A Buyer’s Guide to DtC Alcohol Shipping Compliance Software

Choosing the right solution for your business

With rising ecommerce demands and more people than ever before working remotely, direct-to-consumer (DtC) shipping of beverage alcohol has also grown in popularity. Consumers have become accustomed to being able to have their favorite wines, beers and spirits shipped directly to their front door. Producers, shippers and retailers are all working toward maintaining DtC compliance, but it’s hardly an intuitive process, especially as businesses grow and regulatory landscapes change.

Whether you’re a large-scale winery expanding into new states, or a small-scale distillery growing its product line, you’ve come to the realization that maintaining DtC shipping compliance is no easy feat. You understand what you need to do, but perhaps aren’t sure the best way to go about doing it. Is investing in DtC shipping compliance software even necessary?

Not making that investment could cost your organization time and money—especially if you are shipping to more than a couple of states or to states with complex rules and reporting requirements. Maybe you have one employee dedicating days every single month to trying to account for all state requirements. What happens if you catch a mistake? Do you ship the product out, knowing you’ll get fined after the fact? Or do you delay the shipment, leading to unhappy customers?

The cost of “doing nothing” can be immense, which is why we’ve outlined how to find the right DtC alcohol shipping compliance software.

Recapping the Importance of DtC Alcohol Shipping Compliance

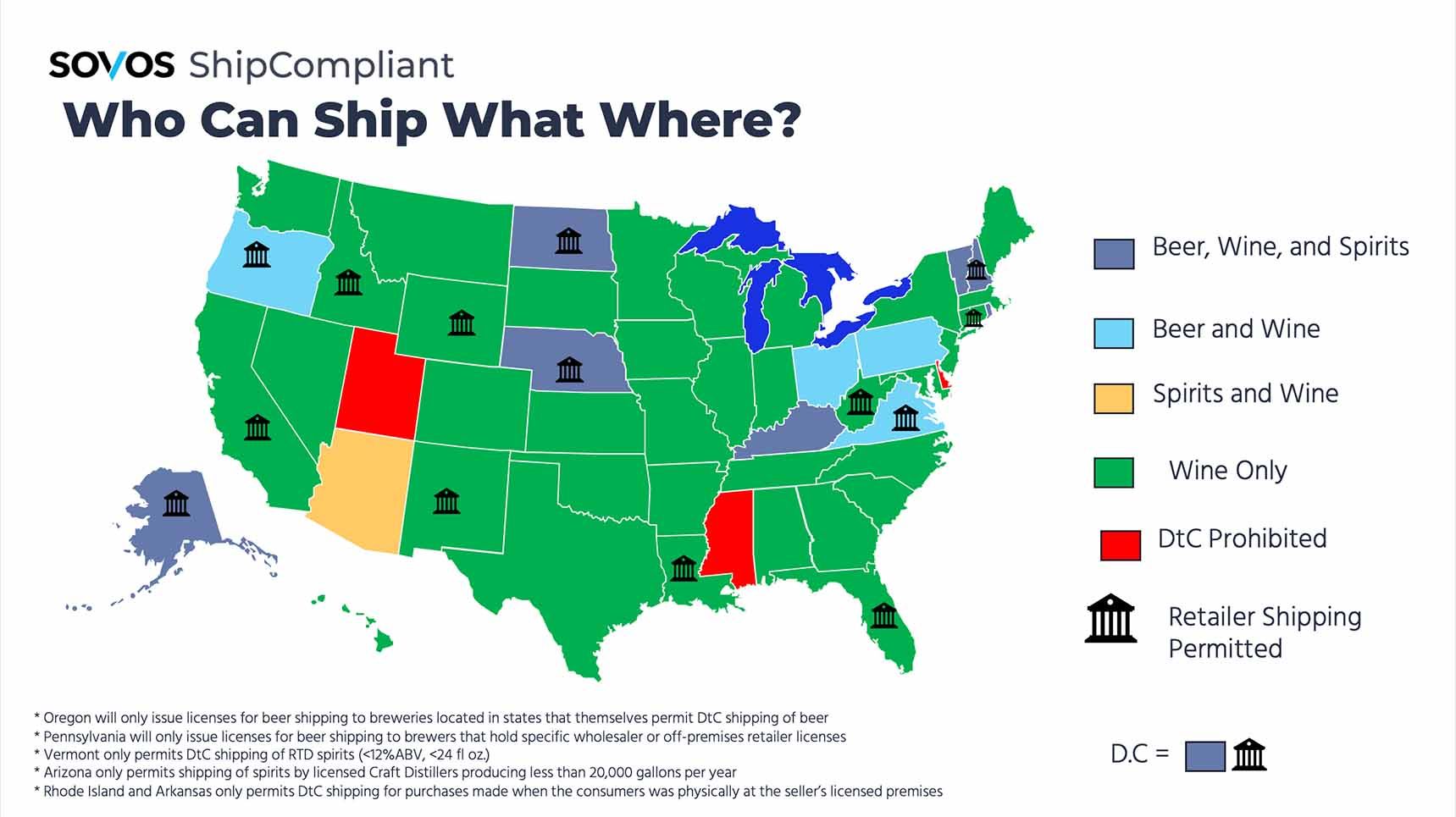

DtC shipping laws vary from state to state, meaning that producers need to keep current on how much they are shipping (to manage against customer aggregate volume limits), to whom (i.e., do you have age verification measures? Are you avoiding shipping to dry counties?) and ensuring the appropriate taxes are determined, collected and submitted. Additionally, the regulations vary by product—just because a state allows DtC wine shipping, does not guarantee that it allows DtC beer shipping, for example.

Non-compliance can lead to:

- Cease and desist letters

- Fines and/or monetary penalties

- Revoked/non-renewed licenses

• If you lose one license, it could affect others, including a production license

Whether you’re a producer, shipper or retailer, it’s critical to know where you’re shipping. From there, understanding—and adhering to—those destination states’ regulations is necessary. But as companies expand into new territories, grow their product lines or scale their business in another way, it’s not always easy to keep tabs on what’s required. That is where DtC alcohol shipping compliance software can be beneficial.

What Are My Options?

Most DtC shippers end up deciding between sticking to manual processes or utilizing compliance software. Here’s a look at how the two approaches compare, and what to look for if you decide to adopt compliance software.

Manual processes

How are new laws found and tracked?

Usually one employee, or a small team, is tasked with keeping pace with the latest regulations. Tracking might take place in binders, notebooks or a series of unwieldy spreadsheets that may or may not allow for multiple-employee access.

- What is the license, product registration and renewals process?

Employees are responsible for keeping track of which states different products are registered in, what the current fees and required paperwork are, and when critical renewal deadlines are coming up. If renewals for licenses and/or products are missed, you will be unable to sell into that particular state.

- How long is setup/implementation?

There is no real “implementation” process, but employee training when there is turnover or an outage could take time, depending on how much manual work is required.

- How are compliance checks handled?

Manually, often after the sale rather than in real-time, or—most riskily—not at all.

- What is the process for determining, reporting and remitting taxes?

This likely falls to one employee, or a small team for hours of cumbersome paperwork. With such variation in tax rates by state and even municipality, and how taxes are often applied differently for alcohol versus general merchandise, the opportunity for error is high.

- What is the employee burden?

Depending on the number of states a business ships into and how many products must be accounted for, the burden could be very heavy. Employees may be required to devote up to several days per month toward compliance. Of course, some companies outsource all of these tasks to consultants or similar providers—for a fee, which can often exceed the cost of an automated software solution on an ongoing basis.

DtC alcohol shipping compliance software

- How are new laws found and tracked?

Rule and regulation updates at all levels (federal, state, other jurisdictions such as county) are kept up to date by a team of regulatory experts.

- What is the license, product registration and renewals process?

A centralized database, visible to all team members, houses all state licensing and federal and state product registration information. The system can send proactive renewal reminders starting months in advance of the renewal deadline, to allow plenty of time for taking action. Renewal and registration requirements are kept up to date at all times by a team of regulatory experts.

- How long is setup/implementation?

Ideally, the DtC shipping compliance software implementation process should have your organization up and running in a matter of weeks so that you can quickly gain value from using the software. Look for a solution that offers a dedicated implementation team who will help guide you through account set up and use.

- How are compliance checks handled?

Automatically and in real time at the point of sale via integration with your ecommerce platform. In some cases, non-compliant orders maybe be flagged for adjustment or cancellation before a customer completes an order. Otherwise, orders should be quarantined for review and action by the team so that no risky non-compliant orders are completed.

- What is the process for determining, reporting and remitting taxes?

Again, look for automated, real-time tax determination that is both alcohol-specific and as granular as the rooftop level, as in some jurisdictions, tax rates can vary from one side of the street to the other.

- What is the employee burden?

While managing compliance and reporting still requires employee time and attention, expect to save hours—possibly days—per month on compliance and reporting work. Expect employees to experience greater job satisfaction in working with a streamlined, modern compliance solution versus inefficient and time-consuming manual processes that are subject to human error.

Review your internal processes to determine what the best, most reliable option will be for your business. Remember to account for any future growth plans as well—a single employee handling compliance may work for operating in one territory, but expanding beyond that could become time-consuming, more difficult to maintain and more prone to human error.

Accounting for Budget and Buy-in

Great ideas can come to life when even one person has the will to help make them possible. Ensure that you have buy-in from internal stakeholders and budget authority to make an investment in DtC shipping compliance software a reality.

Keep these questions in mind when accounting for budget and buy-in:

Budget

- Is the timing right?

Make sure your business isn’t compromising key objectives—the timing may never be perfect, but working with the right partner can mean reaping time-saving benefits within the first month of implementation.

- What are we spending now?

Remember that the cost of doing nothing could outweigh the initial upfront costs of DtC shipping compliance software. The cost of a solution could quickly be recouped from avoiding fines and having employees gain time back to refocus on other key business initiatives that will drive additional revenue.

- What will the overall cost be?

The right partner works with your budget and can scale with you as your business grows. Different companies have different needs, and the right DtC shipping compliance software can meet requirements at all levels of production. Tiered pricing options that evolve with the scope of your business are often a good fit.

Buy-in

- Who needs to be on board?

Your team should understand how the right solution can reduce risk, centralize processes and help gain efficiency. Even one key person acting as a liaison and project champion can create ongoing success.

What are key concerns?

Look for a solution provider that offers a dedicated implementation team, unlimited free support from experts and continued education on the software, all of which can help ensure that utilizing a new solution is seamless from implementation and beyond.

Conclusion: Why Sovos ShipCompliant?

Working with a trusted industry partner can help ensure that your business stays current and compliant in all DtC processes, including license management, production requirements and tax determination and reporting. Utilizing a centralized cloud-based platform that is integrated with major DtC ecommerce, point-of-sale and fulfillment systems, you can rest assured that you’re mitigating risk by staying compliant.

Additionally, the right partner has an implementation process that gets your organization online in weeks—not months. A dedicated implementation team can also ensure you know the necessary information to set up your account, while also letting you have visibility into the compliance process.

“We decided to go with ShipCompliant thanks to the integrations it has with our fulfillment partner, allowing us to automatically pass orders from our website through ShipCompliant, to our warehouse, which then fulfills and ships the orders. We could also receive the tracking information back through ShipCompliant, making the process much easier for all parties and bringing a level of automation we did not have previously.”

“We absolutely fell in love with the idea of how [ShipCompliant] managed the DtC compliance process. Then we found software that would work with it, not the other way around. We were up and running within a month and humming along just perfectly normal within a quarter. ShipCompliant makes it possible to do our job and we can trust that [their] information is accurate. You just can’t put a price on customer satisfaction and peace of mind.”

“ShipCompliant is an indispensable tool for our company. As a growing business, we recognized early on the need for an all-inclusive compliance software system. ShipCompliant not only met these needs but exceeded expectations by adding the DtC module. DtC is a great way to build our brand following and the integration was seamless.”

Sovos ShipCompliant can help in the compliance process, allowing you to experience fully compliant, accurate and seamless DtC shipping management.

Learn HowSubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowKeep Pace with Changing Requirements in the Beer Industry with Sovos ShipCompliant

Introduction

Breweries of all sizes are aware of the rapidly changing regulatory requirements for both three-tier and direct-to-consumer (DtC) shipping channels. Expanding product lines, moving distribution into new territories and accounting for all federal and state laws can put extra pressure on the organization. What does it take to maintain compliance without compromising other aspects of your brewery’s business?

Here are real-world examples of how Sovos ShipCompliant can help those in the brewing industry get a handle on compliance.

“Despite the patchwork and difficult landscape of malt beverage compliance, our team at Sovos ShipCompliant has gone above and beyond to ensure a smooth, functional, effective solution for managing filings, registrations, and compliance. We’re grateful for the time savings associated with managing disparate state laws and policies, as well as the peace of mind it offers.”

Use case #1: Brewery Automates Manual Processes & Centralizes Compliance

Colorado-based Left Hand Brewing Co. struggled with scaling issues as it entered into new states, with employees manually completing all paperwork. The tedious and time-consuming process raised the risk of missing deadlines and overwhelmed the staff. Additionally, Left Hand had limited visibility into specific state compliance requirements, pushing employees to guess on numerous issues.

The Sovos ShipCompliant Market Ready solution helped remove guesswork from Left Hand’s compliance efforts, while also automating the manual processes necessitated by mountains of paperwork. Compliance was centralized into a single platform, ensuring accuracy and providing peace of mind. The brewery can now expand into new regions faster than before and ensure that its product is on shelves when expected.

“We’ve grown too much to let guesswork lead us to the next step. [ShipCompliant] helped us in that regard [with] a centralized point where everything lives. It’s as easy as the push of a button to get all of our paperwork done.” -Director of Accounting & Administration at Left Hand Brewing

Use case #2: Improved Registration Process Helps Brewery Focus on Biz Development

Uinta Brewing had manual processes in place for maintaining compliance and conducting state product registrations. This inefficiency put extra pressure on employees and prevented them from being able to properly focus on other business priorities.

With Sovos ShipCompliant 3-Tier Reporting and Market Ready solutions, Uinta has one platform where it can get answers on state requirements, register a product and keep track of licenses and documents. This helps the brewery save time and reduce the risk of errors.

Uinta Brewing now has a “one-stop shop for regulatory compliance,” according to its director of regulatory compliance. Employees reduced their time spent on compliance from weeks to days and eliminated the risk of getting stuck on small regulatory issues. The brewery can get products to the market and in the hands of their customers faster.

“It comes down to confidence—knowing that we can go to one place and get answers on state details and state requirements, and then in that same platform be able to actually register a product and keep track of licenses and other documentation. It's the Swiss Army knife of regulatory compliance.”

What Sovos ShipCompliant can do for you

Direct

- Real-time compliance checks against more than 1,000 state rules and regulations

- Rooftop-level, alcohol-specific tax determination

- Streamlined reporting

- Integrations with all major DtC e-commerce, point-of-sale and fulfillment systems

Market Ready

- Streamlined state product and brand label registrations

- Integrated directly with 10+ government systems, including the TTB

- Increased visibility with insight into ETAs for federal and state registration approvals

- A central repository for all brand compliance data, state requirements and forms, and license renewal deadlines

Want to learn more? Contact our team to find out how Sovos ShipCompliant can help.

Subscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowMaintain Compliance in the Ever-Evolving Wine Market with Sovos ShipCompliant

Introduction

Whether you’re a large-scale winery looking to start a wine club or subscription service, or you’re a small vineyard that needs to improve its approach to wholesale compliance, regulations and requirements can quickly change. How can you maintain compliance without losing sight of other key business initiatives?

Here are real-world examples of how Sovos ShipCompliant can help those in the wine space get a handle on compliance.

Use case #1: Online Wine Club Saves Money on Reporting, License Management

Vegan Wines is a subscription-based club and online wine club that ships to 38 states. The startup did not have the staff to dedicate ample time to track and manage compliance for every order. The team spent large amounts of time processing online and wine club orders through the system, used spreadsheets and manual data entry to check compliance and then individually forwarded the information on to their fulfillment partner.

Sovos ShipCompliant Direct helps manage shipping compliance, taxes and licenses through one solution. Direct assists with streamlining the reporting process, reduces the risk of errors and incorrect reporting, and keeps all licensing information in one place.

Vegan Wines saves about $10,000 per year, or about 10 minutes per order, by using Direct.

“We decided to go with ShipCompliant thanks to the integrations it has with our fulfillment partner, allowing us to automatically pass orders from our website through ShipCompliant, to our warehouse, which then fulfills and ships the orders. We could also receive the tracking information back through ShipCompliant, making the process much easier for all parties and bringing a level of automation we did not have previously.”

Use case #2: Winery Eliminates Manual Reporting & Improves Customer Experience

Family-owned and operated winery Moshin Vineyards produces approximately 10,000 cases annually with 50/50 direct-to-consumer and three-tier distribution. It was replicating state reporting forms in spreadsheets, manually transferring data from hard copies and then submitting forms at the end of each month. Employees had to know each state’s individual rules, looking up changes as they occurred.

ShipCompliant Direct offers a comprehensive resource for state regulatory information. Moshin receives automatic notifications on state reporting due dates, license expirations and custom customer shipping email notices, ensuring customers get their packages.

Moshin saves over 50 hours a month on checking compliance and knows that its team will be quickly informed of any compliance issues, eliminating shipping problems.

“We absolutely fell in love with the idea of how [ShipCompliant] managed the DtC compliance process. Then we found software that would work with it, not the other way around. We were up and running within a month and humming along just perfectly normal within a quarter. ShipCompliant makes it possible to do our job and we can trust that [their] information is accurate. You just can’t put a price on customer satisfaction and peace of mind.”

Use case #3: Importer & Wholesaler Streamlines Compliance

California-based importer and wholesaler Martine’s Wines needed better structure and efficiency for its compliance processes. A lack of a reliable system made it difficult to know when a state license might need a renewal, when to provide notice for when products were registered to state distributors, or when to inform clients on state license and shipping law requirements—which are often in flux.

The Sovos ShipCompliant 3-Tier Reporting and Market Ready solutions helped Martine’s Wines gain greater visibility into the business with regulatory compliance, license management and automated registrations. The products provided a centralized database, shortened the time to market for new products and better empowered employees to bring the focus back to core business priorities.

“Having these compliance-related resources at my fingertips gives us better peace of mind that our business is following the rules because anything can be looked up in a matter of seconds.”

What Sovos ShipCompliant can do for you

Direct

- Real-time compliance checks against more than 1,000 state rules and regulations

- Rooftop-level, alcohol-specific tax determination

- Streamlined reporting

- Integrations with all major DtC e-commerce, point-of-sale and fulfillment systems

Market Ready

- Streamlined state product and brand label registrations

- Integrated directly with 10+ government systems, including the TTB

- Increased visibility with insight into ETAs for federal and state registration approvals

- A central repository for all brand compliance data, state requirements and forms, and license renewal deadlines

Want to learn more? Contact our team to find out how Sovos ShipCompliant can help.

Subscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowWhat to Expect When Implementing Wholesale Distribution Compliance Software

Introduction

Implementing wholesale distribution compliance software is no small feat, but it doesn’t have to be a difficult experience. By understanding the implementation process, you’ll feel confident and ready to make the switch and finally streamline state registrations, state reporting, distributor management and more.

Key considerations when implementing new compliance software

What do you need to keep in mind before getting your three-tier compliance in order using a software solution? Here are some things to think about, based on what we’ve learned by helping 2,000+ clients get a handle on their brand registrations, state gallonage reporting and so many other facets of their business.

- Buy-in from internal stakeholders: A team that fully understands how a software solution can reduce risk, centralize processes and help gain efficiency is a team that will help drive the project to the finish line.

- Right timing for the business: Don’t let perfect be the enemy of good. While there’s no just-right time to make changes in any business, choose a time that doesn’t conflict with your organizational objectives. Don’t compromise success by starting the process during a period where you don’t have resources to devote to getting set up. And keep your eyes on the prize: Many of our customers see time-saving benefits within the first month of their implementation.

- A point person: Having someone available to work closely with your ShipCompliant implementation consultant will speed up the process and help you meet project milestones. This liaison can provide updates and insight into the implementation process, offering visibility to your organization.

Working with Sovos ShipCompliant

It generally takes a few training sessions to get up and running with Sovos ShipCompliant Market Ready or 3-Tier Reporting. You will be asked to share required as well as recommended data that will help to effectively utilize ShipCompliant’s wholesale reporting offering. Your implementation consultant is always available to explain how your data will be utilized to generate complete and accurate state reports and registrations or to answer any questions about the process.

Sovos ShipCompliant helps get your products to market efficiently by pre-populating required fields and supporting documents so you can submit them automatically. By directly integrating with government systems, your state registration filings are expedited, and all held in one place.

In sum, what can you expect when onboarding with Sovos ShipCompliant?

- World-class software: Our secure, cloud-based software can be accessed from anywhere and is updated centrally, so you never have to deal with inconvenient manual software updates.

- A customizable solution that fits your needs: Collaborate with your account executive to understand what solution(s) meet the unique needs of your business. We’ll work together to design a set of solutions that includes everything you need.

- A team dedicated to your company: Your dedicated implementation consultant will guide you through setting up your customized ShipCompliant account.

- Support when you need it: Enjoy unlimited free support from a team of specialists available by phone or email. You’ll also have the ability to browse our expansive Help library for self-serve troubleshooting.

Continued education: Our educational experts share best practices in our regularly scheduled customer training sessions and webinars. Tune in live or access our on-demand webinars at your leisure.

Take Action

If you’re ready to experience fully accurate, compliant and seamless wholesale distribution management,

Talk to our experts todaySubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowWhat to Expect When Implementing DtC Shipping Compliance Software

Introduction

Implementing a new direct-to-consumer (DtC) shipping compliance software solution may sound like a stressful experience, but it doesn’t have to be. By understanding the implementation process, you’ll feel better prepared to make the switch.

Key considerations when implementing new compliance software

What do you need to keep in mind before getting your compliance in order using a software solution? Here are some things to think about, based on what we’ve seen in our 15+ years of helping clients get a handle on their compliance.

- Buy-in from internal stakeholders: A team that fully understands how a software solution can reduce risk, centralize processes and help gain efficiency is a team that drives the project forward.

- Right timing for the business: Don’t let perfect be the enemy of good. Choose a time that doesn’t conflict with your business objectives. Don’t compromise success by starting the process during a period where you don’t have the resources to devote to getting it set up. And keep in mind that while there’s no perfect time to make changes in any business, our clients report seeing time-saving benefits within the first month of their implementation.

- A point person: Having someone available to work closely with your implementation consultant will speed up the process and help you meet project milestones. This liaison can provide updates and insight into the implementation process, offering visibility to your organization.

Working with Sovos ShipCompliant

Sovos ShipCompliant’s implementation process was designed to bring your organization online in a matter of weeks, so that you can quickly experience the value of using the software. You’ll be paired with a dedicated implementation consultant who will let you know what information is needed to get your account set up and why, giving you visibility into the compliance process.

This includes a set-up checklist to help gather the data required to perform compliance checks, calculate tax rates and ready tax returns to report on each of your DtC orders. After you’ve shared all necessary information for the states you sell to, you can rely on ShipCompliant to ensure compliance everywhere you do business, every time.

In sum, what can you expect when onboarding with Sovos ShipCompliant?

- World-class software: Experience real-time compliance checks and alcohol-specific rooftop-level tax determination for seamless operations. Our secure, cloud-based solution is accessible from anywhere and never requires cumbersome manual software updates.

- A fully customized solution: Collaborate with your account executive to understand what solution(s) meet the unique needs of your business. We’ll work together to design a set of solutions that includes everything you need.

- A team dedicated to you: Work with a dedicated implementation consultant to guide you through setting up your customized ShipCompliant account.

