Blog

On 27 December 2019, the Italian government issued a decree delaying and establishing new dates for when the NSO platform would go live. The Electronic Purchase Orders Routing Node platform (Nodo di Smistamento degli Ordini, NSO) had initially been scheduled to be effective on 1 October 2019. The NSO is the Italian government owned platform […]

Digital tax reporting requirements have arrived and are here to stay. As the global VAT gap continues to grow (estimated to be as high as half a trillion EUR), countries are increasingly using complex reporting requirements to gain insight into VAT activities. In this rapidly changing environment, it’s of utmost importance for companies to ensure […]

The insurance world is often seen as slow and reluctant to fully embrace technology. However, new competition from the growing number of insurtech companies and the digitisation of reporting to local authorities are forcing insurers to wake up to the wave of technology transformation the sector is experiencing. Still, people behind technology remain key. Perhaps […]

Not all states have the same requirements for completing an unclaimed property state report. The state of New York requires that certain companies publish unclaimed property information in newspapers in the form of advertisements. It is important to note the advertising does not replace the need to send due diligence letters. Both advertising and due […]

This month, Sovos ShipCompliant is set to release the 2020 Direct-to-Consumer (DtC) Wine Shipping Report with our partners Wines Vines Analytics, based on 2019 data. Soon after, we’ll be sponsoring and presenting an exclusive first look at the report during the Direct-to- Consumer Wine Symposium near the end of January. Here is what you need […]

Tax time is upon us, which means last minute IRS and state tax information reporting changes are keeping us on our toes. Take five minutes to learn what these changes are and what you need to do to protect your business from penalties. 1. California’s last-minute change On December 9th, the Franchise Tax Board posted […]

In a post-Wayfair world, with evolving economic nexus thresholds and a squishier ‘undue burden’ replacing the bright-line “physical presence” rule as the standard for nexus, it’s no surprise that the upward trend in tax calculation volume for ecommerce from Black Friday through Cyber Monday has continued. As evident by the total number of tax calculation […]

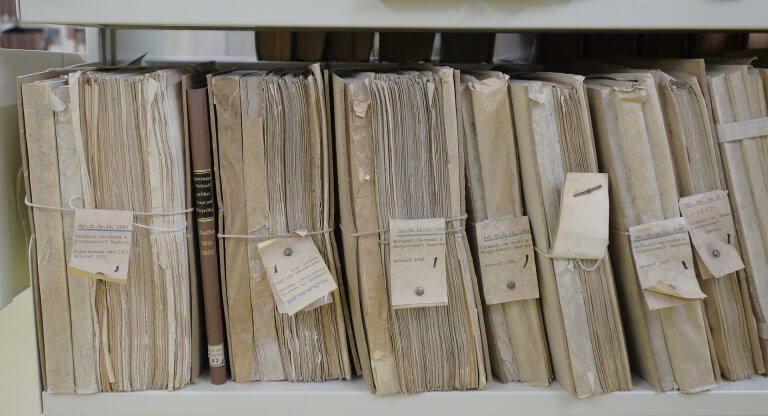

Unclaimed property retention requirements vary based on each state’s rules and regulations. Depending upon the property type and state, record retention periods can take up to 10 years, not including the dormancy period. This means you could retain records for up to 20 years. To successfully keep track of all these records and avoid an […]

Tax compliance is not just an issue that accounts receivable (AR) handles. With regulatory changes becoming more and more complex, the responsibility also lies with accounts payable (AP) to minimize a company’s risk. AP plays an important role in indirect tax compliance. States and the IRS continue to digitize efforts with tax collection and enforcement, […]

It has been several years since California changed its unclaimed property reporting process, yet many holders are still unsure how to remain compliant. This is because California’s reporting cycle includes two different reports. Below are the steps to submitting those reports and remaining compliant in California: Step 1: Holder Notice Report The first report is […]

The following is an excerpt from “Trends in Continuous Global VAT Compliance,” the 11th edition of the industry’s most comprehensive guide to e-invoicing, e-archiving and VAT reporting. The full report is available for download. To reduce the VAT gap, countries are pushing taxable organizations to comply with VAT requirements and enforcing different types of legal […]

The International Chamber of Commerce (ICC) has released the new 2020 version of the Incoterms. Incoterms are important business shorthand and understanding their express meaning and intended usage is incredibly important in minimizing business risk and ensuring compliant VAT reporting. The following information provides some basic guidance for tax compliance professionals looking to refresh their […]

HMRC administers the whole of the tax system for the UK and Northern Ireland. Although there are some 5.7 million active businesses in the UK, less than half a percent are responsible for 40% of the tax HMRC collects (approximately £217 billion in 2017). So, how well those businesses manage their tax compliance will make […]

A recent joint webinar with ASUG, “How the Wayfair Ruling Will Impact Your SAP S/4HANA® Journey,” covered the effects of Wayfair, including changing economic nexus thresholds, challenges for sellers and buyers brought on by the ruling, and how to plan for SAP S/4 HANA. Impact of Wayfair and economic nexus Since the Wayfair decision, when […]

Mexico is introducing a tax reform to be enforced on 1 January 2020, implementing a general anti-abuse rule. Its aim is to increase governmental control over the transactions carried out by taxpayers. To counter abuse of tax law, the anti-abuse rule will allow tax authorities to adjust the nature of the operations reported and, consequently, […]

Historically, the IRS required 1099 filers of 250 or more forms to file electronically (e-file). For businesses filing fewer than 250 forms, the IRS allowed paper filings. However, the 1099 reporting process will soon be almost completely electronic. The state of Oregon made a similar change in 2018, and the trend is about to go […]

For those following the ongoing tax control reform in India, 2019 has been a very eventful year for Indian e-invoicing. Starting last spring, a group of government and public administration bodies have convened regularly with the mission of proposing a new way of controlling GST compliance through the introduction of mandatory e-invoicing. Given the vast […]

Despite what you may have heard, the Affordable Care Act (ACA) tax reporting requirements are not dead. In fact, enforcement of the Employer Shared Responsibility Provisions (ESRPs) under IRC 4980H is very much alive at the federal level. And states are enforcing the individual mandate. Federal Enforcement of ESRPs Many employers and other filers of […]