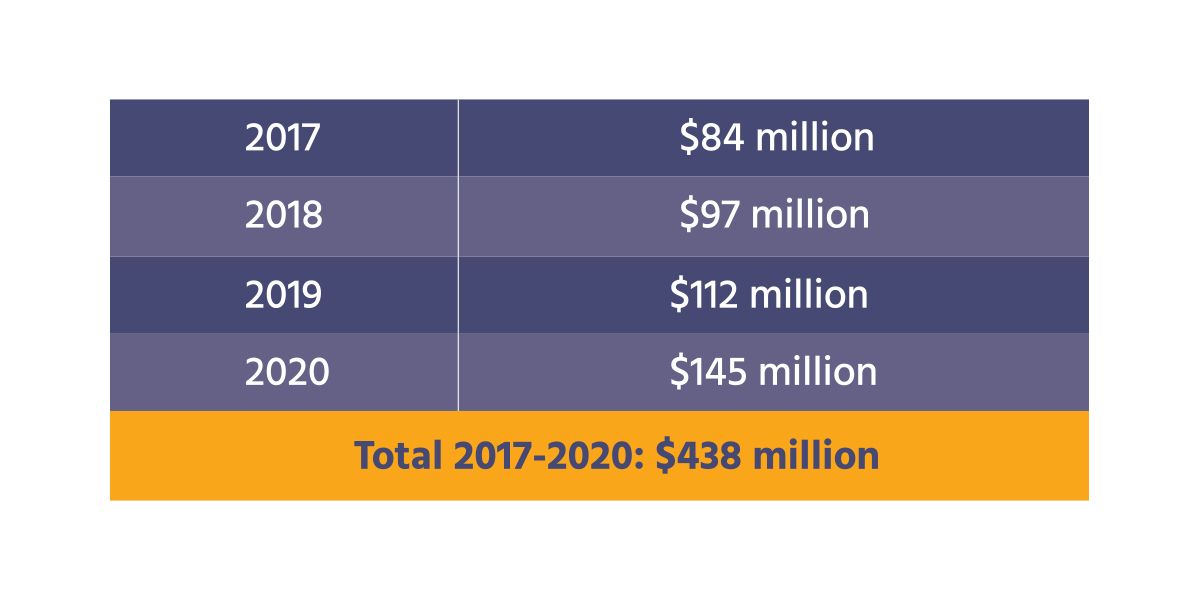

The compliant behavior of DtC alcohol shippers to date has enriched states’ coffers to the benefit of many. As a leading beverage alcohol compliance solutions provider, Sovos ShipCompliant has facilitated states’ securing hundreds of millions in tax revenue each year. Because the footprint for legal DtC shipping of non-wine beverage alcohol is limited, the vast majority of this tax revenue is driven by DtC wine shipments.

DtC Tax Revenue Paid to States Via Sovos ShipCompliant

States opening to the DtC shipment of spirits would only grow these welcome additional revenues.

In conclusion

The case for spirits DtC shipping is clear. The demand is strong from producers and consumers alike, and states stand to benefit greatly. More than 15 years of complaint DtC wine shipping have paved the way for the healthy expansion of DtC beverage alcohol shipping.

Spirit producers simply want the same kind of DtC market access that wine shippers enjoy. The data shows that DtC wine shipping is profitable for states and can be done safely. Consumers are ready for more choice and are already utilizing the DtC market. The time for expanded DtC spirits shipping permissions is now.

Learn how Sovos ShipCompliant can help you manage your taxes and compliance for DtC shipping.

Talk to an expertSubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe now