Blog

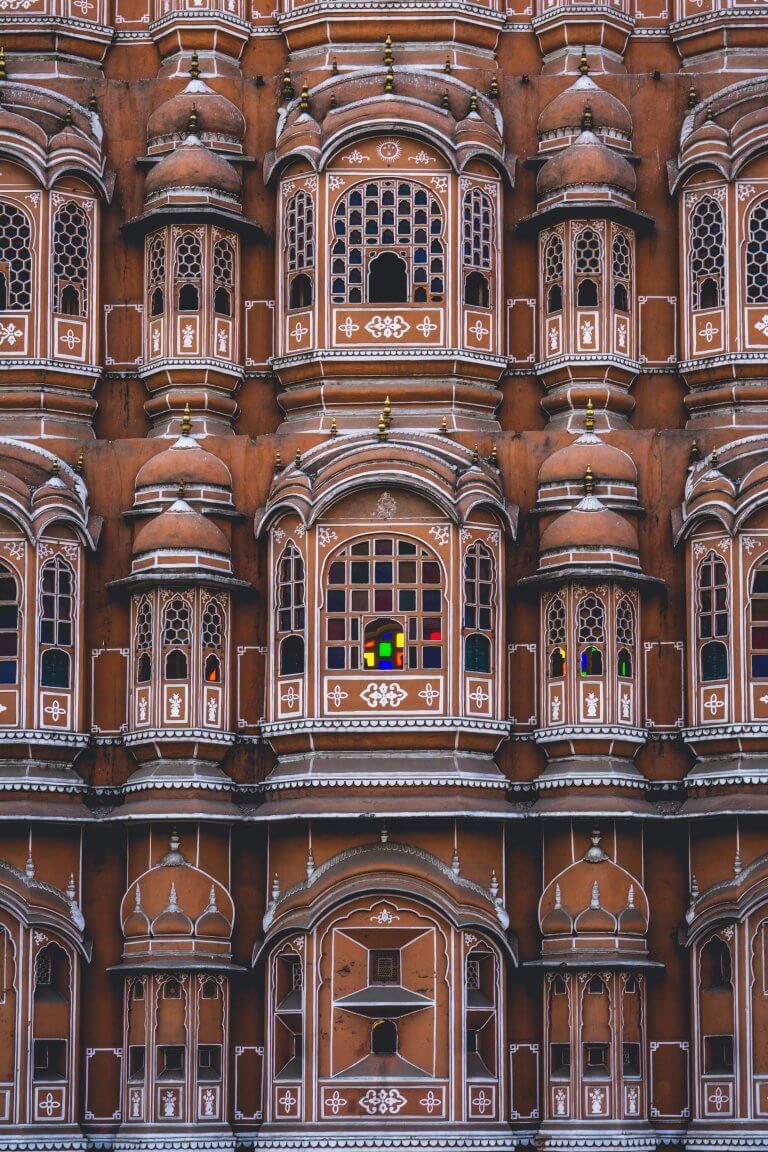

In the past five years, transaction automation platform vendors who embraced e-invoicing and e-archiving compliance as integral to their services grew on average approximately 2.5 to 5 times faster than the market. Two decades of EU e-invoicing: many options, different models Until 1 January 2019, when Italy became the first European country to mandate B2B […]

In the last several weeks, we have monitored many efforts by federal, state and local governments to provide relief to both businesses and individual taxpayers impacted by the COVID-19 pandemic. As they relate to indirect tax (VAT/Sales Tax/GST), the measures enacted to-date have followed varying paths. Here are a few examples of the types of […]

Originally posted: March 18, 2020, at 5:00 p.m. ET. Last Updated: June 29, 2020, at 5:00 p.m. ET. The impact of COVID-19 on businesses across the globe has been swift and severe. In response, many federal, state and local governments are working to provide relief to both businesses and individual taxpayers impacted by the pandemic. […]

With roughly two weeks to go until the first mandatory phase of India’s e-invoicing reform was set to go live, the GST Council has now decided to slam the breaks and halt the go-live. Or at least, bring it to a significant temporary standstill of 6 months, until 1 October 2020. Following a long list […]

The Government Accountability Office (GAO), a U.S. Congress watchdog, published a report evaluating the IRS’s approach to regulating virtual currency (crypto) and the guidance it has offered the public. The GAO’s Recommendation However, a portion of the report was directed at the IRS and the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. […]

