As the global pandemic slowly eases, wine producers, retailers and consumers continue to be impacted by fluctuations in wine direct-to-consumer (DtC) shipments. Watching marketplace data is critical to understanding how the industry can keep up with change and account for evolving market needs.

Nielsen is collaborating with Wines Vines Analytics and Sovos ShipCompliant to provide a much more comprehensive view of the U.S. off-premise wine category than ever previously available, with a data product that enables both separate and combined views of retail off-premise sales and DtC shipments.

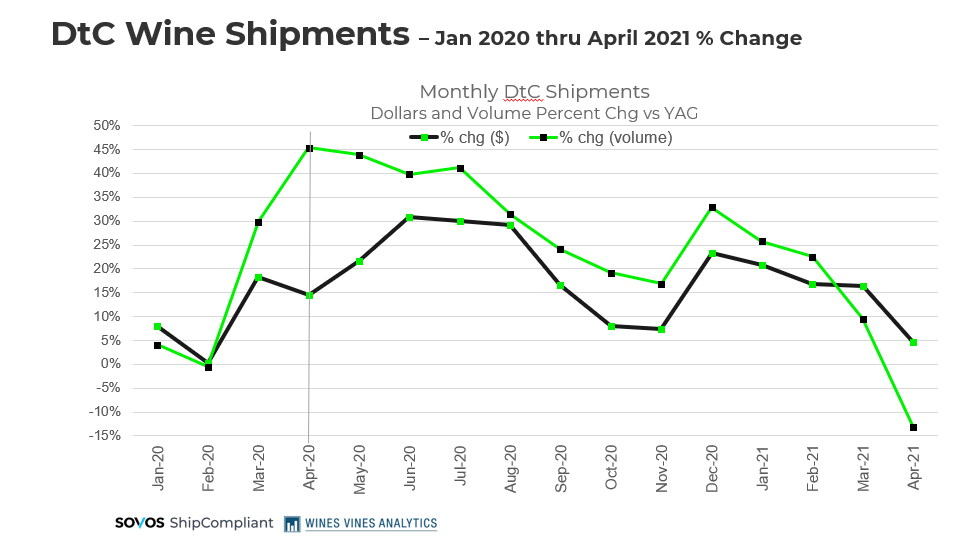

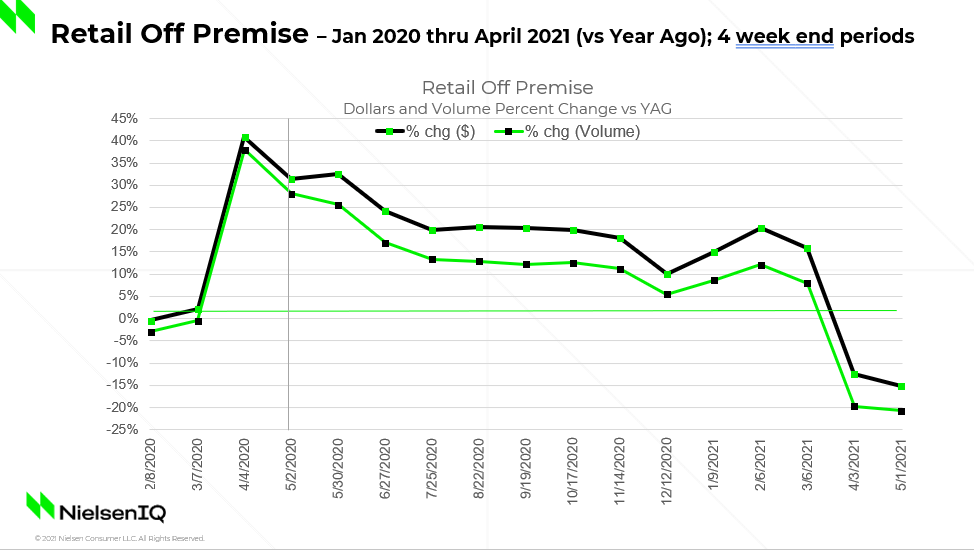

Now that we are comparing to COVID-impacted periods of one year ago, and on-site tasting room business are slowly starting to return, volume growth in April 2021 fell double digits versus year ago. However, dollar growth was still positive and for the second month in a row it exceeded volume changes.

Here are some highlights from the most recent data, along with commentary from Nielsen consultant Danny Brager.

DtC Shipments

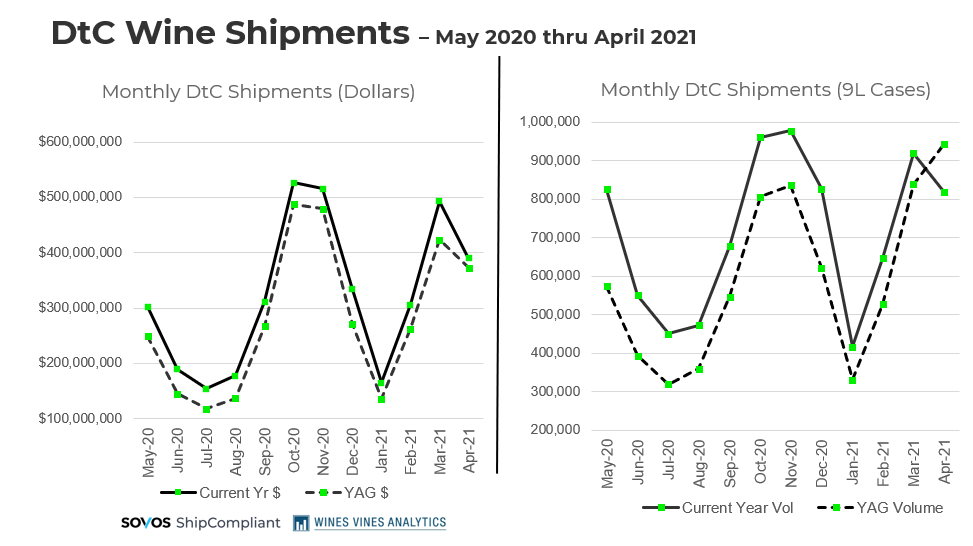

- In April, DtC shipments reached $389.6M and 818K cases shipped.

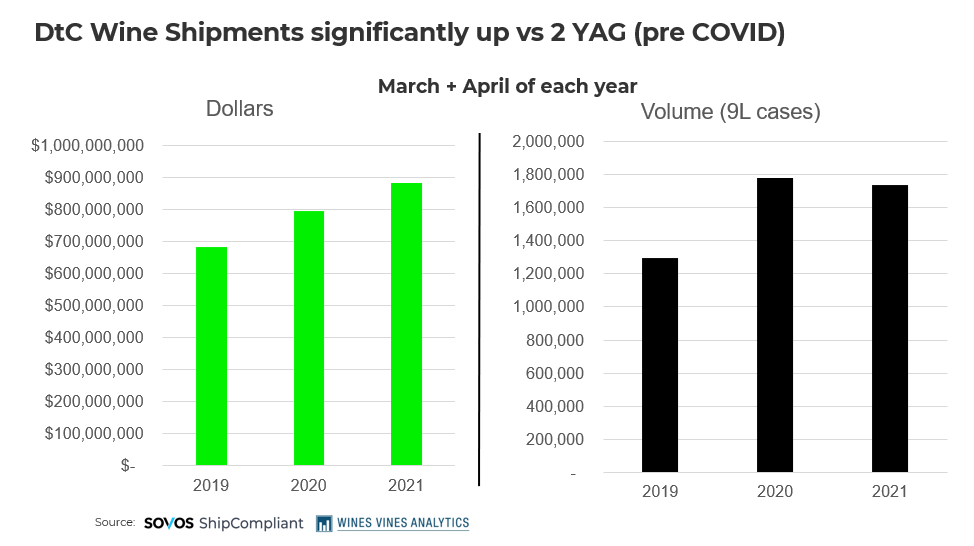

- March and April 2021 dollars and volume were up in the +30% range compared to two years ago. This is likely a result of both on-site tasting room business still being low, and wineries adapting well in expanding the effectiveness and efficiency of their DtC shipment channel during COVID.