- Support when you need it: Enjoy unlimited free support from a team of specialists available by phone or email. You’ll also have access to our robust Help library for self-serve troubleshooting.

Continued education: Join our regularly scheduled webinars and customer training sessions to stay up to date on the regulatory landscape your business faces. Our educational experts share best practices for seamless usage of Sovos ShipCompliant products.

Implementing a new DtC shipping compliance software takes time, but the ShipCompliant team is dedicated to delivering value to your company from day one. With Sovos ShipCompliant, your DtC shipping compliance software is built by a team of experts with your company’s goals in mind. Our team is ready to help you get set up with a streamlined and automated DtC shipping compliance solution that will give you peace of mind.

Take Action

Are you ready to experience fully compliant, accurate and seamless DtC shipping management?

Talk to our experts todaySubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowThe Case for DtC Beer Shipping

Introduction

The wine industry has been shipping direct-to-consumer (DtC) for 20 years, and this once-novel market expansion has proven win-win-win for producers (business growth), states (increased tax revenue) and consumers (increased choice) alike. And yet, beer DtC remains a much narrower market. Why?

Beer producers aren’t the only ones asking that question. Sovos ShipCompliant’s 2025 Direct-to-Consumer Beer Shipping Report found that more than four in five regular craft beer drinkers (83%) say that current beer shipping laws in the U.S. should be updated to make it legal in more states—as do 64% of all Americans age 21+.

Lessons from 20 years of DtC wine shipping

DtC wine shipping is a nearly $4 billion market as of 2024. Because DtC shipping and three-tier distribution complement one another, the three-tier system has continued to thrive in its central role in alcohol distribution even as the DtC channel has grown. In fact, while DtC wine shipping has been in place for two decades, it makes up 8% of total off-premise wine sales in the U.S. (as estimated by Jon Moramarco, managing partner at bw166).

The success the DtC wine channel has found has gone hand in hand with shippers’ commitment to following state regulations and tax requirements. DtC wine shippers participate in a safe, well-regulated market, complying with varying state regulations that include:

- Getting properly licensed by the destination state;

- Abiding by regulatory rulings of the destination state;

- Conducting age checks and preventing sales to minors; and

- Correctly determining, paying and reporting on taxes owed to the states.

Additionally, shippers abide by destination states’ jurisdiction in terms of other producer-enablement rules that include customer volume limits, the registration of brand labels and brand ownership requirements.

Distinct product offerings

The products that reach consumers through the DtC wine shipping channel are not the same ones they are shopping for at their local retail outlets. Rather, wineries typically offer special allocations or other higher-end, more limited offerings direct-to-consumer.

Similarly, beer lovers are not necessarily looking to ship products that can be easily found at local retail stores. However, breweries can offer highly allocated and limited run products that consumers would otherwise have difficulty gaining access to.

Thus, there is generally no direct competition between the products available through these different channels — though a producer that grows its fan base via DtC shipping can expect to see increased demand for their products sold through the three-tier system. In fact, the DtC beer shipping report found that 95% of regular craft beer drinkers who are likely to purchase craft beer via DtC shipping say they’d be likely to look at retail for brands enjoyed via the DtC channel.

An equitable marketplace?

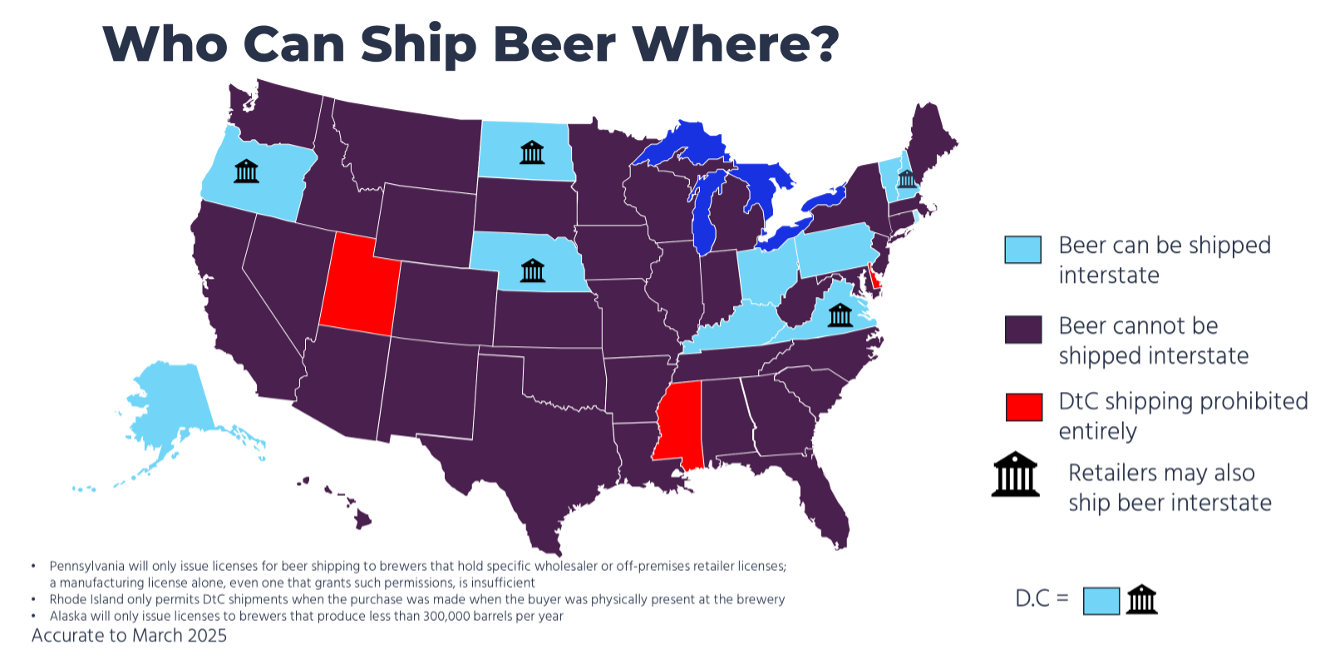

Across the vast majority of the U.S. — 47 states and the District of Columbia — DtC wine shipping is permitted. The map of where beer producers are legally entitled to ship DtC is much, much narrower.

* Pennsylvania will only issue licenses for beer shipping to brewers that hold specific wholesaler or off-premises retailer licenses; a manufacturing license alone, even one that grants such permissions, is insufficient.

Only 12 locales are open for DtC beer shipping, compared to wine’s 48:

As beer producers have demonstrated through their compliant participation in the three-tier system, they are readily equipped to mimic the conforming behaviors of their winery counterparts in the DtC shipping channel.

How states have benefited from DtC shipping

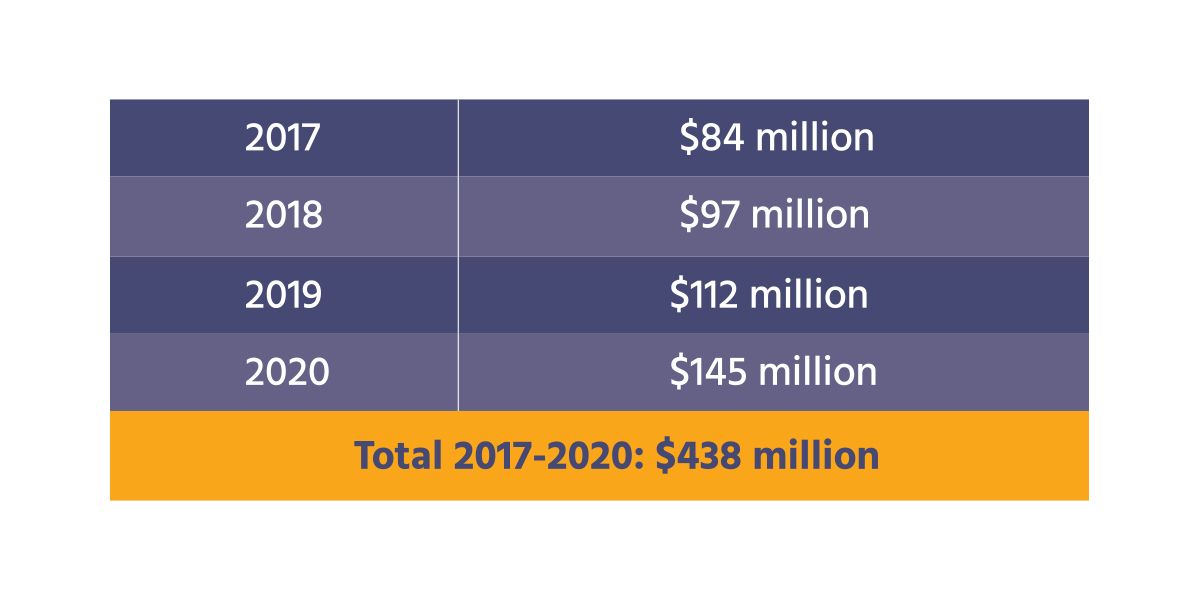

Naturally, states are eager to maximize the tax revenues they collect, as taxes fund their service to the public, including infrastructure, education and social services.

