A Buyer’s Guide to DtC Alcohol Shipping Compliance Software

Choosing the right solution for your business

With rising ecommerce demands and more people than ever before working remotely, direct-to-consumer (DtC) shipping of beverage alcohol has also grown in popularity. Consumers have become accustomed to being able to have their favorite wines, beers and spirits shipped directly to their front door. Producers, shippers and retailers are all working toward maintaining DtC compliance, but it’s hardly an intuitive process, especially as businesses grow and regulatory landscapes change.

Whether you’re a large-scale winery expanding into new states, or a small-scale distillery growing its product line, you’ve come to the realization that maintaining DtC shipping compliance is no easy feat. You understand what you need to do, but perhaps aren’t sure the best way to go about doing it. Is investing in DtC shipping compliance software even necessary?

Not making that investment could cost your organization time and money—especially if you are shipping to more than a couple of states or to states with complex rules and reporting requirements. Maybe you have one employee dedicating days every single month to trying to account for all state requirements. What happens if you catch a mistake? Do you ship the product out, knowing you’ll get fined after the fact? Or do you delay the shipment, leading to unhappy customers?

The cost of “doing nothing” can be immense, which is why we’ve outlined how to find the right DtC alcohol shipping compliance software.

Recapping the Importance of DtC Alcohol Shipping Compliance

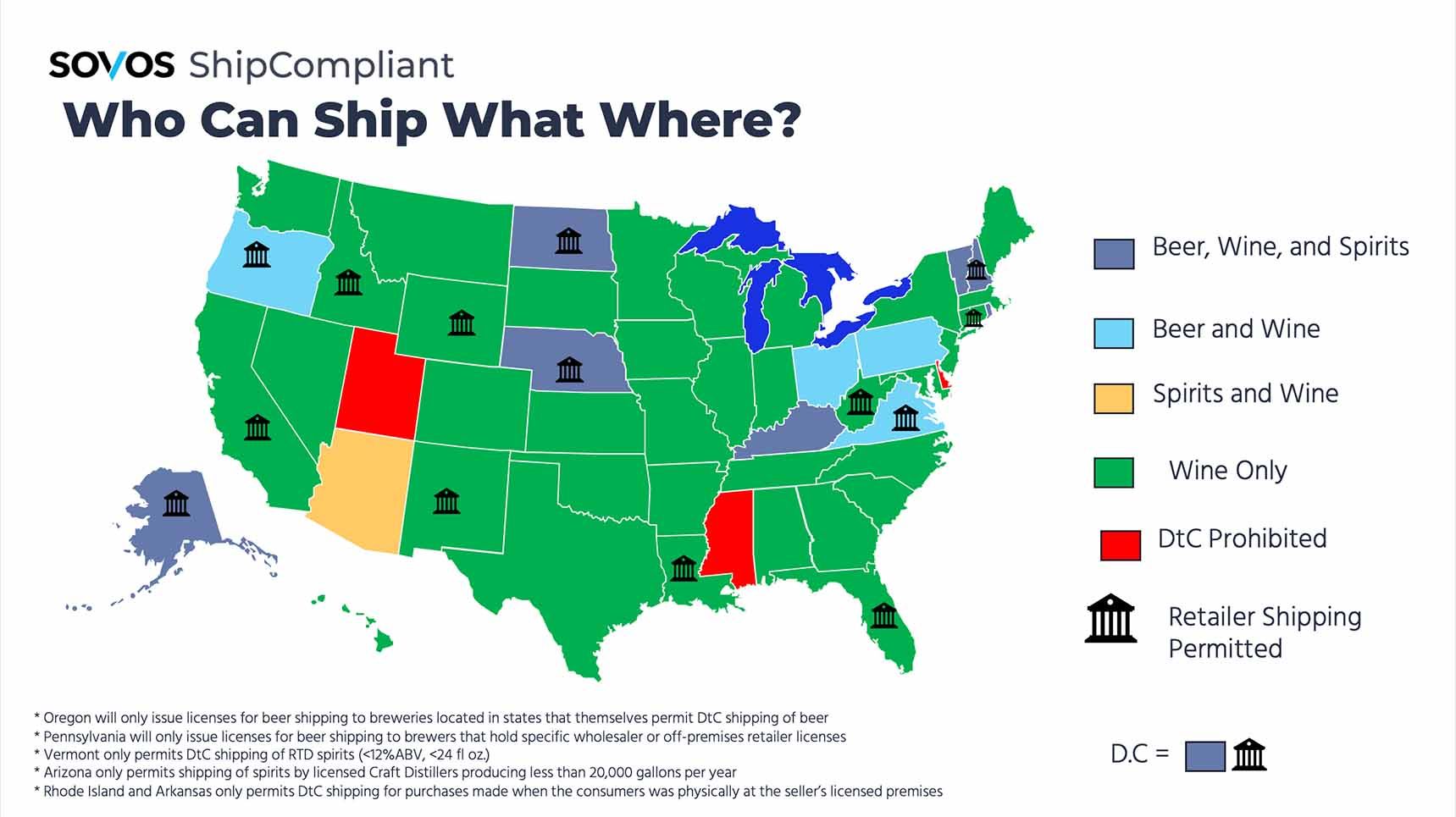

DtC shipping laws vary from state to state, meaning that producers need to keep current on how much they are shipping (to manage against customer aggregate volume limits), to whom (i.e., do you have age verification measures? Are you avoiding shipping to dry counties?) and ensuring the appropriate taxes are determined, collected and submitted. Additionally, the regulations vary by product—just because a state allows DtC wine shipping, does not guarantee that it allows DtC beer shipping, for example.

Non-compliance can lead to:

- Cease and desist letters

- Fines and/or monetary penalties

- Revoked/non-renewed licenses

• If you lose one license, it could affect others, including a production license

Whether you’re a producer, shipper or retailer, it’s critical to know where you’re shipping. From there, understanding—and adhering to—those destination states’ regulations is necessary. But as companies expand into new territories, grow their product lines or scale their business in another way, it’s not always easy to keep tabs on what’s required. That is where DtC alcohol shipping compliance software can be beneficial.

