Blog

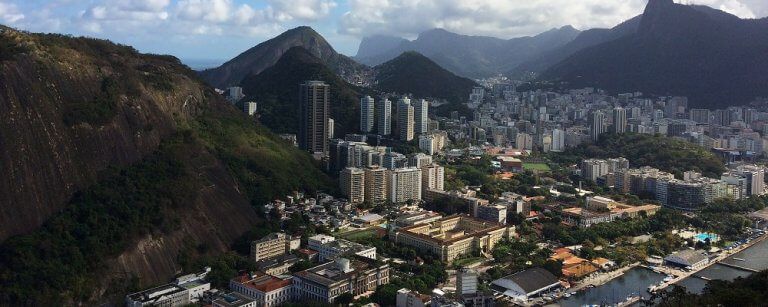

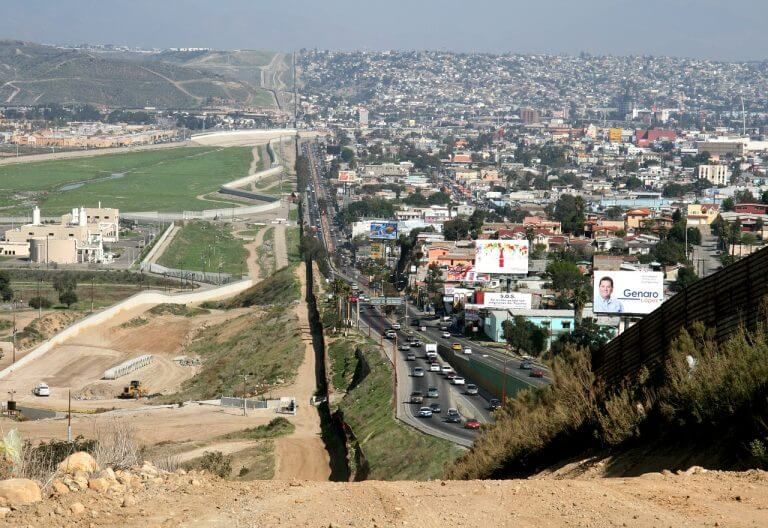

A new wrinkle in Mexican electronic invoicing adds complexity to the e-invoicing process for maquiladoras, or foreign-owned factories operating along the US-Mexico border. Compared to some other countries in Latin America, Mexico has kept its core electronic invoice, the CFDI, relatively simple. Whereas an invoice in Chile has 250 fields or more of required information, […]

Clearance-model e-invoicing will sweep the globe because it works – at least for tax administrations. With the VAT gap opening to more than half a trillion dollars worldwide, governments around the world are likely to follow the Latin American model of tax authorities inserting themselves into transactions. A new report from Bruno Koch at industry […]

The great corporate awakening Many corporations that previously saw e-invoicing mandates as a developing country problem are now realizing that invasive transaction-based digital tax controls are popping up everywhere around the world. Teams of experts and executives across finance, IT, tax and other functions are being pulled together by leading enterprises to define ways to […]

SAP S/4HANA is the promised land for SAP customers: an entire suite of ERP functionality in one place with a single data store. The ability to run all ERP capabilities, both from SAP and non-SAP systems, from a single source represents delivery of a model IT professionals and SAP administrators have sought for years. Getting […]

Marketplace Facilitators and Payment Processors Find Themselves in the Global Tax Compliance Crosshairs – Part II As we discussed in part I, “Marketplace Facilitators and Payment Processors – The New Taxpayers?” an indirect tax trend the past several years is an effort to expand the number of types of businesses responsible for collecting tax, such […]

Mexico has overhauled its e-invoicing requirements in recent years, and while businesses of all kinds have had to adapt, keeping up with changes is particularly important for maquiladoras. Maquiladoras are manufacturers, often with factories near the border with the US, which have a special designation from the Mexican government that allows them to import materials […]

Los cambios relacionados con el nuevo proceso que permite anular facturas electrónicas en México no son triviales, ya que repercuten de manera importante tanto en las operaciones de las AP (cuentas por pagar), como en las AR (cuentas por cobrar). El nuevo mandato, que pretende llenar el gran vacío que hasta ahora existía en la […]

The changes involved in the new process for cancelling electronic invoices in Mexico are not trivial. There are major ramifications for both accounts payable (AP) and accounts receivable (AR) operations. The new mandate, which fixes a major gap in Mexico’s e-invoicing policy, is aimed at enabling the SAT, the Mexican tax authority, to recover money […]

As previously announced by Sovos and after several delays in the implementation of the new CFDI cancelation process, the final deadline has arrived. The Mexican tax authority (SAT) has kept its commitment to not delay the implementation of the new CFDI cancelation process, as advised in their press release. These changes are designed to eliminate […]

Governments have rapidly adopted digital models to better collect every type of transactional tax, including value-added tax (VAT), goods and services tax (GST), and sales and use tax. The SAT (Mexico’s tax authority) is no different. Interestingly, Mexico has been a trailblazer in the digitization of tax, adopting new digital models and processes to ensure […]

During 2017, Mexico made several changes to its eInvoicing framework. In addition to the implementation of CFDI version 3.3, modifications have been made to article 29 A of the Tax Code designed to stop the practice of suppliers unilaterally cancelling CFDIs. This process is being replaced with a bilateral process in which the buyer must […]

Mexico’s planned process change for cancellations of electronic invoices will take effect Sept. 1 rather than in July as previously announced. The Mexican tax authority, the SAT, will require senders of electronic invoices, a document called a CDFI in Mexico, to get permission for cancellation from the party that received the invoice before the sender […]

Invoicing in Latin America has become complex to the point of being daunting. Businesses that get electronic invoicing processes wrong could quickly grind to a halt. Mastering the eInvoicing process is critical, then, and it involves making sure that all four elements of eInvoicing are working smoothly at the same time. New regulations, most notably […]

Tras anunciar a fines de 2016 el mayor cambio en su esquema de facturación electrónica en años, México también anunció una importante actualización de su mandato de contabilidad electrónica en enero de 2017. A pesar de que el SAT, la autoridad fiscal mexicana, no anunció un cronograma específico de implementación de eContabilidad 1.3, tomó a […]

After announcing the largest change to its eInvoicing schema in years in late 2016, Mexico also announced a major update to its eAccounting mandate in January 2017. Though the SAT, Mexico’s authority, did not announce a specific implementation timeline for eContibilidad 1.3, it caught businesses off-guard when it began enforcing the measures in October. The […]

One of the reforms implemented in 2017 which has had a significant impact for Mexico’s fiscalization is the introduction of ‘proof of payment’. This reform outlines how in certain circumstances, when a buyer’s payment is executed as part of a commercial or financial transaction, the seller has an obligation to issue and deliver an electronic […]

When the Miscellaneous Resolution for 2015 entered into force requiring the report of the Electronic Accounting (“eContabilidad” or eAccounting), a great number of taxpayers that considered that their constitutional rights were violated filed Amparos against this new mandate. The immediate result was that thousands of businesses received a suspension of the obligation of: Submitting or […]

The first talks on renegotiating NAFTA begin this month, and with continual discussions of a U.S.-first trade agenda, multinational companies with operations in Mexico are left uncertain on what these talks might entail. While no one knows exactly where these negotiations may land, multinationals should have some answers by the end of 2017, as all […]