By Andrew Adams, Editor, Wine Analytics Report

By Andrew Adams, Editor, Wine Analytics Report

This year’s annual Direct-to-Consumer Wine Shipping Report featured an additional set of data to help put the past two years of unprecedented winery shipment growth in context. Since the surge of shipment volume in March and April 2020, there has been sustained interest in trying to understand just how much of the increase in DtC wine shipping can be attributed to new consumers.

Based on internal Sovos ShipCompliant data on consumers who purchase for the first time from one of the company’s winery clients, these new buyers did have a larger than normal impact in 2020, but it was balanced out in 2021 as the channel reverted to a fairly pre-pandemic normal.

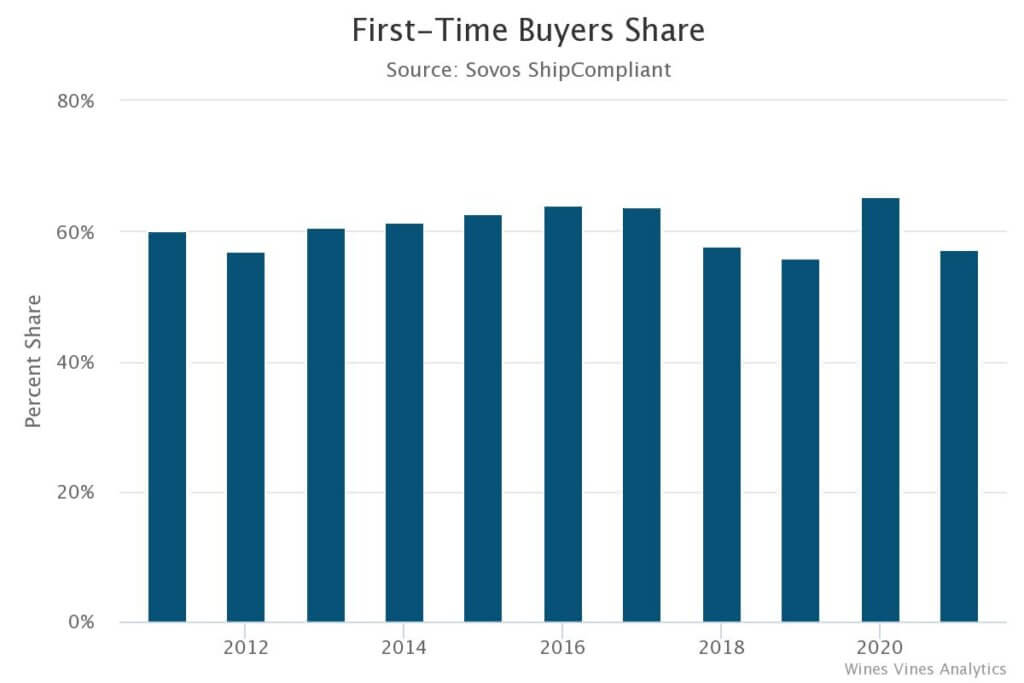

In 2019, the share of first-time buyers of all purchases was at nearly 56%. In 2020, that share jumped to 65%, yet by the end of 2021 it had fallen back to 57%. While the data relate only to Sovos ShipCompliant clients and not the entire DtC channel, these figures confirm that some of the DtC surge in 2020 was a short-term effect of the early months of the pandemic.

The plunge in average bottle prices in 2020, therefore, may have partly been fueled by these new shoppers who were buying at prices similar to what they were used to in grocery stores, but it’s more likely to have been from winery discounts and volume incentives (nearly-free shipping on six-packs or full-case orders, for example). Another factor was the uncertainty of what the pandemic would bring. As the pandemic began, many regular DtC consumers likely held back on buying pricier wines or deferred club shipments as they waited to see how their lives and household budgets would be impacted.

By the summer of 2020, consumers had found a new routine of working from home when it became clear that the pandemic would be for the long haul. However, it did not bring as much economic disruption as initially feared, so the average bottle price began to recover.

Throughout the past two years, wineries have consistently reported that their best DtC sales have come from existing customers rather than chasing new ones. Those new consumers remain vital to grow a program as well as offset member churn, but the Sovos ShipCompliant data provide some indication on the rewards of maintaining customer loyalty.

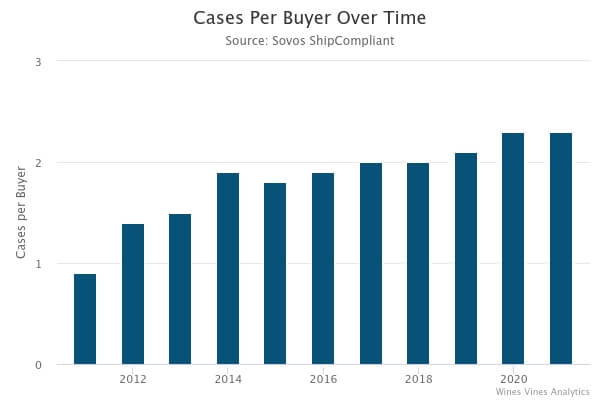

According to Sovos ShipCompliant’s analysis of the first-time buyer data, new customers will typically make around two orders per year. In 2019, the orders per new customer averaged 1.7, but in 2020 this metric jumped to 1.9, and the order rate remained at that level for first-time buyers in 2021.

If a winery can hang onto those consumers, however, the orders and order volume can increase dramatically. Sovos ShipCompliant’s analysis found that a new customer in 2020 bought 0.9 cases but purchased 1.9 in 2021. Maintaining a relationship for even longer pays off even more. A first-time buyer in 2010 was making around four orders by 2021, which accounted for 2.5 cases.

There are a wealth of new digital marketing strategies and techniques available to wineries to help them secure new customers, but using that same outreach to keep your most loyal consumers engaged could yield even better returns or balance marketing dollars spent trying to acquire new ones.

The behavior of established DtC consumers also shows the value of customer recommendations. Part of the reason why virtual tastings are likely to remain a key sales tactic this year and beyond is they help wineries leverage their existing customers by having them host virtual tastings in their homes. One assumes a new consumer brought in by a loyal one is likely to show the same purchasing patterns.

Andrew Adams is the editor of the Wine Analytics Report and a regular contributor to Wine Business Monthly magazine. Adams grew up in the city of Sonoma, Calif., and graduated from the University of Oregon with a degree in journalism. In addition to working at daily newspapers for more than a decade, Adams worked for more than two years (three harvests) in the cellar and lab at a winery in Napa Valley.