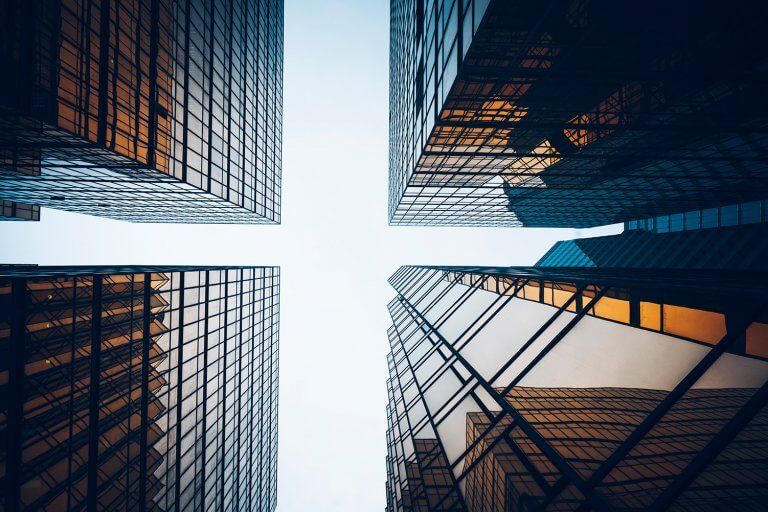

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

What’s your digital transformation strategy? Whether you’re in IT, finance, tax or the executive suite, if that strategy doesn’t include tax, you may be overlooking a huge source of risk – and strategic benefit. It’s time to consider launching a conversation about tax in a digitally transforming world. Which is why we’ve created […]

Value-added tax (VAT) does not exist in the United States, but American companies are increasingly having to deal with VAT mandates in Latin America, Europe and Asia. Seeking to make up a massive gap in revenues, tax administrations are mandating strict policies to digitize VAT collection. American companies that fail to comply could see their […]

As part of the recently updated “new NAFTA,” or USMCA, Mexico is enticing companies to move operations into its maquiladora zone of factories along the US border. Major benefits of relocation include exemptions from value-added tax (VAT) and other taxes for qualifying manufacturers, along with a VAT rate reduced by half applied to local transactions […]

The following is an excerpt from “Trends in Continuous Global VAT Compliance,” the 11th edition of the industry’s most comprehensive guide to e-invoicing, e-archiving and VAT reporting. The full report is available for download. To reduce the VAT gap, countries are pushing taxable organizations to comply with VAT requirements and enforcing different types of legal […]

Companies are dealing with a fundamental shift in the way they do business with trading partners. In a rapidly increasing number of countries, there’s a third party inserting itself into every transaction. It’s the government, and it’s wedging its way into every order a company ships or receives. In an effort to close a massive […]

A new wrinkle in Mexican electronic invoicing adds complexity to the e-invoicing process for maquiladoras, or foreign-owned factories operating along the US-Mexico border. Compared to some other countries in Latin America, Mexico has kept its core electronic invoice, the CFDI, relatively simple. Whereas an invoice in Chile has 250 fields or more of required information, […]

A substantial number of companies are unaware of the full challenges around tax compliance and their procurement processes. Part of the challenge is that tax compliance must functionally sit with procurement and other business functions in the enterprise that own the data interchange, while the ultimate responsibility for tax compliance remains with the tax department. […]

AP automation is supposed to save SAP customers money, but developments in digital tax could derail its benefits and actually create further liabilities. With tax authorities all over the world seeking to increase revenues and close tax gaps, IT professionals and AP system administrators face new challenges in indirect tax compliance. Among those challenges are […]

Far from being a burden, Peru’s electronic invoicing mandate has helped medium-size businesses embark on digital transformation while also catalyzing a broadening of the country’s tax base. The International Monetary Fund (IMF) will release this fall a study detailing the impact mandatory e-invoicing in Peru, which began in 2014 and has since moved to a […]

As a result of an e-invoicing mandate currently rolling out in Argentina, small and medium-size businesses (SMBs) are or will soon be required to use a specific form of invoice when billing larger companies. Companies classified as SMBs (or PyMEs in Spanish) by AFIP, the Argentine tax administration, are required to use the Facturas de […]

Anyone familiar with the Discovery Channel’s Shark Week and the portrayal of hungry sharks setting their sights on surfers may be surprised to learn that tax and IT professionals may be feeling every bit as wary as those surfers as they enter their own version of shark-infested waters. The reason: IT and tax pros are […]