What Are My Options?

Most DtC shippers end up deciding between sticking to manual processes or utilizing compliance software. Here’s a look at how the two approaches compare, and what to look for if you decide to adopt compliance software.

Manual processes

How are new laws found and tracked?

Usually one employee, or a small team, is tasked with keeping pace with the latest regulations. Tracking might take place in binders, notebooks or a series of unwieldy spreadsheets that may or may not allow for multiple-employee access.

- What is the license, product registration and renewals process?

Employees are responsible for keeping track of which states different products are registered in, what the current fees and required paperwork are, and when critical renewal deadlines are coming up. If renewals for licenses and/or products are missed, you will be unable to sell into that particular state.

- How long is setup/implementation?

There is no real “implementation” process, but employee training when there is turnover or an outage could take time, depending on how much manual work is required.

- How are compliance checks handled?

Manually, often after the sale rather than in real-time, or—most riskily—not at all.

- What is the process for determining, reporting and remitting taxes?

This likely falls to one employee, or a small team for hours of cumbersome paperwork. With such variation in tax rates by state and even municipality, and how taxes are often applied differently for alcohol versus general merchandise, the opportunity for error is high.

- What is the employee burden?

Depending on the number of states a business ships into and how many products must be accounted for, the burden could be very heavy. Employees may be required to devote up to several days per month toward compliance. Of course, some companies outsource all of these tasks to consultants or similar providers—for a fee, which can often exceed the cost of an automated software solution on an ongoing basis.

DtC alcohol shipping compliance software

- How are new laws found and tracked?

Rule and regulation updates at all levels (federal, state, other jurisdictions such as county) are kept up to date by a team of regulatory experts.

- What is the license, product registration and renewals process?

A centralized database, visible to all team members, houses all state licensing and federal and state product registration information. The system can send proactive renewal reminders starting months in advance of the renewal deadline, to allow plenty of time for taking action. Renewal and registration requirements are kept up to date at all times by a team of regulatory experts.

- How long is setup/implementation?

