Blog

The Virginia legislature recently passed legislation which makes significant changes to the reporting obligations of gig economy participants and specifically third-party settlement organizations (TPSOs). SB 211 stipulates that TPSOs must issue Form 1099-K to report payments made to their payees. And TPSOs must report payments made to participating payees with a Virginia address if those […]

Did your business receive a letter from the Delaware Secretary of State (SOS) Office? On February 20th, the Delaware SOS office sent “over 100 letters to various companies…that have been identified as likely being out of compliance with Delaware law, 12 Del. C. ch. 11, as it relates to reporting dormant, abandoned, or unclaimed property.” […]

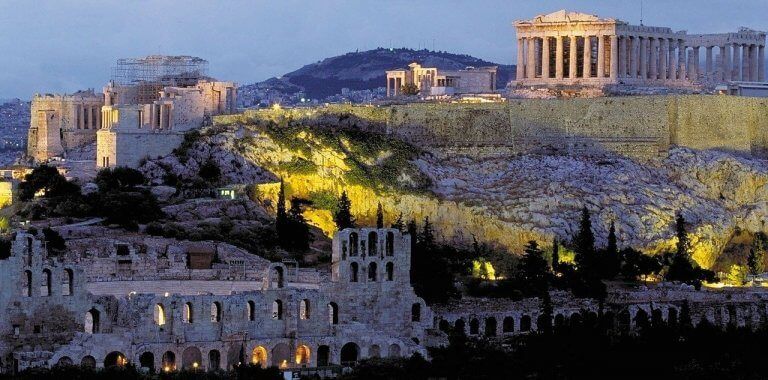

The upcoming tax reform in Greece is expected to manifest itself in three continuous transaction control (CTC) initiatives. The myDATA e-books initiative, which entails the real-time reporting of transaction and accounting data to the myDATA platform which will in turn populate a set of online ledgers maintained on the government portal; Invoice clearance, which is […]

A year and a half removed from the Supreme Court’s decision in South Dakota v. Wayfair, states are beginning to see the benefits of implementing changes to how tax is collected for remote sellers. One of the first states to jump on the economic nexus trend was Pennsylvania. Almost immediately following the Wayfair decision, the […]

Certification of e-invoice service providers is an important first step and milestone ahead of the implementation of e-invoicing in Greece. The Greek Government has now defined the regulatory framework for e-invoice service providers, their obligations, and a set of requirements needed to certify their invoicing software. Key details and parameters Scope E-invoice service providers are […]

In a recent piece published by Deloitte, Upgrading to SAP S/4 HANA: The evolving role of the tax function in large multinationals, the case is made that the move to S/4 HANA is the right time and technology for tax to embrace digital transformation. We would agree. With SAP extending the support deadline of its […]

Italy has been a pioneer when it comes to automating e-invoicing processes. It first introduced a B2G e-invoicing system in 2014 which has since evolved into a robust and mandatory platform for the exchange of invoices now also expanded to include B2B and B2C transactions. The Italian central e-invoicing platform SDI was considered revolutionary by […]

The Government Accountability Office (GAO), a U.S. Congress watchdog, published a report evaluating the IRS’s approach to regulating virtual currency (crypto) and the guidance it has offered the public. The GAO’s Recommendation However, a portion of the report was directed at the IRS and the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. […]

When Massachusetts Governor Charlie Baker issued his Fiscal Year 2021 budget proposal in late January, he proposed several ideas purporting to modernize Massachusetts sales tax by recognizing the growing importance of technology and computing power in tax compliance. The ideas are interesting to say the least. Idea #1 – Shorter Time from Collection to Remittance […]

The Government Accountability Office (GAO), a U.S. Congress watchdog, published a report evaluating the IRS’s approach to regulating virtual currency (crypto) and the guidance it has offered the public. In the report, the GAO offered three recommendations for the IRS, and an additional recommendation for the Financial Crimes Enforcement Network (FinCEN), a bureau of the […]

With little over a month left to go before the first phase of Indian invoice clearance reform goes live, authorities are still busy finalizing the technical framework and infrastructure to support it. Just a few days ago, changes were made to the explanatory schema of the JSON file that will report data to the tax […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

Whilst Vietnam has allowed the issue of electronic invoices since 2011, this has not proved popular with domestic businesses. This is mainly due to the lack of an efficient framework for commercial processes and the technical capabilities required to issue e-invoices compliantly. During the last decade, the Vietnamese government has developed a more robust legal […]

The Hungarian Ministry of Finance had a productive end to the decade. As outlined in an earlier article, the MoF announced a package of measures and proposals as part of its Economic Action Plan for 2020. The aim of the plan is to improve VAT compliance and reduce fraud. A bill to amend the laws […]

Pivotal projects in the development of EU VAT The EU’s Economic and Financial Affairs Council (“ECOFIN”) issued a report in December. This followed its review of EU tax policies and developments since Finland took over Presidency of the Council of the European Union in July 2019. In a previous article we summarised their status review […]

Value-added tax (VAT) does not exist in the United States, but American companies are increasingly having to deal with VAT mandates in Latin America, Europe and Asia. Seeking to make up a massive gap in revenues, tax administrations are mandating strict policies to digitize VAT collection. American companies that fail to comply could see their […]