General VAT information for the Philippines

| Periodic VAT return | Monthly: 20th day of the month following the end of the tax period Quarterly: 25th day following the close of each taxable quarter |

| VAT rates | 12% 0% and Exempt |

There have been improvements in recent years to VAT revenue collection in the Philippines, but there are a considerable number of exemptions from the country’s standard 12% VAT rate.

In addition to periodic VAT filing obligations, the Philippines has launched a Continuous Transaction Controls (CTC) e-reporting pilot program to improve VAT collection. It is also expected to roll out a phased expansion of this VAT control reform to the rest of the economy soon.

This page is your ideal overview for VAT compliance in the Philippines.

| Periodic VAT return | Monthly: 20th day of the month following the end of the tax period Quarterly: 25th day following the close of each taxable quarter |

| VAT rates | 12% 0% and Exempt |

In the Philippines, VAT filings are due monthly or quarterly.

When filing monthly, submissions must be made no later than the 20th day following the end of the taxable month. When filing quarterly, submissions must be made no later than the 25th day following the end of the taxable quarter, aligned with the taxpayer’s income tax quarter.

There are several qualifying factors for taxpayers who must register for VAT in the Philippines. These conditions include:

If you fail to meet your tax obligations in the Philippines, you may be fined 1,000 PHP per instance of failure. However, this can be avoided if the failure is proven to have been caused by reasonable cause and not by neglect.

Taxpayers cannot be charged more than 25,000 PHP in tax-related fines in a year. However, additional penalties, such as surcharges and interest, may also apply depending on the nature of the non-compliance.

Meeting tax obligations in the Philippines may seem complicated, but it doesn’t have to be. Choose Sovos as your compliance partner to save time and gain peace of mind that your requirements are being met.

Sovos combines solutions with regulatory expertise, serving as an extension of your team to make sure you are compliant – not just now, but in the future too. Get in touch today to get started.

Yes, the Philippines levies Valued Added Tax on goods and services. The standard tax rate is 12%.

Valued Added Taxis calculated on the gross selling price of goods or gross receipts from the sale of services.

Tourists or non-resident passport holders can apply to reclaim VAT in the Philippines on goods bought from an accredited store, if goods are taken out of the country within 60 days of purchase, and goods purchased worth at least 3,000 PHP.

China’s VAT digitization journey began nearly two decades ago with the rollout of a tax regime called the Golden Tax System. This created a national taxation platform for reporting and invoicing, as well as legislation regulating the use and legal effect of e-signatures.

With the increase of mobile payment adoption, the push towards customer-facing e-invoicing grows. The Chinese government has taken initiatives to further reform reporting and invoicing with a proposed nationwide e-invoicing service platform to provide an e-invoice issuance service to all taxpayers free of charge.

E-invoicing has been gradually introduced in China, starting with the B2C segment – in some cases by mandating large amounts of taxpayers in the public service sector to issue VAT e-invoices to their customers.

Whilst e-invoicing is not mandatory, it has been widely accepted in B2C instances for several years. It is mandatory in certain core service-based industries, including telecommunications and public transportation. Invoices are issued via the national system, and the hardware and software are certified by the state authority.

A pilot program was launched in September 2020, which enables specific taxpayers operating within China to voluntarily issue VAT special e-invoices. Special invoices are used to claim input VAT and are generally used in B2B transactions.

Electronic invoices take different forms in China. The document is automatically sent to the State Taxation Administration in XML format, and it is returned to the invoice issuer in either PDF or OFD format.

All e-invoices must include a QR code and an electronic signature, buyer and seller information, an invoice number and issuance date, details for the goods or services provided and financial information (unit price, tax rate & amount, etc).

Yes, China began its pilot program for electronic invoicing in September 2020 – specifically for B2B transactions in Ningbo, Shijiazhuang and Hangzhou.

Electronic invoicing is not currently mandatory in China, though it is widely accepted by organisations nationwide.

China’s electronic invoicing dictates that these documents must be securely archived for 30 years from their issuance.

Learn more about China’s journey to adopting electronic invoicing with the key dates below.

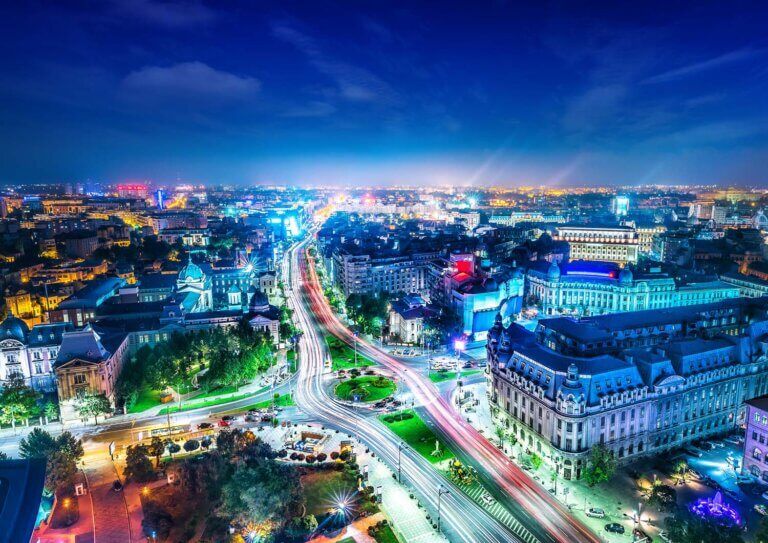

Seeking to close its VAT gap, the Romanian tax authorities have been discussing the idea of implementing measures to combat the country’s ever-increasing VAT gap. After years of discussion, the country announced its Standard Audit File for Tax (SAF-T) initiative which began in January 2022.

The Organisation for Economic Co-operation and Development (OECD) introduced SAF-T in 2005, and Romania joins a long line of European Member States adopting this form of tax legislation.

From 1 January 2022, companies in the General Directorate for the Administration of Large Taxpayers list must report their VAT electronically to the Romanian tax authorities. Transaction and accounting data must be reported through Declaratiei Informative D406 (SAF-T Romania).

This move is not uncommon and follows the trend being seen across the EU with tax administrations requiring increasingly granular data in real-time in Italy, Spain and Hungary paving the way for pre-populated VAT returns.

For more information see this overview about SAF-T in Romania.

The ANAF, Romania’s tax authority, has introduced the RO e-Invoice system. It is optional in the first phase, aiming as a first step at the relationship between companies and the state (B2G) and as a second step, the B2B transactions with high-risk products.

The ultimate goal, as is often the case when a tax administration wants visibility of more data so they can take steps to close their national VAT gap, looks set to be a system that ‘clears’ each supplier invoice prior to it being sent to a buyer.

In this respect, as of 1 July 2022, suppliers will be obliged to use the RO e‑Invoice system in B2B transactions, including high fiscal risk products. Moreover, Romania wants to expand the implementation of e‑invoicing to a broader economy as a next step.

For more information read this overview about e-invoicing in Romania.

Finally, the Ministry of Finance has announced the introduction of a mandatory e-transport system for monitoring certain goods on the national territory from 1 July 2022. The transportation of high-fiscal risk products must be declared in the e-transport system a maximum of three calendar days before the start of the transport, in advance of the movement of goods from one location to another.

The system will generate a unique code (ITU code) following the declaration. This code must accompany the goods being transported in physical or electronic format with the transport document. Competent authorities will verify the declaration and the goods on the transport routes.

September 2021: Voluntary test period began with D406T allowing taxpayers to become familiar with the data extraction and mapping requirements.

January 2022: Large taxpayers included in the Romanian tax authority’s list in early-2021 must comply with new SAF-T regulations.

1 July 2022: Large taxpayers added to the list in November 2021 must comply with the new SAF-T regulations.

1 January 2023: Medium taxpayers must begin submitting SAF-T data.

1 January 2025: Small taxpayers must begin submitting SAF-T data.

March 2020: Pilot program launched.

November 2021: Voluntary participation of B2G scheme.

1 April 2022: Voluntary participation of suppliers in B2B transactions including high-fiscal risk products scheme.

1 July 2022: Mandatory e-invoicing for B2B suppliers of high-fiscal risk products and mandatory issuance of e-transport document for the transport of high fiscal risk products.

2023: Mandate expansion to other B2B flows expected.

Understand more about Romania SAF-T including when to comply, penalties, requirements and how Sovos can help

Understand more about Romania’s CTCs including when businesses need to comply and how Sovos can help.

Need help to ensure your business stays compliant with the evolving VAT obligations in Romania?

Learn how Sovos’ solutions for SAF-T reforms and e-invoicing VAT compliance can help companies stay compliant.

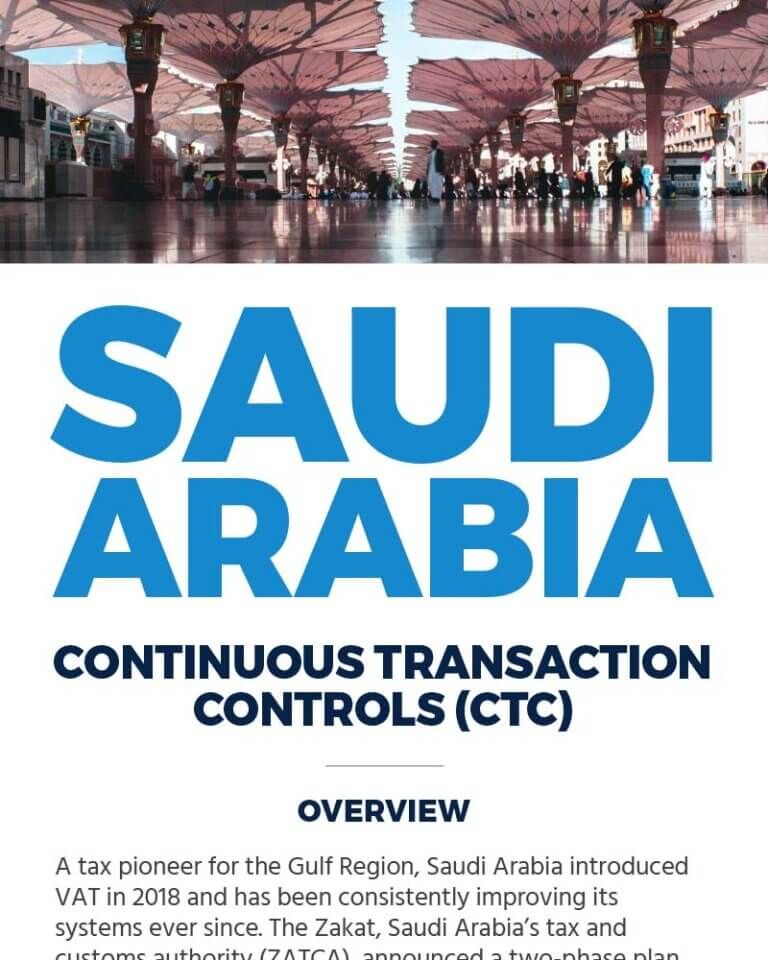

Saudi Arabia leads the way to continuous transaction controls in the Gulf

Saudi Arabia introduced an e-invoicing regime with a phased approach in December 2021. Having only introduced VAT on 1 January 2018, the country is already leading the way in digitizing tax compliance in the Gulf Region.

According to the finalised rules published by Saudi Arabia’s tax authority, Zakat, Tax and Customs Authority (ZATCA) the go-live date of the second phase is 1 January 2023.

In addition to other requirements, Phase 2 also introduced integration with a digital ZATCA platform for continuous transaction controls (CTCs), requiring taxpayers to clear invoices ahead of transmission to buyers.

Phase 1 – Mandatory e-invoicing generation with post audit controls: Started on 4 December 2021

Storage requirements same in both Phases 1 and 2. Documents can be stored on Cloud, a direct link to the online data must be available. In case the storage is outsourced, documents must be kept by a third party established within the territory of Saudi Arabia.

Suppliers must store e-invoices in a structured format regardless of how they’re exchanged with buyers.

Phase 2 – CTC regime: Started on 1 January 2023, requiring taxpayers to transmit e-invoices in addition to electronic notes to tax authority ZATCA for clearance

Phase 1: 4 December 2021 – All resident taxable persons in the Kingdom to generate, amend and store e-invoices and electronic notes (credit and debit notes).

Phase 2: 1 January 2023 – Additional requirements for taxable persons to transmit e-invoices and electronic notes to the ZATCA. It will be a phased adoption starting with larger companies, with more gradually coming into the scope of the mandate. Companies can expect six months’ notice before the deadline by which they must comply.

Understand more about Saudi Arabia’s continuous transaction controls including when businesses need to comply, phase one and two compliance and how Sovos can help.

Need help to ensure your business is VAT compliant in Saudi Arabia? Sovos serves as a true one-stop-shop for managing all e-invoicing compliance obligations in Saudi Arabia and across the globe. Sovos uniquely combines local expertise with a seamless, global customer experience.

The Import One Stop Shop (IOSS) is here. Simplify your EU VAT compliance into a single VAT return – grow your sales in the EU, avoid fines and penalties and enhance the customer experience by removing unexpected fees for buyers.

Since its launch, we’ve been helping e-commerce businesses of all sizes make the switch to the new scheme. Our IOSS service provides you full access to our VAT compliance software solutions and a team of indirect tax specialists. Let us handle the initial registration, monthly filing and intermediary requirements so you can continue to focus on what you do best.

Since July 2021, all goods imported into the EU, regardless of value, are subject to VAT. As of the same date, businesses selling imported goods valued at less than EUR 150 can now use IOSS to collect, declare and pay VAT to the local tax authorities in a single VAT return. IOSS simplifies your EU VAT compliance – unlock the full potential of the EU e-commerce market, maximise your cash flow, and provide an excellent customer service.

In order to obtain a registration, non- EU businesses need to appoint an intermediary. They can then obtain an IOSS VAT registration number in the Member State where the intermediary is established.

Let us handle the registration process, obtain a VAT number for your business and file the monthly IOSS returns. All included, no hidden fees.

Non-EU businesses can only register for the scheme through an intermediary. We can act as your intermediary for you.

