Blog

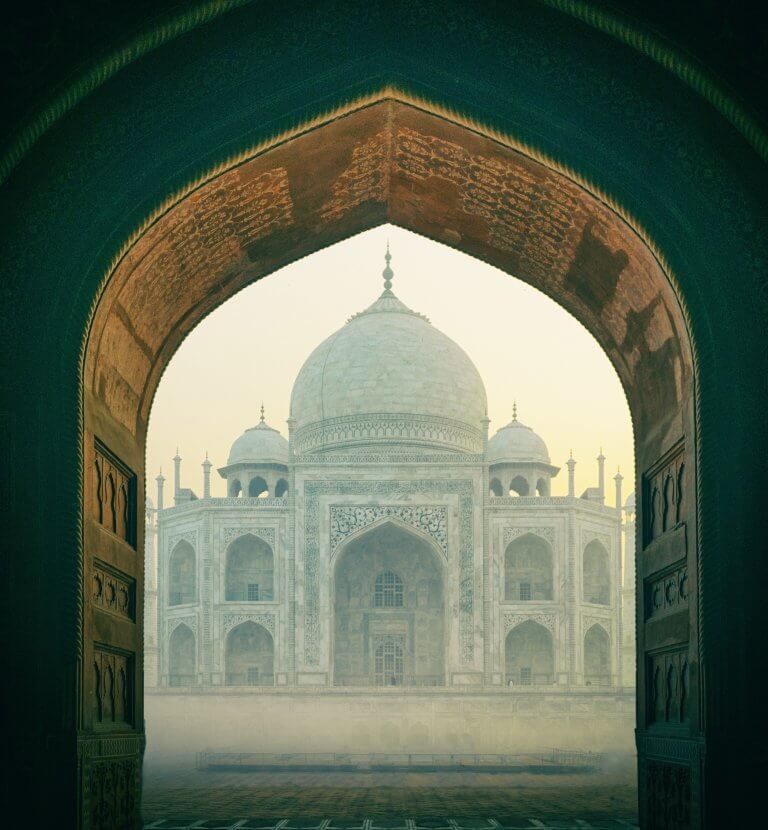

The new framework for invoice clearance in India is a hot topic that concerns many companies. This is not unexpected considering the size of the Indian economy and the number of companies that will be obliged to comply with the new framework. As outlined and confirmed in the Notification numbered 68/2019 published in the Indian […]

The wording of the EU Directive 2018/1910, effective since 1 January 2020, suggests that EU suppliers must check that other businesses they are trading with within the EU are properly VAT registered. The Directive has triggered concerns about the obligation and the timing of when these checks must be done. What is VIES? VIES, the […]

The UK officially left the European Union at 11pm BST on Friday 31 January 2020, 10 months later than originally planned due to two negotiation period extensions. Both are now in a transition period due to end on 31 December 2020. During this period, the conditions of the new relationship will be redefined and agreed. […]

With today’s announcement that SAP is extending support for its Business Suite 7 software suite until the end of 2027 many are breathing a sigh of relief. But are they falling victim to a false sense of security? While SAP adjusted its timeline, largely due to increasing customer pressure, know that governments have no such […]

In an interesting (but not earth shattering) development, on January 29, 2020 the Louisiana Supreme Court held that Jefferson Parrish could not hold Walmart.com liable to collect and remit sales tax on transactions made by third party sellers through their online platform. In short, Walmart.com is not a “dealer” as that term is defined under […]

The insurance market for 2019 was marked by two key trends: insurers implementing post-Brexit strategies, and the continuous rise of insurtech companies. But classic and more traditional insurance companies and captives have not surrendered. A hard Brexit has been anticipated by UK insurers British insurance companies have carefully planned for the different flavours of Brexit […]

Insurance Premium Tax (IPT) doesn’t represent a significant share of the total revenue generated by tax authorities. In the UK for instance, it only accounts for 1% of the total revenue while the share rises to just 4% in Germany. However, over the past five years there has been a regular increase in the amount […]

California’s Assembly Bill 5 (AB5) has sparked a national trend towards increased regulations on the gig economy. New York, New Jersey and Illinois have followed California’s lead, attempting to pass their own versions of AB5. What is AB5? Triggered by the landmark Dynamex ruling, California’s AB5 requires businesses that hire gig workers to treat those […]

In 2019, Sovos acquired Eagle Technology Management (ETM) for its history of innovation in statutory reporting and other key compliance solutions for U.S.-based insurance companies. Today, Sovos announced the acquisition of Booke, which provides critically important educational seminars to employees of American insurance companies and the Internal Revenue Service (IRS) on topics across property, casualty, […]

2019 was an exciting year for VAT and, given the ever-increasing pressure on governments to increase revenues, it’s likely that 2020 will be just as eventful. Although VAT is an ever-shifting landscape, below are three recent trends that we believe are poised to continue in 2020 and beyond: 1. VAT obligations for remote sellers Globally, […]

Experts believe Starbucks plans to enter the financial services industry. This belief is based on the huge sum of money Starbucks holds in stored value card liabilities and Starbucks’ investments in crypto. It also removed the word coffee from its signboard. Billions in value card liabilities Starbucks customers generate a massive amount of money purchasing […]

Working towards a ‘Definitive VAT System’ The EU’s Economic and Financial Affairs Council (“ECOFIN”) issued a report last month. This followed its review of EU tax policies and developments since Finland took over the Presidency of the Council of the EU in July 2019. The report is broad. It covers digital taxation, contributions to the […]

Romania has the largest so-called “VAT gap,” the difference between actual and expected VAT revenues, in the European Union. According to a 2019 European Commission study, 36% of Romania’s VAT revenues, EUR 6.41 billion, went missing in 2017. Romania’s VAT gap reached 48% in 2011, following a sharp increase in the standard VAT rate from […]

The deadline for the electronic invoicing mandate in India is rapidly approaching, and if multinationals aren’t careful, compliance issues could catch some SAP customers by surprise. On April 1, India will begin enforcing its own unique version of mandatory e-invoicing for all but the smallest businesses in the country, although the Indian tax administration has […]

Controls to close the VAT gap and combat VAT fraud The VAT gap for Europe remains around €137 billion every year, according to the latest report from the European Commission. This represents a loss of 11.2% of the expected VAT revenue for the region. The largest gaps were in Romania at 37.89%, Greece 33.6%, and […]

As part of the recently updated “new NAFTA,” or USMCA, Mexico is enticing companies to move operations into its maquiladora zone of factories along the US border. Major benefits of relocation include exemptions from value-added tax (VAT) and other taxes for qualifying manufacturers, along with a VAT rate reduced by half applied to local transactions […]

The Ministry of Finance and the State Taxation Administration are pressing ahead with China’s VAT reform having issued a Consultation Draft of the VAT law of the People’s Republic of China on 27 November 2019. It called for feedback from the public and other interested stakeholders. This draft law aims to consolidate the reforms and […]

The IRS commissioner Chuck Rettig issued the agency’s FY19 updates last month, which included updates on compliance and education initiatives aimed at the emerging gig and crypto industries. Publication 5382 was released in December to provide taxpayers with updates on the IRS’ FY19 goals. Of the six goals discussed in the report, goal two promised […]