A lot has changed in the direct-to-consumer (DtC) wine shipping channel since the January release of our Direct-to-Consumer Wine Shipping Report—changes in volume and value that have the market resembling pre-pandemic patterns.

Note: The proprietary data featured in this mid-year report is compiled from an algorithm measuring total DtC shipments based on millions of anonymous direct shipping transactions filtered through the ShipCompliant system and paired with Wines Vines Analytics’ comprehensive data on U.S. wineries, resulting in the most accurate depiction of the DtC wine shipping channel.

As the market continues to evolve from unprecedented numbers due to the lockdowns of 2020, we’re seeing a return to normalcy. This new normal is one that includes new buyers who recently entered the DtC channel, as well as a return to buying patterns seen in previous years.

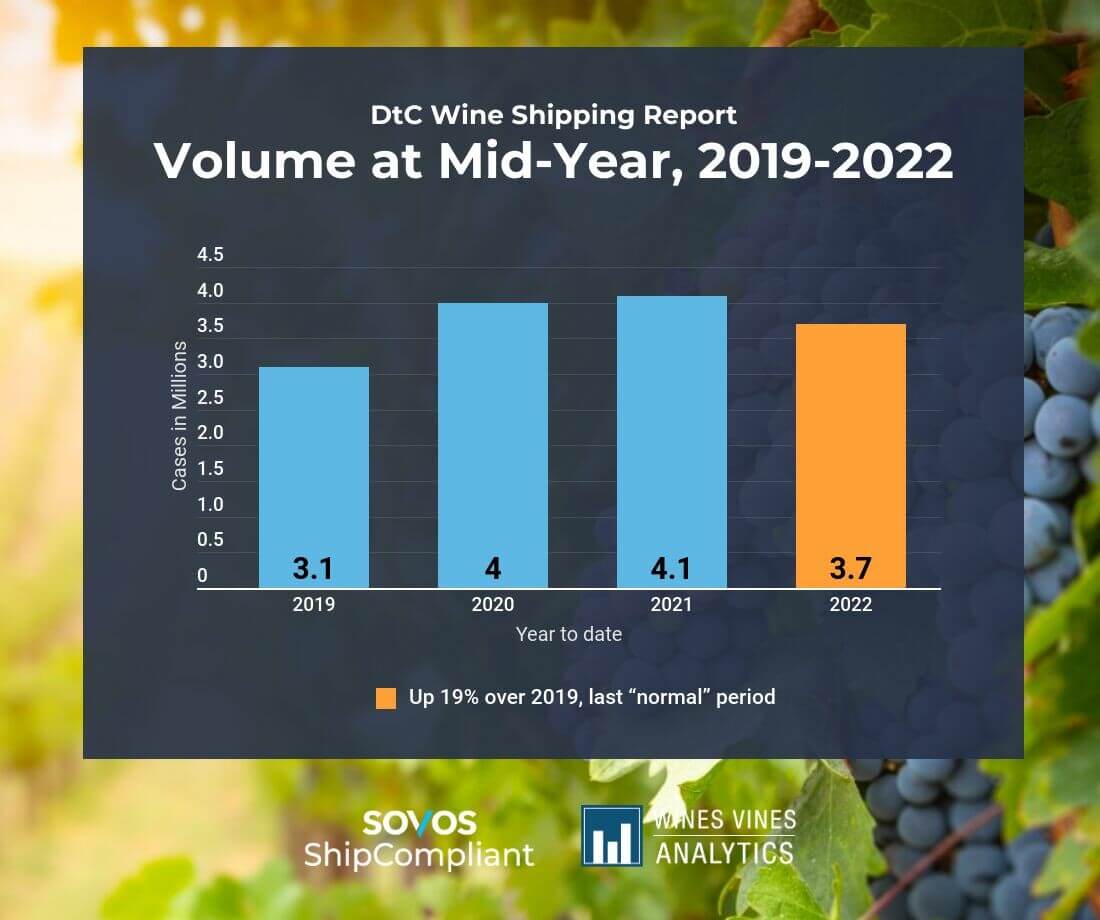

While the overall volume of wine shipped across the country so far this year is down 9% from the same period in 2021, at 3.7M cases, the total value is up 3%, at $1.95B. But again, this reflects a return to normal trends after a 2020 that saw a tremendous 27% increase in volume.