The compliant actions of DtC alcohol shippers to date has enriched states’ coffers to the benefit of many. As a leading beverage alcohol compliance solutions provider, Sovos ShipCompliant has facilitated states’ securing hundreds of millions in tax revenue each year. Because the footprint for legal DtC shipping of non-wine beverage alcohol is limited, the vast majority of this tax revenue is driven by DtC wine shipments.

DtC Tax Revenue Paid to States via Sovos ShipCompliant

| 2017 | $88.6 million |

| 2018 | $101.4 million |

| 2019 | $117.8 million |

| 2020 | $149.7 million |

| 2021 | $172.8 million |

| 2022 | $180.1 million |

| 2023 | $177.4 million |

| 2024 | $171.6 million |

| Total 2017-2024 | $1.16 billion |

States opening to the DtC shipment of beer would only grow these welcome additional revenues.

In conclusion

The case for beer DtC shipping is clear. The demand is strong from producers and consumers alike, and states stand to benefit greatly. Some 20 years of well-regulated DtC wine shipping have paved the way for the healthy expansion of DtC beverage alcohol shipping.

Beer producers simply want the same kind of DtC market access that wine shippers enjoy. The data shows that DtC wine shipping is profitable for states and can be done safely. Consumers are ready for more choice and are already utilizing the DtC market. The time for expanded DtC beer shipping permissions is now.

Learn how Sovos ShipCompliant can help you manage your taxes and compliance for DtC shipping.

Talk to an expertSubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowThe Case for Spirits Direct-to-Consumer (DtC) Shipping

Introduction

The wine industry has been shipping direct-to-consumer (DtC) for more than 15 years, and this once-novel market expansion has proven win-win-win for producers (business growth), states (increased tax revenue) and consumers (increased choice) alike. And yet, spirits DtC remains a much narrower market. Why?

Spirits producers aren’t the only ones asking that question. A Distilled Spirits Council of the United States (DISCUS) survey shows overwhelming consumer demand for DtC shipping of distilled spirits. Eight out of 10 consumers surveyed said distillers should be allowed to directly ship their products to legal-age consumers in any state. Additionally, some 76% said they would consider purchasing spirits online shipped directly from distillers to them from outside or within their state.

Lessons from 15 years of DtC wine shipping

DtC wine shipping is a $4.2 billion market as of 2021. Because DtC shipping and three-tier distribution complement one another, the three-tier system has continued to thrive in its central role in alcohol distribution even as the DtC channel has grown. In fact, while DtC wine shipping has been in place for 15+ years, it makes up 10%-11% of total off-premise wine sales in the U.S. (as estimated by Jon Moramarco, managing partner at bw166).

The success the DtC wine channel has found has gone hand in hand with shippers’ commitment to following state regulations and tax requirements. DtC wine shippers participate in a safe, well-regulated market, complying with varying state regulations that include:

- Getting properly licensed by the destination state;

- Abiding by regulatory rulings of the destination state;

- Conducting age checks and preventing sales to minors; and

- Correctly determining, paying and reporting on taxes owed to the states.

Additionally, shippers abide by destination states’ jurisdiction in terms of other producer-enablement rules that include customer volume limits, the registration of brand labels and brand ownership requirements.

Distinct product offerings

The products that reach consumers through the DtC wine shipping channel are not the same ones they are shopping for at their local retail outlets. Rather, wineries typically offer special allocations or other higher-end, limited offerings via the DtC channel — compared to more inexpensive wines that are widely available at retail or for which a consumer would be hard-pressed to justify the shipping cost. In fact, the average price per bottle of wine shipped DtC hovers around $40, three to four times the average price paid at grocery stores and liquor shops.

Thus, there is generally no direct competition between the products available through these different channels — though a producer that grows its fan base via DtC shipping can expect to see increased demand for their products sold through the three-tier system.

From a DtC shipping standpoint, a bottle of wine and a bottle of spirits look a lot alike — and as in wine, spirits producers offer a number of speciality or limited production releases — so there is every reason to expect that as more states open to DtC spirits shipping, the spirits industry will follow wine’s lead in offering distinct products via different channels.

An equitable marketplace?

Across the vast majority of the U.S. — 46 states and the District of Columbia — DtC wine shipping is permitted. The map of where spirits producers are legally entitled to ship DtC is much, much narrower.

* Oregon will only issue licenses for beer shipping to breweries located in states that themselves permit DtC shipping of beer

* Pennsylvania will only issue licenses for beer shipping to brewers that hold specific wholesaler or off-premises retailer licenses; a manufacturing license alone, even one that grants such permissions, is insufficient

Accurate to October 2021

As the map demonstrates, the only seven locales open for DtC spirits shipping are Alaska, D.C., Kentucky, Nebraska, Nevada, New Hampshire, North Dakota and (in very limited fashion) Rhode Island, compared to wine’s 47.

As spirits producers have demonstrated through their compliant participation in the three-tier system, they are readily equipped to mimic the compliant behaviors of their winery counterparts in the DtC shipping channel.

What's fair for wine is also fair for spirits

How states have benefited from DtC shipping

Naturally, states are eager to maximize the tax revenues they collect, as taxes fund their service to the public, including infrastructure, education and social services.

The compliant behavior of DtC alcohol shippers to date has enriched states’ coffers to the benefit of many. As a leading beverage alcohol compliance solutions provider, Sovos ShipCompliant has facilitated states’ securing hundreds of millions in tax revenue each year. Because the footprint for legal DtC shipping of non-wine beverage alcohol is limited, the vast majority of this tax revenue is driven by DtC wine shipments.

DtC Tax Revenue Paid to States Via Sovos ShipCompliant

States opening to the DtC shipment of spirits would only grow these welcome additional revenues.

In conclusion

The case for spirits DtC shipping is clear. The demand is strong from producers and consumers alike, and states stand to benefit greatly. More than 15 years of complaint DtC wine shipping have paved the way for the healthy expansion of DtC beverage alcohol shipping.

Spirit producers simply want the same kind of DtC market access that wine shippers enjoy. The data shows that DtC wine shipping is profitable for states and can be done safely. Consumers are ready for more choice and are already utilizing the DtC market. The time for expanded DtC spirits shipping permissions is now.

Learn how Sovos ShipCompliant can help you manage your taxes and compliance for DtC shipping.

Talk to an expertSubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowHow and Where Retailers Can Ship Alcohol Direct-to-Consumer

Introduction

While direct-to-consumer (DtC) shipping was thrown into the spotlight by the COVID-19 pandemic, the popularity of shipping alcohol directly to consumers has been growing for some time. For wineries, DtC shipping is a $3.7 billion dollar industry. But for years, retailers have not been able to enjoy the same successes from this growing market.

The map of where retailers are allowed to ship DtC is much smaller than it is for wineries. But as DtC shipping grows in popularity retailers are starting to take more advantage of this channel and reach new customers, despite some of the added regulatory rules to comply with.

Here is what you need to know to consider shipping DtC as an off-premise retailer.

