Blog

In November 2021, a Draft Royal Decree was published by the Chancery of the Prime Minister of Belgium, aiming to expand the scope of the existing e-invoicing mandate for certain business to government (B2G) transactions by implementing mandatory e-invoicing for all transactions with public administrations in Belgium. This obligation was already in place for suppliers […]

Registering for Insurance Premium Tax (IPT) with tax authorities across Europe can be challenging and complex, particularly when multiple territories are involved. There are many elements businesses must consider when registering for IPT. What are the required supporting documents? Who can sign? Do documents need to be legalised? Is there a two-step process? These are […]

On 10 March, the European Parliament (EP) adopted a Resolution to the Commission’s Action Plan on fair and simple taxation supporting the recovery strategy, which set forth 25 initiatives predominantly related to European Union Value Added Tax (EU VAT). The document includes several general considerations and recommendations to the Commission for the VAT Directive revision […]

Poland has been moving towards introducing the CTC framework and the system, the Krajowy System e-Faktur (KSeF), since early 2021. As of 1 January 2022, the platform has been available for taxpayers who opt to issue structured invoices through KSeF and to benefit from the introduced incentives. As the taxpayers have been using KSeF for […]

Governments throughout the world are implementing government mandated e-invoicing for its ability to facilitate compliance and track fraud quickly and efficiently. Driven by the continual growth of global digitization, governments are increasingly leveraging technology to review every transaction in real-time. Real-time monitoring and enforcement has introduced a range of potentially costly penalties ranging from fines […]

Update: 22 January 2024 by Tânia Rei Pre-Filled VAT Returns: Updates in 2024 In recent years, tax authorities worldwide have embraced digital transformation to streamline compliance processes, particularly through the increasing implementation of pre-filled VAT returns. Below we explore the countries that currently provide pre-filled VAT returns or are actively working on projects to implement […]

With a new month comes yet another report due in the Insurance Premium Tax (IPT) sphere. Insurance companies covering risks in Greece must report their insurance policies triggered in 2021 in the form of the Greek annual report. This is due by 31 March 2022. Let us cast our minds back, in late 2019 this […]

Many businesses will now be involved in “cross border” transactions meaning that a business in one territory will sell and, often, deliver goods to a customer located within another territory. The existence of two or more tax territories in the transaction, and the possibility that there may be a customer in the EU and a […]

IPT in Ireland reflects the dynamic shifts in the global tax landscape. With an increasing number of tax jurisdictions adopting electronic filings, Ireland has joined this progressive movement. The Irish tax authority has announced changes to how Stamp Duty, Life Levy, Government Levy and the Compensation Fund are declared and paid from the Quarter 1 […]

Unlike many other country initiatives that we have seen in the e-invoicing space recently, Australia does not seem to have any immediate plans to introduce continuous transaction controls (CTC) or government-portal involvement in their B2B invoicing. Judging from the recent public consultation, current efforts are focused on ways to accelerate business adoption of electronic invoicing. […]

On 24 February 2022, the Indian Central Board of Indirect Taxes and Customs (CBIC) issued a notification (Notification No. 01/2022 – Central Tax) that lowered the threshold for mandatory e-invoicing. In India, e-invoicing is mandatory for taxpayers when exceeding a specific threshold (businesses operating in certain sectors are exempted). The current threshold for mandatory e-invoicing […]

Update: 7 December 2023 by Carolina Silva Spain Establishes Billing Software Requirements The long-awaited Royal Decree, establishing invoicing and billing software requirements to secure Spanish antifraud regulations, has been officially published by the Spanish Ministry of Finance. The taxpayers and SIF developers, defined further below in this article, must be aware of several new official […]

Annual reporting requirements vary from country to country, making it complex for cross-border insurers to collect the data required to ensure compliance. Italy has many unique reporting standards and is known for its bureaucracy across the international business community. Italy’s annual reporting is different due to the level of detail required. The additional reporting in […]

In 2020, the European Commission (EC) adopted a four-year plan to develop a fairer and simpler taxation framework. The Action Plan aspires to tighten up the tax system, ensure that digital platforms are made to follow transparency rules and utilise data better, reducing tax fraud and evasion. In 2021, the Commission implemented e-commerce changes – […]

Insurance is a dynamic sector in constant flux to accommodate with insured’s needs. An increase in holidays abroad following WWII saw the need for Assistance insurance for any unforeseen events that occurred away from the insured’s home country. Council Directive 84/641/EEC regulated Assistance insurance for the first time, and a new class of insurance was […]

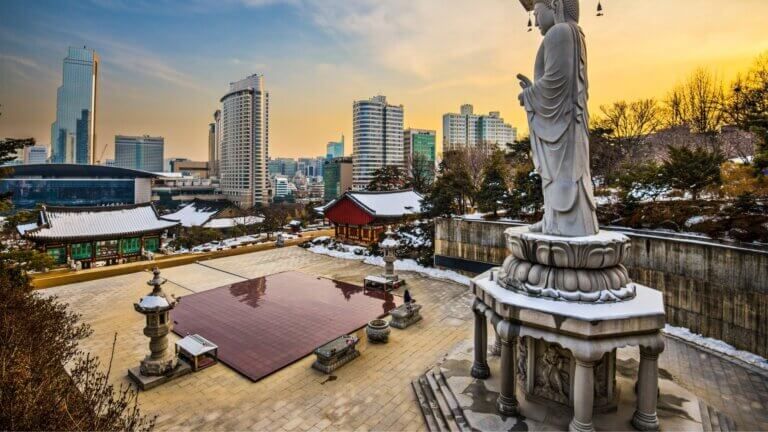

South Korea has an up-and-running e-invoicing system that combines mandatory e-invoicing with a continuous transaction controls (CTC) reporting obligation. This mature and well-established system, launched over a decade ago, is seeing its first significant changes in years. Presidential Decree No. 31445 (Decree) has recently amended certain provisions of the Enforcement Decree of the Value-Added Tax […]

The EU-UK Trade and Cooperation Agreement (TCA) provides for tariff-free trade between the United Kingdom (UK) and the European Union (EU) but does not work in the same way as when the UK was part of the EU. Before Brexit, if the goods were in free circulation within the EU, they could be moved cross-border […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team is often the first to know about new regulatory changes and the latest developments on tax regimes worldwide to support […]