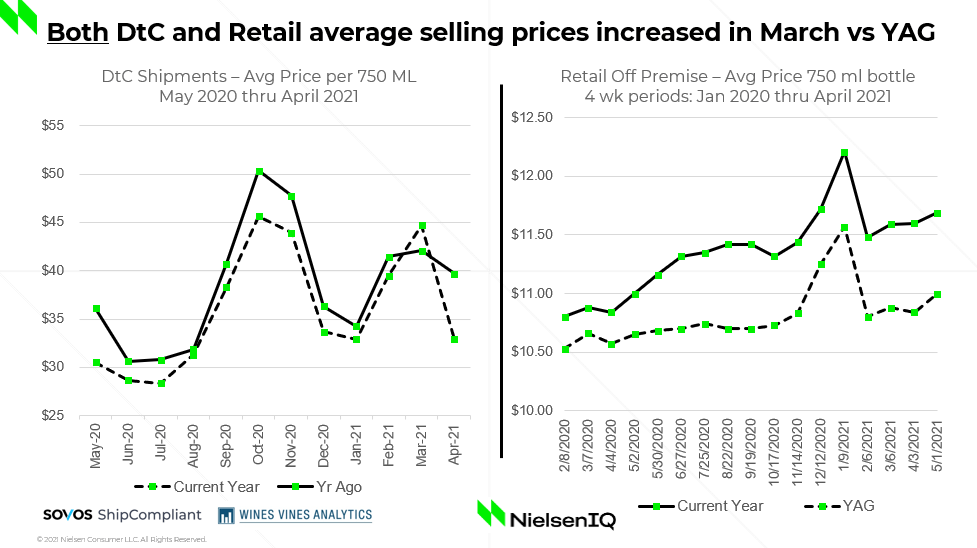

- Less expensive price tier ($20 and below) volume has declined compared to last year, whereas more expensive price tier ($50 and above) volume is up double digits.

- In April, the average bottle price shipped rose to almost $40, almost $7 higher than one year ago.

Retail Off-premise

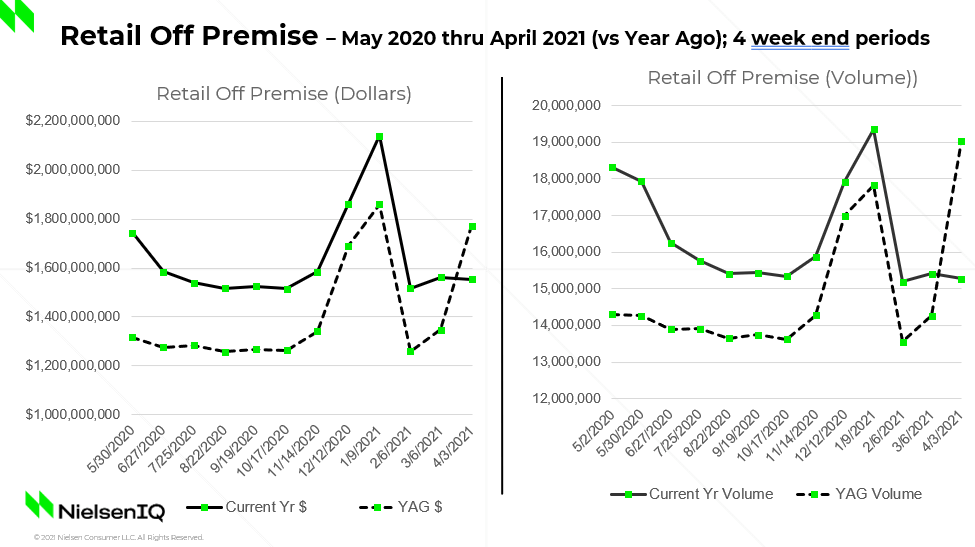

- In April, retail off-premise sales reached $1.5B and 15.2K cases.

- The gap between dollar and volume increases remains significant. For example, wines over $20 continue to perform well, with sales expanding even further versus the hyper levels from last year.

- Sparkling was the only wine type exhibiting growth versus one year ago.

Interested in knowing more (e.g., by price tiers, varietals, origin, winery size, geography)? Contact Danny Brager at danny.brager@nielseniq.com.

Take Action

Download the Direct-to-Consumer Wine Shipping Reporting for an in-depth look at the 2020 DtC wine shipping market.