Blog

We are now more than 16 months removed from the groundbreaking Supreme Court decision of South Dakota v. Wayfair. This decision unlocked the ability for U.S. states to impose a sales tax collection and remittance responsibility on remote sellers based solely on their economic connection to that state. Within that time, virtually every state imposing […]

Full compliance when it comes to unclaimed property requirements can be difficult to determine. For many businesses, it isn’t until they are audited and fined that they find out they made a mistake. Below are the most common mistakes businesses make when complying with unclaimed property requirements. 1. Reporting is mandatory Reporting unclaimed property is […]

A recent fact sheet released by the IRS shows the latest tax gap estimates and overall taxpayer compliance, and demonstrates why the IRS is likely to strengthen its tax reporting enforcement policies. The findings are based on data from tax years 2011, 2012 and 2013. The purpose of this document is to let the public […]

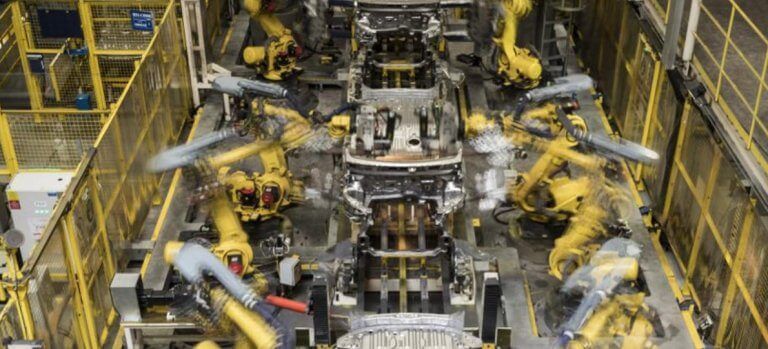

Managing manufacturing sales tax is complex for a number of reasons. You may have thousands of SKUs with taxability rules that differ across states, as well as hundreds, if not thousands, of exemption certificates to track and keep up to date for your customers. Additionally, tracking your own inventory for materials used internally that are […]

Gemini, one of the world’s most trusted cryptocurrency exchanges and custodians, has selected Sovos, the largest private filer of 10-series tax forms, to automate Gemini’s 1099 forms and filings. Sovos will enable Gemini to eliminate potential errors and get automatic regulatory updates on the ever-changing cryptocurrency compliance landscape. The growing confusion related to crypto tax […]

Nice job on getting your fall filing done! You deserve a reward! Take the rest of the day off and make yourself a drink I like to call ‘Good Escheat.’ 1-part orange pop, 1-part lemonade, 1-part rainbow sherbet. Mix it together and enjoy! And remember, just as it takes multiple different items that alone might […]

According to the October 29 Worcester Business Journal, a group of legislators and policy advocates is looking for ways to modernize Massachusetts state tax code, potentially taxing digital goods and services like music downloads or Spotify. Gov. Michael Dukakis attempted to tax services in the early 1990s, only to see his successor, Gov. William Weld, […]

Introduction Tax information reporting and withholding at the state level is often a complex undertaking for organizations to manage. With 43 states now requiring income tax withholding and reporting, and each state having its own specific requirements, compliance can be a logistical nightmare. To add to the mounting complexities of state reporting, organizations need to […]

Recently, a landmark ruling in New York shed light on a nationwide trend in the world of unclaimed property compliance. State governments across the U.S. and Canada are cracking down on businesses that fail to report their unclaimed property accurately and on time. And, as proven by the case in New York, no business, no […]

Unclaimed property results from the everyday functions of a company’s operations. As state budget deficits continue to grow, companies should expect unclaimed property compliance and related audits to continue and possibly increase. So, who is responsible for handling the process of Unclaimed Property management and escheatment to the state and keeping their company compliant? Tax […]

Ron Quaranta is founder and chairman of Wall Street Blockchain Alliance, the world’s leading non-profit trade association promoting the comprehensive adoption of blockchain technology and crypto assets across global financial markets. He will speak at the GCS Intelligent Reporting conference in San Antonio later this month. Ron spoke with Sovos recently about cryptocurrency tax regulations […]

If you have ever had a child wait until the night before an assignment is due to ask for help, or had a client push a deadline as far back as possible to start, you know the frustration of rushed and ineffective project completion. With your unclaimed property reporting process, you can reduce this last-minute […]

Managing an organization’s unclaimed property can be a full-time job. With the complexities of regulatory requirements, the numerous due diligence and dormancy tracking rules by property type and state, along with due diligence requirements, also varying by state, record retention needs in case of an audit, as well as reporting to multiple states, the process […]

“We have less than $1,000 to submit, we’ll just do it ourselves.” Does this thought process sound familiar? The thought is if it’s a small amount, it doesn’t matter nearly as much. It’s totally understandable for one to think along these lines. Unfortunately, the states may disagree with you. Regardless of the dollar amount or […]

The IRS released long-awaited guidance on cryptocurrency tax regulations this week, but the agency did little to clarify tax reporting policy. The guidance, the first update to IRS cryptocurrency policy in five years, is aimed at individual taxpayers and tax practitioners who prepare returns for taxpayers. The new information addresses information IRS Commissioner Charles Rettig […]

Many companies ask me about filing to Alberta. There is some confusion about which companies really need to file to Alberta. If your company is located or has a branch in Alberta you should file with them. If you are a company incorporated or domiciled in the United States, Canadian property records should be treated like […]

The issue of online unclaimed property reporting is an important one. State legislation varies widely on when and how to submit unclaimed property reports, and many states now require that holders use an online reporting system in order to remain compliant. As you consider your options, it is important that your online reporting system is reliable and secure. So […]

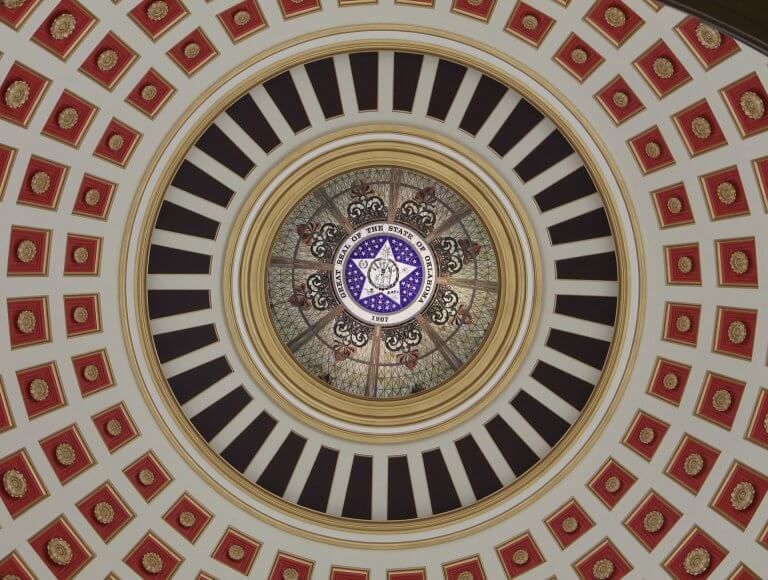

In a startling development that appears intertwined with local Kansas politics, Attorney General Derek Schmidt issued an opinion that attempts to place a temporary halt to the Department of Revenue’s (DOR) plan to extend its sales tax compliance requirements to remote sellers as of October 1, 2019 – leaving taxpayers in a state of limbo. […]