Blog

By Robert M. Tobiassen* As I write this, we honored soldiers and veterans last month on November 11, Veterans Day in the United States and Armistice Day in much of Europe. It is fitting to focus on another type of devastating conflict—the trade war. First and foremost, however, please do not interpret this comparison to […]

As we inch closer to the implementation date of 1 January 2022 for Norway’s new digitized VAT return, let’s take a second look at the details. Norway announced its intentions to introduce a new digital VAT return in late 2020, with an intended launch date of 1 January 2022. With this update comes the removal […]

Even those with only a passing familiarity with sales tax understand that the tax rules and the associated compliance requirements are complex in the state of Louisiana (economic nexus only further added to that complexity). There is an argument to be made among practitioners, with strong challenges from states like Alabama and Colorado, that Louisiana is […]

As of 1 January 2022, the Declaration of Exchange Goods (DEB) will be replaced by two new declarations, a statistical survey and a VAT summary statement. Current requirements Currently, taxpayers must complete the DEB, which is a single declaration that merges a statistical section and a tax section. Taxpayers must fill out both sections of […]

The Provincial Council of the Gipuzkoa region in the Basque Country recently published Foral Order 608/2021. This establishes the schedule for adopting the TicketBAI (TBAI) obligation in that region. This local regulation also exempts certain natural persons of an age close to retirement from its compliance. What is TicketBai? TicketBAI is an initiative between the […]

Continuing our blog series looking at specific IPT-related tax acts around the world, we head to Denmark. This insight is shared in Sovos’ Guide on IPT Compliance. Written by our team of IPT and regulatory specialists, this guide is packed full of insight to navigate the ever-changing regulatory landscape. Non-life insurance tax registration and reporting […]

In our recent webinar, the team at Sovos discussed the upcoming Saudi Arabia e-invoicing mandate. The webinar covered the finalised rules for Phase 1 of the e-invoicing regime which is due to go live on 4 December 2021 as well as updates to phase 2. There were plenty of questions we didn’t have time to […]

The last time I wrote to you about recent trends with unclaimed property and financial institutions, I talked about the increased audit activities and unique challenges that financial institutions face. Read the April 2021 article here. Regardless of your industry, I am sure you have heard the Consulting Team at Sovos share just how important […]

Tax is a critical component of your business’ success and should never feel inaccessible. You don’t want your approach to tax to become a black hole where information disappears and is difficult to find. You and your teams deserve full visibility of your data and tax engine information, with self-service tools at your fingertips to […]

Whether your organization is just starting out in the direct-to-consumer (DtC) wine shipping channel or you’ve been established for years and are looking to expand into new markets, it can be a challenge to know which states to enter. It’s important to have a sense of the potential return on investment (ROI) before selecting a […]

The European Commission (EC) introduced the Import One Stop Shop (IOSS) on 1 July 2021 to simplify the accounting for VAT on goods imported into the EU with an intrinsic value below EUR 150. It is not compulsory, and there are alternative methods of accounting for import VAT on such imports. As with any new […]

Meet the Expert is our series of blogs where we share more about the team behind our innovative software and managed services. As a global organisation with indirect tax experts across all regions, our dedicated team is often the first to know about new regulatory changes and the latest developments on tax regimes worldwide to […]

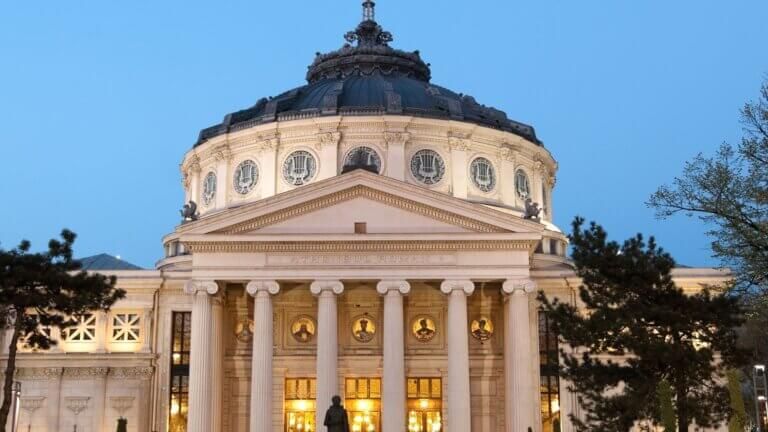

In previous blogs, we’ve taken a deep dive into Romania’s new SAF-T requirements. In the latest guidance released this week, the tax authority has provided updated implementation timelines for different sizes of taxpayers and information on the grace period. In addition to clarifying timelines, the tax authority also issued a new version of the schema […]

What is an unclaimed property securities audit? It is an audit of the holder’s equity positions (i.e., common stock) held by the shareholders of a publicly held company. These positions are recorded in an account specific to each shareholder. The accounts are generally administered by the holder’s transfer agent. These accounts include the number of […]

Phase 1 of the e-invoicing system will be live in less than three weeks. While many businesses are still implementing a solution, the Saudi tax authority continues to publish more details on their official webpage. One of the most recent announcements is about the fines the government will levy in case of non-compliance with the […]

The Turkish Revenue Administration (TRA) published a Draft Communique that includes significant changes to the Tax Procedure Law General Communique No. 509, which initially aimed to unify all e-document regulations when it was published in October 2019. With the Draft Communique, the TRA will lower the current gross sales revenue threshold for mandatory e-fatura and […]

Update: 8 November 2024 by Inês Carvalho Romania: Mandatory B2C e-reporting from 2025 The scope of electronic invoicing in Romania has been expanded to include B2C transactions, following the enactment of Government Emergency Ordinance no. 69/2024, published on June 21st. Established taxpayers are required to electronically report their B2C invoices to the RO e-Factura platform […]

Italy first introduced its e-invoicing mandate in 2019 and in 2022 they are introducing a new continuous transaction control obligation for reporting cross-border invoice data. In this episode of the Sovos Expert Series, Harri Vivian sits down with Gabriel Pezzato, Senior Regulatory Counsel at Sovos to talk through the 2022 reporting changes coming in Italy. […]