Ideally, the DtC shipping compliance software implementation process should have your organization up and running in a matter of weeks so that you can quickly gain value from using the software. Look for a solution that offers a dedicated implementation team who will help guide you through account set up and use.

- How are compliance checks handled?

Automatically and in real time at the point of sale via integration with your ecommerce platform. In some cases, non-compliant orders maybe be flagged for adjustment or cancellation before a customer completes an order. Otherwise, orders should be quarantined for review and action by the team so that no risky non-compliant orders are completed.

- What is the process for determining, reporting and remitting taxes?

Again, look for automated, real-time tax determination that is both alcohol-specific and as granular as the rooftop level, as in some jurisdictions, tax rates can vary from one side of the street to the other.

- What is the employee burden?

While managing compliance and reporting still requires employee time and attention, expect to save hours—possibly days—per month on compliance and reporting work. Expect employees to experience greater job satisfaction in working with a streamlined, modern compliance solution versus inefficient and time-consuming manual processes that are subject to human error.

Review your internal processes to determine what the best, most reliable option will be for your business. Remember to account for any future growth plans as well—a single employee handling compliance may work for operating in one territory, but expanding beyond that could become time-consuming, more difficult to maintain and more prone to human error.

Accounting for Budget and Buy-in

Great ideas can come to life when even one person has the will to help make them possible. Ensure that you have buy-in from internal stakeholders and budget authority to make an investment in DtC shipping compliance software a reality.

Keep these questions in mind when accounting for budget and buy-in:

Budget

- Is the timing right?

Make sure your business isn’t compromising key objectives—the timing may never be perfect, but working with the right partner can mean reaping time-saving benefits within the first month of implementation.

- What are we spending now?

Remember that the cost of doing nothing could outweigh the initial upfront costs of DtC shipping compliance software. The cost of a solution could quickly be recouped from avoiding fines and having employees gain time back to refocus on other key business initiatives that will drive additional revenue.

- What will the overall cost be?

The right partner works with your budget and can scale with you as your business grows. Different companies have different needs, and the right DtC shipping compliance software can meet requirements at all levels of production. Tiered pricing options that evolve with the scope of your business are often a good fit.

Buy-in

- Who needs to be on board?

Your team should understand how the right solution can reduce risk, centralize processes and help gain efficiency. Even one key person acting as a liaison and project champion can create ongoing success.

What are key concerns?

Look for a solution provider that offers a dedicated implementation team, unlimited free support from experts and continued education on the software, all of which can help ensure that utilizing a new solution is seamless from implementation and beyond.

Conclusion: Why Sovos ShipCompliant?

Working with a trusted industry partner can help ensure that your business stays current and compliant in all DtC processes, including license management, production requirements and tax determination and reporting. Utilizing a centralized cloud-based platform that is integrated with major DtC ecommerce, point-of-sale and fulfillment systems, you can rest assured that you’re mitigating risk by staying compliant.

Additionally, the right partner has an implementation process that gets your organization online in weeks—not months. A dedicated implementation team can also ensure you know the necessary information to set up your account, while also letting you have visibility into the compliance process.

“We decided to go with ShipCompliant thanks to the integrations it has with our fulfillment partner, allowing us to automatically pass orders from our website through ShipCompliant, to our warehouse, which then fulfills and ships the orders. We could also receive the tracking information back through ShipCompliant, making the process much easier for all parties and bringing a level of automation we did not have previously.”

“We absolutely fell in love with the idea of how [ShipCompliant] managed the DtC compliance process. Then we found software that would work with it, not the other way around. We were up and running within a month and humming along just perfectly normal within a quarter. ShipCompliant makes it possible to do our job and we can trust that [their] information is accurate. You just can’t put a price on customer satisfaction and peace of mind.”

“ShipCompliant is an indispensable tool for our company. As a growing business, we recognized early on the need for an all-inclusive compliance software system. ShipCompliant not only met these needs but exceeded expectations by adding the DtC module. DtC is a great way to build our brand following and the integration was seamless.”

Sovos ShipCompliant can help in the compliance process, allowing you to experience fully compliant, accurate and seamless DtC shipping management.

Learn HowSubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe now