Blog

Global companies are increasingly using different tactics to address today’s onerous tax compliance burdens. Some rely on outsourcing to third parties, some have in-house teams to manage VAT compliance and reporting, and others look to shared services to centralise tax filing and reporting tasks. In each approach, technology is essential to keep pace with today’s […]

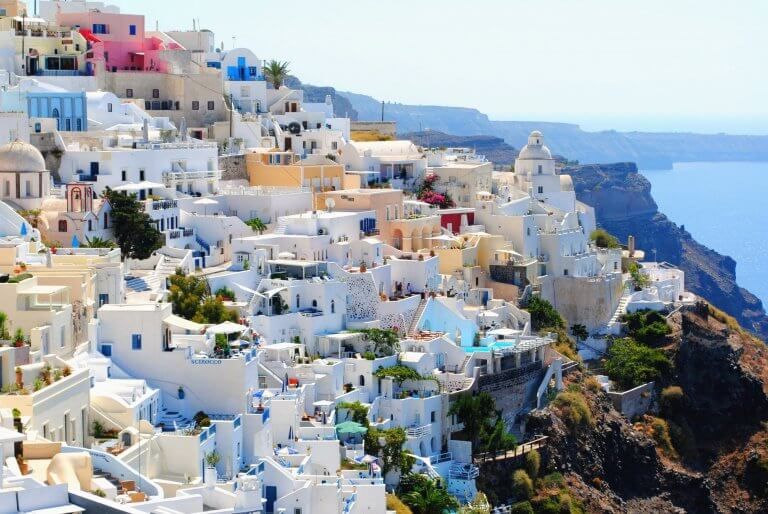

The floodgates may be opening. Following the EU’s approval of mandatory e-invoicing in Italy, it appears that Greece will be the next European Union member state to follow in its footsteps. As announced after the meeting of the intergovernmental group on 23 April 2018, the introduction of a nationwide mandatory e-invoicing framework will come into […]

Ask any business student what the secret to commercial success is and they’ll tell you it’s profit margin, not just sales volume. Therefore, to be good at selling things you have to excel at buying them. Usually, companies have a strong incentive to tightly manage what’s called ‘direct supplies.’ These are the raw materials and […]

Sovos has been named a ‘2018 Provider to Watch’ by Spend Matters, the leading solution intelligent source for procurement and supply chain professionals. This recognition also extends to TrustWeaver, also named on this years’ list and now part of the Sovos family. According to the This Week on Spend Matters email newsletter, “the annual 50 Providers […]

Rapidly changing VAT compliance and reporting regulations sweeping across Europe are forcing companies to determine the best – and most cost-effective – way to minimize the risks and burdens of these measures. These companies need to evaluate three key areas – tax/finance, IT and implementation – to calculate the potential return on investment (ROI) of […]

By Andy Hovancik – President & CEO Today, we announced the acquisition of Stockholm-based TrustWeaver to create a clear leader in modern tax software. TrustWeaver has become a seal of approval for the world’s largest procure-to-pay and AP systems. This is a testament not only to the effectiveness of its e-invoicing software and integrations, but […]

Hoje nós anunciamos a aquisição da empresa sueca TrustWeaver para criar uma clara liderança na nova era de software fiscal – e expandir nossa cobertura de e-Invoicing (faturação eletrônica) a 60 países em seis continentes. Nós estamos assistindo à faturação eletrônica espalhar-se por todos os continentes, adicionando complexidade e risco ao seu processo financeiro e […]

International News European Council Clears Way for Italy e-Invoicing Requirement On April 16, 2018, the European Council approved Italy’s derogation request from Articles 218 and 232 of the EU VAT Directive, bringing Italy one step closer to implementing its mandatory e-Invoicing requirement. Article 218 requires that Member States accept invoices in paper or electronic form. […]

With implementation of technology-enabled tax compliance and reporting initiatives, Spain is leading the way throughout Europe not only in closing the VAT gap but also in obtaining visibility into business data. As more and more countries move toward requiring transactional data in real-time, most notably Italy and Hungary, it’s important for companies to consider lessons […]

With vast changes in VAT compliance and reporting regulations sweeping across the globe, companies need to strategically evaluate their approach to compliance to ensure they stay up-to-date and minimize the risk of errors, fines, penalties and even operational shutdowns. But companies often overlook an important component in selecting a proactive, intelligent approach to VAT compliance […]

Singapore was one of the early adopters of e-invoicing in the Asia Pacific region. Since 2008, e-invoicing has been mandated for all e-invoicing business to government (B2G) transactions. But, when it comes to B2B e-invoicing in Singapore – as a country with a legal system based on common law – has until now focused mainly […]

Several nations worldwide are following in the footsteps of pioneering Latin American countries, leveraging data and automation to ensure compliance with tax regulations. Building on early requirements for VAT reporting and eFiling, many countries are now focusing on transactional data with real-time electronic accounting, ledger, invoice and receipt mandates, paving the way to reach the […]

On 27 September 2017, Italy submitted a formal request for derogation from two provisions in the European Union VAT Directive – a formal hurdle and legal necessity to be able to roll out the ambitious e-invoicing mandate for all domestic Italian invoices. While waiting for the decision from the EU Council, Italy proceeded with legal […]

Only two months remain until Hungary’s new real-time VAT reporting requirements kick in on July 1, 2018, and businesses must be prepared to comply with a fully automated process. Spain was the first country in Europe to adopt a Latin American-style VAT reporting model with its Immediate Supply of Information (SII), which requires companies to […]

International News EU Proposes An Interim Tax On Certain Revenue From Digital Activities The European Commission recently proposed new rules to ensure the fair taxation of digital business, placing the EU at the forefront in designing tax laws aimed at the modern digital economy. The Commission is seeking to instate an interim tax to generate […]

Many companies may consider government-mandated eInvoicing regulations a hassle, requiring them to revamp time-tested processes and upgrade to new technologies while adding new responsibilities and risk throughout the organization. However, eInvoicing can ultimately deliver business benefits, reducing costs, streamlining workflows and driving ROI. Consider these top 6 positive impacts of eInvoicing: Reducing costs – In […]

As a part of the Golden Tax System, the well-known tax administration system in China, the Third Stage of this system named ‘Golden Tax III’ has been fully implemented for more than a year. The goal of this stage is to establish a consistent tax administration backed by information technology and to enable highly efficient […]

In quest’ultimo anno, si è parlato molto, talvolta anche speculando, della situazione della fatturazione elettronica in Italia e, più precisamente, dell’ipotesi che l’Italia potesse o meno rendere obbligatorio l’interscambio di fatture elettroniche per tutte le forniture di beni e servizi. Dopo avere ripetutamente riferito di questi sviluppi man mano che si producevano, Sovos ritiene di […]