Local tax authorities can issue penalties and fines to businesses if returns and payments are not submitted on time. In addition, repeated noncompliance can lead to a two-year exclusion from the scheme. Businesses would then need to register for VAT in all Member States where they import goods or have alternative arrangements in place to deal with the import VAT.

Businesses that want to use IOSS may require an intermediary. If an intermediary is required you can’t do it alone. Our comprehensive service handles all your registration, filing and intermediary requirements.

Our IOSS service gives you full access to our team of indirect tax specialists and VAT compliance software. Let us handle the initial registration, monthly filing and intermediary requirements so you can focus on what you do best.

Contact us to speak to a VAT expert and learn how to get started.

Back in 2019, Portugal passed a mini e-invoicing reform consolidating the country’s framework around SAF-T reporting and certified billing software.

Since then, a lot has happened: non-resident companies were brought into the scope of e-invoicing requirements, deadlines were postponed due to Covid, and new regulations have been published.

Sovos provides a complete VAT, SAF-T and B2G compliance solution for Portugal helping customers meet the demands of the digital transformation of tax and public procurement through a single provider. Sovos uniquely combines local expertise with a seamless, global customer experience.

On 1 July 2021, the EU introduced its e-Commerce VAT Package that replaces existing distance-selling rules and extends the Mini One Stop Shop (MOSS) into a wider-ranging One Stop Shop (OSS).

This is a significant change to VAT rules for B2C suppliers of goods and services, both as imports to the EU as well as intra-EU trading. The significantly lower pan-EU threshold of €10,000 (€0 for organizations established outside the EU) will require businesses to account for VAT on supplies in more countries.

Help your customers navigate the latest e-commerce mandate and grow your revenue in the process.

E-commerce businesses have new VAT obligations. For more on how we can partner to ensure your customers remain compliant and help them prepare for the digital future of tax, get in touch today.

Compared to the requirement for multiple VAT registrations under longstanding distance selling rules, with the OSS simplification, businesses may be able to register in one Member State and report all EU transactions through a single OSS return filed periodically. Payments are collected and distributed from the tax authority in this Member State to others where the VAT is due.

The EU e-Commerce VAT Package introduces three schemes under OSS:

On 1 July 2021: The EU e-Commerce VAT Package came into effect. Whether a business decides to use the OSS schemes or not, they still must account for VAT in all countries where they have a VAT liability. This may result in additional VAT registrations being required.

If a business decides to use the OSS simplification, then they must apply it to all qualifying transactions.

Additional record-keeping is required for OSS: Businesses using any of the OSS reporting schemes must retain more detailed records of transactions than previously. This additional data may be requested by tax authorities and used in audits to check VAT has been applied appropriately.

Declarations for Union and non-Union OSS are quarterly. The submission deadline will change to the last day of the month following the return period. Declarations under IOSS are monthly.

Businesses can correct previous OSS returns in the next OSS return. This is instead of correcting the original submitted OSS return.

Businesses established in the EU may only register for OSS in the Member State of establishment.

Non-EU businesses may need to appoint an intermediary and obtain an IOSS VAT registration in the intermediary’s country of establishment in the EU.

Non-Union OSS registrations can be in any chosen Member State. If already registered under MOSS, existing registration will continue.

Depending on the nature of business activity/supply chains, non-EU retailers may need to report under all three schemes. They will also need at least one ‘standard’ VAT registration and possibly more due to warehouses or similar.

EU businesses may have to report under OSS and IOSS as well as local registrations.

Implementing the changes required to comply with the EU e-Commerce VAT Package into an ERP system could take significant time and resources. Sovos can help ease this tax burden and help your customers prepare for, understand and implement the right solution for their business.

Our large team of advisors can help your customers navigate the complexities of modern VAT compliance.

Contact us to discuss how we can work together to ensure your customers remain compliant and help them prepare for the digital future of tax.

South Korea was one of the first countries to adopt e-invoicing, introducing e-Tax, its Electronic Tax Invoice System, in 2010. E-invoicing in South Korea has been mandatory for all corporations since 2011, and the scope of the mandate has expanded over time.

Bookmark this page to stay up to date with the latest requirements.

South Korea’s e-invoicing system consists of two processes: e-invoice issuance and e-invoice transmission. The combination of e-invoice and real-time reporting mandates is relatively unique to South Korea.

Taxpayers must issue e-invoices and exchange with counterparties via email. Following the exchange, e-invoices need to be reported to the National Tax Service (NTS).

South Korea’s NTS requires transmission of e-tax invoices to the government portal within one day of an invoice being issued.

E-invoices must also be issued to the recipient of goods or service subject to VAT via email. Invoices and amended invoices, including credit and debit notes are in scope of the requirements. Currently, e-invoicing in South Korea applies to domestic transactions only.

Penalties are based on failure type (e.g. non-issuance, issuance form, delayed issuance, non-transmission, late transmission etc.) and vary between 0.3-1% of the supply price.

Network

NTS Central Platform

Format

XML

eSignature Requirement

E-invoices should be signed using the supplier’s digital signature certificate; only certain types of certificates can be used for this purpose. Taxpayers can use either a certificate issued by the Public Certification Authority or an e-tax certificate issued by the NTS.

Archiving Requirement

Suppliers are required to store invoices for five years, but since e-invoices are stored in the NTS system and accessible to both suppliers and buyers, they are released from this obligation. However, it is recommended to keep copies in case of issues with the NTS system or fiscal disputes with tax authorities.

As countries around the globe digitize their tax systems to close VAT gaps, e-invoicing requires a nuanced approach our experts continually monitor, interpret and codify these changes into our software, reducing the compliance burden on your tax and IT teams.

Sovos can be your single-vendor tax compliance partner, helping you handle e-invoicing and related VAT obligations in South Korea and wherever else you do business.

Yes, VAT is South Korea’s consumption tax and is charged on virtually everything sold throughout the country.

E-invoicing in South Korea is mandatory for all corporations and for certain individuals with supplies over a certain amount.

VAT is charged on all supplies of goods and services, with some exemptions and zero-rated supplies of goods and services.

Here’s further information about some of the countries within Asia that require e-invoicing.

Making Tax Digital is part of the UK government’s plans to reduce errors and make managing tax affairs easier using digital tools.

Businesses must digitally file VAT returns using one of the HMRC-recognized compatible software solutions that connect to HMRC’s API. Using software to keep digital records of specified VAT-related content is compulsory.

The UK government introduced Making Tax Digital (MTD) with the aim of making filing VAT returns easier and more efficient for businesses

The regulation requires businesses to keep digital records and submit VAT returns via compatible software.

Making Tax Digital applies to all VAT-registered businesses in the UK. Electronic submission of VAT returns, digital record keeping and digital links are all requirements of the regulation.

MTD doesn’t currently apply for corporation tax, but HMRC published the results of its consultation – and there are plans for a pilot scheme. A potential mandate is likely in 2026. Bookmark this page to stay on top of future updates to the regulation.

The UK government introduced Making Tax Digital (MTD) with the aim of making filing VAT returns easier and more efficient for businesses

The regulation requires businesses to keep digital records and submit VAT returns via compatible software.

Making Tax Digital applies to all VAT-registered businesses in the UK. Electronic submission of VAT returns, digital record keeping and digital links are all requirements of the regulation.

MTD doesn’t currently apply for corporation tax, but HMRC published the results of its consultation – and there are plans for a pilot scheme. A potential mandate is likely in 2026. Bookmark this page to stay on top of future updates to the regulation.

One of the MTD requirements is ‘digital links’ – the electronic exchange of data between software programs, products or applications without manual intervention.

A digital link is required whenever a business uses multiple pieces of software to store and transmit its VAT records and returns in accordance with MTD requirements.

MTD doesn’t currently apply for corporation tax but HMRC published results of its consultation and there are plans for a pilot scheme. A potential mandate is likely in 2026. Bookmark this live blog about updates for MTD or follow us on LinkedIn to stay up to date.

Sovos can help you with MTD in two ways:

You can submit digital records using Excel as part of Making Tax Digital, as long as the file is API-enabled, or the spreadsheet is digital. However, using Excel can prove inefficient and error prone in comparison to other digital record software options.

There are a few steps involved in setting up Making Tax Digital for your business:

All UK VAT-registered businesses need to register for Making Tax Digital. New businesses will be automatically signed up for MTD when registering for VAT through HMRC’s new VAT Registration Service (VRS).

Since April 2022 Making Tax Digital is mandatory for all VAT registered businesses, regardless of annual turnover.

If a sole trader is a VAT registered business, they will have to comply with the Making Tax Digital requirements. In the UK, businesses with an annual turnover of less than £85,000 can opt to register their business for VAT but it is not compulsory.

SII Spain is an electronic VAT system that affects thousands of large companies across the country. It can seem complicated, but it doesn’t have to be.

The mandate is demanding, with the impacted groups having to stay on top of the four-day reporting period. If your business meets the criteria of SII Spain, you will likely be feeling the pressure of having to comply.

Sovos is here to help, breaking down Spain’s SII system into:

SII Spain is only one of the country’s tax compliance obligations. Our Spain VAT Compliance overview can help you stay on top of other mandates and obligations you may be subject to.

The mandate affects Spanish companies above an annual turnover threshold of over €6 million. It’s also applicable to VAT business groups, companies that participate in the monthly tax refund system known as REDEME and other businesses that voluntarily sign up.

Spain’s compliance obligations are further complicated by the country being divided into regions. Depending on where your business is based, you may well be subject to a specific combination of tax mandates.

The distinct areas where SII is applicable include:

2 January 2017: The immediate supply of information on a voluntary basis for taxpayers in Spain begins.

1 July 2017: The mandatory phase of the immediate supply of information for taxpayers under the scope of the mandate begins.

1 January 2018: The period to supply information was reduced from 8 days to 4 days. The mandate also extended to other Spanish territories (Basque Provinces and Canary Islands).

1 January 2020: Introduction of a ledger to record operations related to the sale of goods in consignment.

4 January 2021: Introduction of new validations and fields that record the sales of goods in consignment

Sovos serves as a true one-stop shop for managing all VAT compliance obligations in Spain and across the globe.

Sovos supports the Suministro Inmediato de Información (SII) platform, ensuring our customers remain compliant with the legal and technical framework developed by the Spanish tax authority (AEAT).

Sovos experts continually monitor, interpret, and codify these changes into our software, reducing the compliance burden on your tax and IT teams.

While SII Spain affects many large companies nationwide, there are numerous other compliance obligations taxpayers must be aware of.

Spain B2G E-invoicing: E-invoicing has been mandatory in Spain for all transactions between public administrations and their suppliers since 2015.

Read our dedicated Spain e-invoicing overview for more information on B2G electronic invoicing.

Spain B2B E-invoicing: Businesses are under varying obligations where e-invoicing is concerned, largely depending on the nature of transactions. Mandatory B2B e-invoicing is anticipated to be implemented from 2024.

Read our dedicated Spain e-invoicing overview for more information on B2B electronic invoicing.

Bizkaia Batuz: Batuz is a tax control strategy governed by the government of Bizkaia which applies to all companies and taxpayers that are subject to the province’s regulations.

Find out more about Bizkaia’s Batuz tax system.

TicketBAI: TicketBAI is an e-invoicing mandate from the numerous tax authorities in the Basque Country which covers Álava, Biscay, and Gipiuzkoa. It outlines obligations for both individuals and companies to use software to report invoice data to the Tax Administration in real-time.

Understand TicketBAI with our dedicated blog.

The Suministro Inmediato de Información (SII) is a platform to submit invoice data to the tax authority in Spain. Taxable persons who are in scope must report invoice data within four business days following the date of issue.

In 2020 the tax administration announced a new version of the SII, introducing a ledger to record operations related to the sale of goods in consignment. This came into effect on 1 January 2021.

The Suministro Inmediato de Información (SII) was introduced on 2 January 2017 on a voluntary basis, extending to a mandatory basis on 1 July 2017. Since then, there have been changes and additional requirements

SII applies to multiple regions in Spain, including Mainland Spain, the Canary Islands, Álava, Biskaia, and Gipiuzkoa.

This was not the case when the legislation originally came into effect, as it excluded the likes of the Canary Islands, Ceuta, Melilla, Basque Country and Navarra.

The Immediate Supply of Information (Suministro Inmediato de información) SII is a system for keeping the Value Added Tax record books in the local Tax Authority’s electronic headquarters by supplying VAT-relevant information on a near-real-time basis.

Sovos serves as a true one-stop-shop for managing all VAT compliance obligations in Spain and across the globe.

Sovos supports the Suministro Inmediato de Información (SII) platform, ensuring our customers remain compliant with the legal and technical framework developed by the Spanish tax authority (AEAT).

Sovos experts continually monitor, interpret, and codify these changes into our software, reducing the compliance burden on your tax and IT teams.

While many governments and tax authorities are now on an e-Transformation journey, this trend began in Latin America in the early 2000s. Turkey followed suit a decade later when it began the digitization of its tax system.

Turkey is further along in its e-Transformation journey than most countries – including EU Member States, which are working towards digitization in their own way with the overarching VAT in the Digital Age initiative.

From e-invoicing to electronic self-employment receipts, Turkey now has a fully-fledged, established digital tax system with many moving parts. To understand Turkey’s e-Transformation, bookmark this page then read on.

CTC Type

E-invoice clearance with both parties registered on the portal

Network

Centralised – e-Fatura Portal delivers the e-invoices to Buyers for B2B transactions

Format

UBL-TR format

eSignature Requirement

Required – fiscal stamp or qualified electronic signature

Archiving requirement

10 years

CTC Type

E-invoice reporting (daily basis)

Network

Decentralised – e-Fatura Portal does not deliver e-arşiv invoices; it’s the taxpayers’ responsibility

Format

UBL-TR format or in a free format such as PDF and must also be available in paper form

eSignature Requirement

Required – fiscal stamp or qualified electronic signature

Turkey stepped up its tax system through digitization in 2012 to help important information be gathered and transmitted with ease and accuracy. It’s further ahead than many other countries, with a variety of electronic systems and documents mandated for many taxpayers – all starting with its e-Ledger obligation.

Turkey joined the eEurope+ initiative and moved fast to ensure it was keeping up with tax digitization efforts, relieving its entire economic ecosystem where information is concerned. The aims of such changes are to reduce VAT fraud, increase governmental access to and control of data, standardise financial and accounting processes and reduce errors.

Now effectively utilising electronic versions of invoices, ledgers, delivery notes, self-employed receipts and more, there are a lot of challenges for taxpayers to overcome to remain compliant amidst Turkey’s e-Transformation.

Turkey’s ambition to electronically transform its tax ecosystem required the development and implementation of many products and services. This presented taxpayers with new requirements and, subsequently, new challenges.

Here are the products and services in Turkey’s e-Transformation system:

e-Fatura is Turkey’s e-invoicing initiative. Mandated for companies with turnovers of over TRY 5 million, this obligation came into effect on 1 April 2014. There are also sector-based parameters for the nation’s e-invoicing mandate, ignoring the turnover threshold, qualifying the following for an electronic invoice obligation:

Turkey’s e-invoicing initiative is a clearance model and two-way application, with issued invoices needing to be in the UBL-TR format and archived for 10 years. Sovos’ e-invoice solution enables compliance with e-Fatura requirements.

e-Arşiv Fatura is Turkey’s e-arşiv invoice initiative. Taxpayers registered in the e-Fatura system must also issue e-Arşiv invoices, either in the UBL-TR format or in a free format such as PDF.

Real-time clearance is not conducted for the issuance of these invoices, though an e-Arşiv report must be submitted electronically to the tax authority by the end of the following day. e-Arşiv invoices are always created electronically but must be available in paper form unless the buyer agrees to receive the document electronically.

The Sovos e-Arşiv Invoice solution makes e-archive invoice compliance simple.

e-İrsaliye is Turkey’s e-WayBill initiative. The use of e-İrsaliye documents became obligatory for taxpayers that surpass the TRY 10 million revenue threshold on 1 July 2023, though those outside of the scope can voluntarily switch to electronic WayBill documents.

There are two types of paper waybills, namely shipment and transportation. e-İrsaliye largely replaces the shipment waybill.

Information required in this type of e-document includes:

Legally, there is no difference between paper waybills and eWayBills, though the electronic version requires both parties to be registered in the national system.

e-Defter is Turkey’s e-Ledger initiative. The Turkish tax authorities made the e-Ledger application mandatory for e-invoice users and taxpayers, subject to independent audit, in 2015.

These e-documents must be prepared in XBRL-GL format and include specific information in standard XML format – all signed with a financial seal. In addition to producing e-ledgers, taxpayers are required to create a ledger summary which is to be sent monthly to the TRA and archived for 10 years.

Electronic ledgers reduce the time it takes to collect data, save costs associated with the notarization process and ensure compliance with tax processes.

e-Mutabakat is Turkey’s e-Reconciliation initiative. Reconciliation is the communication between accounts to mutually agree on the debit and credit between companies that are part of an agreement.

Turkey’s tax authority has ruled that companies are obliged to make reconciliations at particular times. The last day of the year is typically the day when the account between two parties will be closed unless an agreement or legal requirement states otherwise.

The BA-BS web application developed by the TRA for e-Reconciliation enables taxpayers to compare current agreements and unbalanced agreements before electronic submission of the BA-BA forms.

e-Müstahsil Makbuzu is Turkey’s e-Producer Receipt initiative. This commercial e-document is issued by farmers or wholesalers to keep a record of the products they buy from farmers that don’t bookkeep.

Taxpayers that are obliged to issue producer receipts have had to issue electronic versions of the document, known as e-Müstahsil Makbuzu, since 1 July 2020. However, fruit and vegetable brokers or merchants have been required to issue e-Producer Receipts since 1 January 2020.

Those obliged to utilise e-Producer Receipts may be outside of the scope of e-Fatura, e-Arşiv Fatura and e-Defter requirements.

e-Serbest Meslek is Turkey’s e-Self-Employed Receipt (e-SMM) initiative. This obligation came into effect on 1 February 2020 and applies to all self-employed individuals, including:

e-SMM receipts can be created, submitted and reported electronically and carry the same legal weight as paper Self-Employment Receipts. They must be archived for 10 years.

While all the above are prominent e-documents, there are even more electronic documents in Turkey that you should know about. To learn more, read our e-documents overview.

E-Transformation includes many documents, each subject to specific thresholds and criteria based on their type. Additionally, certain documents are mandatory for particular sectors without any threshold criteria. E-invoicing is now mandatory for the majority of taxpayers, but it is important to understand which documents are required to be submitted to the tax authorities.

The TRA continues to announce new taxpayer groups in scope of the different document types, so it’s important that businesses stay up to date with the latest information to ensure they remain compliant.

Turkey’s tax transformation aimed to deliver benefits to both the government and taxpayers.

The e-Transformation initiative aims to produce the following benefits:

Turkey’s e-Transformation has impacted tax compliance, successfully implementing real-time transmission of important financial data.

With data automatically being populated in documents, it reduces the possibility of error via manual input and fraudulent invoices being submitted. The reduction of the VAT gap has been a driving force for many countries, including Turkey.

Eliminating paper, cartridge, shipping and archiving costs associated with paper invoices is also an advantage to businesses and government.

With over 16 document regulations, Turkey’s e-transformation system requirements are extensive and complex. Understanding which regulations apply and keeping up with the latest tax compliance guidelines is key.

Sovos provided the first global e-Transformation solution suite, helping businesses of all shapes and sizes to meet the demands of Turkish tax mandates. Our platform meets all the requirements, standards and formats defined by the Turkish Revenue Authority.

Organisations choose Sovos as their global compliance partner, partly due to the convenience of having a single vendor to aid compliance wherever and however they do business.

E-defter is not mandatory for voluntary e-fatura use.

A special integrator is an intermediary service provider authorised by the Turkish Revenue Administration. Special integrators have the authority to create electronic records on behalf of taxpayers.

Designed to reduce the compliance burden and administrative costs associated with audits—while providing tax authorities with greater visibility into a company’s tax and financial data—SAF-T has continued to gain popularity across a growing number of European countries.

SAF-T may seem complicated in this country, but it doesn’t have to be. Read on for your ideal overview of this tax rule.

Norway’s SAF-T requirements apply to businesses with bookkeeping obligations who use electronic accounting systems, including registered foreign bodies. Submission is on request and doesn’t currently have periodic submission requests. SAF-T files must by ideally submitted via the Altinn internet portal.

Businesses with a turnover of less than NOK 5 million who aren’t subjected to mandatory bookkeeping are exempt unless they have electronic bookkeeping information available. Enterprises with less than 600 vouchers annually that hold accounts in spreadsheets or a text editor program are exempt.

In Norway, although SAF-T (Regnskap) reporting is mandatory, submission is on an on-demand basis following a request in connection with an audit.

Please note, however, that Norway’s VAT return, which is also a SAF-T and must be submitted every two months, should not be confused with the financial SAF-T Regnskap.

On 1 January 2022, the tax authority introduced digital submission of its VAT return, which was also enhanced to capture other data that’s already required whenever a SAF-T submission is needed. However, as SAF-T doesn’t yet need to be submitted regularly in Norway, the completion of these new summary boxes creates a challenge for companies who are unfamiliar with SAF-T.

In addition to its requirements, taxpayers should be aware of Norway’s e-invoicing requirements for B2G transactions.

With the EU’s ViDA initiative now approved, Norwegian businesses will need to send invoices electronically for cross-border B2B transactions from 1 July 2030.

Complying with your tax obligations is vital. SAF-T is one of the VAT requirements for Norwegian businesses, adding to compliance workloads.

Sovos SAF-T solutions can help your organisation to spend less time on compliance and more on growing your business. Automate your preparation process to drive efficiency and ensure accuracy, providing peace of mind that you will avoid potential fines and penalties.

SAF-T reporting in Norway is mandatory as of 1 January 2020 but submission is on an on-demand basis.

SAF-T stands for Standard Audit File Tax and is a format used internationally for the electronic exchange of accounting data. The OECD (Organisation for Economic Co-operation and Development) defines the standard for SAF-T.

Under India’s Goods and Services Tax (GST) framework, the country’s e-invoicing system falls under the category of continuous transaction controls (CTCs). India’s electronic invoicing mandate currently includes B2G and B2B transactions.

While the system has now been in place for a number of years, familiarisation and optimisation are not simple. This page aims to help, providing everything you must now about the e-invoicing system in India –bookmark it to stay on top on any future changes.

The obligation to report invoice data to the governmental portal, the Invoice Registration Portal (IRP), is a mandatory step before an invoice can be issued.

The legal validity of the invoice is conditional on the IRP, which digitally signs the invoice and provides an Invoice Reference Number (IRN). If the IRN is not included in an invoice, the document will not be legally valid.

India’s e-invoicing scope covers both domestic and cross-border transactions. The IRP process is mandatory for B2B, B2G and export transactions. So, taxpayers in scope must issue their invoices (as well as other documents that need an IRN e.g. associated eWaybills) according to the new system for all B2B, B2G or export transactions. India has made multiple changes to the initial regulation, and future changes are inevitable.

Electronic invoices must be securely archived for eight years.

Firstly, all e-invoices must be submitted to the nation’s invoice portal in JSON format. From there, the IRP will generate the IRN, include it in the JSON, and sign the file. The IRP will also generate the QR code data which can be used to generate a QR code.

Like with paper invoices and other nations’ versions of e-invoices, India has strict requirements for the information included on electronic invoices issued by businesses.

Required information includes:

India’s journey to implementing e-invoicing began in 2020 and is still ongoing. Here are the key dates and developments:

If an invoice is not registered on the IRP, it will be considered unissued and will result in penalties of at least 10,000 Rupees for each instance of noncompliance. Penalties under various sections of GST will be levied with interest.

Issuing electronic invoices is mandatory for domestic companies in India that surpass the annual threshold of Rs. 5 Crore, specifically for B2B, B2G and export transactions.

India introduced its e-invoicing system on 1 October 2020, though its use was not mandated to all taxpayers at launch.

An electronic invoice, or e-invoice, is a digital version of the traditional paper invoice that is submitted and transferred online. Many countries now mandate the electronic issuance of invoices, including India.

All companies established in India that surpass the Rs. 5 Crore threshold must issue electronic invoices when selling to businesses and government entities.

The initial specifications published by the Indian tax authority in December 2019 had already been revised three times by February 2021. Future changes are inevitable.

Our experts continually monitor, interpret, and codify these changes into our software, reducing the compliance burden on your tax and IT teams.

Find out how Sovos can help you meet your clearance e-invoicing obligations in India.

France will implement mandatory B2B e-invoicing, as well as an e-reporting obligation. This mandate impacts all companies operating in France.

This new e-invoicing mandate is complex and introduces the continuous transaction controls (CTC) model.

Note: On 17th of December 2025 the French Tax Authorities (DGFiP) confirmed Sovos as a certified Plateforme Agréée (PA). This means that Sovos is among the select few certified providers authorized to facilitate e-invoicing compliance in France, reflecting our solution’s robustness and our long-standing commitment to regulatory compliance.

France’s e-invoicing mandate, combined with the e-reporting obligation, provides the tax authorities with access to transaction data. This is to increase efficiency, cut costs and fight fraud. Whether you are a buyer or supplier, the mandate’s effect on businesses and their operational processes, financial systems and people is extensive.

This France e-invoicing guide will explain:

Network

PPF

Format

UBL, CII or Factur-X

Network

ChorusPro

Format

UBL, CII or Factur-X

Want to learn about the upcoming mandatory e-invoicing requirements in France? Download our ebook, France: A New Horizon – E-invoicing Mandate.

Sovos can help your business comply with the French mandate with a range of services:

Learn more about our scalable solution for France’s continuous transaction controls requirements.

France’s e-reporting requirements are established alongside the new e-invoicing mandate, with the reporting frequency based on the taxpayers’ applicable VAT regime. The e-reporting requirement will complement the e-invoicing mandate by facilitating the transmission of data on B2C and cross-border B2B transactions.

In France, an electronic invoice is defined as an invoice which is issued and transmitted in paperless form, following a structured format.

France’s e-invoicing requirements come into effect during 2026-2027, depending on business size. However, from September 2026, all companies must be able to receive e-invoices through an accredited service provider (a PA).

The structure of the e-invoices can be UBL, CII or Factur-X (a mixed format) or any other structured format.

Exchanging e-invoices directly between trading parties is not allowed. Originally it was intended that either a registered service provider (PA) or the centralized platform (Portail Public de Facturation – PPF) would transmit the e-invoice to the buyer party, which would then be able to leverage either a PA or the PPF for receiving the invoice.

However, the French Tax Authorities announced on 15 October 2024 that the PPF’s role has been significantly reduced and they will no longer handle the exchange of invoices for all companies across the country. As such, the French State’s “own free-of-charge” PA utility service will not become available to French businesses.

Therefore, all companies in scope are required to select a PA. Without the PPF being available as a free invoice exchange platform, it is estimated that 4+ million companies will now have to rely on PA-enabled accounting software to receive those transactions.

PAs are private service providers accredited by the tax authority to intermediate data flows between trading partners and the PPF. They will act as the interface between companies and the French government and will be directly involved in issuing and receiving invoices. Following the announcement, on 15th October 2024, that the PPF will no longer be acting as a free invoice exchange platform, all companies in scope are required to select a PA.

Following a rigorous evaluation process by the French Tax Authority (DGFiP), Sovos was granted its “Plateforme Agréée” (PA, formally known as a “PDP”) status, with the registration number n°0004, subject to conditions. This conditional registration recognized Sovos as one of a select few providers authorized to participate in the next phase of the DGFiP certification program, reflecting our solution’s robustness and our long-standing commitment to regulatory compliance.

These conditions required all PAs to successfully complete the official testing process organized by the DGFiP, which commenced on Tuesday, October 14th, 2025, and lasted up 3 months. Following validation by the DGFiP, final and definitive PA certification was granted to Sovos on 17th of December 2025.