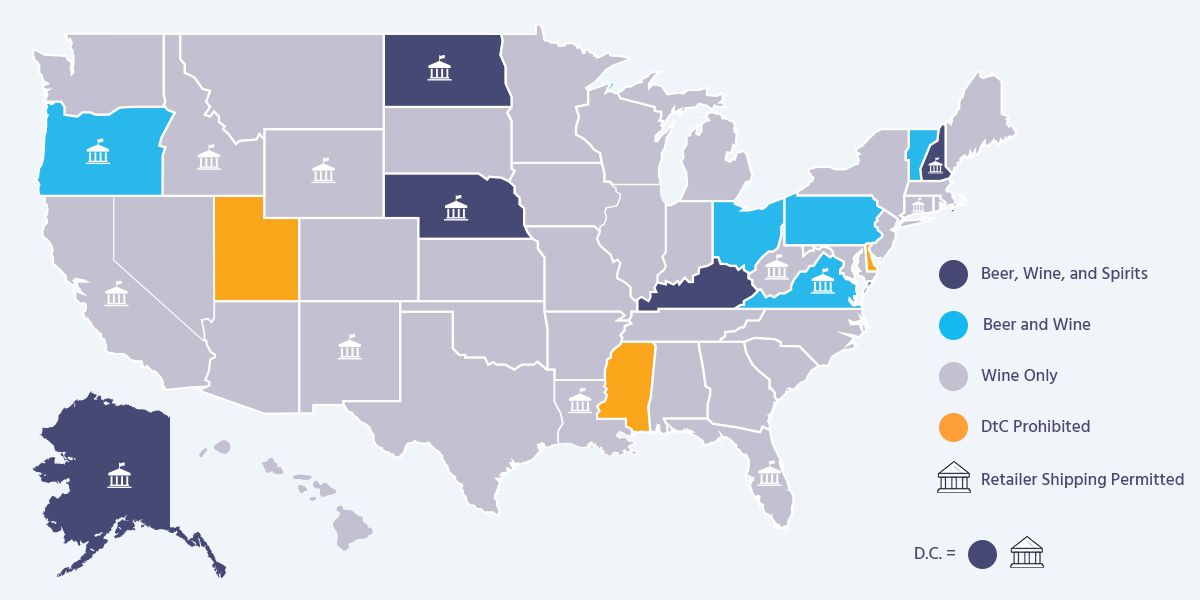

Where you can ship direct-to-consumer as a retailer

Currently, 12 states and the District of Columbia permit out-of-state retailers to sell directly to their residents, and fulfill those orders through a common carrier. Ten of these states require the retailer to receive a license, two operate under a “reciprocal” process, where only retailers located in those reciprocal states can ship to each other’s residents, and only Florida doesn't require a specific license. Except for selling to residents of these 13 states and D.C., it is illegal for a retailer to deliver beverage alcohol into any state in which it does not have a licensed retail operation.

Licensed retailer DtC states

If a retailer receives a DtC license, they may sell out-of-state directly to customers in Oregon, Wyoming, Nebraska, North Dakota, Louisiana, West Virginia, Virginia, New Hampshire, Florida, Connecticut, California and the District of Columbia. However, there are some unique situations:

- Florida and D.C. do not require an actual DtC license, but do have a set of DtC compliance rules that must be followed.

Reciprocal retailer DtC states

Beyond the 10 “license” states and D.C., there are currently two states that operate under what is known as reciprocity rules. These states are California and New Mexico, which permit shipments of wine only.

These two reciprocity states allow out-of-state retailers to sell directly to their residents only if those out-of-state retailers are located in a state that allows out-of-state retailers to sell directly to their residents without any licensing, tax or other regulatory burdens. Put more simply, the rules in state B must be as free and open for retailer DtC sales as the rules in state A for a retailer shipping from state B to sell to a resident of state A. They may also require a specific letter of agreement between the two states, indicating that there are no license or tax requirements. Currently, only California and New Mexico have such an agreement.

State rules for retailers shipping DtC

Wyoming, Louisiana, Connecticut, Florida and West Virginia permit the DtC sale of wine only for retailers. Nebraska, North Dakota, D.C. and New Hampshire permit the DtC sale of all types of beverage alcohol. Virginia permits the DtC sale of beer and wine, as does Oregon. However, Oregon only allows beer to come from states that themselves permit DtC shipping of beer.

Some other state considerations to be aware of include:

- West Virginia and New Hampshire have “dry” communities where it is illegal to sell alcohol in any manner, including DtC.

- West Virginia and Virginia will require a DtC seller to indicate to the alcohol control boards which labels will be sold via DtC.

- Virginia requires a retailer to post that they have permission from the manufacturer to resell their products through DtC, and also prohibits DtC sellers from using third-party marketing to advertise their DtC shipping option.

Packaging

When alcohol is being delivered direct-to-consumer, it must be shipped in a properly labeled package indicating it contains alcohol and an adult’s signature is required for delivery to be made. Carriers experienced with the DtC market (USPS is prohibited by federal law from accepting any packages containing alcohol) are aware of these rules and will collect signatures. These carriers will also ensure retailers have valid DtC licenses before agreeing to ship their packages. When choosing a carrier to use, a retailer should make sure that they have a well-thought out and developed alcohol program and clearly commit to fulfilling their regulatory requirements.

Tax and compliance for DtC retailers

Retailers must also follow specific tax rules. Every state that allows retailer DtC shipping, D.C., require the seller (i.e., the retailer) to collect and remit both excise taxes and sales taxes for the state they ship into. Most states also require a regular report from the retailer detailing the DtC sales they have made, though this is often coupled with an excise tax return.

While retailers should already have a handle on managing sales taxes for sales made at their licensed premises, once they begin engaging with DtC shipping they will be faced with a much bigger burden handling sales taxes in all the states they ship into. This can get complicated, because the correct sales tax rate is based on the customer’s exact deliver-to address, which can be some combination of state, county, city, and special district rates. Some states do make it easy by having a single state-wide sales tax rate, but there are places where the tax rate can be different depending on what side of the street a shipment goes to.

This can make the process of collecting and remitting tax very difficult depending on the state. Tax returns that are still reliant on paper forms or more manual filings processes can also make things difficult for a retailer now dealing with tax policies in several states at once. More states are moving toward simplified online filings, but properly collecting and remitting sales tax remains a major burden for DtC alcohol shippers.

Excise taxes

For retailers, excise tax obligations represent a novel challenge that, unlike sales taxes, many retailers may not have much experience with. This is because while excise taxes are ubiquitous in alcohol sales, they are typically handled by the distributor or possibly supplier in a three-tier sale, and therefore have been handled by the time any alcohol gets to a retailer. However, because shipping alcohol DtC into a state eliminates the parties who would normally remit the state’s excise tax, states require all DtC shippers to directly pay the excise tax due on their shipments.

Unlike sales taxes, excise taxes are fairly straightforward. They are based on the total volume of product shipped into a state, and while the rates can vary state to state, there is only one rate for a single product type or ABV range in a state. Typically, the rates are lowest for beer and cider—maybe 20 cents per gallon—and highest for spirits, with wine rates generally in the middle. One major difference for excise tax from sales tax is that the retailer may not collect the amount of excise tax due from the consumer at the time of purchase like they can with sales tax. Instead, the excise tax is supposed to be built into the listed purchasing price of the alcohol sold.

While excise taxes are in some ways a relatively simple aspect of the compliance burden for DtC shippers, they present a unique complication for retailers engaged in DtC shipping.

Filing a remittance is generally simple, only requiring the shipper to catalog total shipments made and calculate the tax due based on the products shipped. An excise tax return can be made more complicated if the return is required to be accompanied by a shipping report, for which the shipper must provide a detailed list of all shipments made during the reporting period, including date of delivery, name and address of recipient, and products shipped.

While excise taxes are in some ways a relatively simple aspect of the compliance burden for DtC shippers, they present a unique complication for retailers engaged in DtC shipping. This is because all alcohol sold by retailers has already had their state’s excise tax assessed and remitted against it. Retailers are required to purchase the alcohol they resell within their state’s three-tier market, meaning that it came from a local distributor (or from a self-distributing manufacturer where allowed) who was already obligated to pay the local excise tax for that alcohol. But if the retailer then resells that alcohol DtC into a different state, they would be obligated to remit the excise tax of that other state as well.

