2025 Direct-to-Consumer Spirits Shipping Report

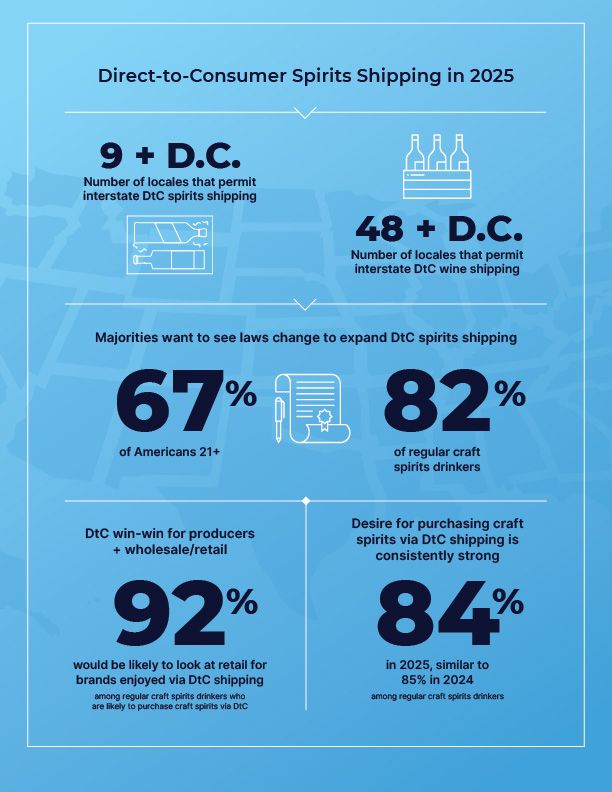

The spirits industry continues to face a pivotal moment. With only nine states and D.C. permitting interstate direct-to-consumer (DtC) spirits shipping (compared to 48 states and D.C. for wine) the gap between consumer expectations and legal access remains stark. The 2025 Direct-to-Consumer Spirits Shipping Report, produced in partnership with the American Craft Spirits Association (ACSA), explores this divide and the growing opportunity to modernize outdated laws.

What’s Inside?

This year’s report, based on a nationwide survey of 2,004 U.S. adults (including 752 regular craft spirits drinkers), reveals:

- The Regulatory Landscape: A state-by-state breakdown of current DtC spirits shipping laws and limitations.

- Roadblocks to Growth: How production caps, reciprocity rules and in-state-only permissions are stalling progress.

- Legislative Developments: Updates on 2025 bills introduced in California, Iowa, Maine, Illinois, Hawaii and South Dakota.

- Consumer Intent & Spend: 84% of regular craft spirits drinkers want DtC access. Those likely to purchase would spend $124/month, or $1,484 annually.

- Retail Synergy: 92% of DtC buyers say they’d seek out brands in retail stores after discovering them via DtC.

- ACSA’s Perspective: Why fair, inclusive DtC laws are essential for small distilleries and the broader spirits ecosystem.