There are a growing number of tax authorities that have implemented e-invoicing globally, including France, Italy, Saudi Arabia and India. There are also many countries working on implementing e-invoicing including Germany and Spain.

Sovos has put together an economic nexus thresholds table to keep you informed of each state’s effective and pending remote sales tax collection legislation.

Reminder: Remote sellers may have obligations if your sales exceed these thresholds. As such, the ability of your tax compliance software to provide always-up-to-date “roof-top” accuracy sales tax rates for any new jurisdictional obligations should be taken into consideration. Also, be sure to work with your out of state suppliers on how to handle invoicing sales and use tax, and make sure any customers with exemptions in economic nexus states have provided up-to-date exemption certificates. Likewise, some states are creating special filing regimes for eCommerce sellers to simplify the filing process, so be sure to check if you’re eligible to avoid errors.

As always – deciding whether or not to register for sales tax in a given jurisdiction is a serious decision – consider involving your accountant or trusted tax advisor if you have any questions or concerns.

Electronic invoicing in Colombia, often called Colombia facturacion electronica, is mandated for established taxpayers. While it was an early mover in giving legal weight to e-invoices, Colombia’s mandate only came into effect in 2019 and has been subject to change since.

Understanding the specificities of the rules of overall tax compliance is vital. That’s why Sovos’ regulatory experts have produced this complete overview of Colombia e-invoicing. Bookmark this page to stay up to date with the latest requirements.

All companies are required to issue electronic sales invoices with prior validation before issuance. Companies must enable themselves as electronic issuers through the web portal assigned by the DIAN.

Suppliers must also certify as Technology Services Providers (PST) and receive a unique software identifier. The standard format used is XML, following the UBL V2.1 (Universal Business Language) adopted by the DIAN.

A digital signature is mandatory to ensure authenticity and integrity throughout the invoicing process.

Invoices must use a consecutive numbering system assigned by the DIAN, along with a Unique Electronic Invoice Code (CUFE) for identification and data integrity. Issuers must create a graphic representation of the invoice in PDF format, including a QR code.

Both issuers and receivers must securely archive e-invoices for a minimum period of five years, counted from January 1 of the year following the document’s preparation, issuance or receipt.

Starting in November 2020, electronic invoicing became mandatory for all taxpayers – including B2G transactions. All suppliers must issue electronic invoices and buyers are required to receive them. Buyers do not need to validate the invoice. Acceptance or rejection is only for invoices that operate as security.

The electronic invoice is the evolution of the traditional invoice. It has the same validity as paper in a legal sense, but it is generated, validated, issued, received, and preserved electronically. In tax terms, it supports sales transactions of goods and/or services.

All electronic sales invoices for tax recognition must be validated prior to their issuance by the Special Administrative Unit of the National Tax and Customs Directorate (DIAN).

The electronic sales invoice will only be classed as issued when it is validated and delivered to the purchaser – providing it also complies with the conditions, terms and technical and technological mechanisms established by the DIAN.

The Spanish language and the Colombian peso must be used in the generation of the documents that are part of the invoicing system, without prejudice to the fact that the respective value may be expressed in another currency and in a language other than Spanish.

In the context of electronic invoicing in Colombia, equivalent documents are digital receipts issued by the DIAN (National Tax and Customs Directorate) for transactions that do not require a sales invoice.

The Electronic Equivalent Document is defined as a document that:

Adjustment notes are included for the electronic equivalent document and have been created as a mechanism for their cancellation or correction.

An electronic sales receipt is a receipt that is issued to final consumers.

The equivalent electronic documents grant the purchaser, subject to compliance with the other requirements provided for in the tax legislation, the right to discountable sales tax, income tax and complementary costs and deductions.

In the case of the equivalent electronic document (a cash register ticket with the P.O.S. system), the purchaser must be identified with the name or company name and identification number to apply these benefits.

The electronic equivalent document requires technical adjustments to be implemented in accordance with the Technical Annex in version 1.0.

Credit and debit notes are documents that allow adjustments or corrections to be made to electronic invoices. They must be generated and transmitted electronically to the DIAN for validation.

The credit note will be the mechanism for cancelling the electronic sales invoice.

This document is a type of invoice that must be issued by the buyer when purchasing goods or services from persons not responsible for issue electronic e-invoice.

Electronic Invoicing is mandatory in Colombia for businesses that are registered for Value Added Tax (VAT).

The mandate follows a pre-clearance model that came into effect in January 2019, starting with large taxpayers. It became mandatory for all taxpayers as of November 2020 and covers B2G, B2B and B2C transactions.

Electronic invoices are sent directly to the DIAN for automatic validation in the current system, ensuring that transactions are recorded accurately and efficiently.

The invoicing system comprises four steps: generation, transmission, validation and dispatch.

For more specifics on Colombia facturacion electronica (e-invoicing), read on.

The electronic invoicing mandate in Colombia applies to the following documents and transactions:

Electronic export and import invoice: Must be issued to support export and import operations and other documents related to customs operations. So far, only electronic export invoices have been developed and put into production.

The standard e-invoicing format for e-invoices in Colombia is XML. This format follows Universal Business Language (UBL) V2.1.

The XML document is generated, comprised of the information that Colombia’s tax authority requires, and then signed with a digital certificate. From there, the taxpayer’s certified software validates the data, as well as both the issuer and recipient, and reports the transaction to the DIAN.

The tax authority will then record the document, assign a unique e-invoice number, notify the issuer that it has been processed successfully and deliver the XML to the issuer.

The Clave Única de Facturación (CUFE) code enables electronic invoices to be identified unequivocally. It’s also known simply as a unique electronic invoice code and is comprised of data from an invoice and the Technical Control Content Key provided by the tax authority.

The CUFE code also ensures the integrity of documents by using SHA384 encryption.

As well as being in the XML format with a digital signature and unique e-invoice code (CUFE), valid e-invoices in Colombia must include a QR code. This is mandated by law and is possible via certified technology providers like Sovos.

For customers who cannot receive electronic invoices, they are sent a QR Code invoice for the transaction.

Resolution 165 contemplates the use of the electronic container. The electronic container is a mandatory electronic instrument used to include the information of the electronic sales invoice, debit notes, credit notes and general electronic information derived from the systems of billing – along with the validation carried out by the DIAN where applicable.

This means that e-invoices must utilise digital signatures to guarantee the authenticity and integrity of the document. The issuer must digitally sign the invoice to the standards laid out by the regulation and the tax authority’s signature policy.

Colombia’s electronic invoicing system contains multiple processes that the electronic biller, the DIAN, the technology providers and the electronic receivers or purchasers participate in.

Once the electronic biller complies with the authorisation requirements, they can start generating electronic invoices and equivalent documents.

Among the most important processes of this generation system are the following:

Validation: Colombia’s current electronic invoicing system requires invoices, and other documents issued by the person responsible for electronic invoicing, to be validated by the DIAN before being issued to their recipient.

Once this process is completed, the DIAN will proceed to register the electronic document in its databases with the value “document validated by the DIAN” while generating, signing, storing and sending a validation message to the electronic biller for its issuance and delivery to the acquirer.