For example, if a California retailer ships a wine DtC to a consumer in Illinois, that wine would have already had a 20-cent per gallon tax remitted to California (paid by the distributor or winery the retailer received the wine from) and then would also be subject to the $1.39 per gallon excise tax in Illinois, to be paid by the retailer. As such, this creates a double-taxation scenario where alcohol shipped by retailers DtC is ultimately subject to more tax than alcohol shipped DtC by the manufacturer (who can sell alcohol that has not already been tax-paid in their home state). Requiring DtC shippers to remit the ship-to state’s excise tax does make policy sense, to create parity with other sales in that state and ensure the state keeps its coffers full, but the extra burden on retailers engaged in DtC shipping remains a point of contention, though perhaps it may just be the price paid by retailers to engage in this market.

Will DtC shipping for retailers expand in the future?

While there is a lot of interest among retailers and consumers for DtC shipping opportunities, the map for retailer DtC shipping map is a lot smaller than it is for other entities, particularly wineries. Part of the reason for this is the perception of unfair advantages that a remote retailer might have over local retailers, which leads to demands for laws restricting “foreign” competition. There is also concern among regulators that they lack the jurisdiction to properly monitor and control retailers located in other states. However, the general success of retailer shipping in the states that do allow it would seem to belie these concerns.

Another issue currently facing the retailer DtC shipping market is the lack of a national policy on whether states can extend discriminatory permissions for local retailers to do DtC shipping, while blocking that permission for remote retailers. The 2005 Supreme Court case Granholm v. Heald established the modern jurisprudence around DtC shipping of alcohol, primarily that states could not allow local shipping of wine while prohibiting it from out-of-state sources. However, that case only mentioned producers (wineries, really, but it has become accepted that the principles would also apply to breweries and distilleries) and it left open the question of retailers. There have been efforts over the years to extend Granholm to retailers, but they have been unsuccessful so far and even faced increasing pushback in just the last year or two.

Nevertheless, if the number of states that allow out-of-state retailer DtC shipping were to expand, there would be great benefit for consumers. There are a number of retailer DtC myths saying that out-of-state retailer DtC permissions would harm local retailers and that states would miss out on the tax revenue. This is untrue, as evidence shows that where allowed to ship DtC, retailers are active in complying with regulatory requirements, including getting licensed and protecting against sales to minors. Those states that allow retailer DtC shipping have earned additional tax revenue they otherwise would not have and they continue to have thriving local retailer markets.

The fact is that shipping of alcohol entails a lot of additional costs, particularly when it comes to the time and fees for shipping, that do not exist with local retailer sales. As such, DtC shipping by retailers largely focuses on purchases of specialty or unique wines that are not distributed in the destination state. The key example is the Nebraska consumer looking for a specialty imported wine that is sold only by one or two select New York retailers who have access to the importer; there is not enough demand in Nebraska (or most states) for a local distributor to pick up that wine, and therefore it is otherwise unavailable to the Nebraska consumer. (While many states do offer “special order” options, that is a long and complicated process that depends on finding a local distributor willing to take the time and effort to manage a single sale.) This is a very different scenario than the sale of a $20 bottle of widely distributed wine, for which any consumer is going to rely on their local wine shop for a purchase.

Hopefully, as DtC shipping continues to grow, more states will see the benefits of retailer DtC shipping and pass legislation that allows consumers to purchase beverage alcohol products they normally wouldn’t have access to.

Learn how Sovos ShipCompliant can help you manage your taxes and compliance for DtC shipping as a retailer.

Talk to an expertSubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowWhite Paper: A Guide to Direct-to-Consumer Taxes for Brewers and Distillers

Get the whitepaper

Brewers and distillers entering the direct-to-consumer (DtC) shipping channel face numerous regulatory requirements, including a variety of tax implications. In fact, taxes on DtC shipments present a special challenge, as they require the shipper to recognize and manage a broader tax burden than if they were selling only through a state’s three-tier system. This extends to both a state’s excise taxes, based on the volume of sales made, and a state’s sales taxes, based on the value of sales made.

This free white paper takes a look at what those obligations are and how breweries and spirits producers can navigate them. Topics discussed include:

- Sales tax rules for shipping beer and spirits direct-to-consumer

- Excise tax requirements

- Some unique tax scenarios for DtC alcohol shippers

Staying on top of tax obligations is critical to remaining in compliance when shipping alcohol to consumers across state lines, thus avoiding the risk of fines and other penalties.

Download your free copy of this white paper today for an expert overview of these essential tax topics for DtC beer and spirits shippers.

Subscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe nowGuide to Interstate Beer Distribution

Everything you need to know to know about expanding into new states

Foreward

For breweries looking to expand their beer distribution, there are numerous rules and requirements that need to be followed and failure to do so can get in the way of expanding your reach or even block you from getting in there at all. A clear understanding of what is allowed where, what isn’t, and what’s required of your business by state and federal regulators is essential to successful market expansion.

Brewers have a ton of regulations to abide by; it’s true when you set up your brewery and it’s true when you want to sell into a new state—the importance then is recognizing what that new state requires.

How did we get here, anyway?

The 21st Amendment set up a national system where each state can establish its own individual rules for the sale, production, transportation, and consumption of alcohol within their borders. This means that when you do any of these activities in a particular state, you have to follow that state’s laws—and they can enforce these rules on any business engaging in these activities within state lines.

For every state you distribute into, there’s a whole new set of laws that you need to follow, adding to the intricacy of interstate distribution. This is where a lot of breweries can get caught—assuming that what is allowed in their home state automatically translates into permissible activity in new states.

In-State and Out-of-State Beer Distribution Permissions

Selling beer in your home state

Over the last few decades, every state has adopted rules that enable easier sales for in-state breweries. These can include on-premise sales at tasting rooms or at your production facility, self-distribution to local retailers and restaurants, giving samples away at your tasting room, and selling beer to-go from your tasting room. But these permissions almost always only apply to local sales, sometimes limited to just within the county where you’re located. States rarely grant these permissions to out-of-state breweries. Instead, when you begin selling across state borders, your brewery will operate within that state’s three-tier system. In doing so, your brewery can benefit from the services and direct connections that distributors bring to the table.

Interstate beer distribution

Home state permissions, like self-distribution and giving away samples, are almost never available when distributing out-of-state. And this requirement to sell through the three-tier system even applies to incidental sales or attending events. For example, if you want to sell your beer at a festival in a different state, you may have to get a license, register your brands, and get them to the festival through an in-state beer distributor.

Varying State Laws

Similarities and differences among states’ laws

So when you’re selling into a new state, where do you look for the rules? Each state sets up its own alcohol rules, and each state has its own government organization that enforces these rules. These departments—like the California Alcoholic Beverage Control, the New York State Liquor Administration, or the Michigan Liquor Control Commission—are where you should look for the rules and compliance requirements.

On the one hand, there is plenty of commonality among states’ beer distribution rules. They follow a similar pattern, from set-up (licensing and product registration) to implementation (distribution and franchises) to follow-up (reporting and taxes). But no two states’ laws are exactly the same—so even if you have a handle on one state, you’ll still need to learn the particularities of each additional state you enter.

Licensing

Getting licensed

The first step to beer distribution for any state is to get licensed. You will need to show you have a TTB-issued Brewer’s Notice and a production license from your home state in order to get the beer distribution license.

Similarly, almost every state has a specific license that they require out-of-state beer suppliers to have before the supplier can distribute their beer in that state. So, for every state that you want to distribute in, you’ll need to get another separate license.

If you’re selling into a state without a license, that is a clear and obvious violation, and one that a state will enforce very strictly. And if you subsequently apply for the necessary license, you will need to report that violation, which that state would not take a friendly view of, likely souring your chances to get that license.

As such, it’s critical to understand all the licensing requirements before entering a new state. While getting an out-of-state supplier’s license is not the most complex process (at least compared to getting your Brewer’s Notice), it can still be difficult and time-consuming since it can require providing a state with a lot of personal and corporate information.