“The decline in volume is not that unexpected considering the record highs of the previous two years, seasonal patterns and the recovery of the on-premise sector where consumers are back to buying wines they may have been purchasing via DtC,” said Andrew Adams with Wines Vines Analytics. “And while it’s very encouraging to see shipment value remain positive, there is growing concern among wineries that challenges in the wider U.S. economy may hinder value growth through the second half of the year.”

Here is a deeper look at the changes in the DtC shipping channel between January and the end of June, 2022.

Average bottle price

Average bottle price has climbed to $43.78, an impressive 14% increase. Interestingly, the regions with the highest priced bottles also showed the biggest increases in price from 2021 to 2022. The average price of a bottle from Napa is now $79.74, an increase of 20%. Sonoma, Oregon, the Central Coast, Washington and the Rest of California also saw an increase in bottle prices. The average bottle price from wineries in the remainder of the U.S. was down 3% from the first half of 2021, averaging $21.78.

Destination state

California is once again the top destination state, producing and shipping the most wine. The top destination states in descending order are California, Texas, Florida, New York and Washington. The top five destination states have remained the same since Pennsylvania fell from the fifth spot last year. Of the states listed, Florida saw the largest value change in wine shipped, with an increase of 13%.

Aside from California, the remaining top four states each averaged 6% of total market share.

Winery location

California wineries outside of Napa, Sonoma or the Central Coast experienced an 8% increase in volume shipped, with the rest of the country seeing a reduction in volume growth. This area has shown consistent growth since 2019 and now makes up nearly 12% of the total volume of wine shipped in the country. When comparing the first half of 2022 to the same six-month period in 2019, the Central Coast is the only region with flat shipment volume.

Winery size

Reflecting a return to more in-person and carry-out sales, wineries of all sizes experienced a drop in volume from 2021 to 2022 at the mid-year. Volume dropped the most among wineries producing under 1,000 cases per year (down 15%), followed closely by wineries producing 5,000 to 50,000 cases per year. The smallest drop was among wineries producing 1,000 to 5,000 cases.

Wine varietal

Cabernet Sauvignon, holding the largest share of overall sales by varietal (29%), saw a 1% decrease in volume from 2021 to 2022 at the mid-year, but a 17% increase in value. Red Blends, with the second largest share, saw an 11% decrease in volume and a 7% increase in value. The varietals leading the way with average bottle price growth are Red Blends (21%), Cabernet Sauvignon (19%) and Merlot (16%). Only Pinot Gris saw negative bottle price performance (-8%).

Moscato saw impressive growth in volume (48%) and value (57%) compared to last year—though notably, Moscato is growing on a small sales base, with the lowest overall sales among varietals tracked. The only other varietal group with growth in volume has been Syrah/Shiraz, with a 3% increase.

The largest decrease in volume growth were White Blends (down 22%), Petite Sirah (down 20%) and Rosé (down 19%), with Sangiovese, Riesling and Merlot following closely behind.

What’s next for DtC wine shipping?

Wine consumers who found their way to the DtC channel in the last two years appear to be staying put, and wineries are once again benefiting from a reversion to pre-pandemic buying patterns, reflected in increased volumes of higher-priced wine sales. Though the future remains uncertain, we will be here to provide commentary on the market. In a few months, our full report on 2022 will be released in January 2023. Until then, discover our 2021 findings by downloading your complimentary copy of the 2022 Direct-to-Consumer Wine Shipping Report.

This data was compiled in partnership with Wines Vines Analytics, a leading source for wine industry data.

Take Action

Want a comprehensive look at the DtC wine shipping channel in 2021? Download the 2022 DtC Wine Shipping Report today.