Receipt of electronic documents: Electronic billers must also act as electronic receivers. To do this, they must establish an email to receive electronic sales invoices issued by their suppliers and other documents subject to the electronic invoice mandate.

This obligation is fulfilled by issuing an acknowledgement of receipt by the recipient and should only be done when the document issued has been validated by the DIAN. From a commercial point of view, if the recipient of the document agrees with the document received then they must formally accept it.

If the document does not comply with the commercial conditions agreed with the supplier, they must commercially reject the document and the associated acknowledgement of receipt issued. If, after receiving the document, the recipient does not reject it within three working days from the day indicated in the deliveryDate field (or in the issueDate field), the document will be considered tacitly accepted.

Contingency: The current electronic invoicing legislation states that if the taxpayer is unable to issue an electronic invoice, or any of the other equivalent documents, due to technological problems attributable to the DIAN, they may issue the document supporting the transaction without the validation of the DIAN.

These documents may be invoices in a paper checkbook. In such situations, the taxpayer must use the billing ranges authorised by the DIAN. After the contingency situation is over, the obligor will have a period of 48 hours to send these documents to the tax authority for validation.

The RADIAN: RADIAN is an information system that allows the circulation and traceability of e-invoices as a security title, hereinafter referred to as an electronic sales invoice value title.

Once an electronic sales invoice becomes a value title and is registered in RADIAN, negotiation is possible for the legitimate holder and/or through agents and/or operators authorised by the Ministry of Commerce, Industry and Tourism.

There are other processes aimed at guaranteeing the negotiation, transfer, endorsement and execution of said document.

Issuance and delivery of the sales invoice and/or the equivalent document: The issuance of the sales invoice or equivalent document includes its generation, transmission, validation and delivery to the purchaser for each of the sales operations and/or provision of services carried out.

The issuance of these documents must comply with the applicable legal requirements, as well as with the special requirements and the conditions, characteristics, terms and technical and technological mechanisms developed by the DIAN.

Those who do not meet the requirements of Colombia’s e-invoicing mandate may well face repercussions.

The current sanctioning system of the regime of Colombia is regulated by the provisions of article 652-1 of the Tax Statute, which basically provides for two types of sanctions. Non-compliance may result in fines of up to 1% of the value involved in invalid invoices, or the closure of establishments for up to 30 days.

Businesses that provide taxable goods or services in Colombia may need to register for VAT. The VAT registration process is done through the single tax registry (RUT). Once registered, the taxpayer identification number (NIT) is obtained.

In Colombia, all VAT-registered businesses are required to send and receive invoices electronically. All taxpayers must establish themselves as electronic invoice issuers through the tax authority’s web portal and then issue e-invoices for transactions.

Colombia’s e-invoicing regime is mandatory for all businesses that are registered for VAT. That said, there are some exclusions like financial institutions, companies with an income below a particular threshold and other segments of business.

Any VAT-registered business that is established in Colombia is required to meet the demands of the tax authority’s electronic invoicing mandate.

You can view the electronic invoice in two ways:

Using a software authorised by the DIAN to open and verify the electronic container. The software must be able to read the XML format and the digital signature of the invoice. You can use the free DIAN upload portal or a third-party software provider.

Scanning the QR code of the invoice with your smartphone or tablet. The QR code will redirect you to the DIAN website, where you can see the invoice details and download it in PDF format.

DIAN registration, testing and enablement are the steps that a taxpayer must follow to become an authorised issuer of electronic invoices in Colombia.

The process consists of the following stages:

Registration: The taxpayer must register in the Unique Tax Registry (RUT) and obtain a digital certificate to sign the electronic invoices. The taxpayer must also choose a software provider to generate, transmit and validate the electronic invoices.

Testing: The taxpayer must perform a series of tests to verify the correct functioning of the software and the compliance with the technical and legal requirements established by the DIAN. The tests include the generation, transmission, validation and consultation of electronic invoices – as well as the management of contingencies and errors.

Enablement: Once the taxpayer passes the tests, the DIAN will enable the taxpayer to issue electronic invoices in the production environment. The taxpayer will receive a notification and a number of authorisation of numeration (NAN) to start issuing electronic invoices.

Sovos is certified by the DIAN to provide e-invoicing technology and solutions to eligible taxpayers in Colombia.

With electronic invoicing becoming more common globally, following the lead of Latin American countries like Colombia, it is important that you prioritise compliance.

The global – yet fragmented – adoption of e-invoicing solidifies the need to choose a single vendor for complete compliance, wherever you do business. Sovos is a tax compliance partner you can trust.

Focus on what truly matters: speak with a member of our team today to begin reclaiming your time.

Related resources you’d like to highlight here

In 2018, Hungary established a legal framework requiring taxpayers to use a designed schema to report invoice data to the tax authority (NAV) in real-time for domestic transactions above a minimum VAT amount.

Due to the success of this measure, the scope of the mandate has been extended to include a wider range of transactions, and the earlier thresholds have been abolished. The impact of the mandate is now broadly felt in Hungary where all transactions between domestic taxable persons must be reported to the NAV, regardless of the amount of VAT accounted.

1 July 2018: Mandate applies to all taxable persons to report invoice data in real-time to the National Custom and Tax administration of Hungary for domestic transactions with a minimum VAT amount of 100,000 HUF.

1 July 2020: The VAT threshold was abolished and all domestic transactions between taxable persons in Hungary must be reported regardless of the VAT accounted.

1 January 2021: Reporting obligations include B2C invoice issue and B2B intra-community supplies and exports.

1 January- 31 March 2021: The Ministry of Finance granted a sanction-free three-month grace period to comply with new reporting obligations and to give businesses time to transfer from the current version (v 2.0 XSD) to the new version v3.0 XSD.

1 April 2021: Mandatory usage of the new version (v3.0 XSD) begins.

Failure to report the invoices in real-time could lead to an administrative penalty of up to 500,000 HUF per invoice not reported.

Additional penalties would apply for non-compliance with the invoicing software requirements.

Understand more about Hungary’s NAV system, how to file invoices, when businesses are required to comply and how Sovos can help.

Sovos enables businesses to stay up to date with the latest requirements and technical specifications so they can effectively connect with the NAV and honour their VAT compliance obligations.

Sovos has put together a marketplace facilitator sales tax collection requirements table to keep marketplace sellers informed of each state’s effective and pending remote sales tax collection legislation and responsibilities based on physical or economic nexus status.

Reminder: Remote sellers may have reporting and/or collection obligations if conducting business through a marketplace. As such, the ability of your tax compliance software to provide always-up-to-date “roof-top” accuracy sales tax rates for any new jurisdictional obligations should be taken into consideration. Also, be sure to work with your out of state suppliers on how to handle invoicing sales and use tax, and make sure any customers with exemptions in economic nexus states have provided up-to-date exemption certificates. Likewise, some states are creating special filing regimes for eCommerce sellers to simplify the filing process, so be sure to check if you’re eligible to avoid errors.

As always – deciding whether or not to register for sales tax in a given jurisdiction is a serious decision – consider involving your accountant or trusted tax advisor if you have any questions or concerns.

Stay up to date on Marketplace and other regulatory updates with our Regulatory Analysis Feed.