Licensing watch-outs

It’s crucial you make sure you’re getting the right license. Every state calls their supplier license something different, and it can be easy to accidentally use the wrong form or check the wrong box. Make sure to review the state rules and see what is the appropriate license for out-of-state businesses and what permits the sale of beer to in-state distributors.

Similarly, you may not see an available license. Alaska and D.C. do not require you to have a license to sell to local distributors—you still need to abide by their three-tier system, but you can engage with distributors without a license. Florida also does not mandate a specific license, though you still need to register with the state as the Primary American Source of your brand/labels.

And New York and New Jersey do not even offer an out-of-state supplier license. Instead, the only available license in these states is to become an in-state distributor, which can be very complex and costly (hint: it requires having a business headquarters in the state; so many out-of-state brewers instead find a New York or New Jersey wholesaler to act as an authorized brand dealer in their respective state).

Product Registrations

Getting COLAs from the TTB

Product registrations begin at the federal level with obtaining a COLA (Certificate of Label Approval) from the Trade and Tax Bureau (TTB). Many small breweries may be unaware of this requirement, as COLAs are not required for the sale of beer that is sold solely within the borders of the state where it was produced. But once you start selling across state borders, it becomes an interstate sale which kicks in federal labeling rules.

Applying for a COLA can be done online, which the TTB will review within a week or two. TTB agents will thoroughly vet your labels for all required and prohibited information and approve them, or send them back for correction if they see anything out of place—which does happen about half the time. Having to resubmit a COLA application, often for something minor like improperly stating the volume size, can create a lengthy and hard-to-track process—editing and resending labels multiple times. To minimize these delays, research label requirements ahead of time or use an automated solution to track and submit registrations.

State product registrations and price posting

In addition to federal registrations, almost every state has its own product registration requirements to ensure 1) that they know what products are being sold through state-compliant distributors and 2) that they are properly labeled.

An aftereffect to product registrations is price posting. This helps ensure fair dealings and not favoring any one distributor. Where present, these price posting rules require you to regularly provide your listed prices to the state and give the state and your distributors a warning of price changes, which can restrict when a price change can become effective.

Product watch-outs

The TTB requires a lot of specific information in a specific format for label submissions, so frequent non- compliance results in rejections and send-backs. To avoid these delays, use tools like LabelVision and the TTB’s Beer Beverage Alcohol Manual (BAM) before submitting.

Some states are rather easy when it comes to registrations, merely requiring getting a copy of your COLAs. Other states are very complex and will do their own multi-week review of your labels. Often states also require the submission of supporting documents, like distributor territory assignments, authorization notices, and laboratory analyses.

sovos.com/shipcompliant

Distributing

Distributor relationships

Distributor relationships are essential both for instate and interstate market access as they can be key allies in brand ambassadorship, advertising to retailers and engaging consumers. But, it’s also important to acknowledge that your beer is not the only one they sell. So it’s critical to have a solid, clear contractual agreement with your distributor(s) setting out clear and trackable expectations. In addition, you should see what you can do to support them and help them sell your products.

However, many states set out restrictions on where and how your distributor arrangements may operate. These can limit you to work with a single distributor in the entire state or perhaps one distributor in a given territory or just one distributor per brand. These agreements will need to be documented and likely shared with the state so they can police them.

It is also extremely important to recognize state franchise rules. These laws restrict your ability to terminate or renegotiate your existing distributor agreements. They can require you to provide clear, documented proof of good cause when you want to adjust or cancel an agreement, and can even limit what is defined as “good cause.” They can require you to give your distributor months to correct any problems, and even then not allow you to cancel. In a word, these franchise rules can lock you into a bad relationship with a distributor that doesn’t give your products the care and attention you want. Recognizing where these franchise rules exist and getting ahead of them by establishing clear and followable distributor agreements in written contracts is critical to avoid greater problems down the road.

Taxes and Reporting for Beer Distribution

Excise taxes

Taxes are a large part of alcohol sales at both the federal and state level. As a brewery, you pay taxes on your production to both the TTB and your home state, but your interstate beer distributions are also taxed by every state you sell into. Generally, these excise taxes are paid by “the first party to own the product in that state,” meaning your distributor. However, there are a few exceptions (Wisconsin and Ohio for two) where you as the out-of-state supplier will need to remit to the state the appropriate tax money based on the volume of product you sold there.

It’s also important to note—something that even larger breweries forget—that you should not pay excise taxes to your home state on beer that you distribute out-of-state. As such, your exports and interstate sales should be deducted from your total local production so you only pay home state excise taxes on your beer that is actually consumed in your home state.

Shipping reports

Beyond excise taxes there are general shipping reports to file. Almost every state that you ship into will require you to provide follow up reports indicating what you sold into the state, when, and to whom. This is how the state verifies their tax collections from distributors. These reports can range from very simple, like a single statement on total volume, to more complex, like a thorough summary of all your invoices in a given period of time.

Direct-to-Consumer Shipping

The direct-to-consumer (DtC) shipping of beer is a developing topic with growing interest. DtC shipping of beer—where consumers purchase it over the internet or at a taproom and then the order is fulfilled through a service like FedEx or UPS—is generally not allowed. Currently only Alaska, Nebraska, Nevada, New Hampshire, North Dakota, Ohio, Pennsylvania*, Oregon, Vermont, Virginia and Washington, D.C. allow interstate DtC beer shipping. (*Pennsylvania will only issue a DtC beer shipping license to businesses that hold a wholesaler or off-premises retail license in their home state.)

However, the temporary COVID-19 relaxations have brought a new look to these rules, and questions whether states might adjust them. Several states have issued emergency provisions allowing local DtC shipping of beer (actually, these provisions don’t “allow” such shipments, but they indicate the state will not prosecute local brewers who violate otherwise effective prohibitions during the emergency). But these are temporary provisions, and making them permanent will require each state’s legislature to change their statutes. And once these laws are amended, breweries will need to abide by the rules that govern DtC shipping of wine—like licensing, shipping volume limits, expanded tax requirements, and using specific shipping services.

The Importance of Compliance for Beer Distribution

Consider compliance with federal and state laws the baseline of success. Failure to follow federal and state beverage alcohol regulations can have a variety of consequences—most commonly monetary penalties, but in severe situations it can lead to a loss of license.

Penalties and other unwanted consequences

Not prioritizing compliance can quickly snowball into numerous consequences. For example, delayed licensing or product registrations due to an incorrect filing can mean having to hold off on future sales, hindering your growth. It can be quite costly to have your production team, sales department, and everyone else held up because you need another few weeks to get a COLA.

Fines are a relatively common penalty that states and the TTB are imposing on brewers who violate the rules. While many recent high-profile fines have focused on trade practice violations, a fine of a few thousand or tens of thousands of dollars for repeatedly selling without registering a brand/label would not be unthinkable.

While extreme, the loss of a license is another potential consequence. If you lose a license, you’ll forfeit all permissions associated with that license. Losses of licenses can compound on each other, so if you have a history of violations and losing licenses in other states, that could be reason for your home state to take away your production license—meaning you would have to close down all operations. That history will also severely restrict your ability to get future licenses (it will reflect poorly on your background checks). So, while these penalties may not have the vigor of jail time, they could easily lead to a premature exit for you from the beer industry if not careful.

Protect yourself with information

There is a lot of growth and opportunity in the market for those who want to expand their beer distribution. But, before entering it’s important to evaluate your brewery’s current operations, future goals and financial abilities.

Expanding into new markets can be an exciting time, but there are a lot of rules and nuances that could impede a brewery’s development. Knowing the rules when it comes to distribution permissions, distributor relationships, state laws, licensing requirements, product registrations, taxes and reporting, and compliance is crucial to success. Protect yourself and your brewery’s operations by remaining informed and compliant during expansion.

Sovos ShipCompliant helps breweries manage three-tier and direct-to-consumer compliance risk.

Learn HowSubscribe to our Newsletter

Get monthly updates on Sovos ShipCompliant resources, data reports, fresh resources and more.

Subscribe now